Market Insights Q2

Industry Trends

Market Insights

Amid global economic headwinds and elevated tariffs, Indian exports have continued to demonstrate remarkable resilience. According to the latest data from the Ministry of Commerce and Industry, India’s total merchandise exports reached US$ 433.56 billion in FY25, marking a modest yet steady 0.11% YoY growth. While the overall growth may appear marginal, the underlying story reveals a strengthening export momentum in key markets.

Notably, Japan and Brazil have emerged as bright spots, driving much of this upward trajectory. In FY25, exports to Japan surged by ~21% YoY, while exports to Brazil increased by ~12% YoY. In this section, we take a closer look at the commodities fuelling this growth and explore how Indian exporters are tapping into these promising markets.

India-Japan

India’s exports to Japan have steadily evolved, reflecting deepening economic ties between the two nations. As strategic partners, India and Japan engage across diverse sectors, with trade forming a vital pillar of their relationship. The Comprehensive Economic Partnership Agreement (CEPA) signed between the two countries in 2011 has facilitated smoother trade flows by reducing tariffs and enhancing market access. Exports from India to Japan have seen moderate growth recording a CAGR of ~4% between FY18 and FY25. However, in FY25, exports reached US$ 6.25 billion, marking a healthy ~21% YoY increase.

India exports a range of mineral fuels, organic chemicals, marine products, iron and steel, and textiles to Japan, while also expanding its footprint in sectors such as pharmaceuticals, engineering goods, and automobiles. Among these, one such category driving the majority of the growth in exports is engineering goods.

Engineering Goods

Of the total exports to Japan, share of the engineering goods sector has consistently increased over the past few years and held ~39% share of the total exports in FY25. Although Japan holds just 2.09% share in the total engineering goods exported from India, it has been gaining a lot of traction over the past few years, especially post COVID-19. India’s exports of engineering goods to Japan have grown impressively and more than doubled from US$ 1.08 billion in FY18 (~22% share) to US$ 2.44 billion in FY25 (~39% share).

Under Prime Minister Mr. Fumio Kishida, who took office in 2021,Japan deepened ties with India by focusing on cybersecurity, supply chain resilience, and green energy. To reduce reliance on China, Japan pledged US$ 42 billion investments in India until 2027, supporting sectors such as semiconductors and rare earths minerals. In 2023, the Japan-India Digital Partnership was launched, enhancing collaboration in artificial intelligence and supply chain technology. On India’s front, 10 new PLI schemes were launched in November 2020 for sectors such as electronic/technology products, telecom products, solar PV modules, automobiles and auto components, which have played a key role in boosting exports from India to Japan.

Engineering goods include the production of automobiles, auto components, industrial machinery, non-ferrous metals, iron, steel, and associated items. Of these, automobile export has been the key driver of exports to Japan.

Automobiles

India’s motor vehicle exports to Japan have witnessed a remarkable upswing, rising from US$ 86.44 million in FY23 to US$ 725.66 million in FY25. This growth reflects a shift in Japan’s automotive sourcing strategy, where affordability, compact design, fuel efficiency, and hybrid technologies are increasingly prioritised. India’s robust manufacturing ecosystem, competitive cost structures, and adherence to stringent global quality and emission standards have positioned it as an attractive production hub for Japanese automakers.

A significant contributor to this export surge is Maruti Suzuki, India’s largest carmaker with a dominant share in domestic sales and a reputation for operational efficiency. Leveraging its scale and capabilities, Maruti Suzuki emerged as a key driver of India’s automotive exports to Japan. In 2024, the company began exporting the ‘Fronx’ SUV to Japan, followed by the launch of the India-made five-door ‘Jimny’ in early 2025. These models have been well-received in Japan, reflecting the company’s ability to adapt products to meet Japanese market preferences.

This momentum is evident in Maruti Suzuki’s export performance, which touched 70,560 units in Q1 FY25, increased to 77,716 units in Q2, peaked at 99,220 units in Q3, and moderated to 85,089 units in Q4. The strong response to models like the ‘Fronx’ and ‘Jimny’ not only boosted Maruti Suzuki’s overall export volumes but also played a pivotal role in driving India’s rising motor vehicle exports to Japan.

Electrical machinery and equipment is the second category within the engineering goods segment, witnessing impressive growth.

Electrical Machinery and Equipment

Japan has been long-known to be the powerhouse for technological innovation and manufacturing and exporting some of the world’s most hi-tech products. However, there are factors such as aging population, restricted capacity expansions and insufficient support from the government that have led to Japan outsourcing its technological advantage, which it carried since decades. While China has been the major player whenever a country or industry thinks about outsourcing, India has not been too far, atleast in the past few years.India’s booming youth population, technological advancements, cost-efficient labour, and strong governmental support has enabled it to be the ‘Plan B’ for countries such as Japan in terms of outsourcing. This is reflected in Japan’s investments in India. Japan has been a major source of FDI for India, ranking 5th amongst the highest investing countries. For FY25 (April-December), FDI from Japan stood at US$ 1.36 billion. Considering the technological edge and the high amount of FDI that Japan has invested in India, it has been wanting to diversify away from China and set base in India especially to manufacture electrical components and machinery.

India’s increasing exports of electrical machinery, equipment and related components to Japan can be attributed to several reasons, including confluence of strategic agreements, policy initiatives, and the evolving supply chain dynamics. The CEPA, signed in 2011, has been the foundation of enhancing the bilateral trade between India and Japan. It has significantly reduced tariffs on a wide array of goods, including electronics, facilitating smoother trade flows. Further in 2021, the electric machinery exports from India were about to receive another dose of expansion. Supply Chain Resilience Initiative (SCRI) was signed between India, Japan and Australia with the prime focus being to diversify the supply chains away from China. Through this initiative, Japanese tech-laden firms began to setup manufacturing units in India and exported back to their home country. To reap the benefits of investments done by Japan, a Semiconductor Collaboration Memorandum was signed between India and Japan in July 2023. This initiative specifically focuses on cooperation in semiconductor design, manufacturing, research, talent development and exports.

India-Brazil

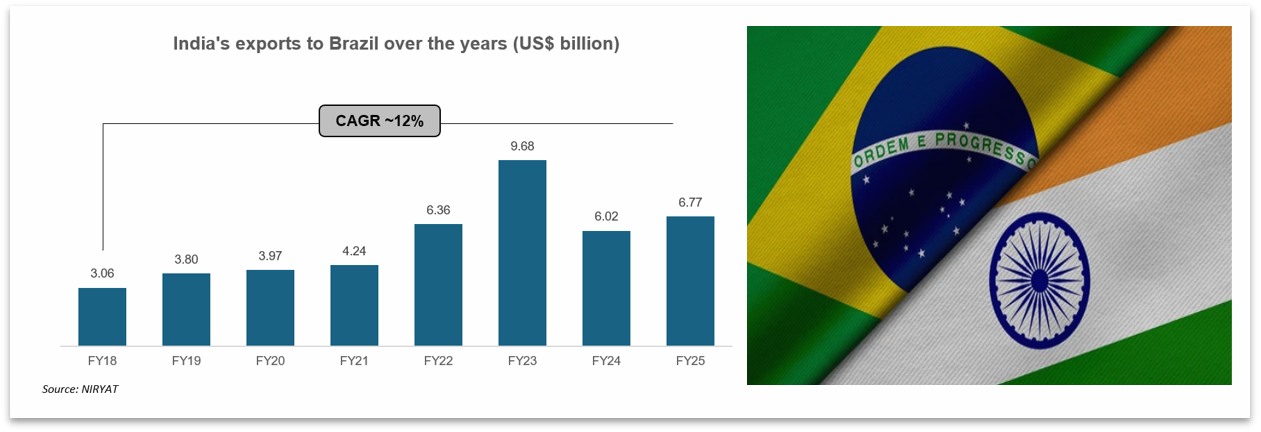

India and Brazil, two dynamic economies and BRICS partners, share a trade relationship that’s not only growing but also full of potential. For India, Brazil isn’t just a trading partner—it serves as a gateway to the wider Latin American region, opening doors for expanding exports and deepening regional ties. India’s exports to Brazil have seen a robust CAGR of 12% between FY18 to FY25, with value of total exports climbing from US$ 3.06 billion to US$ 6.77 billion during the same period. India exports a range of commodities, including engineering goods, organic and inorganic chemicals, drugs and pharmaceuticals, to Brazil, while importing commodities such as crude oil, gold, sugar, and soybean oil. What strengthens this partnership even further is their shared vision for South-South cooperation and multilateral engagement. As the relationship grows, so does the promise of closer economic and investment collaboration between the two nations. Notably, the engineering goods sector has been a major driver behind the rise in exports.

Engineering Goods

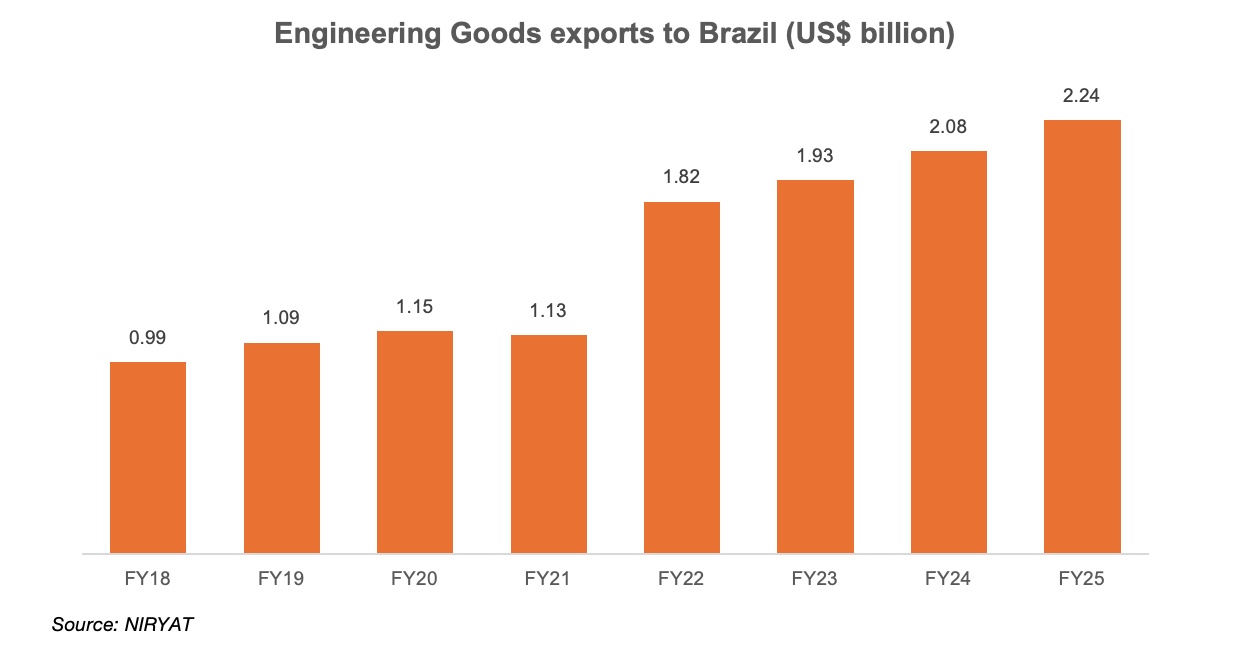

Although Brazil accounted for just 1.92% of India’s total engineering exports in FY25, the share of engineering goods within India’s overall exports to Brazil has grown significantly over the years, particularly in the post-COVID-19 period. Engineering exports from India to Brazil stood at US$ 0.99 billion in FY18, comprising 32.53% of India’s total exports to Brazil. The value of these exports rose to US$ 1.13 billion in FY21 and reached a record high of US$ 2.24 billion in FY25, representing 33.04% of total exports to the country. This upward trend post-pandemic coincides with the Indian government’s rollout of various Production-Linked Incentive (PLI) schemes targeting the engineering and manufacturing sectors, which played a crucial role in enhancing India’s export competitiveness. The impact of these initiatives is particularly evident in the automobile segment, one of the key components of engineering exports. Specifically, a dedicated PLI scheme introduced in September 2021 has contributed to a notable rise in export volumes to markets such as Brazil.

Automobiles

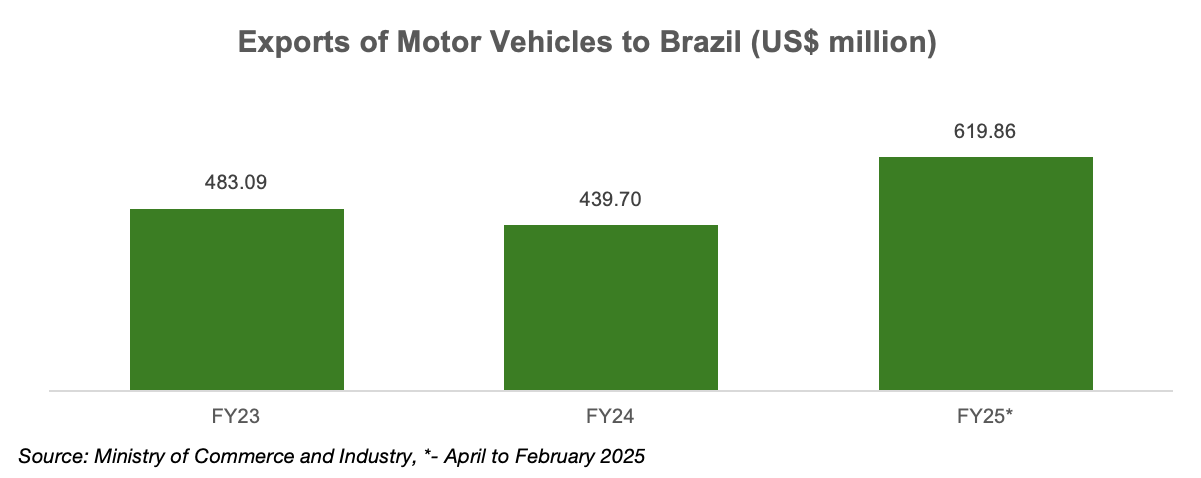

India’s automobile exports to Brazil surged from US$ 439.7 million in FY24 to US$ 619.9 million in FY25, driven by strong manufacturing capabilities, competitive pricing, and growing trade ties. As Latin America’s largest auto market, Brazil offers Indian manufacturers a key growth opportunity. India exports passenger cars, commercial vehicles, two-wheelers, and auto components, meeting Brazil’s demand for reliable, affordable, and fuel-efficient vehicles. Supportive trade policies and the ‘Make in India’ initiative have strengthened this partnership. With Brazil focusing on flex-fuel and ethanol-based vehicles due to its agriculture-driven economy, India is providing compatible, sustainable solutions—solidifying its position as a trusted partner in Brazil’s green mobility transition.

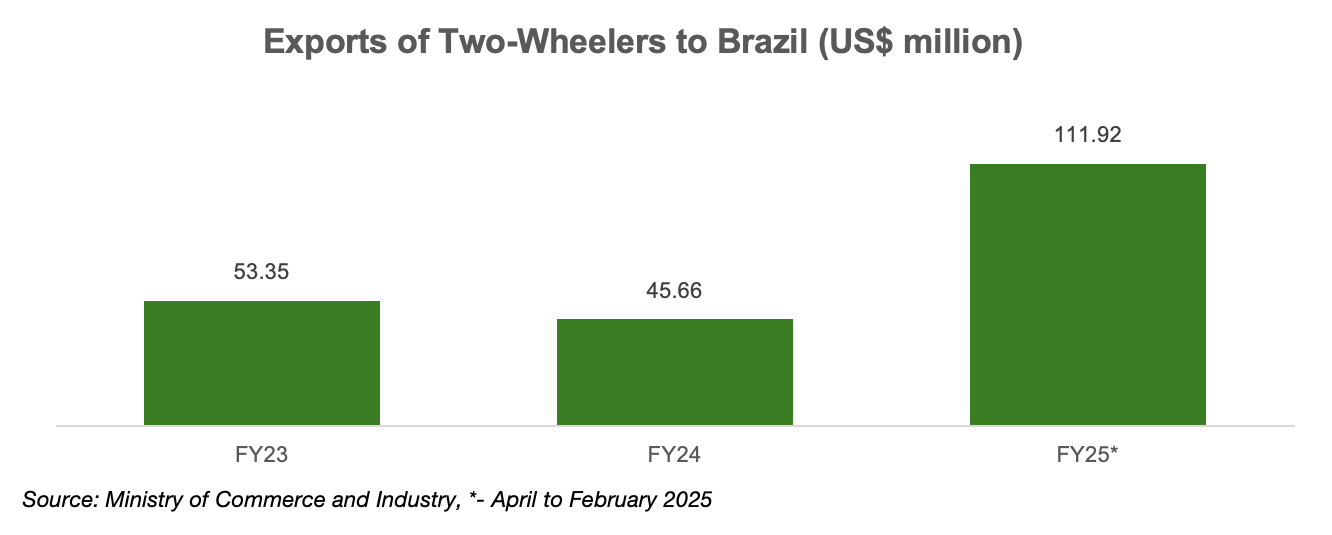

What’s especially driving this growth story is the surge in India’s two-wheeler exports. Affordable, fuel-efficient, and perfect for city travel, Indian two-wheelers are quickly gaining popularity across Brazil.

Indian two-wheeler manufacturers are increasingly looking at Brazil as a key global growth market—and for good reason. With over 210 million people and a booming demand for affordable, fuel-efficient mobility, Brazil is becoming one of the most important destinations for India’s two-wheeler exports. As some traditional export markets, including Africa, see a slowdown, Indian OEMs are diversifying and finding fresh opportunities in Latin America’s largest economy.

Leading companies such as Bajaj Auto, Royal Enfield, TVS Motor Co, and Hero MotoCorp have begun establishing a stronger presence in Brazil—not just through exports, but by setting up local assembly operations. What makes this strategy work is the Completely Knocked Down (CKD) export model: Indian companies ship vehicle components to Brazil and assemble them locally. This allows them to stay cost-competitive, comply with local regulations, and tap into Brazil’s growing appetite for two-wheelers more effectively.

Royal Enfield was the first to open a CKD plant in Manaus, Brazil, in 2022. Bajaj Auto followed with its facility in June 2024, starting with the Dominar models and eyeing to expand to 50,000 units annually from 20,000 units. Bajaj is also betting big on flex-fuel models such as the Dominar E27.5 and Pulsar NS160 Flex, tailored for Brazil’s ethanol-blended fuel. Hero MotoCorp, too, is entering the market in early 2025 with locally assembled, ethanol-ready bikes. TVS Motor Co, already a strong exporter, has announced plans to invest in the region and scale up operations.

Brazil’s push for cleaner, more affordable fuels—particularly ethanol made from sugarcane—aligns perfectly with India’s flex-fuel technology capabilities. As per the IMARC group, Brazil’s two-wheeler market is projected to grow from US$ 2.34 billion in 2024 to US$ 3.39 billion by 2032, so the timing couldn’t be better.

In short, while Indian two-wheeler brands are physically setting up shop in Brazil, they are still exporting—cleverly routed via the CKD export model.

Disclaimer: This information has been collected through secondary research. The views expressed by the spokespersons are their own and do not necessarily reflect those of IBEF. IBEF is not responsible for any errors in the same.

Get In Touch

Your input is valuable in shaping the future of the IBEF Export Newsletter! Take a moment to share your thoughts and help us bring you more relevant insights, success stories, and export branding strategies.

Contact & Subscriptions: Contact Us

Email us at: info.brandindia@ibef.org

Call: +91 11 43845501