Advantage India

Robust

Demand

*India’s housing market is shifting as more buyers seek larger, premium homes. The Anarock H1 2025 survey shows 36% now prefer properties priced between Rs. 90 lakh-1.5 crore (US$ 1,02,052-1,70,087), up from 18% before Covid-19.

*Luxury home demand in India remained strong in 2025, with sales of Rs. 4 crore (US$ 0.5 Million) and above rising nearly 28% YoY across seven major cities.

*In Q1 2025, 1,930 luxury homes were sold across India’s top seven cities, a 28% jump from the 1,510 units sold in the same period the previous year.

Attractive

Opportunities

*The real estate sector shows promise with a projected 9.2% CAGR from 2023 to 2028. 2025 is expected to drive growth with urbanization, rental market expansion, and property price appreciation.

*ICRA expects new project launches across the top seven cities to rise by 6-9% in FY2026, reaching around 620-640 million square feet

*Average home prices rose by 13-15% in FY25, and they're expected to climb another 3–5% in FY26, a sign that demand remains strong and developers continue to hold pricing power.

*Private market investor, Blackstone, which has significantly invested in the Indian real estate sector worth Rs. 3.8 lakh crore (US$ 50 billion), is seeking to invest an additional Rs. 1.7 lakh crore (US$ 22 billion) by 2030.

*The Reserve Bank of India cut the repo rate by 50 basis points in June 2025, significantly reducing home loan EMIs and boosting real estate demand and buyer confidence.

Policy

Support

*The Government has allowed FDI of up to 100% for townships and settlements development projects.

*The Union Budget 2025-26 allocated Rs. 1 lakh crore (US$ 11.35 billion) to the Urban Challenge Fund, aiming to transform cities into growth hubs through redevelopment and infrastructure projects.

*The National Real Estate Policy 2025 introduced a major reform with a unified single-window clearance system for real estate projects, aimed at streamlining approvals and reducing project delays by up to 40%. The policy also incentivizes green-certified developments with tax benefits and subsidies to promote sustainable construction.

Increasing

Investments

*Driven by increasing transparency and returns, there’s a surge in private investment in the sector.

*According to Anarock Capital, Foreign private equity (PE) investments in Indian real estate reached approximately US$ 3.1 billion in FY25, marking a significant increase from US$ 2.6 billion in FY24.

*Institutional investments surged, especially in Q2 2025, with a 122% QoQ rise to US$ 1.8 billion, primarily targeting commercial assets. Major foreign investors from the US, Japan, and Hong Kong accounted for about 89% of foreign inflows, indicating growing global confidence despite some YoY moderation.

*Panattoni is investing Rs. 900 crore (US$ 104.43 Million) to set up a 25-acre Grade-A logistics park in Hosur, Tamil Nadu, marking a major step in its expansion across India.

*Government launches Rs. 15,000 crore (US$ 1.70 billion) fund to revive stalled affordable and mid-income housing projects in Swamih Fund II.

Real Estate Clusters

- Mumbai

- NCR

- Bengaluru

- Pune

- Chennai

- Hyderabad

Posters

MORE

THE GOLDEN SKY LINE

India is the leading real estate investment market in Asia. Construction margins in India are also double that of the world average - a perfect combination that makes India the most profitable construction market in the world.

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREGrowing Power of India’s DIIs

India’s equity markets are experiencing a major structural shift. Dom...

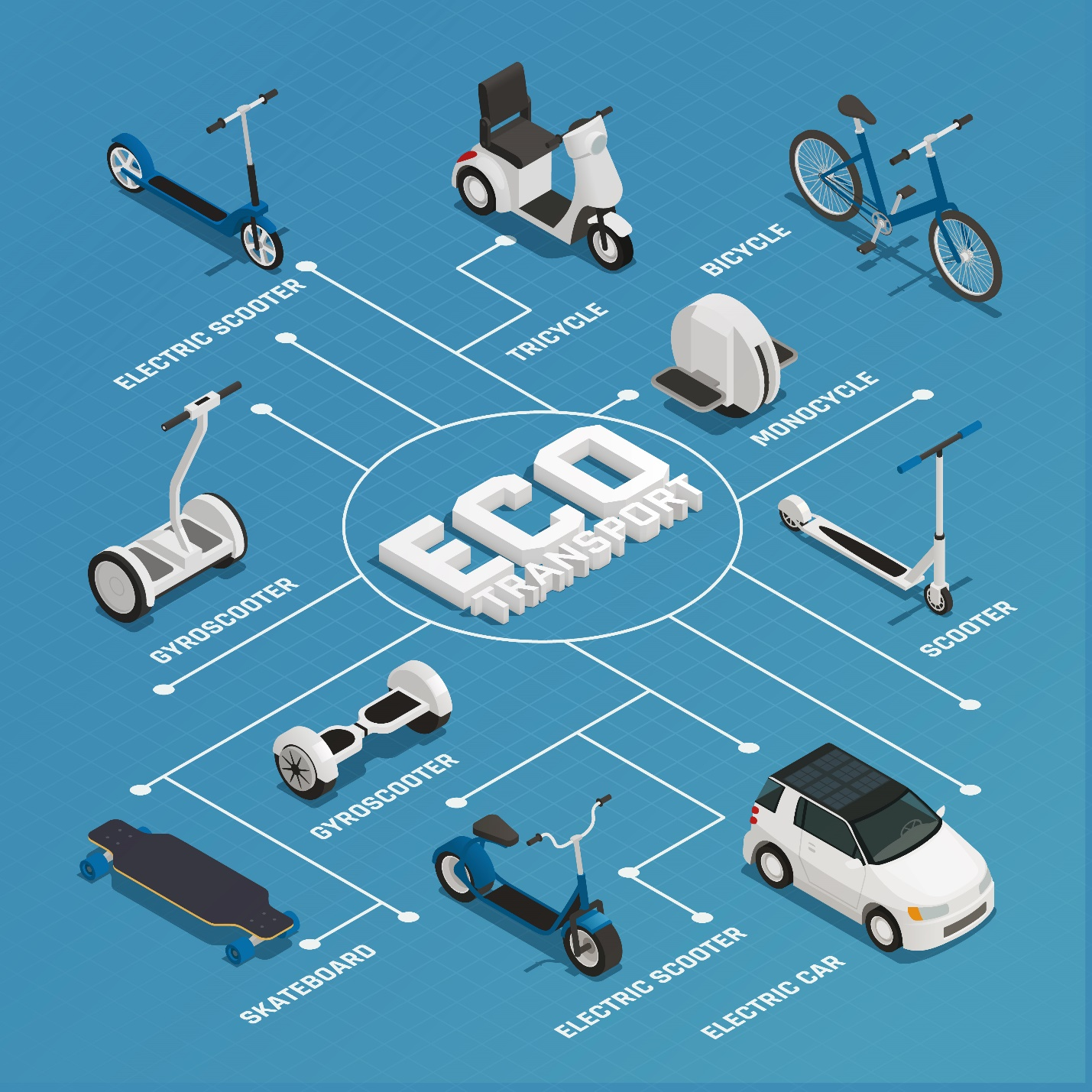

Electric Mobility in Secondary Cities: Beyond Delhi and Bengaluru

India’s electric vehicle (EV) revolution is gathering pace nationwide...

AI for Local Language - Inclusion through Vernacular Models

India, home to hundreds of languages and celebrated for its cultural divers...