Advantage India

Growing

Demand

*Rising income is driving the demand for financial services across income brackets.

*India’s financial services sector is projected to nearly double profits by FY30, led by NBFCs growing at 16% annually. Growth drivers include retail credit, wealth management, payments, and insurance.

*Investment corpus in Indian insurance sector might rise to US$ 1 trillion by 2025.

*Private credit investments in India hit a record US$ 9.0 billion in H1 2025, marking a 53% YoY jump. This surge in private credit is driven by expanding demand from businesses and confidence from institutional investors.

Innovation

*India benefits from a large cross-utilisation of channels to expand reach of financial services.

*Emerging digital gold investment options.

*AI-driven banking is said to cut operational timelines by over 60%, boosting digital customer bases and improving security.

Policy

Support

*FDI sectoral cap in the insurance sector has been revised from 49% to 74% under the automatic route. The Union Budget 2025-26 also announced the further increase of FDI sectoral cap for the insurance sector from 74% to 100%. This enhanced limit will be available for those companies, which invest the entire premium in India.

*The government launched a 3-month financial inclusion campaign starting in July 2025, targeting full saturation of inclusion schemes at local levels. In July 2025, nearly 6.65 lakh new bank accounts were opened under PM Jan Dhan Yojana, and over 10 lakh re-verifications of KYC were done. The campaign also promotes financial literacy and digital fraud awareness, showing steady progress towards inclusive finance.

Growing

Penetration

*Credit, insurance and investment penetration is rising in rural areas.

*HNWI participation is growing in the wealth management segment.

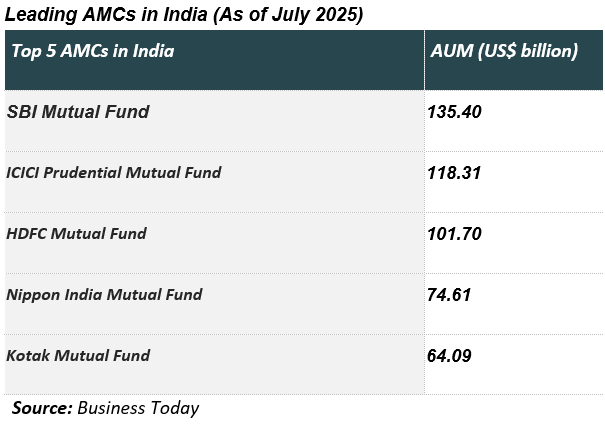

*Lower mutual fund penetration of 5-6% reflects latent growth opportunities.

*A report from the Reserve Bank of India (RBI) suggests that generative Artificial Intelligence (AI) has the potential to enhance banking operations in India by up to 46%.

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREHow Green Hydrogen Will Shape Renewable Energy in India

Green hydrogen, a superior and a more sustainable alternative to fossil fue...

Cooperatives Rising: How Local Communities Are Shaping India’s Growth

The co-operative movement in India is a strong driving force of inclusive d...

India’s Aspirational Districts: Stories of Progress and People-Led Change

India’s Aspirational Districts Programme (ADP) was launched in Januar...