RECENT CASE STUDIES

India’s Floriculture Sector: Blooming with Export Potential and Rural Prosperity

Last updated: Dec, 2025

India’s floriculture sector is evolving into a globally competitive industry, offering vast potential in rural income generation, export diversification, and employment. With 2,85,000 hectares under cultivation in FY24 and a combined flower production of over 3.2 million metric tonnes (MT), India is the second-largest producer of flowers globally, trailing only China. Dominated by Tamil Nadu, Karnataka, Madhya Pradesh, and West Bengal, the industry has expanded beyond traditional cultivation to become an export-driven enterprise. Successful interventions like the Anthurium export initiative from Mizoram, reinforces the sector’s ability to unlock rural prosperity and capture global market share with strategic support and modernisation.

The Indian floriculture industry that had long been a niche in the agriculture sector has grown into a dynamic industry, forming a part of the export earnings, rural livelihood, and incorporating technology. Farming and trade of flowers and non-edible ornamental plants have become paramount to the Indian horticultural structure forming part of value-added exports and diversified agriculture.

The global flower market, motivated by the demand of cut flowers, foliage, and ornamental plants, is experiencing continued market growth. Floriculture represents a strategic sector because of the country’s agro-climatic diversity, the changing patterns of consumer requirements and the growing demands urban landscaping. Floriculture has also gained momentum in investments and modernisation with the government recognising floriculture as a 100% export-oriented industry. However, its entire potential has not yet been reached because of breakage in supply chains, a lack of awareness and restrictions of exports.

India’s floriculture landscape

Area and production statistics

Over the past 20 years, there has been a stable growth in Indian floriculture due to rising commercialisation and export-oriented integration. The National Horticulture Database indicates that the area of floriculture cultivation in FY24 was ~2,85,000 hectares and the average production was ~22,84,000 metric tonnes (MT) of loose flowers and 9,47,000 MT of cut flowers. These numbers highlight the commercial potential of mass-scale agriculture.

These changes of subsistence flower farming to organised, commercial-scale flower farming have been facilitated by advancement in the quality of seeds, the introduction of greenhouse technology and paying of government subsidies. It is worth noting that increased demand has been seen in floricultural products like roses, lilies, and carnations which has motivated small holders and agri-entrepreneurs to move towards floricultural crops industry.

The Indian floriculture industry is very diversified and includes ornamental foliage, cut flowers, potted and loose flowers employed in religious rituals. It also plays the central role of providing raw materials to extract the essential oil, formulation of cosmetics, and pharmacologically present herbs hence dashing multiple-sectorial value.

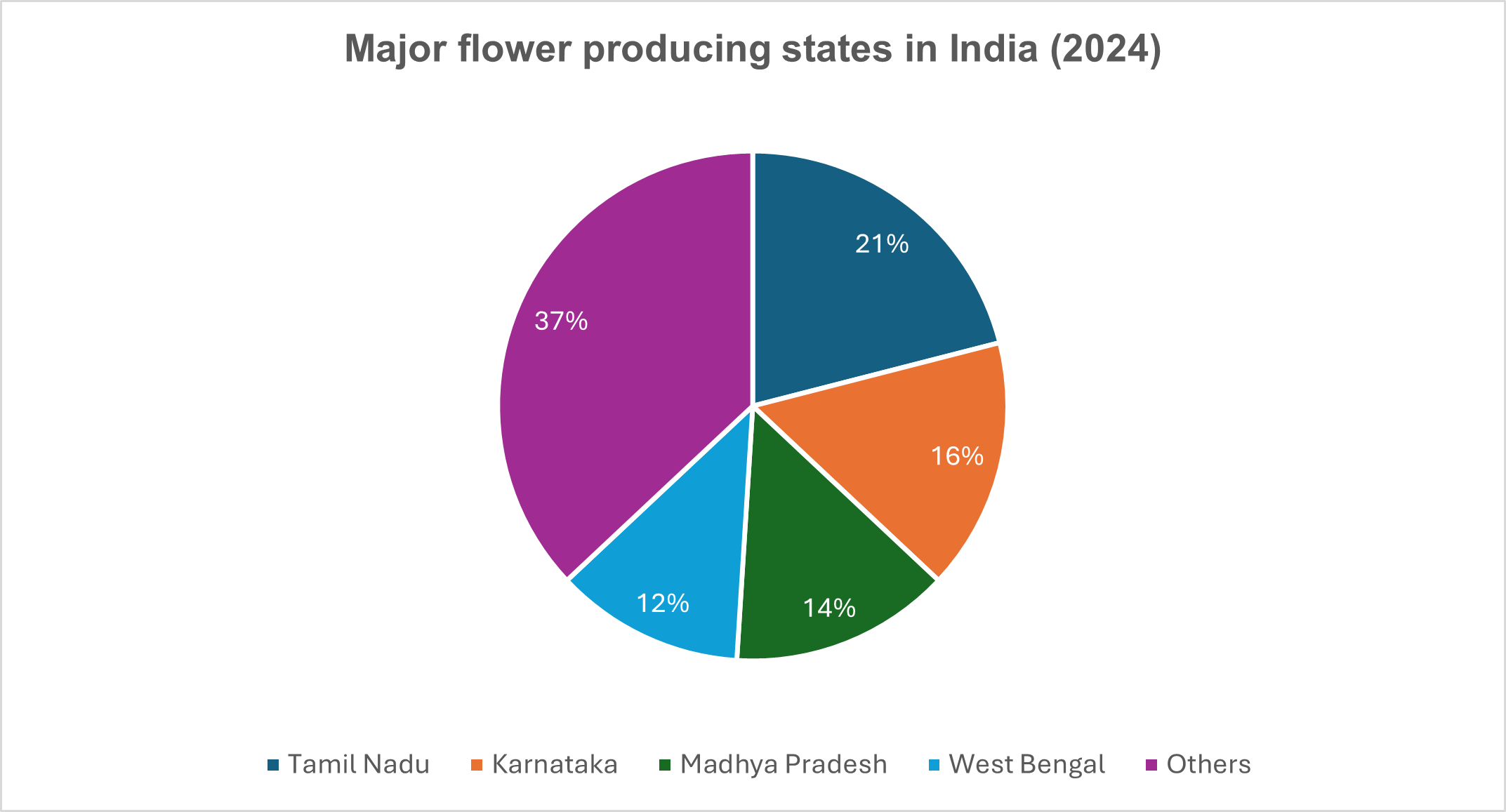

Major flower producing states

Source: APEDA

Floriculture in India is seen in many geographies. Tamil Nadu produces 21% of the national productions followed by Karnataka (16%), Madhya Pradesh (14%), and West Bengal (12%). Other major producing states include Mizoram, Odisha, Haryana and Chhattisgarh.

Each area specialises in the production of specific types of flower according to its agro-climatic conditions:

Tamil Nadu: Marigolds, jasmine, crossandra

Karnataka: Gerberas, orchids, roses

West Bengal: Gladiolus, chrysanthemums

Madhya Pradesh and Maharashtra: Ornamental marigold and loose flowers used in ceremonies

These areas have had an infrastructure boost, government patronage and privately-owned projects regarding cold chain storage, nurseries, and agri-clinics. The introduction of export clusters in Bengaluru, Pune and Hosur has availed direct export markets to the growers.

Key flower varieties

India cultivates a variety of flowers tailored to domestic and international demand. Key varieties include:

Roses: Widely grown in Karnataka and Maharashtra; high in export value.

Marigolds: Popular in religious ceremonies; extensively grown in Tamil Nadu and Madhya Pradesh.

Carnations, Chrysanthemums, Gerberas: Grown in controlled environments for export.

Lilies and Orchids: High-end flowers grown in select regions like Sikkim and Mizoram.

The demand for exotic flowers has increased, with orchids and anthuriums becoming commercially viable in the north-eastern region. These flowers are also gaining traction in urban landscaping, event décor, and the wellness industry.

Domestic applications

Flowers form a part of everyday activities of Indians. Jasmine, marigold and crossandra are among the common flowers used in worship, social functions, and personal decoration. Along with the increased levels of urbanisation and disposable incomes, the culture gifting bouquets, venue customisation, and beautifying residential spots has exploded.

The domestic floriculture industry also sources ingredients to secondary industries:

Perfumery and cosmetics: jasmine, lavender and rose petals

Pharmaceuticals: calendula, hibiscus, and chamomile

Dye and colour extraction: marigold and hibiscus

Consumer bases in urban areas, event organisers, and hospitality chains are increasingly demanding consistency in quality and variety of the floriculture products, leading to the demand for greenhouse cultivated and seasonal flowers all year round.

Floriculture exports: Performance and potential

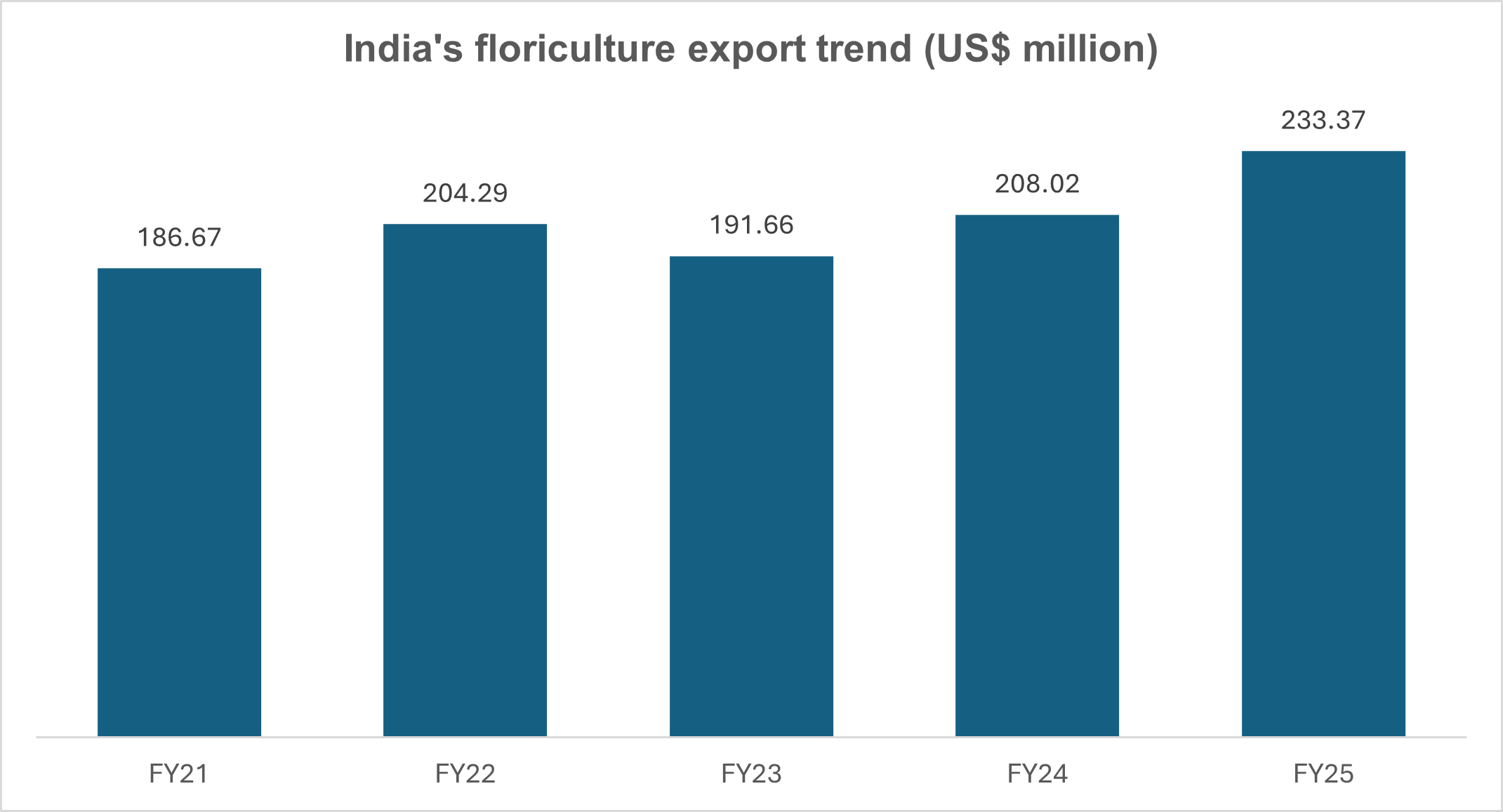

Export statistics and trends

Source: APEDA, AgriExchange

India’s floriculture exports have been on an upward trajectory over the past five years, reflecting growing global interest in Indian floral products. From Rs. 1,600 crore (US$ 186.67 million) in FY21, exports rose to Rs. 2,000 crore (US$ 233.37 million) in FY25.

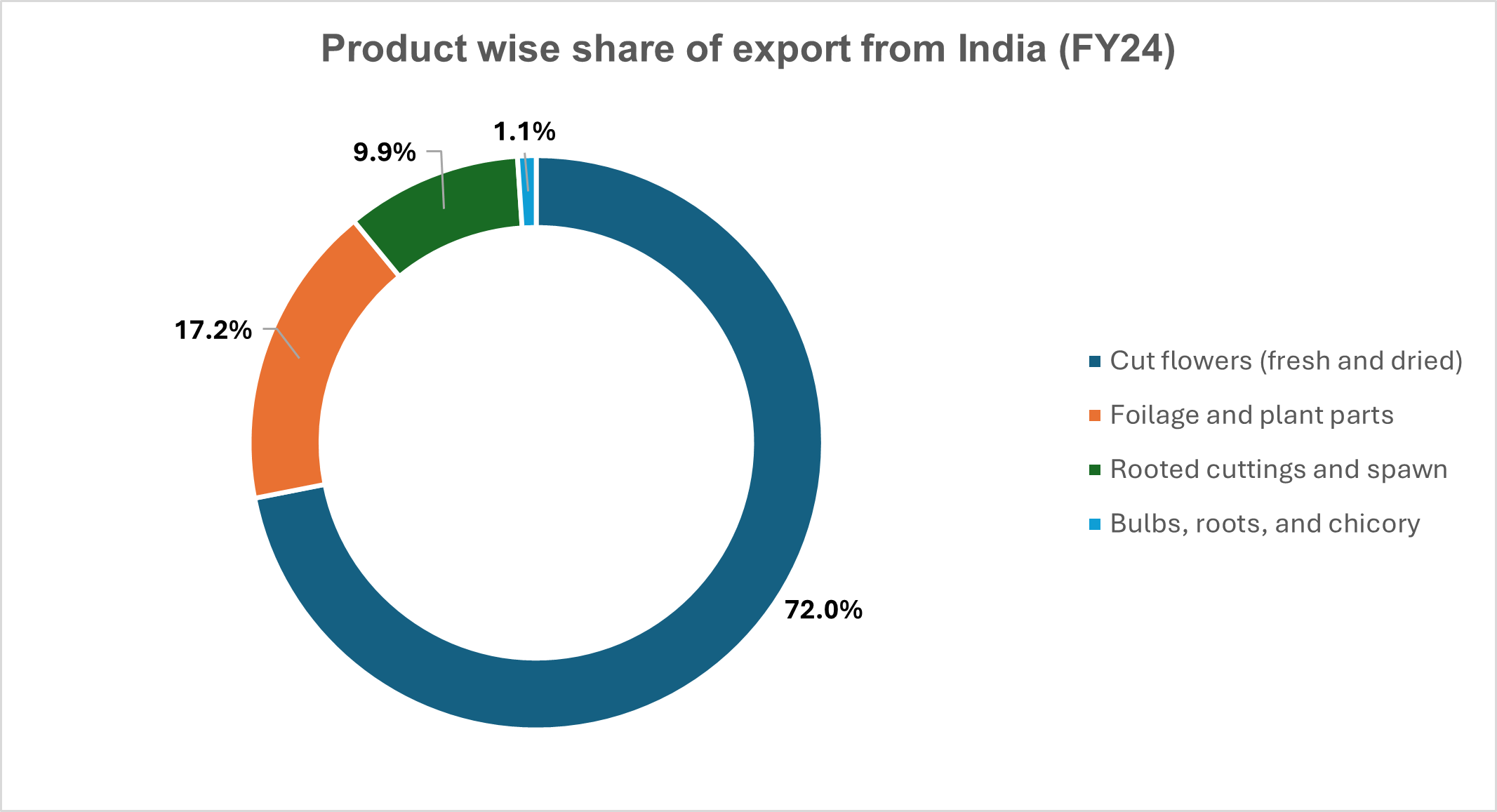

Product wise share

Source: Export Import Data

India’s floriculture exports in FY24 were driven by a few key products. Both fresh and dried cut flowers topped the list, making up 72% of the total exports. This was followed by foliage and other plant parts at 17.16%. Rooted cuttings and spawn contributed 9.92%, while bulbs, roots, and chicory made up a modest 1.05%. These figures reflect a clear global demand for Indian ornamental flowers and greenery, especially in the premium and decorative segments.

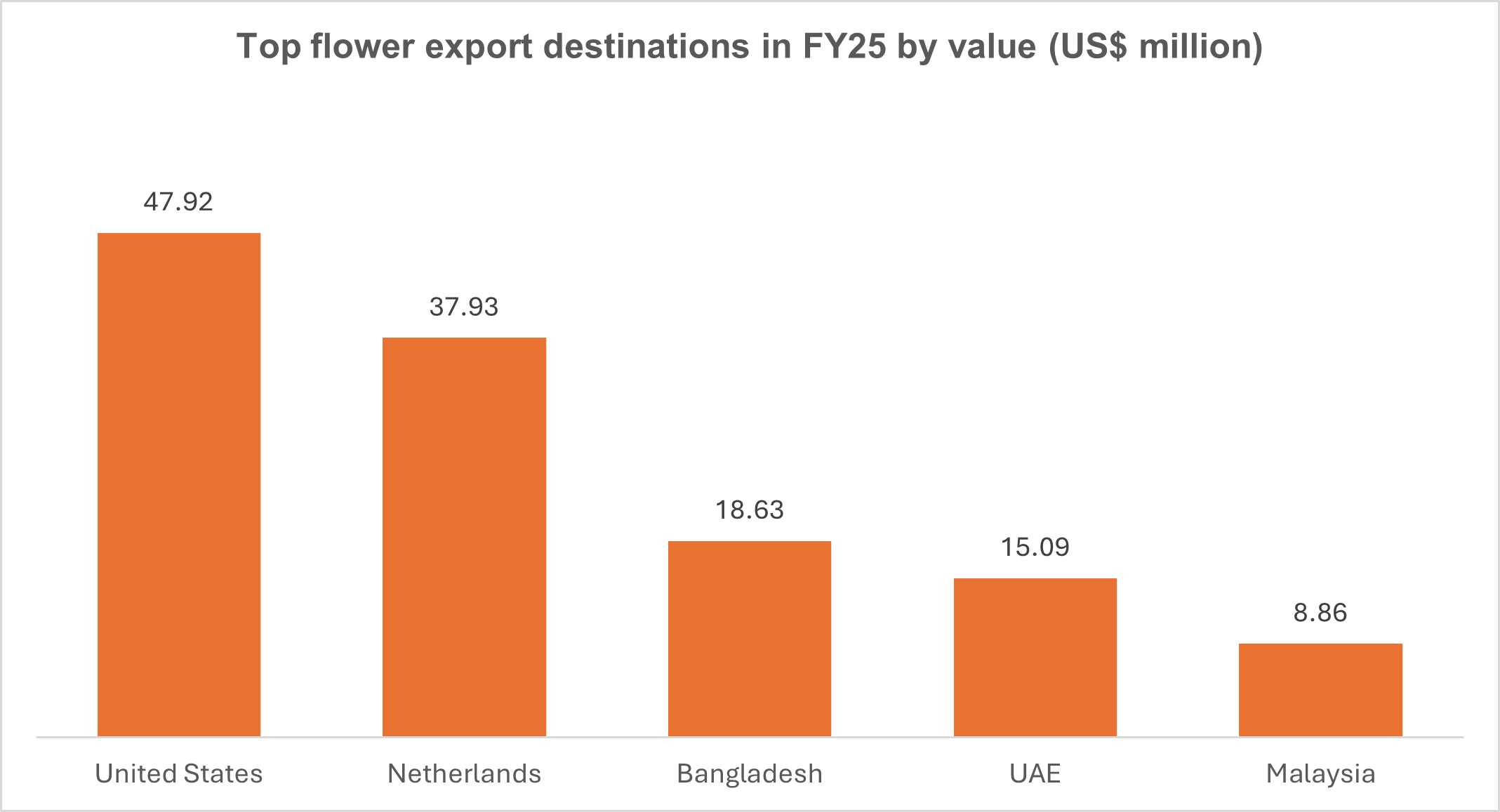

Key export markets

Source: APEDA, AgriExchange

In FY25, India’s floriculture products found strong demand across key international markets, with the United States emerging as the top destination, accounting for exports worth Rs. 411 crore (US$ 47.92 million). It was followed by the Netherlands, a significant base of international flower trade, with Rs. 325 crore (US$ 37.93 million). Floriculture product imports by Bangladesh were Rs. 160 crore (US$ 18.63 million), while the United Arab Emirates (UAE) and Malaysia added product imports of Rs. 129 crore (US$ 15.09 million) and Rs. 76 crore (US$ 8.86 million), respectively. These figures highlight India’s expanding footprint in traditional and emerging markets for floriculture exports.

Conclusion

The floriculture industry in India is on the verge of a breakthrough. The country is geared to emerge as a world leader in cut flowers, ornamental plants and value-added products and it owns the second largest area under cultivation and high diversity of flowers. However, to accomplish this vision, major infrastructure, logistic, quality control and market access bottlenecks should be addressed. Examples of initiatives by the government include the National Horticulture Mission, APEDA and state level policy interventions. Moreover, the fact that the initial export of Anthurium flowers produced in Mizoram to Singapore was successful indicates real results that can be obtained with the help of coordinated institutional support, empowerment of farmers and market linkage. As urban demand has escalated, so has hybrid seed and post-harvest technology improvement, agri-startups and all-women run cooperatives. The floriculture industry is experiencing a visible change.

It is not the concern of aesthetics or exports, but of sustainable livelihoods and inclusive growth, and it is of making India a responsible country within the global floral economy. To go ahead, a unitary and prospective strategy that combines infrastructure, innovation, inclusion, investment, and internationalisation may unleash the real potential of this sector. With policy initiative and stakeholder cooperation, the story of floriculture in India can become the global success story, thus bring prosperity to rural India and making its export-driven economy more robust.