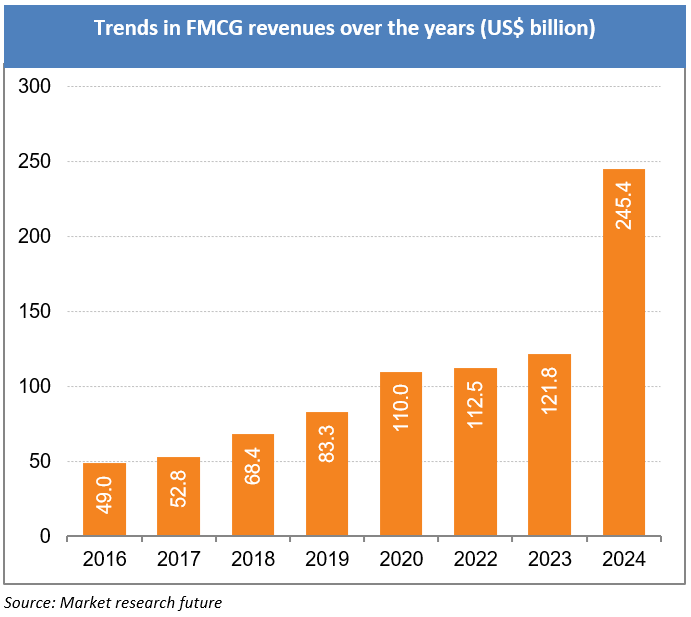

The Indian FMCG market generated revenue of Rs. 20,73,300 crore (US$ 245.39 billion) in 2024 and is expected to grow at a CAGR of 27.9% through 2021–27, reaching nearly US$ 615.87 billion. In 2024, the urban segment contributed 62% while rural India accounted for more than 38% of annual FMCG sales, highlighting the importance of both markets in driving growth.

Household spending patterns vary across cities. West Delhi records the highest FMCG spend at Rs. 39,325 (US$ 456) per year, more than double the national average. South Delhi leads in purchase volumes at around 240 kg annually, Bengaluru spends the most per kg at Rs. 211 (US$ 2.44), and Mumbai tops in shopping frequency with 233 trips per year. In 2025, rural India overtook cities in affordable premium FMCG consumption, accounting for 51% of volume share and 42% of super-premium sales, with average rural premium spend rising at an 11% CAGR over five years. This created a Rs. 98,000 crore (US$ 11.38 billion) market.

Leading FMCG players are leveraging rural India’s potential. Dabur derives 45–50% of its revenue from rural markets, reaching over 1,31,000 villages and 1.42 million outlets. Hindustan Unilever generates 35–40% of its revenue from rural areas, supported by its Shikhar app, which has 1.4 million retailers on board and a 70% monthly active user rate.

Emerging categories are also boosting the FMCG landscape. India’s pet economy is projected to grow from Rs. 89,743.5 crore (US$ 10.5 billion) in FY24 to Rs. 1,38,461.4 crore (US$ 16.2 billion) by FY32 at a CAGR of 5.65%. The healthy snack market, led by makhana, is expected to reach Rs. 20,000 crore (US$ 2.32 billion) by 2030, driven by premiumisation, quick commerce, and demand for natural, functional products. The dairy industry is projected to expand by 13–14% in FY25, backed by strong demand and increased milk supply. Meanwhile, the alcoholic beverage (alcobev) industry is set to grow 8–10% in FY26, reaching Rs. 5,30,000 crore (US$ 61.97 billion). India’s Rs. 46,571 crore (US$ 5.29 billion) snack market is seeing startup challenges to legacy brands and is set to reach Rs. 1,01,811 crore (US$ 11.57 billion) by 2033, with namkeen adding Rs. 39,591 crore (US$ 4.5 billion) by 2029.

Quick commerce has become a defining growth engine. It now accounts for 70–75% of total e-grocery orders, compared to 35% in 2022, and is expanding at a CAGR of 70–80%. Operating across 80 cities, India is the first market globally to scale quick commerce, which has delivered FMCG companies a 50–100% sales increase in FY25.

Government initiatives and policies continue to support growth. The Union Government approved a Production Linked Incentive (PLI) scheme for the food processing sector with a budget outlay of Rs. 10,900 crore (US$ 1.46 billion). Till June 2025, the scheme had approved 278 units of 170 applicants, attracted Rs. 9,032 crore (US$ 1.04 billion) in investments, created 3.4 lakh jobs, and added 35 lakh MT of annual capacity. The Ministry of Food Processing Industries (MoFPI) has also sanctioned over 1.44 lakh projects through its flagship schemes to boost rural economies, strengthen supply chains, and promote Indian food brands globally.

Digital transformation is reshaping consumption. India’s internet users are projected to cross 900 million by 2025, with rural India accounting for 55% of them. In 2024, Indians collectively spent 1.1 lakh crore hours on smartphones, averaging five hours daily per person. E-commerce accounted for 17% of FMCG consumption among affluent buyers in 2024, with average spends of Rs. 5,620. India’s e-commerce industry, valued at Rs. 10,82,875 crore (US$ 125 billion) in FY24, is expected to grow to Rs. 29,88,735 crore (US$ 345 billion) by FY30 at a 15% CAGR. The online grocery segment alone is projected to expand from US$ 4.54 billion in 2022 to US$ 76.76 billion by 2032, growing at a CAGR of 32.7%. Digital payments, which reached US$ 300 billion in 2021, are projected to touch US$ 1 trillion by 2026.

The D2C market crossed Rs. 6,96,400 crore (US$ 80 billion) in 2024 and is expected to exceed Rs. 8,70,500 crore (US$ 100 billion) in 2025. FMCG new product launches rose 1.8 times in the year ending May 2025, though only 4% reached 1% market penetration due to intense competition from regional and D2C brands. Legacy companies are adapting: Hindustan Unilever acquired Minimalist for Rs. 3,000 crore (US$ 348.5 million), Marico bought Beardo, Plix, Just Herbs, and True Elements, ITC acquired Yoga Bar, and Emami gained full ownership of The Man Company.

Around two‑thirds of acquisitions by FMCG firms from FY21 to FY25 have been in the direct‑to‑consumer (D2C) space, per Crisil Ratings.

Competition is intensifying between global majors, domestic giants, and start-ups. FMCG leaders such as Johnson & Johnson, Himalaya, HUL, ITC, and Lakmé are facing challenges from digital-first players like Mamaearth, Sugar, The Moms Co., and Nua, which reached Rs. 100 crore revenue milestones far faster than traditional brands. Global majors are also scaling up: L’Oréal India, which produces 95% of its local sales domestically, plans to double its business and expand manufacturing. P&G India crossed Rs. 17,094 crore (US$ 2 billion) in FY24 sales, maintaining leadership in sanitary napkins and shaving razors. Reliance Industries is positioning itself to tap India’s 600 million value-conscious consumers by strengthening partnerships with local kirana stores.

India’s FMCG sector continues to be the largest advertiser in the country, with a nearly one-third share of the total ad market, spending Rs. 31,000 crore (US$ 3.75 billion) in 2023. With rising incomes, shifting consumer preferences, growing digital penetration, and robust policy support, the sector is well positioned to remain one of the strongest drivers of India’s consumption-led growth story.