Advantage India

Robust

Demand

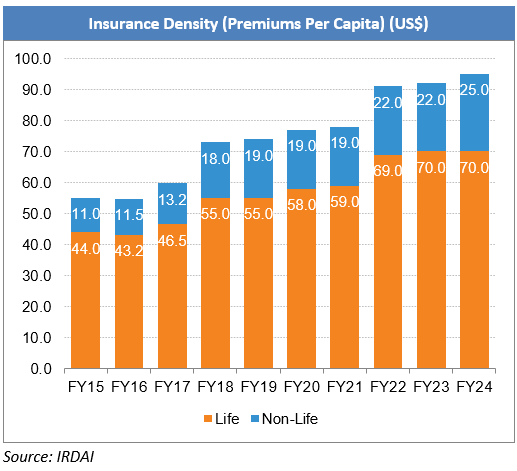

*India's insurance sector has witnessed significant growth, with the domestic market expanding at CAGR of 17% over the past two decades. It is projected to reach Rs. 19,30,290 crore (US$ 222.0 billion) by FY26. This growth has been driven by increased awareness, favorable regulatory changes, and greater participation from the private sector.

*India’s life insurance sector saw growth, with new business premiums rising to Rs. 40,206 crore (US$ 4.59 billion) in September 2025 and YTD collections growing even more from Rs. 1,89,214 crore (US$ 21.62 billion) to Rs. 2,03,668 crore (US$ 23.28 billion) this month.

Attractive

Opportunities

*Robotic Process Automation (RPA) and AI will occupy center stage in insurance, driven by newer data channels, better data processing capabilities and advancements in AI algorithms.

*Bots will become mainstream in both the front and back-office to automate policy servicing and claims management for faster and more personalized customer service.

*The rise of digital-only insurers and aggregator platforms is opening new avenues for reaching untapped customer segments, particularly millennials and rural populations. Platforms like IRDAI’s "Bima Sugam" are simplifying policy purchase and comparison

*India’s IoT insurance market is projected to reach Rs.1,83,120 crore (US$ 21.4 billion) by 2033, growing at nearly 55% annually.

Policy

Support

*The Indian government has increased the Foreign Direct Investment (FDI) limit in insurance companies from 74% to 100%, enabling complete foreign ownership. This strategic decision is intended to attract additional capital into the long-term, capital-intensive insurance sector, ensuring that insurers invest all collected premiums within the country.

*Insurance cover for 74.6 crore persons under PM Suraksha Bima and PM Jeevan Jyoti Yojana was provided till April 2025.

Increasing

Investments

*The IPO of LIC of India was the largest IPO ever in India and the sixth biggest IPO globally in FY22

*In February 2025, nine insurers, including HDFC Ergo and SBI General, have submitted IPO plans to IRDAI as part of a push to raise capital and strengthen governance in India’s insurance sector.

*At least six Indian reinsurance companies, plan to launch IPOs over this year and next, selling 10–15% stakes to raise capital and expand market presence.

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREHow Green Hydrogen Will Shape Renewable Energy in India

Green hydrogen, a superior and a more sustainable alternative to fossil fue...

Cooperatives Rising: How Local Communities Are Shaping India’s Growth

The co-operative movement in India is a strong driving force of inclusive d...

India’s Aspirational Districts: Stories of Progress and People-Led Change

India’s Aspirational Districts Programme (ADP) was launched in Januar...