Forging Ahead: Ramkrishna Forgings’ Global Growth Story

Case Study

Forging Ahead: Ramkrishna Forgings’ Global Growth Story

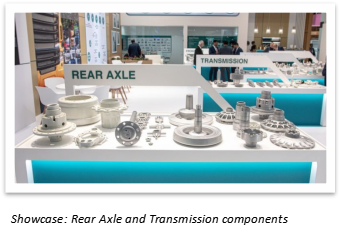

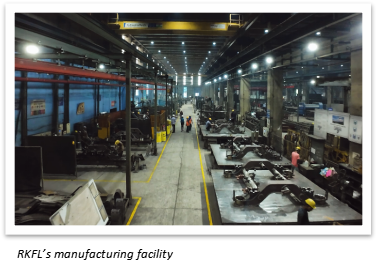

With over four decades of engineering excellence, Ramkrishna Forgings Limited (RKFL), founded on November 12, 1981, has emerged as one of India’s leading players in the metal forming industry. Headquartered in Kolkata, the company has established a strong global footprint, supplying high-quality forged, machined and fabricated components across diverse sectors, including automotive, railways, farm equipment, oil & gas, earth moving, mining & construction, power and general engineering. Backed by a robust forging capacity of over 2,00,000 MT and a network of seven advanced manufacturing plants, RKFL has built a reputation for precision-driven production and full-service capability. With operations spanning 23 countries, it continues to reinforce its position as India’s second-largest integrated forging company.

With 43 years of a celebrated journey, RKFL has seen innovation and world-class certifications, which include TS 16949, and ISO 14001, geared towards technology and talent. Today, the company has witnessed growth in its capacity by adding modern-state press lines and warm- and hot-forming units, heat treatment and machining facilities. RKFL continues to be a trusted name that serves some very premium OEMs and Tier-1 suppliers in the global arena: TATA Motors, Ashok Leyland, Volvo, Dana and American Axles, to name a few. Its 433rd rank in Business Standard's BS 1000 Companies of India for 2022-23, which was 566 last year, and its 21st position in Auto Ancillaries are some evidence of its ever-growing stature and scale in the industry.

We interviewed Mr. Chaitanya Jalan, Executive Director, and Mr. Naresh Jalan, Managing Director at Ramkrishna Forgings (RKFL), to dig into the company’s export branding journey, tracing its initial strategies and milestones to its current global positioning and future roadmap. The following sections capture key perspectives shared during our engagement with the company’s leadership, along with excerpts from the interview.

First leap

How did Ramkrishna Forgings begin its export journey? Did you start by following existing customers abroad (such as Tata or Ashok Leyland’s global plants) or by seeking new international contracts directly?

The company initially established its reputation in the domestic commercial vehicle segment by becoming a reliable forging supplier to major OEMs. A pivotal moment came when it secured a breakthrough order from a global leader in drivetrain mobility and braking solutions for commercial vehicles. This engagement marked RKFL’s first formal venture into international supply chains.

Rather than limiting itself to following existing Indian clients abroad, RKFL quickly pivoted to building direct relationships with global customers. The team proactively engaged in international outreach, trade exhibitions and one-on-one engineering showcases to pitch their capabilities.

This two-pronged approach, leveraging existing relationships and aggressively courting new ones, laid the foundation for its current international portfolio, which spans more than 22 countries.

Global pivot

In recent years you’ve made big moves, for example, launching operations in Mexico and winning a major supply contract in North America. How did these or other initiatives transform your global footprint and business strategy?

RKFL’s foray into Mexico is not just geographic expansion; it reflects a sharp understanding of global trade realignments. The launch of its operations in Mexico was a calculated response to the growing importance of the United States-Mexico-Canada Agreement (USMCA), which encourages North American manufacturing and regional supply chains. At a time when geopolitical developments, such as the tariffs initiated by the US administration, were creating trade headwinds, RKFL’s presence in Mexico allowed it to insulate itself from import tariffs and serve OEMs in North America more efficiently.

This expansion was more than a logistical move; it was RKFL's first fully operational manufacturing setup outside India, and it marked its transformation into a truly multinational company.

The Mexico plant positions RKFL as a strategic partner, not just a supplier, and has given the company a unique edge in the North American market.

Export realities

Forged components are heavy and custom-engineered. Did you face issues such as logistics costs, raw material sourcing, or meeting varied technical standards in export markets? How did you address regulatory, logistical, or cultural challenges overseas?

Forged components, by nature, present an array of complexities in exports. They are not only heavy but highly customised, often requiring tight tolerances and material grades tailored to individual OEM standards. RKFL’s early international journey had to reckon with these fundamental realities back in the late 2000s.

Logistics was one of the most pressing challenges. Events such as COVID-19, the Suez Canal blockage and regional conflicts highlighted the vulnerability of global shipping lanes. RKFL mitigated these risks by building a distributed warehousing model and a demand-pull logistics system, where customer forecasts and regional stockpiles drive shipments.

In terms of raw material sourcing, while India has a robust steel industry, global OEMs have stringent vendor approval processes. RKFL invested significant effort in getting Indian steel suppliers certified by global Tier-1 customers. In instances where ultra-clean or specialty steels were needed, RKFL transparently sourced from overseas mills to meet client expectations, while nudging Indian mills towards greener, higher-purity steel production. Today, the conversation has moved from mere sourcing to sustainability, with clean steel and process-level controls becoming focal points.

Regulatory hurdles in new geographies were navigated through strong local partnerships and consultants. On the cultural front, RKFL took a decentralised approach: hiring regional talent, listening to local feedback and tailoring its commercial communication to resonate with each market.

RKFL tackled export challenges by building resilient logistics, enabling certified sourcing and adopting localised, sustainable practices to meet global OEM demands.

Regional footprint

How have you localised your operations for export markets? Have you set up local assembly, sourcing, or support teams in regions, including North America, LATAM, Europe, or Asia?

Localisation has been a cornerstone of RKFL’s international strategy. The Mexico facility is a clear personification of this, with not just manufacturing but also machining capabilities being housed closer to end-customers. This reduces lead times, eliminates tariff-related costs and enables rapid iteration in response to client needs.

Additionally, RKFL strategically deployed engineering and technical sales teams in North America, Europe and parts of Asia. These teams act as both customer liaisons and technical translators ensuring that product requirements are not lost in communication across time zones or engineering cultures. This model allows RKFL to offer the responsiveness of a local player while delivering the cost and quality advantages of an Indian manufacturer.

RKFL’s localisation strategy includes setting up manufacturing in Mexico and deploying regional tech-sales teams to reduce lead times, avoid tariffs, and ensure seamless client communication—offering local agility with Indian cost and quality advantages.

Distribution and customer management

How do you manage distribution and customer relations abroad? Have you established distributor networks or service centres in key markets?

RKFL’s products don’t require conventional distribution networks or service centres as seen in FMCG or auto parts businesses. What they require is a synchronised, high-velocity delivery chain to meet just-in-time or scheduled delivery systems of global OEMs.

To that end, RKFL has invested in a network of commercial warehouses in key markets across North America and Europe. Currently, it operates more than eight third-party warehouses globally, with its dedicated facility in Mexico. These locations serve as regional fulfilment hubs, allowing flexible deliveries, reducing inventory burden on clients and enhancing customer satisfaction.

Customer relations are managed centrally and locally. A mix of regional account managers, global key account executives and technical service teams ensures that each client, whether a European axle maker or an American truck OEM, receives bespoke attention.

RKFL relies on a high-speed, just-in-time delivery model supported by more than eight third-party global warehouses, including its dedicated Mexico facility, while combining central and local teams to offer tailored service to global OEMs.

Brand credibility

How is RKFL’s brand positioned internationally? How do you communicate your value proposition to win trust against established foreign competitors?

RKFL has aligned itself to position its name as a high-quality and cost-effective forging and casting solutions provider. In this long-established European and American players' environment, the company sets itself apart by offering more than mere products; it offers reliable partnerships instilled with trust, performance and efficiency. Quality, competitive pricing and reliability are among the critical differentiators that make it an attractive option compared with traditional world suppliers, particularly for patrons who seek better value without sacrificing standards.

The firm's proposition is advanced manufacturing and process traceability, guaranteeing unquestionable adherence to global Production Part Approval Process (PPAP) and Advanced Product Quality Planning (APQP) standards, untiringly ensuring timely delivery within flexible order volumes. Being deeply vertically integrated throughout its chain of operations reduces external dependencies.

Innovation and co-development

What role has R&D and innovation played in your exports? Can you give examples of new products or processes developed for global customers?

Though RKFL traditionally built its export success by manufacturing to print, its R&D muscle has steadily evolved. Today, the company actively co-develops solutions with its clients, especially in areas such as warm and cold forging, where dimensional precision, microstructure control and weight optimisation are critical.

For example, RKFL’s successful development of warm-forged components for high-stress applications in commercial vehicles showcases its engineering leadership. Similarly, its diversification into cold forging has allowed it to tap into passenger vehicle platforms and lightweighting trends.

The in-house R&D team works across simulation, tool design, material testing and process validation. This upstream involvement has allowed RKFL to win complex mandates where innovation is as important as cost.

Smart systems

Have you leveraged digital or data-driven methods for exports? How has that shaped your export approach?

While digital marketing may not directly drive forged product sales, RKFL has used data and digital tools strategically for customer engagement, supply chain management and forecasting.

Internally, the company uses advanced ERP and analytics to align production schedules with export commitments. Demand sensing, freight analytics and raw material cost tracking tools help optimise pricing and inventory strategies. RKFL also uses customer feedback data and complaint analytics to drive quality improvements and build proactive client communication models. Externally, digital product catalogues and customer-specific dashboards allow buyers to track orders, quality documentation and delivery timelines in real time.

Export discipline

What impact have exports had on Ramkrishna Forgings’ operations? Exports now make up more than 40% of revenue. How has this shift affected your plants and planning?

Crossing the 40% export revenue threshold has redefined RKFL’s DNA. Export markets have brought not only higher-value contracts but also more stringent quality expectations, forcing a step change in operational discipline. RKFL now operates its plants with export-level planning embedded as the norm rather than the exception.

There is no segmentation between export and domestic quality; every product is built to meet the highest standards. However, export business demands more robust scheduling, greater contingency planning for shipping and customs, and proactive material management. Misjudging export timelines even by a week can have ripple effects across customer assembly lines abroad. As a result, the company has institutionalised tighter Sales and Operations Planning (S&OP) processes.

With over 40% revenue from exports, RKFL has embedded global quality and planning standards across operations, institutionalising tighter S&OP processes to meet stringent export timelines and customer expectations.

Outlook and advice

Looking ahead, what are your export aspirations and advice for others? Based on RKFL’s experience, what guidance would you give to other firms aiming to expand globally, in terms of strategy, partnerships, or capacity building?

RKFL remains confident about its international growth trajectory. It has a clear goal of enabling exports to rise above 50% of its total revenue. The company is strengthening its position in North America, deepening its footprint in Europe and unlocking new opportunities in Latin America (LATAM) and the Association of Southeast Asian Nations (ASEAN) region. RKFL’s worldwide foray is mainly bolstered by a conviction in value-driven, meaningful relationships rather than just chasing volume, thereby ensuring that its offerings fit regional needs with a view on client expectations and value in the long run.

To aspiring exporters, they present an honest, well-experience-backed roadmap. International success requires laser focus on the customer, while rolling with business cycles and a sharp commitment to quality. It underlines the need to build capabilities such as design, packaging and quality assurance over merely expanding manufacturing capacity. It also cautions that one must not sacrifice credibility for a short-term cost advantage, as trust and consistency are worth far more.

Disclaimer: This information has been collected through secondary research. The views expressed by the spokespersons are their own and do not necessarily reflect those of IBEF. IBEF is not responsible for any errors in the same.

Get In Touch

Your input is valuable in shaping the future of the IBEF Export Newsletter! Take a moment to share your thoughts and help us bring you more relevant insights, success stories, and export branding strategies.

Contact & Subscriptions: Contact Us

Email us at: info.brandindia@ibef.org

Call: +91 11 43845501