Advantage India

Robust

Demand

*The country's entertainment and media industry is expected to see a growth of 9.7% annually in revenues to reach US$ 73.6 billion by FY27.

*According to a report published by Telecom Regulatory Authority of India (TRAI), India’s total internet users crossed 100 crore in June 2025.

*In India, revenue in the AVoD market is projected to reach Rs. 18,227 crore (US$ 2.08 billion) in 2025. The revenue in this market is expected to show an annual growth rate (CAGR 2025-2030) of 8.50%, resulting in a projected market volume of US$ 3.12 billion by 2030.

Attractive

Opportunities

*The Indian entertainment sector could unlock an estimated Rs. 50,724 crore (US$ 6 billion) in unrealised value by FY30, according to a recent industry report. This growth potential is attributed to international collaboration, technology adoption, and strategic changes in content creation.

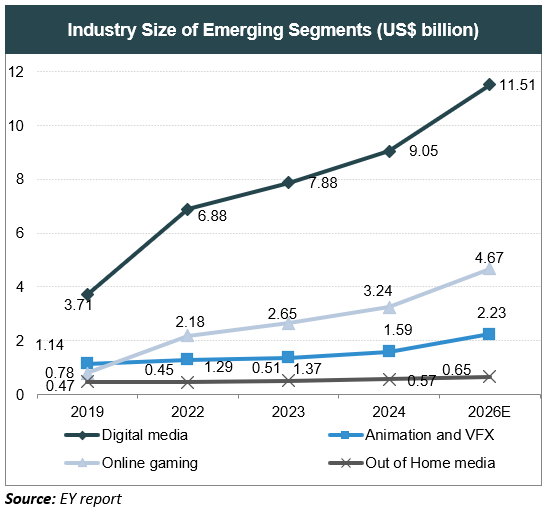

*India's Animation and VFX sector is projected to grow from US$ 1.3 billion in FY23 to US$ 2.2 billion by FY26, increasing its share of the media and entertainment (M&E) industry from 5% to 6%.

Policy

Support

* The Government of India has increased the FDI limit from 74% to 100%.

*In February 2024, the Union Cabinet approved the auction of 10,523.15 megahertz (MHz) of spectrum across bands at a reserve price of Rs 96,317.65 crores (US$ 11.60 billion).

Higher

Investments

*FDI inflows in the information and broadcasting sector (including print media) stood at Rs. 1,02,988 crore (US$ 11.77 billion) between April 2000-June 2025.

*The Indian gaming sector has raised a total of US$ 2.8 billion from domestic and global investors, over the last five years (2019-2024).

*In FY26, JioStar plans to invest Rs. 33,000 crore (US$ 3.85 billion) in new content, a move aimed at transforming India’s media landscape with greater focus on Indian-language, localised entertainment and sports.

Media and Entertainment India

Posters

MORE

CINEMA OF THE WORLD

India has one of the largest film industries in the world, produces the largest number of films annually, constitutes the highest number of tickets sold annually and has the second highest screen count in the world.

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREHow Green Hydrogen Will Shape Renewable Energy in India

Green hydrogen, a superior and a more sustainable alternative to fossil fue...

Cooperatives Rising: How Local Communities Are Shaping India’s Growth

The co-operative movement in India is a strong driving force of inclusive d...

India’s Aspirational Districts: Stories of Progress and People-Led Change

India’s Aspirational Districts Programme (ADP) was launched in Januar...