Atal Pension Yojana

Introduction

In June 2015, the government launched the Atal Pension Yojana (APY) to create a universal social security system by providing/offering guaranteed schemes to all citizens, especially the poor, underprivileged and employees of the unorganised sector. The Pension Fund Regulatory and Development Authority (PFRDA) oversees the administration of the APY.

Through APY, the government offers subscribers a minimum monthly pension - ranging from Rs. 1,000 (US$ 13.61) to Rs. 5,000 (US$ 68.06) - at the age of 60, depending on their contribution (APY subscribers). The scheme also provides guaranteed pension to the subscriber’s spouse, in case of the subscriber's death and return of the cumulative pension wealth to the nominee.

Need for APY

According to a 2014 Dvara Research report, the ratio of retired citizens to working-age citizens in India is expected to increase from 9.5% in 2015 to 28% in 2060. The aging population in the country (aged 65 and above) is expected to grow from 5.4% in 2015 to 16.7% by 2060, while the working-age population (aged 20-64 years) is expected to increase by 3% in the same period. Due to the rising old age dependency ratio, it was important for the government to establish a post-retirement financial programme to secure the well-being of its citizens.

Also, the unorganised or informal sector, that is a key element of the Indian economy, faces numerous challenges such as cyclical unemployment and absence of social security protection. As of January 2023, ~93% Indian workforce is employed in the unorganised sector.

Therefore, to support every citizen with an adequate retirement income in their old age, the Government of India introduced various schemes such as National Pension System (NPS) (in 2008) and NPS-Swavalamban Scheme (NPSS) (in 2010) for citizens working in the unorganised sector to aid and encourage them to save for their retirement.

In June 2015, the government introduced the APY to replace NPSS, wherein the NPSS subscribers (aged 18-40 years) were given the option to migrate to APY. While NPSS was open for all workers in the unorganised sector, the government designed the APY scheme for citizens in the age group of 18-40 years to ensure a minimum guaranteed pension to citizens working in the unorganised sector.

Details of Atal Pension Yojana

Eligibility of APY Subscriber

- All Indian citizens between ages of 18 and 40 years are eligible for this scheme.

- All eligible citizens must have an Aadhar card and active mobile number.

Atal Pension Yojana Chart - Monthly Contribution

Under this scheme, the subscriber can contribute to payments in the following three modes: monthly, quarterly, and half-yearly. To receive a minimum guaranteed benefit of Rs. 1,000 (US$ 13.61), an individual (18 years) must pay a monthly fee of Rs. 42 (US$ 0.57). The monthly contribution chart for the APY subscribers is as follows:

|

Minimum age of entry |

Monthly pension of |

Monthly pension of |

Monthly pension of |

Monthly pension of |

Monthly pension of |

|

18 |

Rs. 42 |

Rs. 84 |

Rs. 126 |

Rs. 168 |

Rs. 210 |

|

20 |

Rs. 50 |

Rs. 100 |

Rs. 150 |

Rs. 198 |

Rs. 248 |

|

25 |

Rs. 76 |

Rs. 151 |

Rs. 226 |

Rs. 301 |

Rs. 376 |

|

30 |

Rs. 116 |

Rs. 231 |

Rs. 347 |

Rs. 462 |

Rs. 577 |

|

35 |

Rs. 181 (US$ 2.46) |

Rs. 362 |

Rs. 543 |

Rs. 722 |

Rs. 902 |

|

40 |

Rs. 291 |

Rs. 582 |

Rs. 873 |

Rs. 1,164 |

Rs. 1,454 |

Benefits of Atal Pension Yojana

According to the Pension Fund Regulatory and Development Authority (PFRDA), the Atal Pension Yojana offers subscribers a guaranteed rate of 8% assured returns and the possibility of higher earnings, if the return rate is >8% at the time of scheme maturity, after investing in a plan for 20-42 years.

Also, subscriber contributions are eligible for tax benefits.

Progress of Atal Pension Yojana Scheme

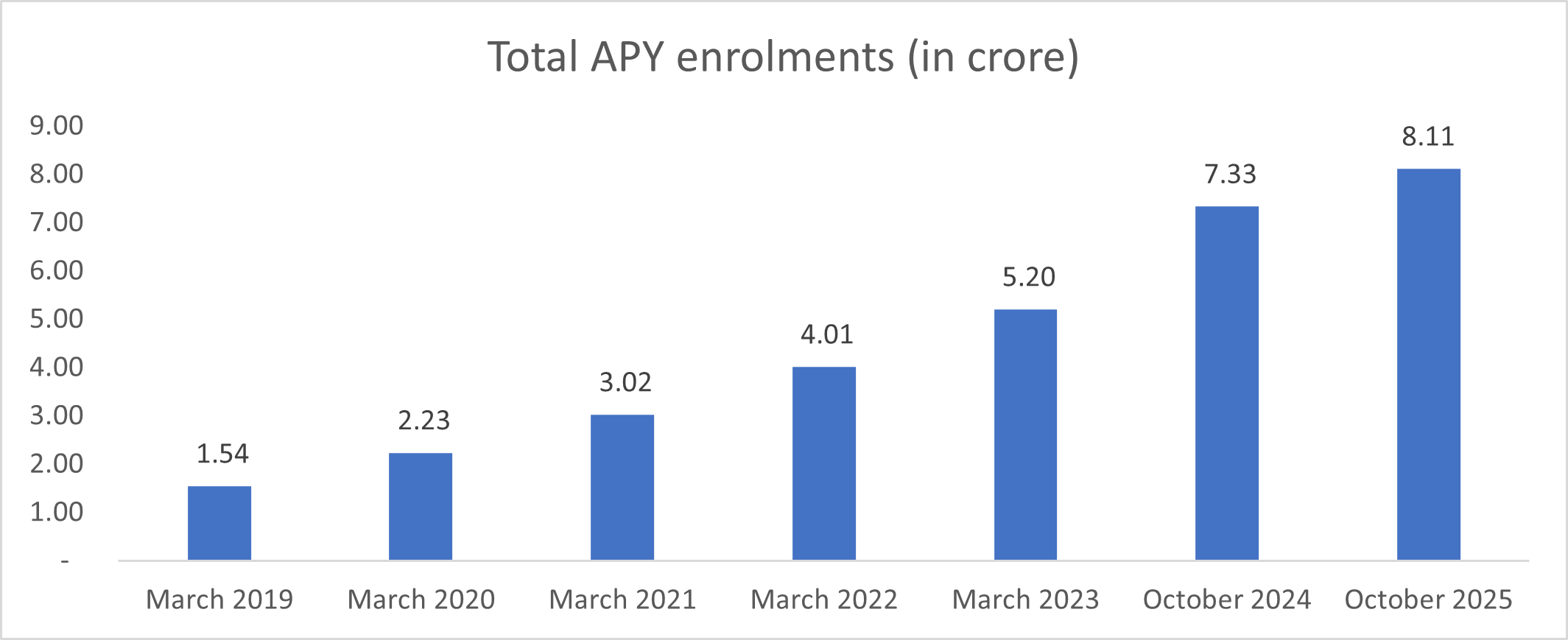

By August 21, 2025, APY crossed 8.11 crore subscribers with 1.17 crore new enrolments in FY25. Youth participation was strong, with 46% of new subscribers aged 18-25. The scheme's assets under management reached Rs. 48,000 crore (US$ 5.41 billion) with a CAGR of 9.12% since inception. According to the latest data presented in the Lok Sabha, Uttar Pradesh leads with 16.11% of total enrolments, followed by Bihar (9.59%), Maharashtra (7.96%), West Bengal (7.68%), and Tamil Nadu (6.69%). Combined, these states contribute almost 48% of the total enrolments under the scheme. Public sector banks led the way, contributing significantly to the record-high enrolments, followed by regional rural banks and other financial institutions.

In FY23, Pension Fund Regulatory and Development Authority (PFRDA) organized 47 Atal Pension Yojana (APY) outreach programs and Town Hall meetings nationwide at multiple venues, in collaboration with State Level Bank Committees (SLBCs) and Regional Rural Banks (RRBs). Various initiatives were implemented, including the introduction of a digital onboarding platform utilising Aadhaar, the release of an updated APY mobile application, 17 podcasts aimed at raising awareness about the advantages of APY, and the introduction of a Chatbot service for obtaining fundamental information on APY.

Bank contribution to the APY scheme

In FY25, over 1.17 crore new subscribers joined Atal Pension Yojana, driven by strong bank support. Public Sector Banks led with Bank of India (126%), State Bank of India (123%), and Indian Bank (118%) topping the list. IDBI Bank excelled among major private banks with 145%. Regional Rural Banks like Jharkhand Rajya Gramin Bank (393%) and Tripura Gramin Bank (351%) set benchmarks. Cooperative banks such as Shri Mahila Sewa Sahakari Bank (400%) also stood out.

More than 1.22 crore new subscribers enrolled in FY24. In the public sector banks accounted for 70% of scheme enrolments, while regional rural banks contributed 20%. Private sector banks, payment banks, small finance banks, and cooperative banks accounted for 6.18%, 0.37%, 0.62%, and 2.39% respectively.

Rise in the number of enrolments for monthly pension of Rs. 1,000 (US$ 13.61)

Enrolments in the category amounted to Rs. 1,000 (US$ 13.61) experienced a 11% growth to ~ 12.2 million in the FY24. This increase occurred as 12 states collectively enrol over 80% of the total, with Uttar Pradesh leading at over 10 million, followed by Bihar, Maharashtra, and others.

Increasing number of female enrolments

In addition, the gender disparity in APY enrolments narrowed with participation of female subscribers, which increased to over 52% as of March 2024 from 37% in March 2016.

Rising younger enrolments

According to Atal Pension Yojna the age profile of subscribers highlighted an increase in the number of younger enrolments, wherein the number of participants (aged 18-30 years) accounted for more than 70% of the total enrolments under the scheme as of FY24.

Road Ahead

Pension Fund Regulatory and Development Authority (PFRDA) Chairman, Mr. Supratim Bandyopadhyay said, “Acknowledging the social significance of this scheme, we constantly undertake prompt initiatives for accomplishing exponential growth.”

He also stated that this task of supporting the most vulnerable sections of society, under the pension coverage, was only achievable due to the enduring efforts of public & private banks, regional rural banks, payments banks, small finance banks, the Department of Post and assistance provided by the state level bankers' committees. All these collaborative efforts have resulted in boosting the number of subscribers in the pension programme.

Supported by the growing number of enrolments under the APY scheme, PFRDA plans to continue its efforts to promote the scheme and take it to greater heights; thereby, aid India in becoming a pensioned society.