SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (68)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (24)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (33)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (17)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (13)

- Trade (5)

Trends and Opportunities in India’s Biscuit, Cookies and Crackers Market

- Jul 22, 2025, 11:10

- Consumer Markets

- IBEF

In India, a cheerful conversation is incomplete without four key ingredients – people engaging with one another, the television humming softly in the background and the timeless ritual of sipping tea with biscuits. Indians cherish the tradition of conversing over tea and biscuits, a cultural nuance that significantly fuels the biscuit, cookies and crackers market.

Why India’s biscuit market is on a roll?

With expected revenue of Rs. 1,16,706 crore (US$ 13.58 billion) in 2025, the biscuit, cookies and crackers market is forecast to register a 6.80% compound annual growth rate (CAGR), reaching around Rs. 1,64,716 crore (US$ 18.87 billion) by 2030.The transition in the market represents the evolution from the traditional glucose biscuit, once considered a treat for every school child to artisanal cookies designed for urban millennials. Biscuits are now seen as comfort food in India, representing convenience, and a taste of the times for changing consumer demands.

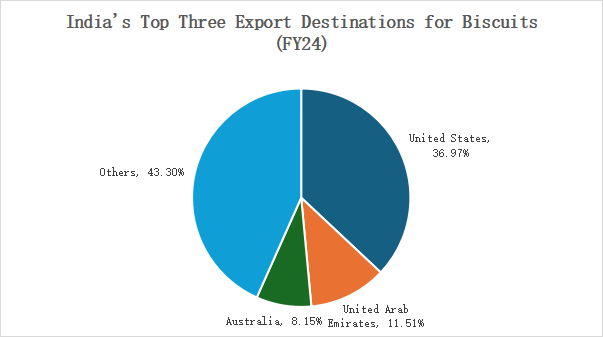

Global export snapshot

Source: Volza

India exports biscuits to over 180 countries. Key importers include:

- United States: 60,803 shipments (~37% market share)

- United Arab Emirates: 18,941 shipments (~12% market share)

- Australia: 13,416 shipments (~8% market share)

Collectively, these markets absorb 57% of India’s biscuit exports.

Recent trade data (FY24) from Volza shows that the top three global biscuit exporters are:

- India: 3,34,330 shipments

- Turkey: 1,40,789 shipments

- South Africa: 71,956 shipments

Demand drivers

The market presents a diverse product mix—from traditional glucose and plain biscuits to premium gourmet cookies. Key drivers include:

- Urbanisation and dual-income households: Occupied lifestyles and higher disposable incomes stimulate demand for convenient, ready-to-eat snacks.

- Health and wellness trends: Consumers are now switching to healthier products rich in nutrients. Manufacturers are including innovative changes such as lowering the amount of sugar in the product, developing plant-based food items and recipes with whole grains.

- Western influence and innovation: Consumers are increasingly interested in products with globally inspired flavours and prefer more contemporary snacks. The improvement of retailing and distribution makes the products even more accessible.

Key growth trends

- Health-focused innovation: Nowadays, biscuits are getting more nutritious than ever. While Britannia offers protein-filled biscuits, Sunfeast has sugar-free, fibre-rich biscuits. Other upcoming startups such as Yoga Bar and Nourish Organics are joining in with vegan, gluten-free options, along with brands such as 24 Mantra Organic promoting millet-based, immunity-boosting crackers.

- Premiumisation: Urban millennials are willing to spend more on gourmet experiences to enhance their lifestyle. Innovative artisanal cookies in popular flavours and packed in resealable pouches and design-savvy gift boxes are changing the consumer expectations. The trend towards premiumisation and sophisticated packaging is gaining momentum.

- Local products go national: Old-school flavours such as masala-chai cookies, flavoured with cardamom and ginger, with revised versions of the classic ‘nankhatai’, are making their way into the hearts of consumers across the country. Ragi crackers, in fact, are the coming back food of choice for health conscious buyers, as India is on the stage of awareness, and is constantly making choices for a healthier and fit future.

- Digital disruption: There has been a sharp increase in online shopping transactions post-COVID period. Quick commerce industry, such as Zepto and Blinkit, have made it very simple for customers to get their favourite snack through e-commerce delivered at their doorstep. More recently, direct-to-consumer (D2C) brands are becoming adept at using social media in establishing brand loyalty and positioning themselves on clean labelling claims. Digital advertising through influencer partnerships, and retargeting are effectively used to drive their campaigns, creating an increased lift into these channels.

- Innovations in packaging: With consumer demand for convenience and sustainability on the rise, packaging innovation is crucial. Several news articles project that India’s food processing sector is expected to reach Rs. 46,75,365 crore (US$ 535 billion) by FY26, with the food and beverage packaging industry forecast to hit Rs. 7,51,554 crore (US$ 86 billion) by 2029. Eco-friendly solutions using biodegradable, recyclable or compostable materials—such as corn plastic, bamboo, wood fibres and mushroom-based packaging—are gaining traction.

Competitive landscape

In this competitive landscape, major players such as Britannia and Parle continue to dominate their peers. Britannia holds an estimated 38% market share, driven by its premium, innovative product lines (e.g., Good Day and NutriChoice), while Parle’s flagship Parle-G biscuits command roughly 32% share. Meanwhile, nimble startups and regional brands are gaining traction by targeting niche segments and driving product innovation.

Expansion drivers

- Conquer rural India: Rural markets, which account for approximately 55% of biscuit consumption, offer significant growth potential. Brands can deepen market penetration by introducing smaller, affordable packs of Rs. 5 (US$ 0.057) each, partnering with local ‘kirana’ stores and launching targeted campaigns.

- Regional flavours into biscuit offerings: Traditional snacking may prove to be hard competition, but not without a little innovation. Introducing regional flavours, millet-based ingredients and placing homemade videos in a nostalgic context can significantly alter sales for biscuit brands currently facing this competition.

- Embrace sustainability: Sustainability is emerging as a key differentiator. Leading brands such as Britannia are pioneering eco-friendly initiatives—from tree planting and waste management to energy-efficient practices. Additionally, partnerships with local farmers ensure sustainable agriculture. Thus, the reduction of environmental impact feeds right into consumer trust and customer loyalty. In parallel, ITC’s Sustainability 2.0 vision drives innovation with the launch of the first-ever 100% paper outer bag, used in its Sunfeast Farmlite Digestive family pack, setting a new industry benchmark for sustainable packaging.

What’s on the horizon?

Looking ahead, several trends are poised to shape the industry:

- Keto and low-carb cookies: As health-focused urban consumers increasingly look for healthier alternatives in their lives, the market for lower-carb cookie choices is growing by the day.

- Co-branding opportunities: Collaborations, such as the pairing of tea and any cookies / biscuits brand can integrate traditional flavours with contemporary snacks.

- Artificial intelligence (AI)-driven supply chains: Mondelez and other companies use AI to calculate how much demand there is and maintain a system that works flawlessly to ensure that they always have enough products in stock.

Summing up

The market for snacks in India is very closely related with the significance of the macroeconomic and social transformation that has been occurring in the country for some time now. Currently, the shift is taking place in the market whereby traditional, affordable snacks would always be found in Indian households-to premium, health-focused snacks. As the food processing and packaging sectors surge, the snacks market in India is expected to follow suit, combined with the use of sophisticated technology-driven supply chain systems.