Advantage India

Robust

Demand

* According to the EY 2021 NextWave Global Consumer Banking Survey explored consumers’ primary financial relationships and found that FinTechs and neobanks are gaining ground.

* That demand seems particularly strong when it comes to the critical need of protecting consumer data, where incumbent banks have a trust advantage. Some super apps may also turn to banks for access to banking licenses and to meet other regulatory requirements.

* Indian Fintech industry is estimated to be at US$ 150 billion by 2025. India has the 3rd largest FinTech ecosystem globally.

* BCG predicts that the proportion of digital payments will grow to 65% by 2026.

Innovation in

Services

* In the recent period, technological innovations have led to marked improvements in efficiency, productivity, quality, inclusion and competitiveness in the extension of financial services, especially in the area of digital lending.

* Digitalization of Agri-finance was conceptualized jointly by the Reserve Bank and the Reserve Bank Innovation Hub (RBIH). This will enable delivery of Kisan Credit Card (KCC) loans in a fully digital and hassle-free manner.

* In Union Budget 2023, the KYC process will be streamlined by using a 'risk-based' strategy rather than a 'one size fits all' approach.

* In September 2023, Hitachi Payment Services launched India's first-ever UPI-ATM with NPCI.

Business

Fundamentals

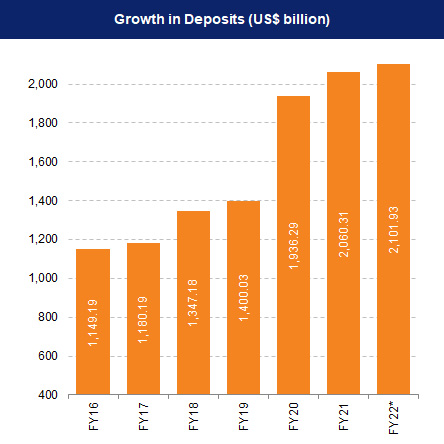

* The Indian banking industry has been on an upward trajectory aided by strong economic growth, rising disposable incomes, increasing consumerism and easier access to credit.

* Digital modes of payments have grown by leaps and bounds over the last few years. As a result, conventional paper-based instruments such as cheques and demand drafts now constitute a negligible share in both the volume and value of payments.

Policy

Support

* The RBI has launched a pilot to digitalize KCC lending in a bid for efficiency, higher cost savings, and reduction of TAT. This is expected to transform the flow of credit in the rural economy.

* In November 2022, RBI launched a pilot project on central bank digital currency (CBDC).

* In Union Budget 2023, a national financial information registry would be constructed to serve as the central repository for financial and ancillary data.

* In March 2023, India Post Payments Bank (IPPB), in collaboration with Airtel, announced the launch of WhatsApp Banking Services for IPPB customers in Delhi.

Banking India

Posters

MORE

NEW INDIA DIGITAL INDIA

India will contribute 2.2% to the world's digital payments market by 2023, while the value of such transaction is expected to reach US$ 12.4 trillion globally by 2025.

IBEF Campaigns

MORE

India Organic Biofach 2022

Ibef Organic Indian Pavilion BIOFACH2022 July 26th-29th, 2022 | Nuremberg, ...

Case Studies

MOREIBEF BLOG

MOREIndia's Solar Power Revolution

India is leading the renewable energy revolution, with a strategic emphasis...

Empowering MSMEs: Fintech Solutions for Small Businesses in India

Micro, small, and medium enterprises (MSMEs) are the backbone of the Indian...

Unlocking India's Digital SME Credit Gap and Economic Potential

The Indian economy thrives on the contributions of the Micro, Small, and Me...