Pradhan Mantri Jan Dhan Yojana

Introduction

Launched in 2014, Pradhan Mantri Jan Dhan Yojana (PMJDY) aims to connect every household (later refocused to every unbanked adult) of the country with the banking system. The scheme’s main objective is to help citizens receive banking services such as credit, pension, and insurance at a reasonable cost.

The scheme also aims to simplify the govt.-to-consumer (G2C) fund transfer by removing redundancies such as multiple transaction requirements, ID validation and time delays. The PMJDY acts as a platform to support government social schemes such as Pradhan Mantri Mudra Yojana (PMMY), Atal Pension Yojana (APY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY).

Initially, the scheme was targeted for four years until 2018, covering every household; however, after understanding the impact and prospect, the govt. has extended the scheme to cover every adult.

Need for Pradhan Mantri Jan Dhan Yojana

Financial inclusion is critical for poverty reduction as this helps in transferring the benefits of economic growth and development to the lowest strata of the population. Limited access to financial services among citizens also obstructs economic growth as it limits the new initiatives and developments.

While India had focused on financial inclusion in the past, its success was limited. Before 2014, only 50% adults had bank accounts. As per World Bank estimates, in 2014, India had 469 million bank accounts despite a population of >1.2 billion. Also, a majority of labourers working in the unorganised sectors and households below poverty line did not have bank accounts.

These limitations resulted in lukewarm success of government schemes in extending basic financial support to households and hence, the PMJDY was launched with renewed focus and objective to ensure maximum coverage of banking services across the country and demographics.

PMJDY Objective

Key objective of the PMJDY is to ensure access of financial services such as basic savings & deposit accounts, insurance, pension, credit, and remittance to all households at an affordable cost.

Basic bank account acts as a focal point of this scheme and the scheme started off by requesting all citizens (without any bank accounts) to open accounts under the PMJDY. Govt. reached out to all public and private banking providers to support the scheme and help citizens open accounts in any branch.

Creating a pull for opening bank accounts among the underserved population was a key challenge and to overcome this, the govt. focused on bottlenecks that restricted citizens from opening accounts. These bottlenecks include a long list of required documents, bank criteria of minimum balance in accounts (otherwise the account holder will pay account maintenance charge) and limited banking infrastructure availability.

The govt. has developed policies for these bottlenecks, which has resulted in higher adoption of the scheme and opening of new accounts.

Pradhan Mantri Jan Dhan Yojana Features

- Zero balance savings account can be opened with minimum documents

- No mandate to maintain any minimum balance in these accounts

- These accounts are like regular saving accounts and offer an interest on the deposit

- Accountholders also receives a RuPay debit card

- Accountholders can enrol for an accident insurance cover of Rs. 2 lakh (~US$ 2400) (for accounts opened after 28.8.2018) and Rs. 1 lakh (~US$ 1200) for accounts opened before this date

- An overdraft facility of up to Rs. 10,000 (~US$ 120) (only eligible accountholders)

- Receive benefits of govt. schemes such as Direct Benefit Transfer (DBT), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY) and the Micro Units Development & Refinance Agency Bank (MUDRA) scheme

Progress Update

As of October 15, 2025, about 56.77 crore accounts have been opened across different banks under this scheme. Banks have distributed 39.15 crore RuPay debit cards to PMJDY accountholders and over Rs. 2,73,658 crore (US$ 31.1 billion) has been deposited in these accounts.

27 states and union territories have connected 100% households with banking services, while in the remaining eight states and union territories, over 99% households have been connected.

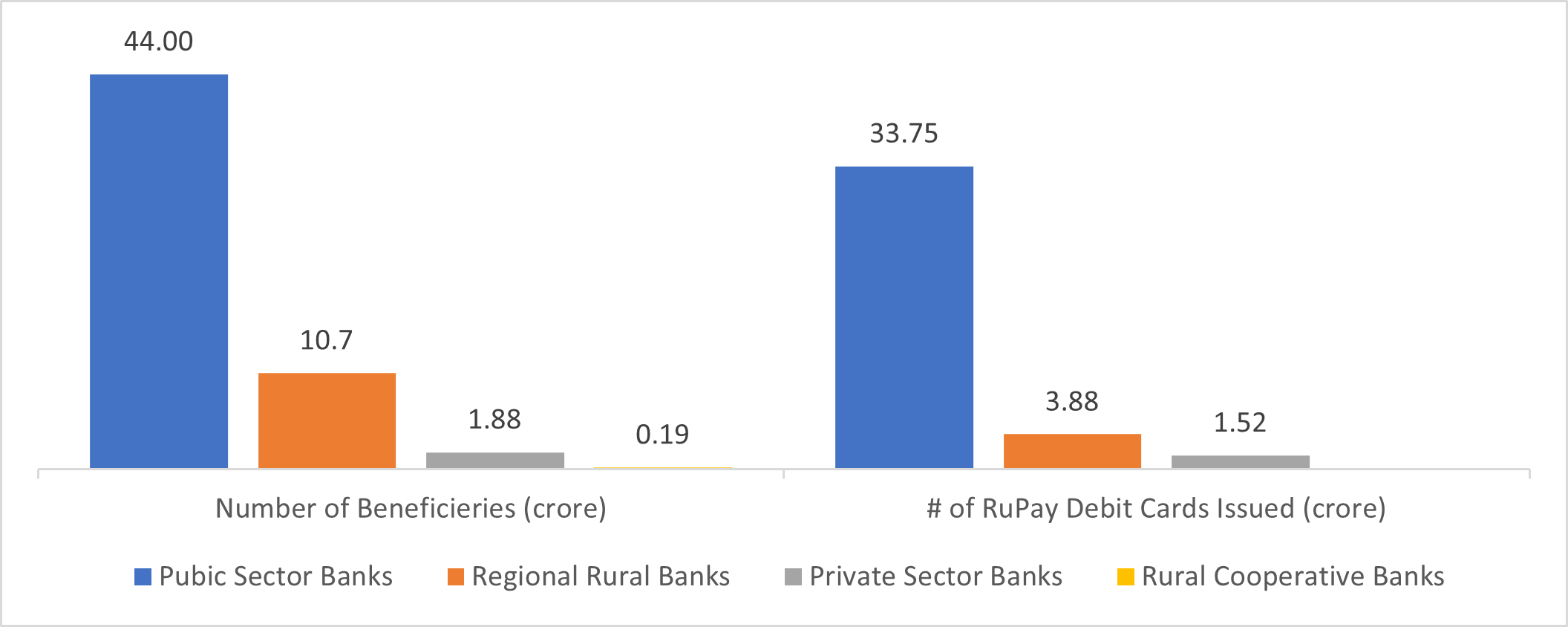

Figure 1: PMJDY Beneficiaries by Bank Type (as of October 2025)

As of August 4, 2025, the scheme has benefited over 55.98 crore individuals, with women accounting for more than 55% of the total beneficiaries. To enhance financial awareness, multiple outreach campaigns were conducted to reach last-mile users. The Reserve Bank of India (RBI) launched the Centre for Financial Literacy to promote community-led, innovative, and participatory financial inclusion approaches. A network of 13.55 lakh Bank Mitras has been established to connect eligible individuals with banking services, while 107 Digital Banking Units (DBUs) have been set up by banks as of December 2024 to provide services such as account opening, passbook printing, fund transfers, and loan applications.

On August 28, 2024, the Pradhan Mantri Jan Dhan Yojana (PMJDY) celebrated its 10th anniversary, achieving a significant milestone with a total of 53.13 crore accounts opened. Among these, 55.6% (29.56 crore) of account holders are women, and 66.6% (35.37 crore) are from rural and semi-urban areas. Launched in 2014, PMJDY has played a crucial role in promoting financial inclusion in India, bringing over 80% of Indian women into the financial system.

Although India has made efforts towards financial inclusion in the past, the key challenge was to keep these accounts active and ensure adequate consumer transactions. To counter these challenges, the PMJDY scheme includes provisions and links such as subsidy transfer, insurance, and pension, which are supporting operations of these accounts. The bank accounts opened under PMJDY also helped the govt. in transferring COVID-relief funds directly to beneficiary accounts.

Approach of the Scheme

In the past financial inclusion schemes, focus was on improving the reach of banking services at a village level. For example, in 2012, the govt. launched a financial inclusion programme to connect villages (with population of 2,000 or more) with banking services. Though this scheme added 74,000 villages to banking services, engagement of consumers was low, and many accounts did not record deposits or transactions.

Under the PMJDY, the aim is to create consumer interest in banking and improve the BFSI infrastructure. The PMJDY encourages use of banking by linking several govt. facilities with these accounts.

- Between April and June 2020, the Indian govt. released three tranches of US$ 1.3 billion each, to be directed to around 200 million women under the Pradhan Mantri Garib Kalyan Yojana

- In 2020, the govt. transferred Rs. 8 billion (US$ 109.3 million) through PMJDY accounts to the beneficiaries of Pradhan Mantri Awas Yojana

- 14 ministries and departments are routing their subsidy payments through 57 national programmes into PMJDY accounts

The govt. has also ensured the availability of banking agents at fixed points in each service area. This helped consumers access services as per their needs.

Another factor that contributed to the success of the scheme is simplifying account opening. Limited documentation and single form were the only requirements to open accounts under the PMJDY scheme. People with no ID documents can also open accounts with limitations of deposits, credit and withdraw limit.

Pradhan Mantri Jan Dhan Yojana List of Documents for Account Opening

Proof of Identity and Address, which include:

- Aadhaar card number

- If Aadhaar number is not available:

- Voter ID Card

- Driving License

- PAN Card

- Passport

- NREGA Card

Note: If above documents are not available, and individual is in low-risk category of banks, any of the following documents can be accepted:

- Central/state govt., statutory authorities, public sector undertakings (PSUs) issued identity card with applicant’s photograph.

- Letter issued by a gazette officer having a duly attested photograph of the person.

Key Enablers of the Scheme

To ensure successful implementation of the scheme, the govt. focused on streamlining the banking system by institutional collaboration and alignment of govt. departments with the scheme’s objectives.

Govt. departments such as the prime minister’s office (PMO) involvement was high since the scheme roll-out. Central govt. is the primary shareholder in large public-sector banks (PSBs) as well as the main sponsor of the scheme, which helped implement and execute the scheme across PSBs in the country. The scheme’s progress is monitored by the PMO through weekly video conference meetings with senior bureaucrats overseeing the programme. All banks are required to participate in these meetings and give presentations on numbers, key issues being faced and possible solutions.

The other factor which contributed to the scheme’s success is presence of large banking systems in the country. The Indian banking system is one of the largest in the world, comprising 12 public-sector banks, 22 private-sector banks, 45 foreign banks, 43 regional rural banks and numerous smaller cooperative banks. The scheme was channelled through all these institutions with the same requirements and offerings. This helped create unified communication with consumers and increase the reach of the scheme.

While all banks participated in the scheme, PSBs are the flag bearers with the highest share of accounts and deposits under the scheme. As of March 2024, PSBs accounted for 78% of all PMJDY deposits.

Also, the large scope of the scheme required an infrastructure which can sustain the KYC mandate. Availability of online biometric-based and digitally verifiable national identification system helped banks expedite account openings under the PMJDY. This infrastructure also helped in identifying the redundancies and ghosts to ensure the authenticity and credibility of services offered through these accounts.

Key Developments

The Finance Ministry reported that the three-month financial inclusion saturation campaign, concluding on September 30, led to the opening of 61 lakh new PM Jan Dhan Yojana accounts, 2.6 crore new Jan Suraksha Scheme enrolments, KYC re-verification of 2.32 crore inactive accounts, and organisation of 2,30,895 camps nationwide.

PMJDY has been a key driver of digital payments in India. The country has witnessed rapid growth in digital transactions with the installation of 1.11 crore PoS/mPoS machines and the expansion of mobile-based platforms such as the Unified Payments Interface (UPI). Total digital transactions surged from 2,338 crore in 2018-19 to 22,198 crore in 2024-25. UPI has been the primary contributor, accounting for 84% of all digital payments, with transaction volumes increasing from 535 crore worth Rs. 8,77,000 crore (US$ 99.68 billion) in 2018-19 to 18,587 crore worth Rs. 2,61,00,000 crore (US$ 2,966.58 billion) in 2024-25. Similarly, RuPay card transactions at PoS and e-commerce platforms grew from 67 crore in 2017-18 to 93.85 crore in 2024-25.

Conclusion

Success of the scheme is evident from the data of households linked by bank accounts. About 99.97% households in India are connected to the banking system, which helped them receive benefits of various govt. schemes directly into their accounts. Also, linking the scheme with other govt. services and facilities have helped in high transactions and low dormancy of the PMJDY accounts.