Foreign Direct Investment (FDI)

Introduction

Foreign Direct Investment (FDI) stands as a key catalyst for India's economic growth, constituting a substantial non-debt financial reservoir for the nation's developmental endeavours. International corporations strategically invest in India, capitalizing on the country's unique investment incentives, including tax incentives and relatively competitive labour costs. This not only facilitates the acquisition of technological expertise but also fosters job creation and various ancillary advantages. The influx of these investments into India is a direct result of the government's proactive policy framework, a dynamic business environment, improving global competitiveness, and a burgeoning economic influence.

The implementation of the Goods and Services Tax (GST) has further simplified the tax framework and increased transparency, while Special Economic Zones (SEZs) continue to offer infrastructure support and fiscal incentives that appeal to global investors. Recent policy momentum includes legislative approval to raise the FDI ceiling in the insurance sector from 74% to 100%, expected to broaden participation by international insurers and deepen capital flows into the financial sector. The total amount of EFDI inflows received during (April 2000-September 2025) was Rs. 50,72,333 crore (US$ 764.06 billion). This FDI has come from more than 175 countries that have invested across 33 states and UTs and 63 sectors in the country.

India has reached a significant milestone in its economic development, with gross foreign direct investment (FDI) inflows totalling an impressive Rs. 99,08,749 crore (US$ 1.12 trillion) since April 2000. This achievement has been further strengthened by 13% increase in FDI compared to FY24, amounting to Rs. 4,41,259 crore (US$ 50 billion) during FY25. Such growth underscores India's rising attractiveness as a global investment destination, fuelled by a proactive policy framework, a vibrant business environment, and enhanced international competitiveness.

India's FDI equity inflows for FY26 (April-September 2025) surged by 18% (in USD terms) over last year, to Rs. 3,03,402 crore (US$ 35.18 billion), with significant investments in services and computer software & hardware sectors.

Market Size

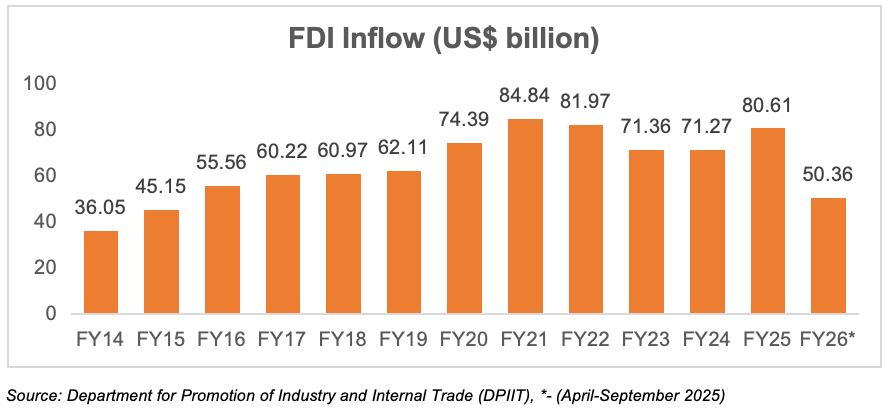

India's FDI inflows have increased ~20 times from FY01 to FY25. According to the Department for Promotion of Industry and Internal Trade (DPIIT), India's cumulative FDI inflow stood at Rs. 99,08,749 crore (US$ 1.12 trillion) between April 2000-September 2025, mainly due to the government's efforts to improve the ease of doing business and easing of FDI norms. The total FDI inflow into India from April-September 2025 stood at Rs. 4,44,641 crore (US$ 50.36 billion) and FDI equity inflow for the same period stood at Rs. 3,03,402 crore (US$ 35.18 billion).

From April 2000-September 2025, India's service sector attracted the highest FDI equity inflow of 16% amounting to Rs. 8,09,564 crore (US$ 123.94 billion), followed by the computer software and hardware industry at 16%, amounting

to Rs. 8,62,922 crore (US$ 119.74 billion), trading at 6% amounting to Rs. 3,58,667 crore (US$ 50.35 billion), telecommunications at 5% amounting to Rs. 2,41,901 crore (US$ 40.16 billion), and automobile industry at 5% amounting to Rs. 2,62,237 crore (US$ 39.43 billion).

India also had major FDI inflows during April 2000-September 2025, coming from Singapore at Rs. 13,21,127 crore (US$ 186.82 billion) with a total share of 24%, followed by Mauritius at 24% with Rs. 11,22,807 crore (US$ 183.66 billion), the USA at 10% with Rs. 5,50,451 crore (US$ 77.27 billion), the Netherlands at 7% with Rs. 3,77,095 crore (US$ 54.93 billion), and Japan at 6% with Rs. 2,93,864 crore (US$ 45.61 billion).

The state that received the highest FDI equity inflow during April 2000-September 2025, was Maharashtra with Rs. 7,88,640 crore (US$ 94.24 billion) at 31%, followed by Karnataka at 21% with Rs. 5,26,511 crore (US$ 67.05 billion), Gujarat at 15% with Rs. 3,66,897 crore (US$ 47.15 billion), Delhi at 13% with Rs. 3,15,456 crore (US$ 40.11 billion), and Tamil Nadu at 6% with Rs. 1,46,031 crore (US$ 18.19 billion).

Investments/Developments

India has become an attractive destination for FDI in recent years, influenced by several factors that have boosted FDI. In the Global Innovation Index (GII) 2025, India secured the 38th position among 139 global economies. This marks a significant improvement from its 81st rank in 2015, demonstrating India's commitment to fostering a robust innovation ecosystem that is underpinned by strong policies, investment in research and development (R&D), and a collaborative environment for startups and industries. These factors have boosted FDI investments in India. Some of the recent developments are as follows:

- Foreign Portfolio Investors (FPIs) resumed equity purchases in October 2025, recording a strong net inflow of Rs. 14,610 crore (US$ 1,650). Flows moderated thereafter amid global risk-off trends and interest rate volatility, though India continued to remain one of the most preferred emerging market investment destinations.

- FPIs also recorded positive investments in mutual fund equity units, with net inflows of Rs. 244 crore (US$ 27.6 million) in October 2025 and Rs. 544 crore (US$ 61.2 million) in November 2025.

- India is emerging as a reliable alternative hub in the global semiconductor supply chain, supported by strong domestic demand and policy push. India’s semiconductor market, valued at about US$ 38 billion in 2023, is projected to nearly triple to ~US$ 109 billion by 2030, driven by growth in smartphones, automotive electronics, industrial automation, and data centres. To cut import dependence and attract fabs and advanced packaging units, the government launched a US$ 10 billion incentive scheme in 2021 under the India Semiconductor Mission. As of October 2025, 10 projects across six states have been approved, with total investments exceeding Rs. 1.6 trillion (US$ 18–19 billion), cementing India’s position as a key player in the global semiconductor ecosystem.

- The Union Cabinet has approved four new semiconductor projects under the India Semiconductor Mission, taking the total approved projects to 10 with a cumulative investment of Rs. 1.60 lakh crore (US$ 18–19 billion). These include India’s first Silicon Carbide compound fab and an advanced packaging unit, strengthening domestic chip manufacturing and jobs.

- The OECD has raised India’s FY26 GDP growth forecast to 6.7%, citing monetary and fiscal easing along with recent GST cuts, and expects inflation to ease to 2.9%. S&P Global has retained its FY26 growth outlook at 6.5%, supported by strong domestic demand and higher government investment, while trimming its inflation estimate to 3.2% and expecting a small RBI rate cut.

- India’s venture capital ecosystem remained resilient in Q2 2025, attracting Rs. 30,205 crore (US$ 3.5 billion) across 355 deals, up from the previous quarter, despite global slowdown trends, according to KPMG. Strong investor activity in fintech, health tech, and logistics underscores India’s growing role as a leading destination for foreign capital in the startup and innovation economy.

- India and the UK have signed a Comprehensive Economic and Trade Agreement (CETA), providing duty-free access for 99% of India’s exports to the UK and expanding services market access in IT, finance, education, and digital trade. With bilateral trade at Rs. 4,83,784 crore (US$ 56 billion) and plans to double by 2030, the pact is expected to boost FDI flows, strengthen supply-chain linkages, and enhance India’s role in global trade.

- Significant opportunities exist to deepen collaboration between Indian and Japanese firms in the textiles sector, with Tokyo-based companies expressing keen interest to invest in India, according to the Apparel Export Promotion Council (AEPC). Chairman of Apparel Export Promotion Council, Mr. Sudhir Sekhri, highlighted that numerous meetings have been held between Indian and Japanese apparel companies to explore potential business partnerships. Several Indian exporters are participating in the India Tex Trend Fair (ITTF) in Tokyo, a flagship textiles event inaugurated by Union Minister of Textiles Mr. Giriraj Singh. The fair is organised jointly by the Embassy of India, the Ministry of Textiles, AEPC, and the Japan India Industry Promotion Association (JIIPA). He urged Japanese firms to increase sourcing and investments in India, citing successful discussions with major brands such as Uniqlo, Adastria, Toray, Itokin, Broque Japan, Daiso, YKK, and Pegasus.

- India has cleared Starlink to begin commercial satellite broadband services after final regulatory approval, capping subscriptions at two million users and targeting remote areas. As the third licensed satellite internet provider alongside OneWeb and Jio, Starlink’s entry highlights growing FDI participation in India’s space and digital connectivity ecosystem, supported by a liberalising regulatory environment.

- India’s green warehousing capacity is set to quadruple to 270 million sq. ft by 2030, with institutional-grade sustainable warehouses emerging as a major investment theme, according to JLL India. With over 45% of global investor portfolios already green-certified, rising ESG standards and strong logistics demand are strengthening FDI inflows into India’s modern, sustainable warehousing and supply-chain infrastructure.

- The Reserve Bank of India’s Financial Inclusion Index rose from 64.2 to 67 in FY25, reflecting stronger access, usage, and quality of formal financial services nationwide. Rising financial inclusion enhances household participation in the formal economy and strengthens India’s investment environment, supporting foreign investor confidence and long-term FDI inflows into banking, fintech, and financial services.

- India’s garment exports to Japan stood at Rs. 2,015 crore (US$ 234.5 million) in 2024, a modest share of Japan’s Rs. 1,97,639 crore (US$ 23 billion) apparel imports. The AEPC noted that India has a golden opportunity to significantly grow its presence in the Japanese market, supported by duty-free trade agreements, strong sustainability credentials, and a flexible manufacturing base underpinned by initiatives such as the PM MITRA Parks. However, challenges remain in improving quality standards, especially in man-made fibres (MMF), simplifying trade procedures, and adhering strictly to Japanese compliance norms to capture a greater share of the Rs. 3,00,755 crore (US$ 35 billion) Japanese apparel market.

- India’s data centre sector is expected to attract Rs. 1,60,000–2,00,000 crore (US$ 18.67–23.33 billion) in investment over the next 5–7 years, supported by strong demand growth and accelerating capacity expansion, according to India Ratings and Research. With hyperscalers and global cloud firms driving large-scale deployments, India continues to emerge as a major destination for FDI in digital infrastructure and AI-ready facilities.

- Thermal power investments in India are projected to rise to Rs. 2,30,000 crore (US$ 26.71 billion) by FY28, nearly doubling from recent years, with private sector participation expected to jump to about one-third of total funding, according to Crisil. With 80 GW of new thermal capacity planned by 2031–32, growing investor participation, especially from private players, signals renewed FDI interest in India’s power infrastructure alongside its clean-energy transition.

- Leasing of office space by Global Capability Centres (GCCs) in India rose 24% YoY to 31.8 million sq. ft in FY25, reflecting strong multinational investment in India’s services ecosystem. With Bengaluru and Mumbai leading demand, India’s skilled workforce, infrastructure growth, and supportive policies continue to strengthen the country’s appeal as a key destination for FDI-driven global operations and back-office hubs.

- Foreign institutional investment in India’s real estate sector surged 242% QoQ to Rs. 10,226 crore (US$ 1.19 billion) in Q2 2025, with the US, Japan, and Hong Kong accounting for 89% of inflows, according to Vestian. Around 69% of investments flowed into commercial assets, reflecting strong global investor confidence in India’s property market, supported by solid macro fundamentals and improving financing conditions.

- India’s services sector contributed 55% to the country’s Gross Domestic Product (GDP) in FY25, up from 40% in the early 1990s, positioning it as a key driver of wealth creation, according to Axis Mutual Fund’s report, “Scaling New Heights, India’s Service Sector Report”. The sector is central to India’s ambition of becoming a Rs. 4,28,35,000 crore (US$ 5 trillion) economy and represents a major opportunity for both domestic and international investors. Between FY23 and FY25, the sector recorded an average annual growth rate of 8.3%, with sub-sectors like information technology (IT), financial services, healthcare, telecommunications, and e-commerce witnessing rapid acceleration due to digitalisation, rising incomes, and urbanisation.

- IT services are expected to grow by 4–6% in FY26, driven by the adoption of generative artificial intelligence (AI) and cloud computing. Financial services are continuing a strong digital shift, with mutual fund assets growing over 20% compound annual growth rate (CAGR) in the last decade. Healthcare saw a 62% YoY growth in March 2025, supported by rising demand and technology integration. Indian e-commerce is projected to expand from Rs. 8,82,401 crore (US$ 103 billion) in 2024 to Rs. 27,84,275 crore (US$ 325 billion) by 2030. The services sector attracted the highest share of foreign investments in FY25, 19% of the total. Investment avenues include sector-specific mutual funds, stocks in IT, banking, telecom, healthcare, and emerging areas like fintech, medtech, and premium services.

- India ranked third globally in fintech startup funding in H1 2025, attracting Rs. 7,593 crore (US$ 889 million), led by strong early-stage and M&A activity, according to Tracxn. Sustained investor interest, supportive regulatory signals, and Bengaluru’s leadership in fundraising continue to strengthen FDI flows into India’s fintech ecosystem.

- OYO is expanding its European holiday home brand DanCenter in India, planning to add 250 premium vacation homes in FY26 across key leisure destinations. The move reflects rising investor interest and strengthens FDI-led participation in India’s tourism and hospitality sector, as global brands scale high-quality vacation home offerings to serve growing domestic travel demand.

- HCLTech has entered a multi-year strategic collaboration with OpenAI, positioning itself among OpenAI’s first global services partners to scale enterprise generative AI adoption. The partnership is expected to boost high-value technology investment inflows into India’s AI ecosystem, strengthen the country’s position as a global digital services hub, and support multinational enterprises in deploying AI-driven transformation at scale.

- Mahindra Group CEO Mr. Anish Shah said India is strongly positioned to become a global manufacturing hub, supported by a young workforce, expanding infrastructure, and pro-industry policies, factors that continue to attract overseas investors.

- The Union Cabinet has approved a Rs. 1,00,000 crore (US$ 11.68 billion) Research, Development, and Innovation Scheme to boost private-sector R&D in advanced technologies such as AI, green tech, and deep-tech. By offering long-term concessional finance and equity support, the scheme is expected to strengthen India’s innovation ecosystem and attract high-value foreign investment into strategic technology sectors.

- India’s renewable energy generation rose 24.4% YoY in H1 2025, with record growth in solar and wind output and renewables (ex-hydro) crossing 17% share in June. With 32 GW of new renewable capacity expected in 2025, strong policy momentum and accelerating clean-energy deployment are enhancing India’s attractiveness for long-term foreign investment in green infrastructure and technology.

- Union Minister of Commerce and Industry, Mr. Piyush Goyal stated that, in the past few months, investors worldwide have announced plans to invest over Rs. 50,000 crore (US$ 5.7 billion) in India's finance and banking sector, underscoring India’s emergence as a preferred destination amid global economic uncertainty.

- The Trade and Economic Partnership Agreement (TEPA) between India and the European Free Trade Association (EFTA) was implemented from October 1, 2025. EFTA has committed to investing Rs. 8,82,200 crore (US$ 100 billion) in India over 15 years and is expected to create around one million direct jobs.

- Japan plans to announce a US$ 68 billion investment target in India over the next decade during Prime Minister Mr. Narendra Modi’s visit in August 2025. The commitment, expected to be formalized in a joint statement with Japanese Prime Minister Mr. Shigeru Ishiba, doubles the five-year, US$ 34 billion pledge made in 2022. The fresh plan focuses on semiconductors, AI, clean energy, pharmaceuticals, and critical minerals, aiming to boost supply chain security and reinforce Japan-India economic ties under a free and open Indo-Pacific vision.

Government Initiatives

In recent years, India has become an attractive destination for FDI because of favourable government policies. India has developed various schemes and policies that have helped boost India's FDI. These schemes have prompted India's FDI investment, especially in upcoming sectors such as defence manufacturing, real estate, and research and development. Some of the major government initiatives are:

- Uttar Pradesh is rapidly emerging as a major investment destination, driven by tech-enabled governance reforms like Nivesh Mitra 3.0, which streamlines approvals through PAN-based authentication, single-window clearance, and real-time digital tracking. The platform enhances transparency, integration, and accessibility, especially for MSMEs, helping investors navigate the setup and growth process smoothly in the state.

- Commerce & Industry Minister Mr. Piyush Goyal announced that the government is finalising a dedicated scheme to boost domestic toy manufacturing, strengthening design, quality, and branding capabilities. With exports rising to 153 countries and strong policy support, including quality standards and MSME cluster development, India’s evolving toy sector is increasingly attractive for FDI-led manufacturing partnerships and global value-chain integration.

- Finance Minister Ms. Nirmala Sitharaman announced that the proposal to raise FDI limits in insurance to 100% is expected to lift sectoral growth to 7.1% annually over the next five years, attracting stable foreign capital and improving insurance penetration. Simplified ownership rules are set to enhance competition, technology transfer, and investor participation, reinforcing India’s reform-driven FDI policy environment in financial services.

- India is advancing a Rs. 60,000 crore (US$ 6.94 billion) scheme to modernise 1,000 Industrial Training Institutes under a hub-and-spoke model, partnering with leading Indian and global companies to train two million youth over five years. With co-financing support from multilateral institutions, the initiative will expand India’s skilled workforce and further strengthen the country’s attractiveness for FDI in manufacturing and high-value industries.

- The Union Cabinet has approved the Rs. 24,000 crore (US$ 2.79 billion) PM Dhan-Dhaanya Krishi Yojana to modernise agriculture across 100 districts from FY26, alongside expanding renewable energy investments through NTPC (Rs. 20,000 crore / US$ 2.33 billion) and NLC India (Rs. 7,000 crore / US$ 814.6 million). These initiatives strengthen India’s agricultural productivity and green-energy transition, reinforcing the country’s attractiveness for FDI in agri-value chains and clean-energy infrastructure.

- Large-scale electronics and pharmaceutical manufacturing accounted for ~70% of total PLI disbursements in FY25, with electronics firms receiving Rs. 5,732 crore (US$ 666.3 million) and pharmaceuticals Rs. 2,328 crore (US$ 270.6 million) out of Rs. 10,114 crore (US$ 1.18 billion) released across 14 sectors. Introduced with a total outlay of Rs. 1,97,000 crore (US$ 22.90 billion), the PLI scheme is strengthening India’s manufacturing base and export competitiveness, key drivers for FDI inflows into high-value sectors. Electronics exports rose 32.46% in FY25 to Rs. 3,31,904 crore (US$ 38.58 billion), while pharmaceutical exports climbed 10% to Rs. 2,62,392 crore (US$ 30.5 billion), underscoring India’s growing role in global value chains.

- India is strengthening its flagship AB PM-JAY health insurance scheme, now covering 1,961 procedures across 27 specialties and backed by over 1.77 lakh Ayushman Arogya Mandirs delivering primary care nationwide. By expanding access to affordable, quality healthcare, these reforms support social infrastructure and create a stronger foundation for FDI in healthcare services, life sciences, and medical technology.

- As part of the Union Budget 2025-26, the government has raised the sectoral cap for the insurance sector from 74% to 100%. Additionally, an Investment Friendliness Index for states will be introduced this year. The government is also set to launch Jan Vishwas 2.0 to enhance the business environment further.

- Government permits 100% Foreign Direct Investment via automatic route for Aircraft Maintenance, Repair and Overhaul (MRO).

- The government is taking steps such as facilitating foreign direct investments, nudge prioritisation, and promoting opportunities for using Indian rupee as a currency for overseas investments to simplify FDI regulations and to speed up the approval process.

- The Union Cabinet approved the signing and ratification of a Bilateral Investment Treaty between India and the United Arab Emirates aiming to boost investor confidence, attract foreign investments, and create opportunities for overseas direct investment, potentially leading to job creation. Additionally, it is anticipated to stimulate investments in India, aligning with the vision of ‘Atmanirbhar Bharat’ by promoting domestic manufacturing, reducing import reliance, and boosting exports.

- The Union Cabinet approved an amendment to the Foreign Direct Investment (FDI) policy concerning the Space Sector, aligning with the vision of ‘Atmanirbhar Bharat’ outlined by Prime Minister Mr. Narendra Modi. This amendment liberalised the Space sector, allowing 100% foreign direct investment in specified sub-sectors/activities. The reform is expected to improve the Ease of Doing Business in India, attract greater FDI inflows, and stimulate investment, income, and employment growth.

- In line with the 'Atmanirbhar Bharat' vision, the Union Cabinet approved the PLI Scheme for White Goods (Air Conditioners and LED lights) with a budget of Rs. 6,238 crore (US$ 752 million) from FY 2021-22 to FY 2028-29. The scheme has approved 64 applicants, with a total committed investment of Rs. 6,766 crore (US$ 816 million).

- FDI equity inflows in India's manufacturing sector have seen significant growth, particularly over the last decade. The government reports indicate a 69% increase in FDI equity inflows in the manufacturing sector from Rs. 8,37,191 crore (US$ 97.7 billion) during 2004-14 to Rs. 14,14,742 crore (US$ 165.1 billion) during 2014-24. This growth is attributed to various factors, including the Make in India initiative, Production-Linked Incentive (PLI) scheme, and India's overall economic growth.

- The Government of India increased FDI in the defence sector by liberalizing it to 74% through the automatic route and 100% through the government route.

- The Foreign Investment Facilitation Portal (FIFP) is a new online single-point interface of the government for investors to facilitate Foreign Direct Investment proposals to evaluate and further authorise them under the Government approval route.

- The sectoral cap for the pharmaceutical industry has been lowered, 74% of FDI is permitted in the Brownfield pharma sector via the automatic method, and 100% is permitted via the approved route.

- In the civil aviation sector, 100% FDI is allowed under automatic routes in brownfield airport projects.

- For single-brand retail trading, local sourcing norms have been relaxed for up to 3 years and 100% FDI is allowed under automatic route.

- The government has amended the Foreign Exchange Management Act (FEMA) rules, allowing up to 20% FDI in insurance company LIC through the automatic route.

- Many reforms like National Technical Textiles, Silk Samagra-2 scheme, Seven Pradhan Mantri Mega Integrated Textile Region and Apparel (PM MITRA) Parks, Production Linked Incentive (PLI) Scheme for Textiles to promote the production of Man-Made Fibre (MMF) Apparel, MMF Fabrics and Products of Technical Textiles, and more initiatives are taken by the government to enhance export and to promote FDI in the textile sector.

Road ahead

FDI has become one of the strongest pillars supporting India’s growth story, providing a steady source of long-term capital without adding to public debt. Global companies continue to invest in India to leverage its competitive labour costs, expanding market, tax incentives, and technology-friendly ecosystem, resulting in job creation, capability building, and wider economic gains. Policy stability, GST-led tax simplification, SEZ-driven infrastructure support, and recent reforms such as the proposal to raise FDI limits in insurance to 100% have further strengthened investor confidence.

Momentum remains strong, with FDI equity inflows rising 18% YoY in FY26 (April–September 2025), led by services and computer software & hardware. With improving competitiveness and expanding global linkages, India is set to remain a preferred destination for strategic, long-term capital.