Advantage India

Growing

Demand

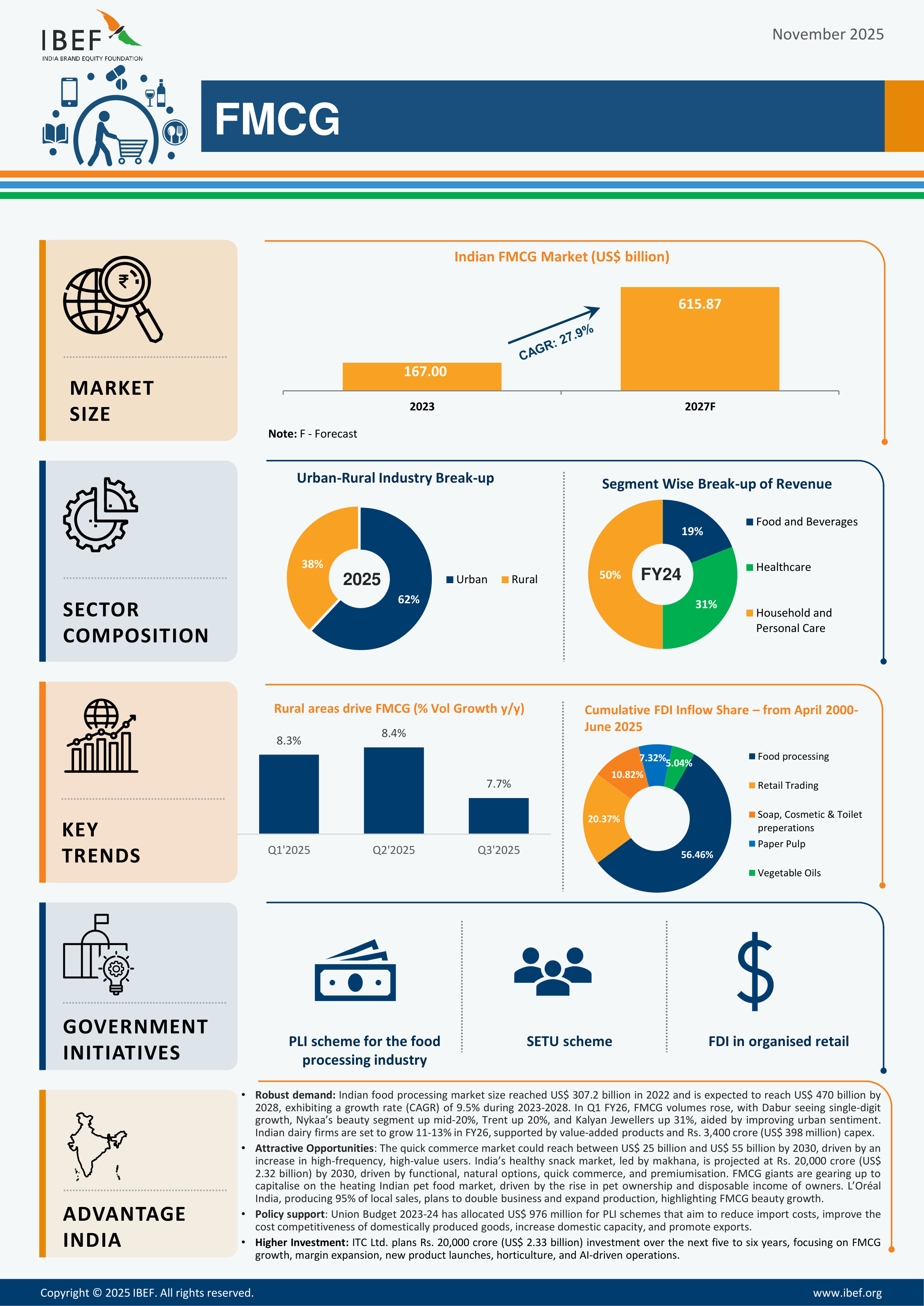

*Indian food processing market size reached US$ 307.2 billion in 2022 and is expected to reach US$ 547.3 billion by 2028, exhibiting a growth rate (CAGR) of 9.5% during 2023-2028.

*Indian dairy firms are projected to grow 11-13% in FY26, led by value-added products, with improved margins and Rs. 3,400 crore (US$ 398 million) capex.

*India’s Rs. 46,571 crore (US$ 5.29 billion) snack market is seeing startup challenges to legacy brands and is set to reach Rs. 1,01,811 crore (US$ 11.57 billion) by 2033, with namkeen adding Rs. 39,591 crore (US$ 4.5 billion) by 2029.

Attractive

Opportunities

*Increased rural consumption presents an opportunity for expanding distribution networks in tier-2 and tier-3 cities.

*The quick commerce market could reach between US$ 25 billion and US$ 55 billion by 2030, driven by an increase in high-frequency, high-value users.

*India’s healthy snack market, led by makhana, is projected at Rs. 20,000 crore (US$ 2.32 billion) by 2030, driven by functional, natural options, quick commerce, and premiumisation.

*FMCG giants are gearing up to capitalise on the heating Indian pet food market, driven by the rise in pet ownership and disposable income of owners.

Policy

Support

*The Union Budget 2025-26 provides a strong push to consumer spending, particularly benefiting the FMCG industry. The increase in disposable income, rural development focus, and MSME support create an ideal environment for growth.

*MoFPI has approved over 1.44 lakh food processing projects through its flagship schemes to boost rural economies, strengthen supply chains, and promote Indian brands globally.

Higher

Investments

*ITC Ltd. plans Rs. 20,000 crore (US$ 2.33 billion) investment over the next five to six years, focusing on FMCG growth, margin expansion, new product launches, horticulture, and AI-driven operations.

*Amul will set up the world's largest curd plant in Kolkata, West Bengal, with an investment of Rs. 600 crore (US$ 68.6 million), processing 10 lakh kilograms (KG) daily.

Major FMCG cities

- Chandigarh

- Maharashtra

- Tamil Nadu

- Gujarat

- Punjab

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREHow Green Hydrogen Will Shape Renewable Energy in India

Green hydrogen, a superior and a more sustainable alternative to fossil fue...

Cooperatives Rising: How Local Communities Are Shaping India’s Growth

The co-operative movement in India is a strong driving force of inclusive d...

India’s Aspirational Districts: Stories of Progress and People-Led Change

India’s Aspirational Districts Programme (ADP) was launched in Januar...