Market Insights

Industry Trends

Market Insights

Building on a strong trade foundation, India’s exports have continued to chart a steady course despite an uncertain global backdrop. According to the Ministry of Commerce and Industry, merchandise exports reached US$ 112.32 billion in Q1 FY26, up from US$ 110.05 billion in Q1 FY25, marking a 2.06% YoY growth. More than just numbers, this performance signals India’s growing competitiveness and its evolving role as a dependable partner in global supply chains.

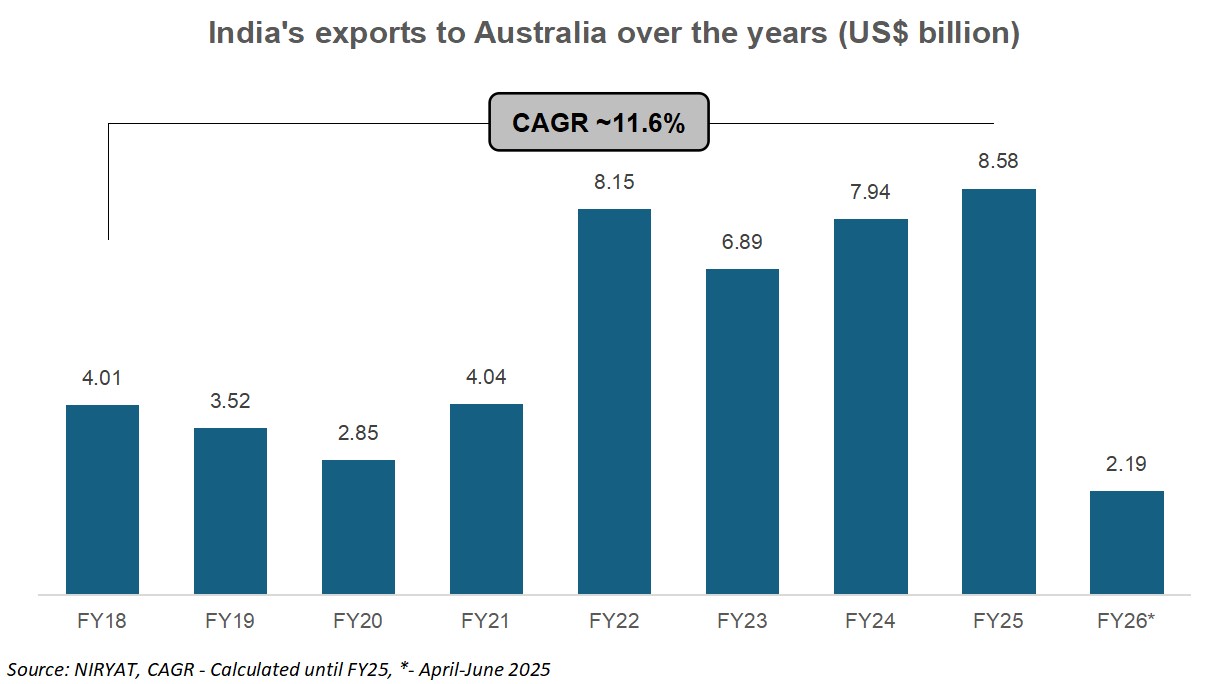

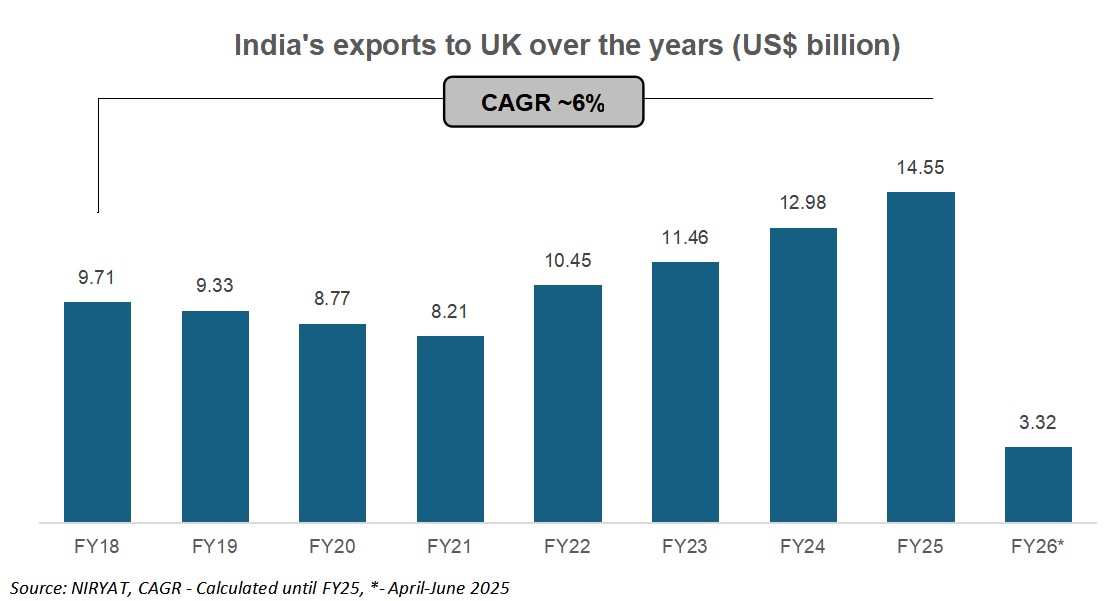

Within this landscape, advanced economies such as Australia and the United Kingdom (UK) stand out as anchors of growth. Australia registered a robust 15.4% YoY rise in exports in Q1 FY26, carrying forward the strong momentum of the previous year. The UK, meanwhile, saw trade flows stabilize after a phase of robust expansion in FY25, reaffirming its role as a consistent and strategic market for Indian exporters. Together, these markets demonstrate not only the resilience of India’s export basket but also the growing global confidence in India as a reliable source of high-quality goods.

India-Australia

India’s goods exports to Australia have witnessed a significant upswing over the past few years, underlining the strength of their strategic partnership as Indo-Pacific neighbours. Exports rose from US$ 4.01 billion in FY18 to US$ 8.58 billion in FY25, registering a healthy CAGR of ~11.6%. This steady expansion reflects India’s growing competitiveness in the Australian market and its ability to diversify across a wide export basket. The momentum also highlights the increasing alignment between the two economies, with trade emerging as a vital enabler of bilateral ties.

A key turning point came with the signing of the India-Australia Economic Cooperation and Trade Agreement (ECTA) in 2022, which reduced tariffs and unlocked greater market access for Indian exporters. The agreement has provided a strong boost to categories such as engineering goods, refined petroleum, pharmaceuticals, and agri-products, enabling them to expand their footprint in Australia.

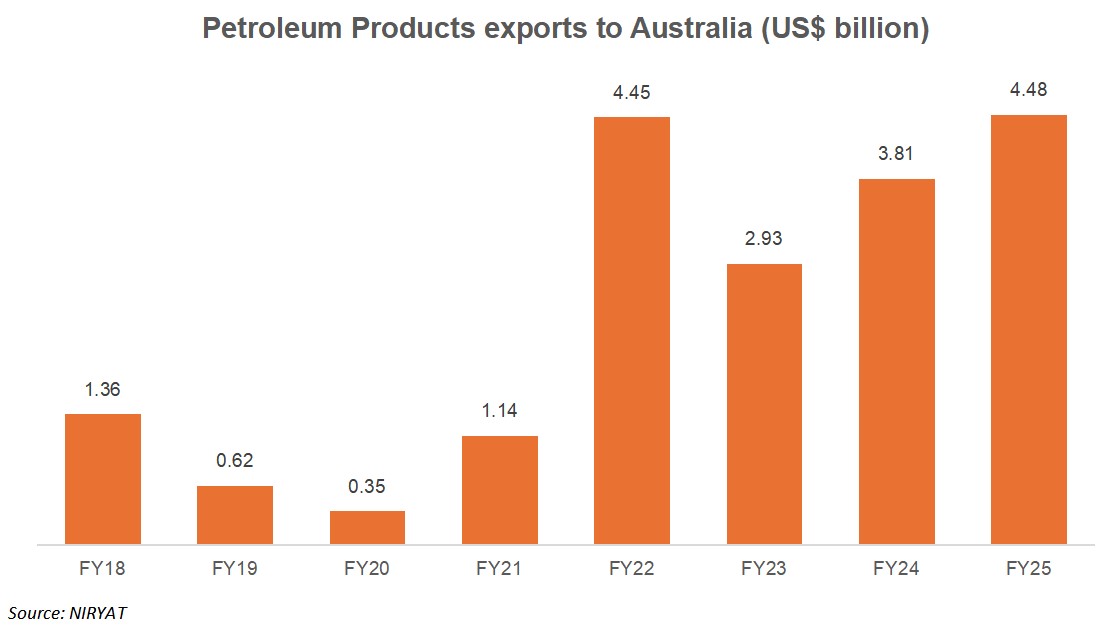

India exports a diverse range of goods to Australia, including textiles, pharmaceuticals, chemicals, engineering items, and agricultural products, while steadily widening its presence across emerging categories. Among these, petroleum products have been a major driver of export growth in recent years. Strong demand from Australia’s energy sector, coupled with India’s expanding refining capacity, has positioned petroleum products as a cornerstone of bilateral trade, significantly contributing to the surge in overall exports.

Petroleum Products

Of the total exports to Australia, share of Petroleum Products has consistently increased over the last few years and holds ~52% share of the total exports in FY25. Australia holds 7.46% share in the total Petroleum Products exported from India, ranking as the fourth largest importing country after Netherlands, United Arab Emirates (UAE), and Singapore.

India’s exports of petroleum products to Australia have grown impressively and more than tripled from US$ 1.36 billion in FY18 (~34% share) to US$ 4.48 billion in FY25 (~52% share), reflecting the synergy of India’s booming refining sector and Australia’s rising import needs. On the supply side, India has significantly scaled up refining throughput in recent years. New world-scale capacity, high run-rates, and policy shifts such as higher ethanol blending have freed up gasoline and diesel for export. These volumes, backed by competitive pricing and access to diversified crude sources, have strengthened India’s positioning as a key exporter to Asia-Pacific markets.

On the demand side, Australia’s fuel import dependency has grown sharply following the closure of major refineries such as Kwinana and Altona in 2021, leaving only a small number of domestic plants operational. Government stockpiling requirements, seasonal maintenance, and the need to secure stable fuel flows have further boosted reliance on imports. As a result, shipments from India have surged, with petroleum products becoming a cornerstone of bilateral trade. Looking ahead, the proposed Comprehensive Economic Cooperation Agreement (CECA) between the two nations is expected to further enhance this momentum, creating new opportunities for petroleum trade while reinforcing India’s role as a long-term and reliable energy partner for Australia.

India-UK

India’s goods exports to the UK have grown steadily in recent years, underscoring a strengthening trade partnership. Exports to the UK climbed to about US$ 14.55 billion in FY25 (up from US$ 9.71 billion in FY18), reflecting robust expansion and diversification of India’s export basket. This momentum highlights India’s growing competitiveness in the British market and the increasingly strategic alignment of the two economies. A key turning point was the India-UK Comprehensive Economic and Trade Agreement (CETA), which was being discussed and negotiated since 2022 and finally signed in July 2025. This landmark FTA eliminates nearly all tariffs on trade between the countries. Under CETA, about 99% of Indian export tariff lines to the UK face zero duties, opening duty-free access for labour-intensive sectors like textiles, engineering goods, and chemicals as well as for high-value categories.

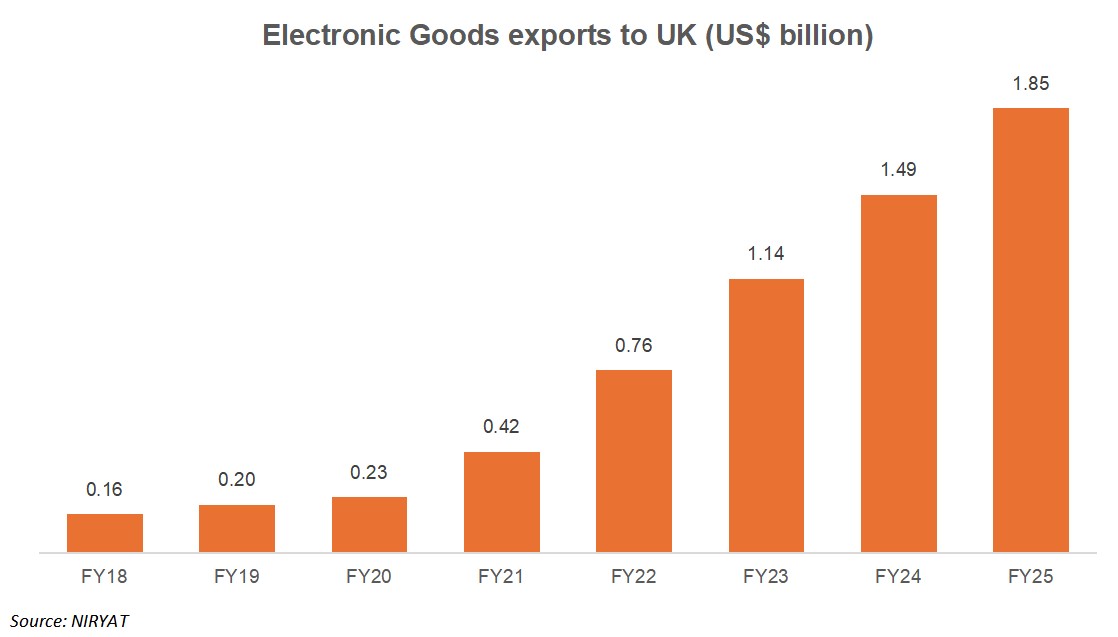

One especially notable beneficiary has been the electronics sector. Over the past few years Indian exports of consumer and telecom electronics have boomed; with growth led by telecom instruments, inverters, and other electronic machinery. Products such as smartphones, fibre-optic cables and power inverters are now poised for further lift under the new agreement. CETA’s provisions grant Indian TV sets, monitors, telecom equipment, and similar goods duty-free entry from day one, sharply improving price-competitiveness against other suppliers. In short, while India continues to ship a wide range of goods to the UK (including textiles, pharmaceuticals, chemicals, and automotive parts), the fast-growing electronics segment which is backed by zero tariffs on high-tech items, is set to be a new cornerstone of bilateral export growth.

Electronic Goods

Of the total exports to UK, share of Electronic Goods has consistently increased over the last few years and holds ~13% share of the total exports in FY25. UK holds 4.81% share in the total Electronic Products exported from India, ranking as the fourth largest importing country after USA, United Arab Emirates (UAE), and Netherlands.

India’s exports of electronic goods to the UK have surged nearly twelvefold, rising from just US$ 0.16 billion in FY18 to US$ 1.85 billion in FY25. This remarkable growth reflects the expansion of India’s electronics manufacturing ecosystem, powered by government initiatives like the Production-Linked Incentive (PLI) scheme, large-scale investments, and the rapid rise of mobile and telecom equipment production. With hundreds of new assembly and component plants, India has transformed into a competitive global hub for electronics, enabling it to meet rising overseas demand with scale and cost efficiency. At the same time, the UK’s growing appetite for consumer electronics and telecom equipment, coupled with its limited domestic production capacity, has created a strong pull for imports from India. Post-Brexit, UK buyers have also been looking to diversify away from China, which has further elevated India’s positioning as a trusted alternative supplier.

The signing of the India-UK Comprehensive Economic and Trade Agreement (CETA) in July 2025 is expected to further accelerate this momentum. The agreement removes import duties on a wide range of Indian electronic products including smartphones, inverters, optical-fibre cables, televisions, and telecom equipment, enhancing their competitiveness in the UK market. While India’s share of UK electronics imports is still relatively small, this duty-free access combined with regulatory alignment creates an opportunity for exponential growth. Indian electronics exports to the UK could double by 2030, making the sector a cornerstone of bilateral trade. With strong supply-side capabilities and greater market access now locked in, India is well placed to emerge as a reliable and cost-effective electronics partner for the UK in the coming years.

Disclaimer: This information has been collected through secondary research. The views expressed by the spokespersons are their own and do not necessarily reflect those of IBEF. IBEF is not responsible for any errors in the same.

Get In Touch

Your input is valuable in shaping the future of the IBEF Export Newsletter! Take a moment to share your thoughts and help us bring you more relevant insights, success stories, and export branding strategies.

Contact & Subscriptions: Contact Us

Email us at: info.brandindia@ibef.org

Call: +91 11 43845501