Advantage India

Growing

Demand

*The Indian Beauty and Personal Care (BPC) market is experiencing rapid growth, projected to reach a GMV of Rs. 2,60,610 crore (US$ 30 billion) by CY27. This represents 5% of the global beauty industry. The market is expanding at an annual growth rate of around 10%, making it the fastest-growing BPC market among major economies.

*India’s e-retail sector is poised for strong long-term growth, with GMV projected to rise over 18% annually to reach Rs. 14.5 lakh crore (US$ 170 billion) by 2030.

*India's Business-to-Business (B2B) online marketplace would be a US$ 200 billion opportunity by 2030.

Attractive

Opportunities

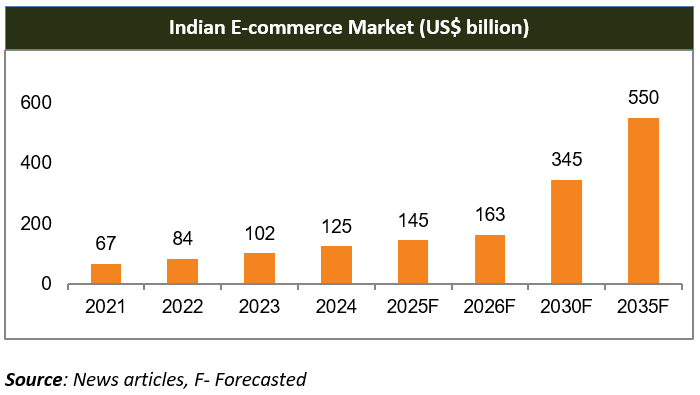

*The rapidly expanding Direct-to-Consumer (D2C) segment is driving growth, with India's D2C market projected to grow at a 40% CAGR, reaching US$ 60 billion by 2027. E-commerce in India is expected to surpass US$ 145 billion in 2025, powered by mobile commerce and AI-driven hyper-personalization enhancing customer experiences.

*The Government e-Marketplace (GeM) crossed a GMV of Rs. 5 lakh crore (US$ 58.5 billion) in FY25, achieving the feat 18 days before year-end. Services led the growth, contributing 62% Rs. 2.54 lakh crore (US$ 29.7 billion), while. products made up 38% to Rs. 1.55 lakh crore (US$ 18.1 billion).

Policy

support

*100% FDI is allowed in B2B e-commerce & marketplace model of E-commerce.

*Government initiatives like the National Logistics Policy and Digital India are boosting e-commerce by improving connectivity, streamlining logistics, and expanding digital access. These efforts aim to support the creation of a trillion-dollar online economy by 2025

*The Union Budget 2025-26 backs MSMEs with increased investment limits, better credit support, and a Rs. 10,000 crore (US$ 1.17 billion) startup fund. It also promotes electronics manufacturing and Global Capability Centre in Tier 2 cities to strengthen e-commerce supply chains.

Increasing

Investments

*Amazon CEO Mr. Andy Jassy announced that the company is committed to invest US$ 26 billion in India by 2030, out of which US$ 11 billion has already been invested as of July 2025.

*In June 2025, Nestle India announced plans to invest Rs. 5,000 crore (US$ 585 million) in capacity expansion, new product lines, and sustainability across its factories.

Major Hubs for E-commerce

- Karnataka

- Delhi

- Maharashtra

- Tamil Nadu

- Andhra Pradesh

Industry Contacts

Posters

MORE

CLICKING THE CART

India's E-commerce industry is expected to reach US$ 99 billion in size by 2024

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREHow Green Hydrogen Will Shape Renewable Energy in India

Green hydrogen, a superior and a more sustainable alternative to fossil fue...

Cooperatives Rising: How Local Communities Are Shaping India’s Growth

The co-operative movement in India is a strong driving force of inclusive d...

India’s Aspirational Districts: Stories of Progress and People-Led Change

India’s Aspirational Districts Programme (ADP) was launched in Januar...