Advantage India

Robust

Demand

*India’s cement sector is set for robust growth in FY26, with operating profit expected to rise 12-18% to Rs. 900-950 (US$ 10.14-10.71) per metric tonne (MT), according to ratings agency ICRA. Strong demand from housing and infrastructure, better realisations, and stable input costs will drive the improvement.

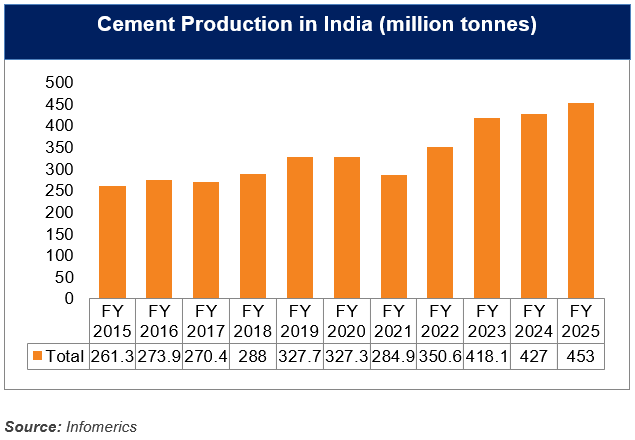

*In FY25, India’s cement production rose to about 453 million tonnes, up from 426.29 million tonnes in FY24, registering a 6.3% YoY growth.

*India's cement industry, as per CRISIL Ratings, plans to increase its capacity by 150-160 MT between FY25 and FY28, building upon the 119 MT annual capacity addition over the last five years, to cater to growing infrastructure and housing demands.

*The GST revamp announced in September 2025 is expected to reduce cement prices by Rs. 30-35 (US$ 0.34-0.40) per 50-kg bag, lowering construction costs and potentially stimulating demand further in the sector.

Attractive

Opportunities

*As of August 2025, the Mumbai-Ahmedabad Bullet Train Corridor is significantly boosting the cement and construction industry, utilizing around 20,000 cubic meters of cement daily—equivalent to eight 10-story buildings. This project, spanning 508 km with multiple stations and tunnels, has generated substantial employment, with about 20,000 workers engaged daily.

*Government has plans for 33.4% outlays for capital investments to Rs. 10 lakh crore (US$ 120 billion) and outlays for railways of Rs. 2.4 lakh crore (US$ 29.05 billion). Also, plans to build 100 new significant transport projects involving an investment of Rs. 75,000 crore (US$ 9.04 billion) for end-to-end connectivity for ports, coal, steel etc.

*Karnataka approved investment proposals worth Rs. 17,183 crore (US$ 2.01 billion) in cement manufacturing, which are expected to generate around 12,500 jobs.

Long-term

Potential

*Indian cement companies are among the world’s greenest cement manufacturers.

*India's top four cement companies - UltraTech, ACC-Ambuja, Shree Cement, and Dalmia Cement are set to add over 42 million tonnes of capacity in FY25, increasing their market share from 48% in FY23 to an expected 54% by FY26.

*Indian cement makers plan to invest around Rs. 1.25 lakh crore (US$ 14.63 billion) between FY25 and FY27 to add 130 million tonnes of grinding capacity about 20% more than current levels.

*The government's infrastructure push is a significant catalyst, with projects like the Mumbai-Ahmedabad Bullet Train Corridor significantly boosting cement demand. This project alone uses around 20,000 cubic meters of cement daily, generating large-scale employment.

Increasing

Investments

*FDI inflows in the industry, related to the manufacturing of cement and gypsum products, reached Rs. 51,135 crore (US$ 7.92 billion) between April 2000-June 2025.

*National Infrastructure Pipeline (NIP) introduced projects worth Rs. 102 lakh crore (US$ 14.59 billion) for the next five years.

*As per the Union Budget 2025-26, the government approved an outlay of Rs. 2,87,333 crore (US$ 33.08 billion) for the Ministry of Road Transport and Highways i.e., 3% higher as compared to the previous budget.

*India’s top cement producers are set to invest about Rs. 1,20,000 crore (US$ 13.53 billion) in capital expenditure between FY26 and FY28, nearly 50% higher than the previous three years, according to Crisil Ratings. The investments will focus primarily on capacity expansion, with the 17 companies covered in the report representing 85% of the country’s total 668 million tonnes (MT) of installed capacity as of March 2025.

Cement Clusters

- Rajasthan

- Tamil Nadu

- Andhra Pradesh

- Madhya Pradesh

- Chhattisgarh

- Odisha

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREWhy India Is Emerging as a Global Sourcing Hub for Textiles

India’s textile industry is quickly weaving a new story on the world ...

How Green Hydrogen Will Shape Renewable Energy in India

Green hydrogen, a superior and a more sustainable alternative to fossil fue...

Cooperatives Rising: How Local Communities Are Shaping India’s Growth

The co-operative movement in India is a strong driving force of inclusive d...