Market Spotlight: ASEAN

Market Spotlight: ASEAN

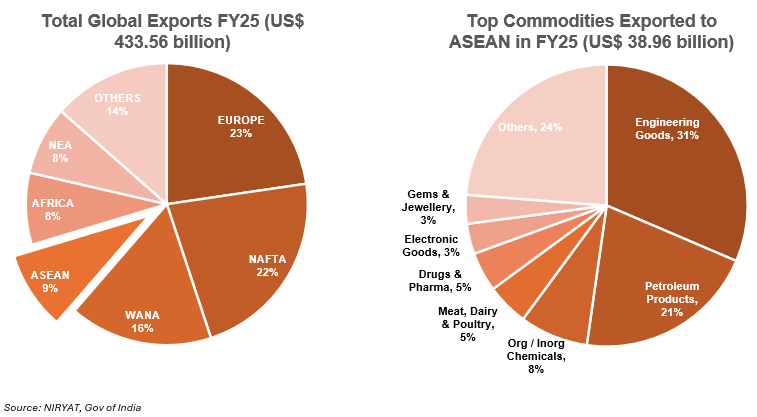

ASEAN (Association of Southeast Asian Nations) brings together Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam to cooperate on economic and security matters. In FY25, the ASEAN region was the 4th biggest market for Indian goods with US$ 38.96 billion worth of goods being shipped, making up c.9% of all of India’s exports. Despite ASEAN’s share of India’s total exports being reduced over the years (11.38% in FY18 down to 8.99% in FY25), the value of the exports sent their way is growing. Indian exports to ASEAN were valued at US$ 34.20 billion in FY18 and reached US$ 38.96 billion in FY25. Over half of the Indian exports to the ASEAN countries consist of engineering goods and machinery, petroleum products and both organic and inorganic chemicals.

Competition Analysis:

India’s share in ASEAN’s imports decreased slightly from 2.26% in 2022 to 2.04% in 2023. China, the United States and Korea are the biggest export hubs to ASEAN, with shares of 23.9%, 7.3% and 7.0%, respectively. At the same time, India is challenged by Australia, UAE, and Germany, each with shares of 2.6%, 2.3% and 2.0%, respectively. Mineral fuels, nuclear reactors, gems and jewellery and organic chemicals have long been important exports for India because they are cost-effective and the quality keeps getting better. Let us look at India’s competition in these sectors:

China: In 2002, China and ASEAN established the base for their trade relationship after signing a free-trade agreement. The FTA and China’s low-cost production make it India’s biggest competition for machinery, electronic components, and organic chemicals. According to data from 2023, almost a quarter of ASEAN’s total imports came from China.

As more major economies turn away from China as part of the “China+1” trend, India can benefit due to the good relationship and support it receives from major nations.India’s increased attention on infrastructure, changes in business laws and many trade arrangements with important global markets boost its position as a market for manufacturing and exports.

GCC: Trade with ASEAN gives the Gulf Cooperation Council (GCC) a noteworthy position in the competition with India. The GCC-Singapore Free Trade Agreement which began in 2013, has encouraged a rise in trade between the regions. Also, CEPAs signed by the UAE with countries like Indonesia are intended to increase trade between the two nations. The top countries from this region, UAE, Saudi Arabia, Qatar and Kuwait, have spent considerable effort exporting mineral fuels and oils to countries in the ASEAN region (about 29% of total ASEAN oil imports come from the GCC).

India’s reputation has been built because it called for adjustments to the ASEAN-India Free Trade Agreement (AIFTA), making it beneficial for Indian exporters. Through changes in the deal, Indian goods will have improved chances of being bought in the ASEAN markets, improving India’s competitiveness.

Australia: Australia provides ASEAN with mineral fuels and gems on account of its vast natural resources, consistent supply, and good trade deals through AANZFTA. Being close to Asia, Australia exports reasonable amounts of thermal coal, LNG, and raw gemstones.

Yet, India is getting ahead by exporting upgraded petroleum products and by offering high-quality jewellery through its professional cutting and polishing fields.

Thanks to improvements in refining, signed trade agreements and more places to sell goods in ASEAN, India is gaining an edge as an international trader in these fields.

France: France is almost equal to India in exporting nuclear reactors, gems and jewellery and organic chemicals to ASEAN. ASEAN nations can rely on French businesses for innovative nuclear work, exquisite jewellery brands and highly regarded chemicals. To address the challenge, India is using its low labour expenses, large factories and increasing partnerships. Affordable nuclear parts, jewellery, gems, and organic chemicals are exported from the country, helping the industry provide better products and meet compliance standards. India remains a well-regarded and dependable export nation by making investments in retail and industrial sectors throughout ASEAN.

India maintains a strong presence in select commodity categories and is working to expand its market share. While the country faces intense competition, it holds significant potential to break into the ranks of the top 10 trading partners and sustain its position.

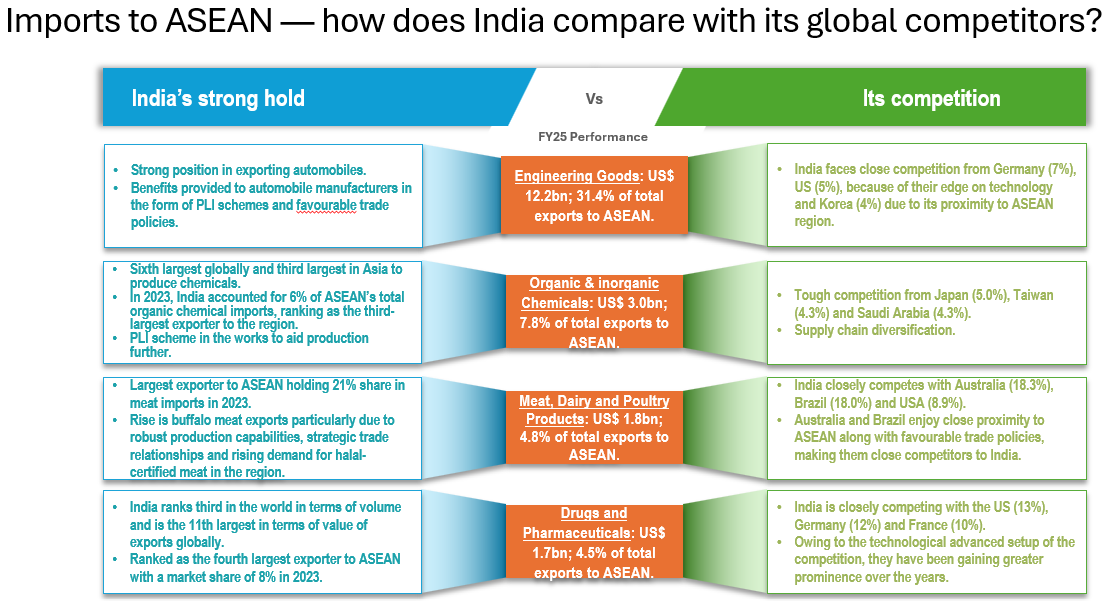

Let us look at the key commodities in which India has traditionally enjoyed a competitive edge and continues to perform well:

- Engineering Goods : Engineering products play a key role in India’s exports to ASEAN, making up 31.4% of all exports in FY25, an increase from 29.5% in FY24. Their export value rose slightly from US$ 12.14 billion to reach US$ 12.24 billion. Most of this segment’s growth comes from auto exports which depend on India’s strong manufacturing industry and cheap pricing. Promoting electric vehicle and advanced manufacturing development through the PLI scheme is fuelling more automobile and auto component exports. Thanks to the India-ASEAN Free Trade Agreement, the country’s trade with ASEAN has made it easier to enter those markets by decreasing fees and regulatory barriers. Upgrades in transportation infrastructure make it easier and less costly for cargo to get ships in and out of ports. High skills, increasing demand and special incentives are pushing India towards greater participation in the ASEAN market for engineering goods.

- Organic and Inorganic Chemicals : India is the world’s sixth-largest chemical producer and the third largest in Asia. In 2023, it accounted for 6.0% of ASEAN’s total organic chemical imports, making it the third-largest supplier to the region. As global economies diversify their sourcing and reduce dependence on China, India is well-positioned to capitalise on this shift. To further strengthen its competitiveness, the Indian government is expected to introduce a Production Linked Incentive (PLI) scheme aimed at enhancing domestic manufacturing and export capacity in the chemical sector. This move could boost India’s presence in key export markets, including ASEAN.

- Meat, Dairy and Poultry Products : In FY24, the global trade of animal products from India was US$ 4.54 billion and more than 82% of those exports were buffalo meat, amounting to US$ 3.74 billion. In 2023, India accounted for almost a quarter of the meat exports to ASEAN, representing a 21% share. Buffalo meat exports in the ASEAN have increased recently, mainly because of India’s established trade ties, ability to produce large quantities, and the demand for halal-certified meat.

- Drugs and Pharmaceuticals : Because of its role in producing and shipping pharmaceuticals, India is often referred to as the "pharmacy of the world." The country ranks third for volume and eleventh for the value of its pharmaceuticals exports. As per 2023 records, India took fourth spot as the region’s biggest exporter, representing 8% of total exports. Although Indian pharma is strong, US, Germany and France are still at the top in the high-end drug and research sectors. Improving R&D, following the rules closely and investing in advanced manufacturing may allow India to increase its role in ASEAN’s pharmaceutical industry.

Other sectors gaining traction:

Food industries, residues and wastes thereof; prepared animal fodder: India’s exports of food industry residues and prepared animal fodder to ASEAN are rising due to strong demand from ASEAN’s growing livestock and poultry sectors. India stood as the 4th largest exporter in 2023 and held a market share of 5%, rising from being the 6th largest exporter with a market share of 3%. Indian agro-industries produce abundant oilseed meals, cereal bran, and processing by-products that serve as cost-effective, high-nutrition animal feed. Proximity to ASEAN ensures low freight costs and fast delivery, giving Indian exporters a logistical edge. Additionally, ASEAN nations are diversifying feed import sources, and India benefits from duty concessions under the India-ASEAN FTA. Sustainability-focused ASEAN economies also prefer plant-based feed derived from food industry waste, aligning well with India’s residue-based exports and circular economy practices.

Coffee, tea, mate, and spices: India is the world’s seventh largest coffee grower and the eight largest exporter.

India’s exports of coffee, tea, mate, and spices to ASEAN have surged, driven by rising demand for these products in the ASEAN markets of which Indian coffee is gaining major prominence in Malaysia, Singapore, and Indonesia. In 2023, India stands as the largest exporter of these commodities to ASEAN, with a market share of 18% (17% in 2022).

ASEAN’s growing café culture and increasing preference for premium and diverse coffee blends have made Indian coffee, especially robusta and speciality varieties from Karnataka and Kerala highly demanded.

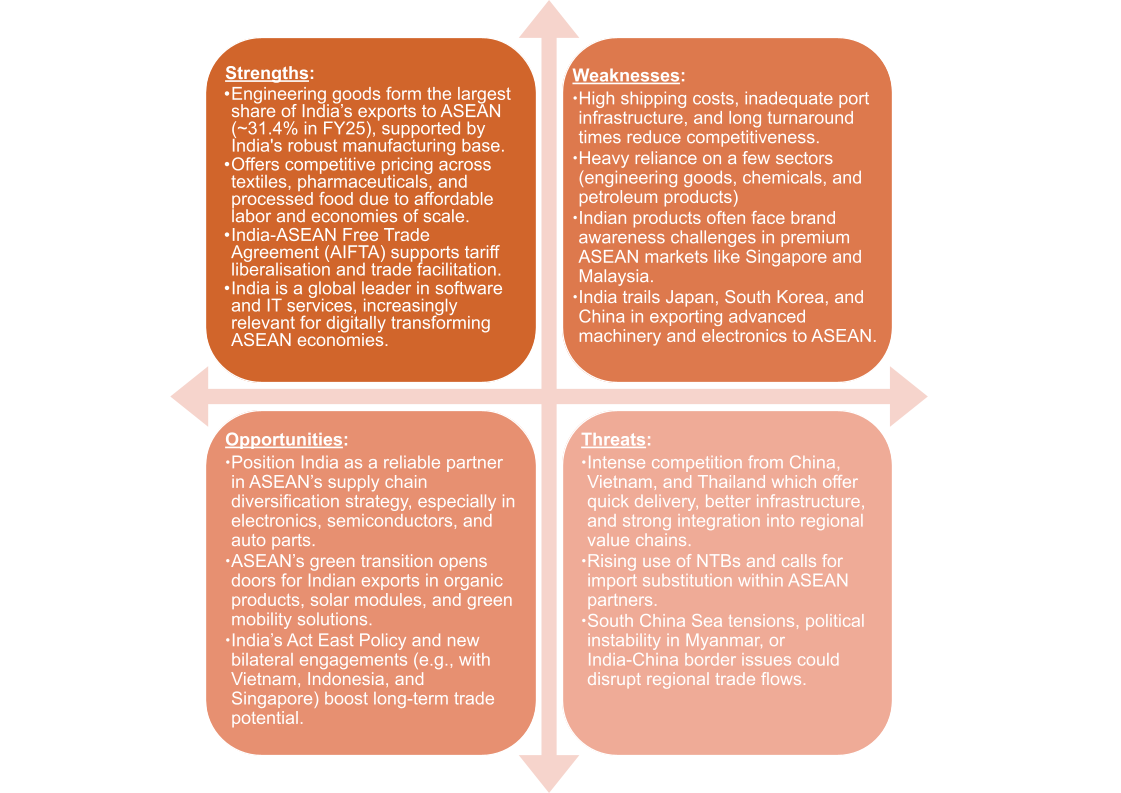

SWOT Analysis

India–ASEAN Trade Agreements

An important part of the economic relationship between India and ASEAN is the ASEAN–India Free Trade Agreement (AIFTA). A Framework Agreement on Comprehensive Economic Cooperation was signed in 2003 to formally support the making of a free trade area for goods, services, and investments. For this reason, ASEAN and India agreed to the ASEAN–India Trade in Goods (TIG) Agreement in Bangkok on August 13, 2009, and it officially took effect on January 1, 2010. The TIG Agreement allowed duty-free trade for more than 80% of all traded goods and used a negative list to guard sensitive sectors. Basing their approach on these principles, ASEAN and India agreed on the Trade in Services and Investment Agreements in November 2014. These agreements came into effect on July 1, 2015 and offers rights to investors and flexibility in the movement of experts in IT, finance, and healthcare.

To consider new developments in trade, India and ASEAN began reviewing the Trade in Goods Agreement in September 2022. The first Committee Meeting to review the working of the agreement was organized in March 2023 in New Delhi. The process, ending in 2025, aims to boost transparency, manage non-tariff issues and increase the use of current FTAs. At present, India’s trade with ASEAN amounts to nearly US$ 122 billion annually, making it the fourth-biggest trading partner for India. Yet, India records a trade deficit with the bloc mainly because it imports mineral fuels, palm oil and electronic products in high amounts.

- India-Singapore agreement: In 2005, India and Singapore signed a Comprehensive Economic Cooperation Agreement. It was implemented on August 1 that year. Unlike the ASEAN-wide FTA, the CECA included trade of both goods and services, investor protection and the use of mutual recognition agreements (MRAs) in accounting, architecture, and nursing. It provides businesses with simpler movements; more access to other countries’ markets and quick customs procedures. It experienced various revisions, and the latest update was done in 2018 to strengthen trade facilitation and widen covered areas.

- India-Malaysia agreement: On February 18, 2011, Malaysia and India finalized a Comprehensive Economic Cooperation Agreement (CECA). It was implemented on July 1, 2011. Trade-in services and investment have more open commitments in the agreement than was the case in AIFTA. It features provisions for quick elimination of tariffs, more investor protection, and options for settling disagreements. India and Malaysia have collaborated on customs issues, training and economic issues using the CECA framework.

Key challenges between India and ASEAN

- Low FTA utilization and regulatory complexity: Indian exporters often struggle to fully benefit from the ASEAN–India Free Trade Agreement due to complex rules of origin, inadequate awareness, and inconsistent documentation procedures across ASEAN nations.

- Trade imbalance and non-tariff barriers: India faces a persistent trade deficit with ASEAN, driven by high-value imports like mineral fuels and palm oil, while non-tariff barriers such as divergent standards and regulatory practices. This limits access for Indian products in ASEAN markets.

Actionable insights for Indian brands

The ASEAN market is rapidly evolving, driven by a young, digitally connected population, a growing middle class, and rising awareness of sustainability and health. Here are key consumer trends and strategic opportunities that Indian exporters can tap into:

- Affordable Innovation for a value-conscious Market : In Indonesia, Vietnam, and the Philippines, people are mostly concerned about the price, but they now strive for better living. They are open to products that offer quality, reliability and are not too expensive. Indian brands can make use of low-cost innovation, adjust packaging for each place, and promote products for local areas. As an example, TVS Motor Company has managed to enter the ASEAN markets by selling two-wheelers that are cost-effective and well-suited to the area, offering great fuel economy and durability at fair prices.

- Digital-First Engagement and E-commerce Readiness : Since the internet economy in ASEAN is set to grow to over US$ 300 billion by 2025, it is crucial for Indian brands to focus on digital advertising, influencer campaigns and regional online stores such as Shopee, Lazada and Tokopedia. boAt, an Indian audio company, uses a digital approach and collaborates with influencers to reach out to young buyers in Southeast Asia.

- Halal Certification and Cultural Sensitivity : For many people in Indonesia and Malaysia, buying halal-certified goods is required by official rules, not just preferred. For Indian companies to be successful in the food, cosmetics, and pharmaceutical sectors, they should earn halal certification and create branding that respects cultural values. Dabur India, known for its herbal and natural products, has adjusted its lines to include halal-approved ingredients and packaging for its products in Malaysia and Indonesia.

Disclaimer: This information has been collected through secondary research. The views expressed by the spokespersons are their own and do not necessarily reflect those of IBEF. IBEF is not responsible for any errors in the same.

Get In Touch

Your input is valuable in shaping the future of the IBEF Export Newsletter! Take a moment to share your thoughts and help us bring you more relevant insights, success stories, and export branding strategies.

Contact & Subscriptions: Contact Us

Email us at: info.brandindia@ibef.org

Call: +91 11 43845501