7th Pay Commission's booster dose for the consumer economy

- Livemint

- November 20, 2015

New Delhi: The Seventh Pay Commission has proposed a 23.55% increase in emoluments for 4.7 million government employees and 5.2 million pensioners, potentially providing a boost to the ailing consumer economy.

It, however, passed up on the opportunity to push reforms in the government recruitment process, including lateral entry of professionals. It also steered clear of a controversial demand by civil services employees seeking pay parity with the elite Indian Administrative Service.

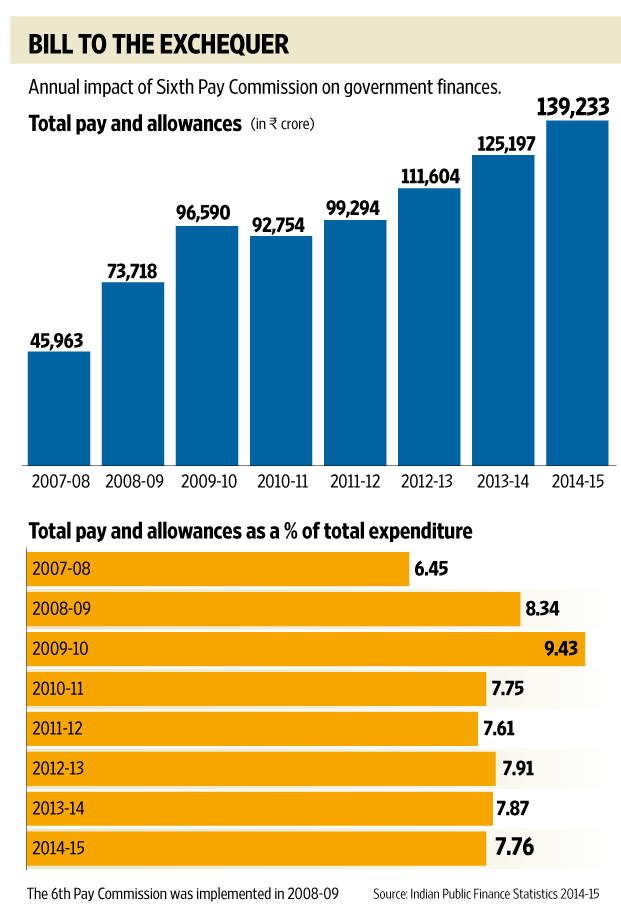

The impact of the recommendations on the finances of the centre and, subsequently, on the finances of state governments, may curtail their development expenses. The panel, headed by former Supreme Court judge A.K. Mathur, however, argued that the overall impact would be less than that caused by the recommendations of the 6th Pay Commission. Additional government expenditure as a proportion of gross domestic product (GDP) is projected at 0.65 percentage points compared to 0.77 percentage points arising from the report of the 6th Pay Commission.

Additional financial burden on central government coffers in 2016-17 will be Rs.1 trillion, of which Rs.73, 650 crore will come from the general budget, and Rs.28,450 crore from the railway budget. The rise in estimated share of total emoluments in total revenue expenditure (excluding railways) will be 4.25%, which is lower than the 4.32% for the 6th Pay Commission award.

The report said that since the award will be implemented from 1 January 2016, it may entail marginal payment of arrears, unlike after the last two Pay Commission reports.

“Thus, we feel that the macroeconomic impact of the recommendations is in conformance with the need for fiscal prudence and macroeconomic stability,” the report stated.

The details

The basic salary (plus dearness allowance) increase recommended is 16%, while that in housing rent allowance, other allowances and pensions are 138.71%, 49.79% and 23.63%, respectively. The minimum pay has been increased from Rs.6,600 toRs.18,000 per month while the maximum pay will be hiked from Rs.80,000 to Rs.2.25 lakh per month and Rs.2.5 lakh for the cabinet secretary—the senior-most civil servant.

These increases have has been done by abolishing 52 allowances altogether.

The present system of pay bands and grade pay has been dispensed with and a new pay matrix has been designed. The status of the employee, so far determined by grade pay, will now be determined by the level in the pay matrix. Separate pay matrices have been drawn up for civilians, defence personnel and for military nursing service.

Virjesh Upadhyay, the general secretary of the Bharatiya Mazdoor Sangh labour union, said the 7th Pay Commission report was disappointing; the fitment benefit is very low, and there is a huge gap between minimum and maximum salary, while existing anomalies haven’t been addressed.

The commission has recommended introduction of the performance-linked pay for all categories of central government employees based on key indicators and a performance appraisal system.

To be sure, previous commissions had made a similar proposals, but the government implemented it only partially.

Significantly, 7th Pay Commission passed up on the opportunity to provide a mechanism for formal lateral induction to the government from the private sector.

The vexed issue of parity of pay scales for officers from the Indian Administrative Services (IAS) and other civil services cadres, such as Indian Revenue Service (IRS) and Indian Police Service (IPS), remains.

The Pay Commission skirted the issue because of differences of opinion.

The previous Congress-led United Progressive Alliance (UPA) government appointed the 7th Pay Commission on 28 February 2014.

The central government constitutes the Pay Commission every 10 years to revise the pay scales of its employees and these are usually adopted by states after some modifications.

The finance ministry had earlier expressed apprehensions that the recommendations of the 7th Pay Commission would significantly increase the revenue expenditure of the government in the next financial year, leaving it with less money to spend on building capital assets.

In the medium-term expenditure framework statement laid before Parliament on 13 August, the finance ministry said salary and pension expenditure in 2016-17 is expected to rise by 15.8% and 16%, respectively, which may leave capital expenditure room to grow by no more than 8% during the year.

Total revenue expenditure is expected to jump 8.1% to Rs.16.6 trillion in 2016-17 against a budgeted growth of 3.1% in 2015-16.During the same period, growth in capital expenditure is expected to slow to 8%—at Rs.2.6 trillion from a budgeted growth of 25.4%.

Boost for consumption

If the government implements the 7th Pay Commission’s recommendations, it could provide a boost to consumer spending—something that was quickly noted by representatives of the ailing consumer economy.

Rakesh Biyani, a director at Future Group, said more cash in the hands of the middle-class will boost consumption. “Better level of disposable incomes will help retailers at large,” he added. If hefty arrears are handed down to employees it “could clearly lead to one-time high-ticket purchases,” he added.

Similarly, Anuj Puri, chairman and country head at real-estate consultancy Jones Lang LaSalle India, said that the prospect of increased disposable income in sufficient magnitude could even improve the appetite for buying a home since home-ownership remains one of the top priorities for Indian households.

“There is also a lot of interest for buying second homes as investments among those who already have their primary residences squared away. Increased take-home salaries will definitely improve the overall sentiment for the right-priced residences,” he added.

Much like it did in 2008 when it was last announced, a pay revision will likely boost sales of consumer appliances and electronics.

Indeed, back then, this helped stave off, albeit temporarily, the effects of the global financial crisis on consumer markets

Nilesh Gupta, managing director of Vijay Sales, a consumer electronics and durables chain in western India, said additional payouts to government employees will help increase sales of automobiles, two-wheelers and other consumer durables.

“The festive season saw growth of 15% over the last festive season and now with the arrears payout to government employees there will be a further consumption boost,” he added.

Sapna Agarwal in Mumbai and Suneera Tandon in Bengaluru contributed to this story.

Disclaimer: This information has been collected through secondary research and IBEF is not responsible for any errors in the same.