Advantage India

Robust

Demand

*India’s cement sector is set for robust growth in FY26, with operating profit expected to rise 12-18% to Rs. 900-950 (US$ 10.14-10.71) per metric tonne (MT), according to ratings agency ICRA. Strong demand from housing and infrastructure, better realisations, and stable input costs will drive the improvement.

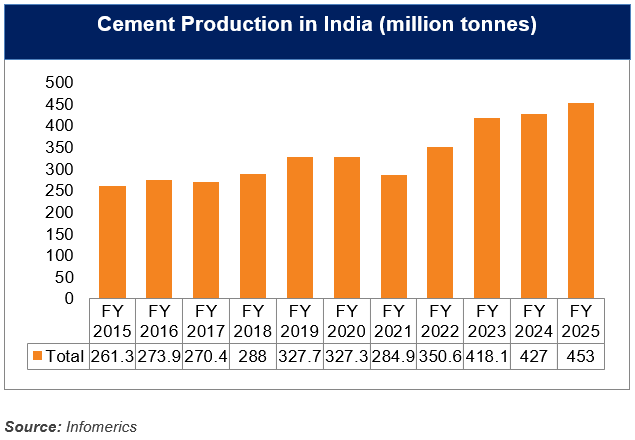

*In FY25, India’s cement production rose to about 453 million tonnes, up from 426.29 million tonnes in FY24, registering a 6.3% YoY growth.

*India's cement industry, as per CRISIL Ratings, plans to increase its capacity by 150-160 MT between FY25 and FY28, building upon the 119 MT annual capacity addition over the last five years, to cater to growing infrastructure and housing demands.

*The GST revamp announced in September 2025 is expected to reduce cement prices by Rs. 30-35 (US$ 0.34-0.40) per 50-kg bag, lowering construction costs and potentially stimulating demand further in the sector.

Attractive

Opportunities

*As of August 2025, the Mumbai-Ahmedabad Bullet Train Corridor is significantly boosting the cement and construction industry, utilizing around 20,000 cubic meters of cement daily—equivalent to eight 10-story buildings. This project, spanning 508 km with multiple stations and tunnels, has generated substantial employment, with about 20,000 workers engaged daily.

*Government has plans for 33.4% outlays for capital investments to Rs. 10 lakh crore (US$ 120 billion) and outlays for railways of Rs. 2.4 lakh crore (US$ 29.05 billion). Also, plans to build 100 new significant transport projects involving an investment of Rs. 75,000 crore (US$ 9.04 billion) for end-to-end connectivity for ports, coal, steel etc.

*Karnataka approved investment proposals worth Rs. 17,183 crore (US$ 2.01 billion) in cement manufacturing, which are expected to generate around 12,500 jobs.

Long-term

Potential

*Indian cement companies are among the world’s greenest cement manufacturers.

*India's top four cement companies - UltraTech, ACC-Ambuja, Shree Cement, and Dalmia Cement are set to add over 42 million tonnes of capacity in FY25, increasing their market share from 48% in FY23 to an expected 54% by FY26.

*Indian cement makers plan to invest around Rs. 1.25 lakh crore (US$ 14.63 billion) between FY25 and FY27 to add 130 million tonnes of grinding capacity about 20% more than current levels.

*The government's infrastructure push is a significant catalyst, with projects like the Mumbai-Ahmedabad Bullet Train Corridor significantly boosting cement demand. This project alone uses around 20,000 cubic meters of cement daily, generating large-scale employment.

Increasing

Investments

*FDI inflows in the industry, related to the manufacturing of cement and gypsum products, reached Rs. 51,135 crore (US$ 7.92 billion) between April 2000-June 2025.

*National Infrastructure Pipeline (NIP) introduced projects worth Rs. 102 lakh crore (US$ 14.59 billion) for the next five years.

*As per the Union Budget 2025-26, the government approved an outlay of Rs. 2,87,333 crore (US$ 33.08 billion) for the Ministry of Road Transport and Highways i.e., 3% higher as compared to the previous budget.

*India’s top cement producers are set to invest about Rs. 1,20,000 crore (US$ 13.53 billion) in capital expenditure between FY26 and FY28, nearly 50% higher than the previous three years, according to Crisil Ratings. The investments will focus primarily on capacity expansion, with the 17 companies covered in the report representing 85% of the country’s total 668 million tonnes (MT) of installed capacity as of March 2025.

Cement Clusters

- Rajasthan

- Tamil Nadu

- Andhra Pradesh

- Madhya Pradesh

- Chhattisgarh

- Odisha

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREHow Green Hydrogen Will Shape Renewable Energy in India

Green hydrogen, a superior and a more sustainable alternative to fossil fue...

Cooperatives Rising: How Local Communities Are Shaping India’s Growth

The co-operative movement in India is a strong driving force of inclusive d...

India’s Aspirational Districts: Stories of Progress and People-Led Change

India’s Aspirational Districts Programme (ADP) was launched in Januar...