Advantage India

Robust

Demand

*India is the export hub for software services.

*On July 2, 2025, IDC reported that India’s domestic IT & Business Services market reached Rs. 1,41,389 crore (US$ 16.5 billion) in 2024, growing by 6.9% YoY, while maintaining a projected CAGR of approximately 8% between 2022 and 2027.

*India's software service industry is expected to reach Rs. 86,63,000 crore (US$ 1 trillion) by 2030.

*India’s services exports stood at approximately Rs. 11,00,517 crore (US$ 128 billion) in FY26 (April-July 2025), while service imports stood at Rs. 5,56,128 crore (US$ 65 billion) in the same period reinforcing India's global standing.

Competitive

Advantage

* India has climbed to the 39th position out of 133 economies in the Global Innovation Index (GII) 2024, according to the World Intellectual Property Organization (WIPO).

*The Confederation of Indian Industry (CII) has unveiled a plan to position India as a global logistics hub, calling for a collaborative effort among stakeholders to unlock opportunities across industries and regions. The initiative aims to create aspirational career paths, facilitate professional growth, and develop leadership opportunities.

Policy

Support

*The Ministry of Health and Family Welfare (MoHFW) is leveraging artificial intelligence (AI) to enhance public health services across India focusing on developing and adopting AI-driven healthcare solutions.

*Government is planning to setup over 100 branches of India Post Payment Bank in the Northeast region to enhance banking services.

Increasing

Investments

*100% FDI is allowed for any regulated financial sector activity under the automatic route.

*As of March 2025, experts forecast that India is poised to attract over Rs. 52,32,600 crore (US$ 610 billion) in alternative investments, primarily private equity and venture capital, from 2025 to 2027, substantially powering the startup ecosystem.

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREGrowing Power of India’s DIIs

India’s equity markets are experiencing a major structural shift. Dom...

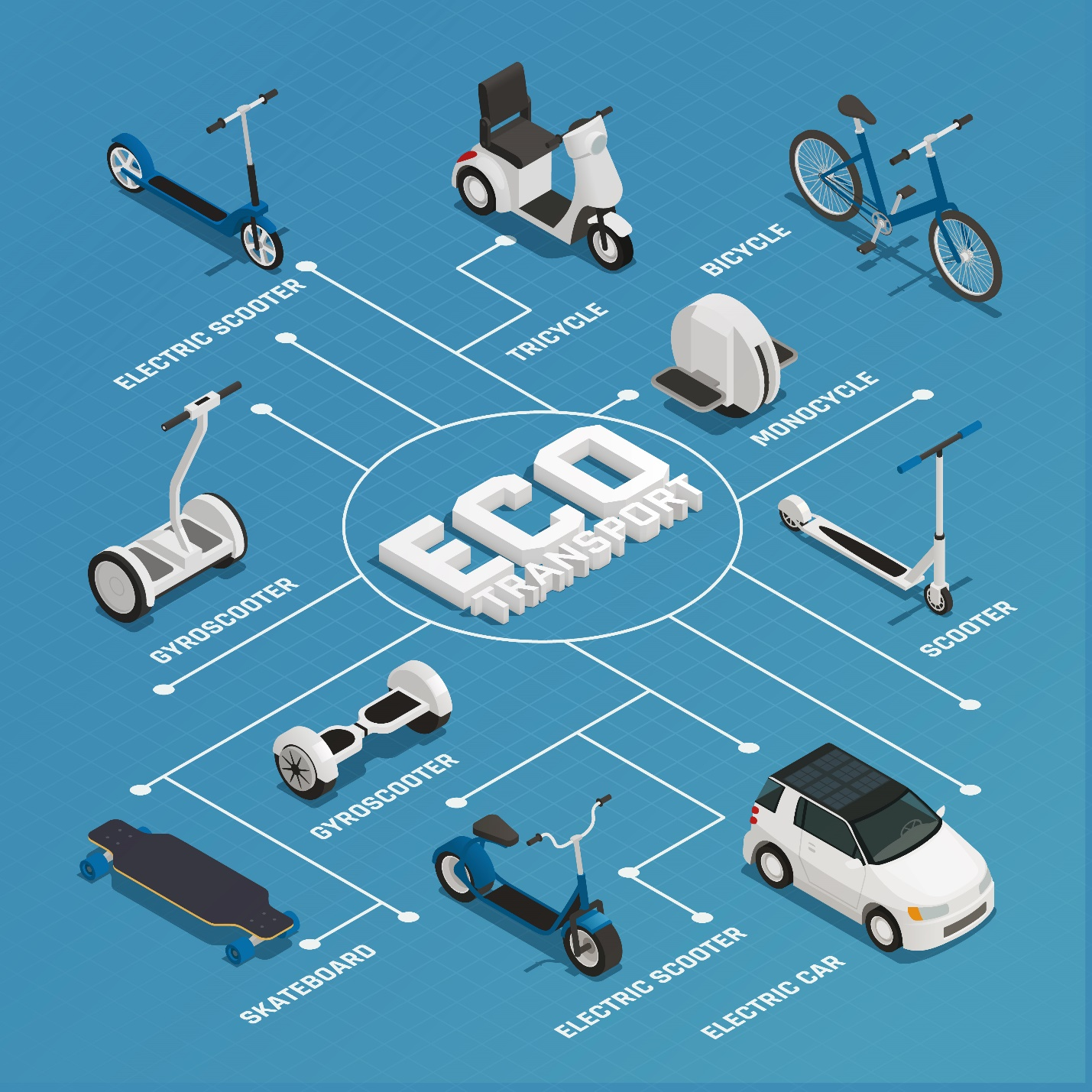

Electric Mobility in Secondary Cities: Beyond Delhi and Bengaluru

India’s electric vehicle (EV) revolution is gathering pace nationwide...

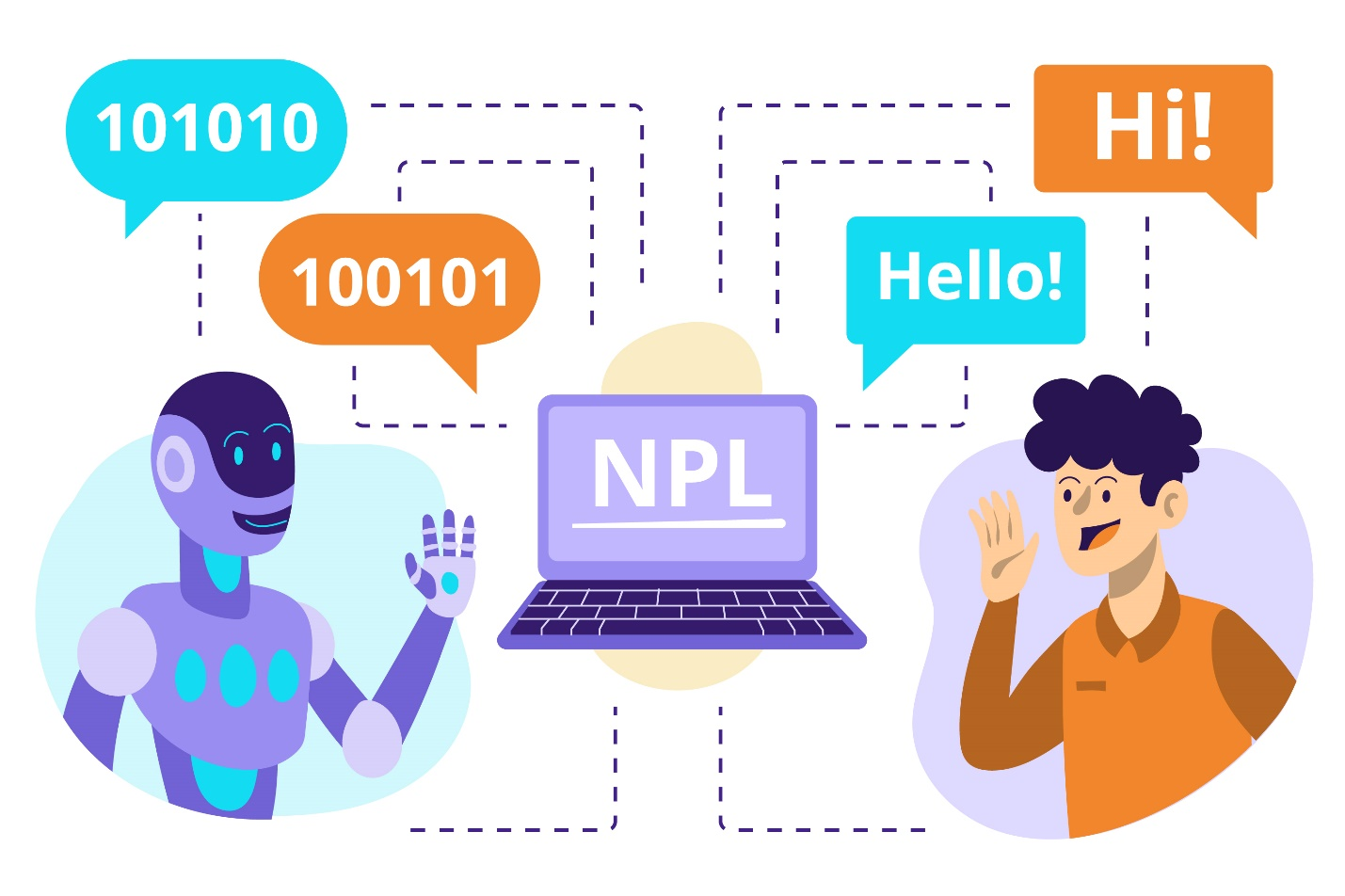

AI for Local Language - Inclusion through Vernacular Models

India, home to hundreds of languages and celebrated for its cultural divers...