Market Spotlight: Latin American Countries

Market Spotlight: Latin American Countries

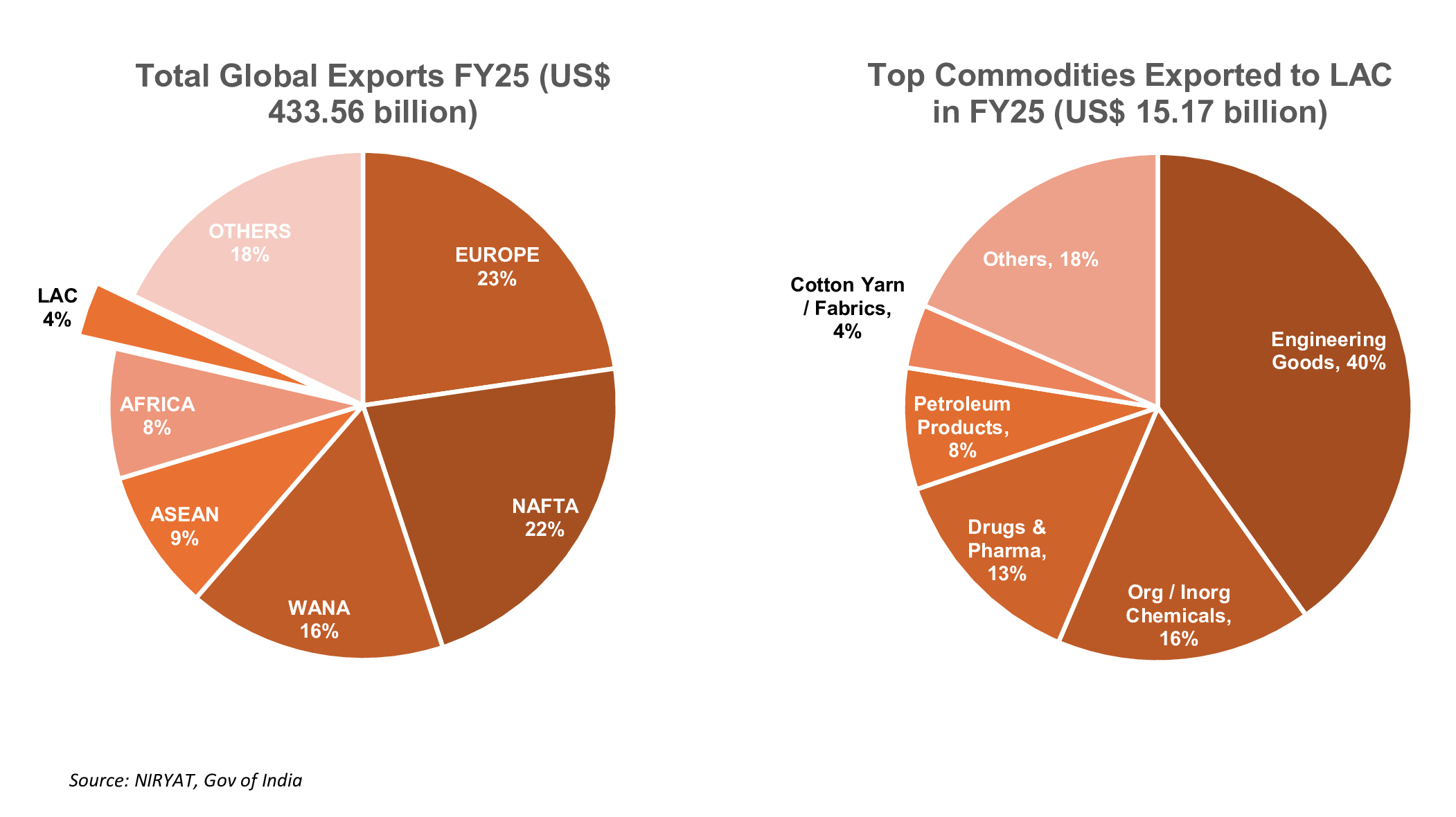

Latin American Countries (LAC), comprising over 40 nations, have steadily strengthened their position in India’s trade portfolio. In FY25, the region ranked as India’s 8th largest export market, with shipments worth US$ 15.17 billion, accounting for ~3.5% of India’s total exports. The share of LAC in India’s exports has grown at a steady pace from 2.86% in FY18 to 3.50% in FY25, with values nearly doubling over the period, from US$ 8.61 billion to US$ 15.17 billion.

Brazil leads the pack with a dominant 44.63% share of India’s exports to LAC, followed by Colombia (9.70%), Chile (7.61%), Argentina (6.71%), and Peru (6.61%). More than half of India’s shipments to the region are concentrated in engineering goods, organic and inorganic chemicals, and pharmaceuticals, reflecting the complementarity between India’s manufacturing strengths and LAC’s market demand.

Competition Analysis:

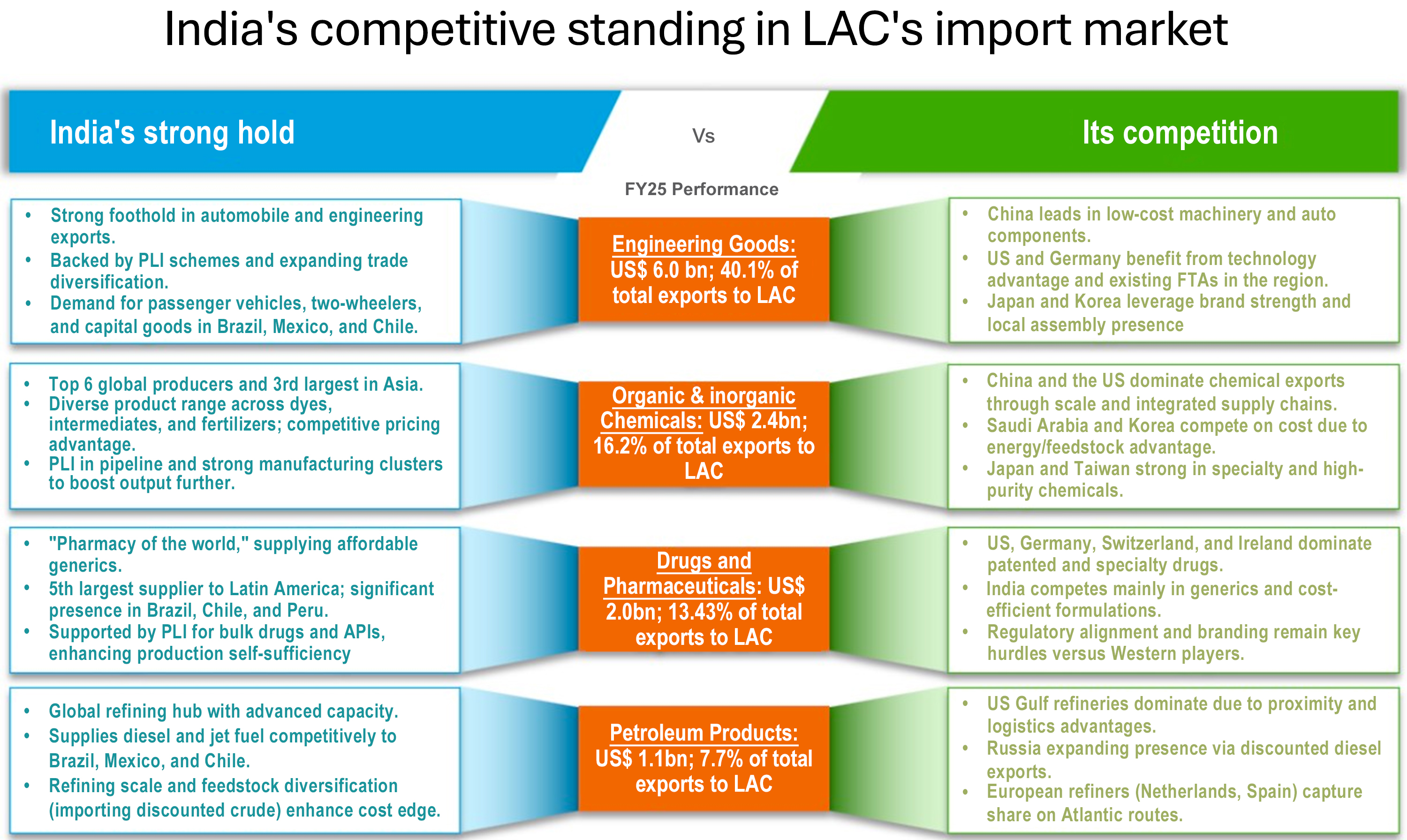

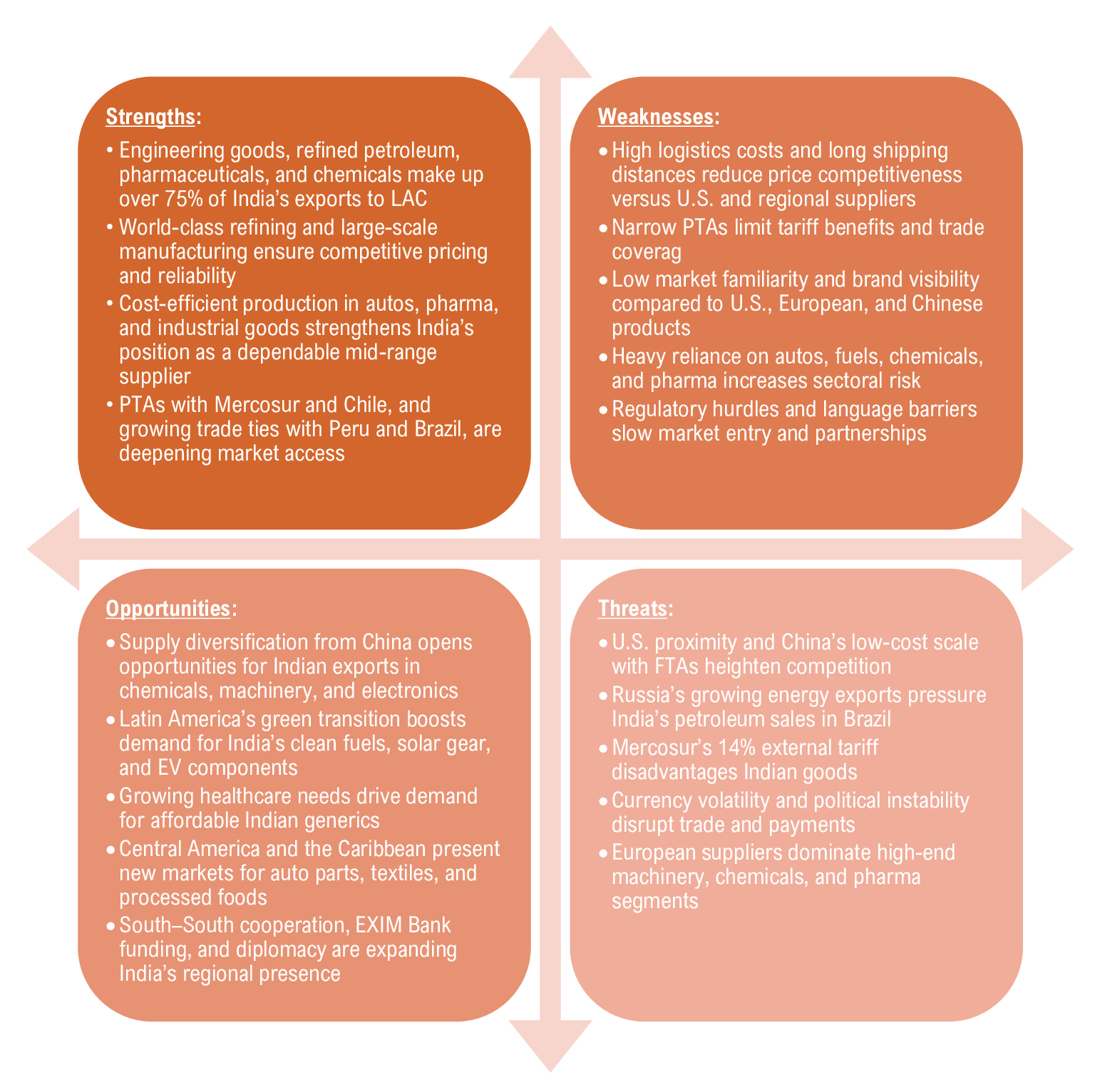

India’s exports to LAC have grown at a strong pace, valued around US$ 10.1 billion in FY21 to US$ 15.1 billion in FY25, increasing India’s share in Latin America’s total imports from roughly 1.4% to about 2.1%. Despite this, India remains a relatively small player compared to dominant suppliers like the United States (~35%) and China (~25%). Still, the region offers substantial untapped potential, with India’s competitive edge lying in automobiles, refined petroleum, pharmaceuticals, and chemicals, sectors that have benefited from improving quality, cost efficiencies, and global diversification efforts by Latin American buyers.

China: China has established itself as Latin America’s second-largest trade partner, commanding nearly ~25% of total imports. Its influence stems from early and aggressive engagement through free trade agreements with Chile, Peru, Costa Rica, Ecuador, and Nicaragua. Chinese exports dominate the region’s markets for machinery, electronics, and organic chemicals, benefiting from economies of scale and low-cost production. However, as Latin American nations increasingly seek to diversify away from overdependence on China, India stands to benefit. Backed by its expanding industrial base, infrastructure upgrades, and the global “China+1” manufacturing shift, India can position itself as a competitive alternative in mid-range manufacturing and chemicals, where cost and reliability matter most.

USA: The United States remains Latin America’s top supplier, leveraging its geographical proximity and a web of trade agreements such as USMCA (Mexico, Canada, U.S.), CAFTA-DR with Central America, and bilateral FTAs with countries like Chile, Colombia, and Peru. American exports dominate high-value sectors such as machinery, energy, and refined fuels, thanks to its advanced industrial infrastructure and seamless logistics. For India, competing with the U.S. remains challenging due to distance, higher tariffs, and absence of preferential trade frameworks. Nevertheless, India is proactively strengthening ties with the region in the form of trade discussions with Peru, Chile, and Mexico are underway to secure market access for Indian goods. Competitive advantages in automobiles, generic pharmaceuticals, and affordable chemicals offer India entry points into markets less dependent on U.S. supply chains.

Mercosur Bloc (Brazil, Argentina, Paraguay, Uruguay): Latin America’s Mercosur bloc represents a unique challenge for India due to its internal duty-free regime and a Common External Tariff averaging 14%, which makes intra-bloc trade far more competitive than imports from external countries. For example, Brazil’s automotive and agricultural sectors benefit from tariff-free exports to neighbouring countries like Argentina and Uruguay, while Indian vehicles face higher import duties. India currently has a Preferential Trade Agreement (PTA) with Mercosur covering over 450 tariff lines, but its limited scope restricts broader market penetration. Indian exporters are thus focusing on specialized segments such as refined petroleum, specialty chemicals, and pharmaceuticals where local production gaps exist. Expanding the PTA into a deeper trade pact remains critical for India to gain meaningful traction in this bloc.

Germany: Among European nations, Germany stands out as a formidable competitor in Latin America’s pharmaceuticals, chemicals, and machinery sectors. German firms are deeply entrenched through decades of trade partnerships and reputation for technological excellence. India, which ranks fifth in Latin America’s pharmaceutical imports, is gradually narrowing the gap by offering cost-efficient generics and improving product compliance with international standards. In chemicals and engineering equipment, Indian producers are increasingly recognised for their affordability and consistency. Collaboration with local Latin American firms and participation in regional infrastructure projects have also strengthened India’s credibility as a reliable trade partner. However, European exporters continue to dominate premium categories, meaning India’s strategy will rely on scaling up quality while maintaining cost leadership.

India continues to maintain a strong foothold in select commodity categories and is steadily working to expand its global market share. Despite facing intense competition, the country’s export portfolio reflects strong potential and resilience across several product segments. Below are some of the key commodities where India has traditionally held a competitive advantage and continues to perform well:

- Engineering Goods : Engineering goods are a cornerstone of India’s exports to LAC, accounting for over a third of the total in FY25. The segment is driven by automobiles, auto components, and capital equipment, backed by India’s cost-efficient manufacturing and PLI-supported upgrades in autos and advanced engineering. Two-wheelers and compact cars are finding strong demand in Mexico, Colombia, and Chile, appreciated for their reliability and value-for-money. Although logistics lead times remain longer than those of regional or US suppliers, improved port connectivity and consistent delivery are steadily bridging the gap. Trade pacts such as the India-Mercosur and India-Chile PTAs, along with ongoing talks for deeper access, are helping ease tariff and regulatory barriers. Looking ahead, India is well placed to tap opportunities in EV components, small ICE vehicles, and specialised machinery by combining competitive pricing with better quality and after-sales support.

- Organic and Inorganic Chemicals : India’s diversified chemicals base (from bulk organics/inorganics to dyes and intermediates) has scaled up exports to LAC, supported by expanding domestic capacity, cluster ecosystems, and improving compliance. Competitive feedstock access and operating efficiencies underpin pricing, while impending policy support (including a proposed PLI for chemicals and ongoing investments in PCPIRs) should accelerate high-value products and specialty lines. As LAC buyers diversify away from single-country dependency, India is well-placed to capture share in solvents, intermediates, basic inorganics, agro-chemical inputs, and selected specialties. Near-term focus areas include expanding distributor partnerships in Brazil and Mexico, building local technical service capability, and deepening REACH/FDA/ISO-aligned quality systems to move further up the value chain.

- Drugs and Pharmaceuticals : India, a global leader in generics, has strengthened its presence across mid-sized LAC markets, maintaining a steady FY25 performance in formulations and APIs. Strong cost competitiveness, a wide network of quality-certified plants, and reliable supply chains enable India’s participation in both tender-led and private demand channels. The country ranks among the top five suppliers in the region, with strong positions in several Andean and Central American markets, though it remains underrepresented in larger markets dominated by patented and high-end therapies. Expanding market share will depend on sustained regulatory compliance with US and EU GMP standards, deeper product portfolios in key therapeutic areas, and local partnerships to enhance registration and access. Continued investment in complex generics, biosimilars, and injectables will also be critical. As healthcare cost pressures rise, LAC procurement agencies continue to rely on India’s reputation for delivering affordable, quality-assured medicines.

- Petroleum Products : India’s refined petroleum exports to LAC, including diesel, gasoline, and jet fuel, remained resilient in FY25, supported by world-class refining capacity and cost-effective feedstock sourcing. Large-scale refineries, flexible crude processing, and efficient export logistics enable India to offer competitive pricing to key demand hubs such as Brazil, Mexico, and Chile. While competition is strong, with US Gulf Coast refineries leveraging proximity, Russia offering discounted diesel, and European suppliers capitalising on Atlantic trade routes, India continues to stand out for its consistent product quality, reliable delivery schedules, and ability to optimise crude price differentials. Looking ahead, the focus will be on meeting cleaner fuel standards, securing long-term supply contracts, and establishing storage and throughput partnerships at major LAC ports to manage freight volatility and seasonal demand shifts.

Other sectors gaining traction:

Textiles & Apparel: Rising orders for cotton yarn, fabrics, and value apparel as LAC brands diversify sourcing beyond East Asia. Competitive Indian pricing, broad product ranges, and improving lead-times support growth, especially in Mexico, Brazil, Chile, and Caribbean markets. Opportunity to scale man-made fibres, home textiles, and niche ethnic/fashion segments via local distribution tie-ups.

Plastics & Rubber Products: Steady growth in polymers, packaging materials, moulded goods, and tyres. Cost advantages from India’s petrochemical base and growing sustainability offerings (recycled content, lighter-weight packaging). Building technical service and inventory buffers with regional partners can lift repeat business.

SWOT Analysis

India-LAC Trade Agreements & Economic Integration

India’s relationship with Latin America has long been driven by broad diplomatic and trade outreach rather than a single sweeping free trade agreement. Over time, India has sought to build integration through Preferential Trade Agreements (PTAs), bilateral trade pacts, and multilateral engagement. These arrangements aim to reduce tariffs, facilitate investment and services, and improve market access, while trade volumes continue to grow steadily.

India-Mercosur PTA

India signed a Framework Agreement with Mercosur in June 2003, followed by a Preferential Trade Agreement in January 2004, which came into effect on June 1, 2009, covering concessional tariffs on 450 Indian and 452 Mercosur product lines. The PTA includes rules of origin, safeguard mechanisms, and dispute settlement, with India offering concessions in sectors such as chemicals, machinery, and cotton yarn, while Mercosur’s list covers food preparations, pharmaceuticals, and electrical goods. However, the agreement has limited coverage and lacks deep tariff cuts or provisions for services and investment. Both sides have expressed interest in upgrading the PTA to a more comprehensive trade deal, with ongoing discussions in 2025, including announcements during a recent state visit to expand coverage and reduce non-tariff barriers. India’s exports to Mercosur reached US$ 8.12 billion in FY25, with imports at US$ 9.36 billion, highlighting the corridor’s significance amid Mercosur’s average 14% Common External Tariff, which limits competitiveness for external suppliers like India.

India-Chile / Bilateral Trade Pacts

India and Chile have had a Preferential Trade Agreement since 2007, providing tariff reductions on about 90% of product lines. In May 2025, both countries began negotiations for a Comprehensive Economic Partnership Agreement (CEPA) to upgrade the PTA, covering goods, services, digital trade, critical minerals, MSMEs, investment cooperation, and more. The CEPA aims to deepen tariff liberalization, enhance trade facilitation, improve regulatory coherence, strengthen investment protection, and expand trade in emerging sectors.

New Trade Discussions and Emerging Initiatives

Beyond Mercosur and Chile, India is actively pursuing trade agreements with Latin American countries such as Peru and potentially Colombia, with a deal with Peru expected by the end of 2025 following multiple negotiation rounds. India is also working to expand product coverage under existing PTAs, reduce regulatory barriers, and improve access in key sectors like engineering goods, pharmaceuticals, and chemicals. Initiatives such as the “Focus LAC” program aim to promote trade, investment, and economic cooperation, while diplomatic visits, lines of credit, infrastructure financing, and institutional support from entities like the Indian Exim Bank strengthen India’s position as a trusted development and trade partner in the region.

Key Challenges between India and LAC

- Limited trade access and high logistics costs: Narrow PTAs with Mercosur and Chile, combined with long shipping distances, high freight charges, and lack of direct maritime routes, constrain market access and reduce price competitiveness for Indian exporters.

- Regulatory, market, and infrastructure barriers: Diverse customs procedures, certification standards, language differences, low brand visibility, concentrated trade in a few sectors and markets, and currency or banking challenges increase compliance costs and limit expansion opportunities in LAC.

Actionable Insights for Indian Brands

The Latin American market presents a growing opportunity for Indian exporters, driven by a rising middle class, digital transformation, and increasing preference for affordable quality products. Consumers across Brazil, Mexico, Chile, Colombia, and Peru are open to brands that combine value, reliability, and adaptability. Below are key trends and strategic entry points for Indian companies:

- Value, Quality, and Trust : Indian exporters can succeed by offering cost-efficient, durable products with strong after-sales support, certifications, and compliance. Localized packaging, cultural adaptation, and alignment with health, safety, and sustainability standards enhance credibility and consumer trust.

- Digital and Distribution Strategies : Expanding e-commerce presence through platforms like MercadoLibre and Amazon, coupled with localized digital marketing and influencer partnerships, improves visibility. Building robust local partnerships, joint ventures, and after-sales networks strengthens market access and customer retention.

- Focus on Emerging and Niche Segments : Opportunities exist in EV components, renewable energy equipment, processed foods, ethnic products, and IT/digital services. Targeting these high-growth niches allows India to leverage existing manufacturing strengths and align with evolving consumer trends in Latin America.

Disclaimer: This information has been collected through secondary research. The views expressed by the spokespersons are their own and do not necessarily reflect those of IBEF. IBEF is not responsible for any errors in the same.

Get In Touch

Your input is valuable in shaping the future of the IBEF Export Newsletter! Take a moment to share your thoughts and help us bring you more relevant insights, success stories, and export branding strategies.

Contact & Subscriptions: Contact Us

Email us at: info.brandindia@ibef.org

Call: +91 11 43845501