The insurance industry in India has witnessed an impressive growth rate over the last two decades driven by the greater private sector participation and an improvement in distribution capabilities, along with substantial improvements in operational efficiencies.

In FY24 (until September 2023), non-life players’ saw a premium income increase by 14.86% year-over-year to Rs. 1,43,802 crore (US$ 17.29 billion) due to strong demand for health and motor policies.

The Indian non-life insurance industry logged 14.86% growth during the first half of FY24 as compared to 15.30% growth for the same period the previous year. The business growth for the first half of FY24 was driven by health (especially the group segment), motor, and crop insurance.

In April-November 2023, life insurers’ new business premiums grew to Rs. 211,690.65 crore (US$ 25.38 billion), according to Life Insurance Council data.

The premium in the month of March 2023 for the private life insurance industry grew at a healthy pace of 35% on a year-on-year basis and 20% for FY23.

Life insurance firms collected 18% more premiums in FY23 compared to the year before. Life insurers collected Rs. 3.71 lakh crore (US$ 44.85 billion) as the first-year premium in FY23 as against Rs. 3.14 lakh crore (US$ 37.96 billion) in FY22, shows the latest IRDAI data.

Mr. Debashish Panda, Chairman, IRDAI informed that the insurance industry of India has become a Rs. 59 crore (US$ 7.1 million) industry as of February 2023.

Driven by a pick-up in health and motor insurance segments, the non-life insurance industry has grown by 16.4% in FY23 compared to 11.1% in the previous year.

Among the private players, SBI Life, HDFC Life and ICICI Prudential Life led the industry in premium collection. SBI Life collected Rs. 29,587 crore (US$ 3.57 billion) premium in FY23 while HDFC Life and ICICI Prudential Life received Rs. 28,876 crore (US$ 3.48 billion) and Rs. 16,921 crore (US$ 2.04 billion), respectively.

As expected, the state-run insurance behemoth LIC alone contributed over 60% to the total new business premium collection. The insurer received close to Rs. 2.31 lakh crore (US$ 27.93 billion) as premium in FY23 compared to Rs. 1.99 lakh crore (US$ 24.06 billion) in FY22.

Among the private players, SBI Life, HDFC Life and ICICI Prudential Life led the industry in premium collection. SBI Life collected Rs. 29,600 crore (US$ 3.58 billion) premium in FY 2023 while HDFC Life and ICICI Prudential Life received Rs. 28,900 crore (US$ 3.49 billion) and Rs. 17,000 crore (US$ 2.05 billion), respectively.

According to the latest data released by the insurance regulator – the Insurance Regulatory and Development Authority of India - LIC improved its market share by 67.72% as of October, a gain of 447 basis points (bps). At the end of 2021-22, private players had a 36.75% share of the life insurance market, while LIC had 63.25%.

With nearly 62.58% of the new business market share in FY23, Life Insurance Corporation of India, the only public sector life insurer in the country, continued to be the market leader.

In FY23, non-life insurers (comprising general insurers, standalone health insurers and specialized insurers) recorded a 16.4% growth in gross direct premiums.

In India, gross premiums written off by non-life insurers reached US$ 10.95 billion in FY24* and US$ 31 billion in FY23.

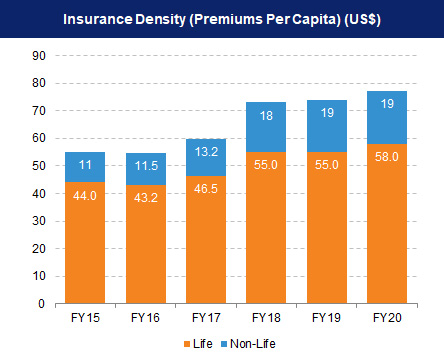

The life insurance industry was expected to increase at a CAGR of 5.3% between 2019 and 2023. India’s insurance penetration was pegged at 4.2% in FY21, with life insurance penetration at 3.2% and non-life insurance penetration at 1.0%. In terms of insurance density, India’s overall density stood at US$ 78 in FY21.

Premiums from India’s life insurance industry is expected to reach Rs. 24 lakh crore (US$ 317.98 billion) by FY31.

Between April 2021-March 2022, gross premiums written off by non-life insurers reached Rs. 220,772.07 crore (US$ 28.14 billion), an increase of 11.1% over the same period in FY21. In May 2022, the total premium earned by the non-life insurance segment stood at Rs. 36,680.73 crore (US$ 4.61 billion), a 24.15% increase compared to the previous year’s period. The market share of private sector companies in the general and health insurance market increased from 48.03% in FY20 to 49.31% in FY21 to 62.5% in FY23. Six standalone private sector health insurance companies registered a jump of 66.6% in their gross premium at Rs 1,406.64 crore (US$ 191.84 million) in May 2021, as against Rs. 844.13 crore (US$ 115.12 million) earlier.

According to S&P Global Market Intelligence data, India is the second-largest insurance technology market in Asia-Pacific, accounting for 35% of the US$ 3.66 billion insurtech-focused venture investments made in the country.