Pradhan Mantri Mudra Loan Bank Yojana (PMMY)

Introduction

In April 2015, the Indian government introduced the Pradhan Mantri MUDRA Yojana (PMMY) to provide loans of up to Rs. 10 lakh (US$ 11,711) to non-corporate, non-farm small/micro enterprises. Through PMMY, the government aims to support and fund small business owners to help them generate/create jobs in sectors such as manufacturing, services, retail, and agriculture & allied industries.

The scheme was developed to aid unbanked citizens (who do not have a savings or checking account with a bank) by getting them into mainstream banking, assisting them with microcredits and empowering them to become self-reliant.

Moreover, this scheme, in collaboration with partner institutions, aims to cultivate an inclusive, sustainable, and value-based entrepreneurship culture to boost self-employment, create new jobs and contribute to the overall development of the economy.

Need for PM Mudra Yojana

According to a 2013 NSSO survey, India comprised ~5.77 crore small/micro units, wherein a majority were sole proprietorships/own account enterprises, which employed ~12 crore people. Of the total small/micro units, ~60% were owed by people from scheduled castes, scheduled tribes, and other backward classes. However, due to low credit availability, which was mostly generated from informal lenders such as friends and relatives. Providing micro/small business units with access to institutional finance will help create a significant potential for small businesses to generate employment opportunities and thereby, drive the country's economic growth.

In line with this, to support and boost the morale of aspiring young people who want to be first-generation entrepreneurs, in 2015, the government launched the MUDRA bank to ‘fund the unfunded’ small entrepreneurs. The initiative aims to empower ~58 million small businesses in India that account for just 4% institutional funding and employ >120 million people, many of whom are from low-income families.

PM Mudra Yojna Details

PM Mudra Yojana Loan is classified into the following 3 categories:

|

Categories |

Maximum Loan Amount |

Description |

|

Shishu |

Rs. 50,000 (US$ 677.07) |

|

|

Kishor |

Rs. 5 lakh (US$ 6,770) |

|

|

Tarun |

Rs. 10 lakh (US$ 13,540) |

|

In the past 10 financial years, from April 1, 2018, to March 31, 2025, Pradhan Mantri Mudra Yojana (PMMY) has facilitated the extension of over 52 crore loans, amounting to US$ 367.31 billion (Rs. 32,61,000 crore) in sanctioned funds.

According to a study published by the Labour Bureau, under the Ministry of Labour and Employment, MUDRA loans generated 11.2 million additional jobs between 2015 and 2018, wherein 55% were self-employed jobs and 45% comprised new jobs, which were created in existing businesses. In the same period, women workforce accounted for 62% of the total estimated increase in jobs in India.

According to the report, prior to the MUDRA scheme, 39.3 million people were working in numerous small businesses; this number increased to 50.4 million between 2015 and 2018. In addition, the number of self-employed people increased to 31 million until 2018, from 25.9 million (before the scheme). Also, the number of hired employees rose from 13.4 million to 19.5 million until 2018.

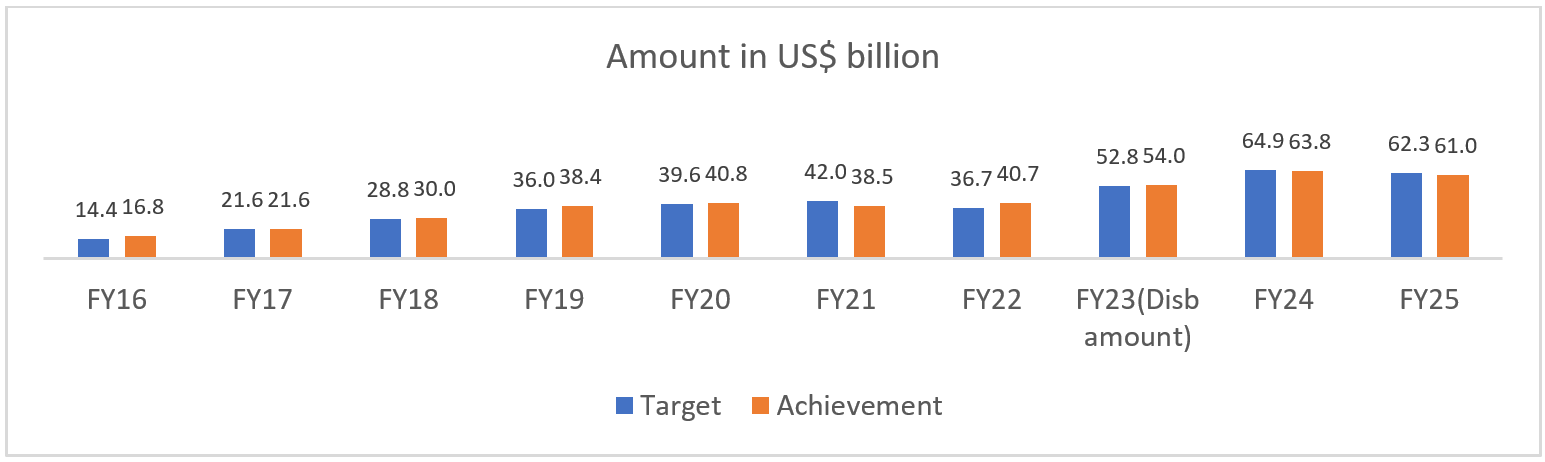

PMMY: Target vs. Achievement

Source: MUDRA

In FY25, within the framework of PMMY, a sum totalling US$ 61.03 billion (Rs. 5.42 lakh crore) was approved across 5.47 crore loan accounts.

In FY24, within the framework of PMMY, a sum totalling US$ 63.82 billion (Rs. 5.32 lakh crore) was approved across 6.67 crore loan accounts.

In FY23, within the framework of PMMY, a sum totalling US$ 54.72 billion (Rs. 4.56 lakh crore) was approved across 6.23 crore loan accounts.

As of FY21 (until February 2021), PMMY disbursed 94% loans that were approved for micro and small enterprises (MSEs). Of the US$ 32 billion (Rs. 2.38 lakh crore) loans to 3.68 crore accounts, US$ 303,440 (Rs. 2.24 crore) was disbursed within 11 months in FY21.

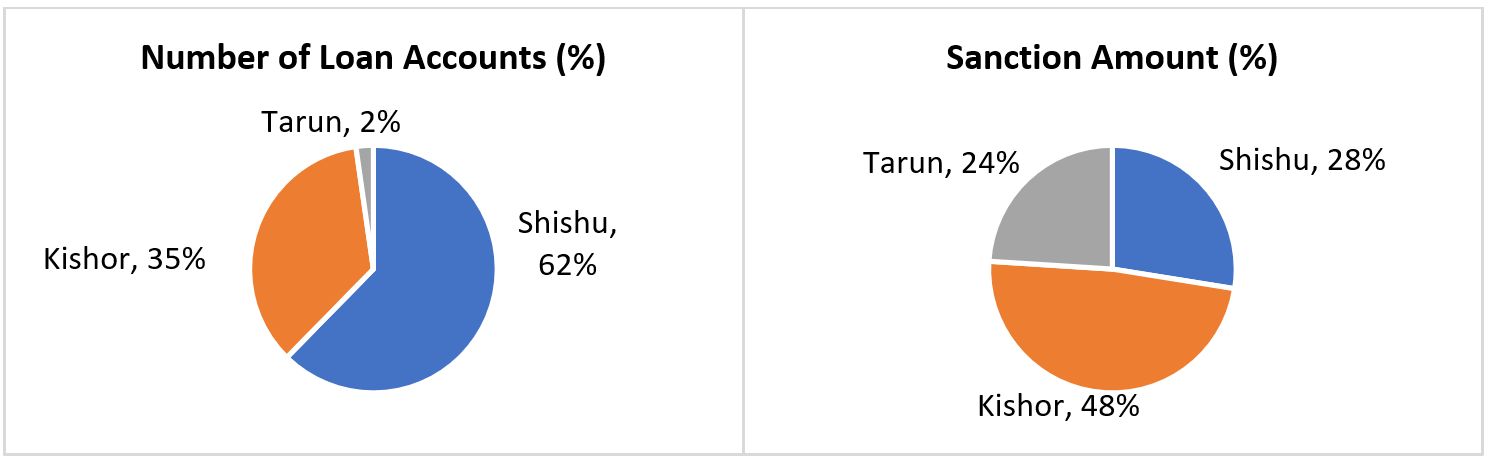

PMMY Sanctions in FY24 by sub-categories of borrowers

Source: MUDRA Annual Report FY24

In FY24, Among the three categories, Kishor loans had the largest share of 48% followed by Shishu loans at 28% in terms of disbursement amount. Further, Kishor loans sanctioned funds increased by 27.95% YoY.

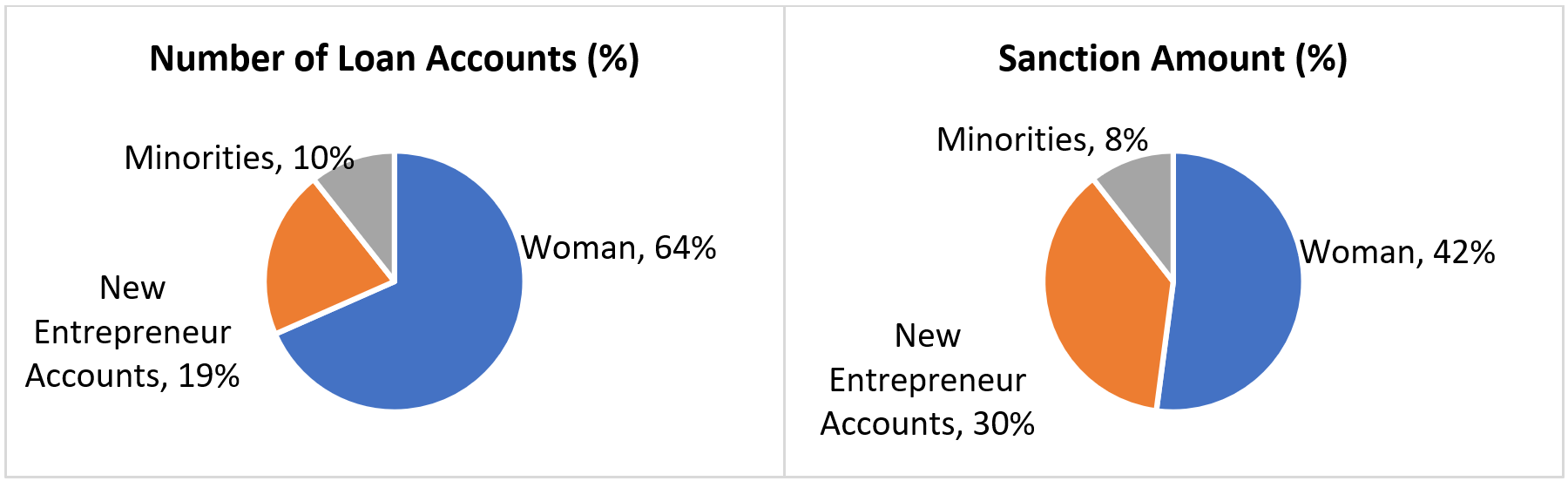

Source: MUDRA Annual Report FY24

In FY24, out of the total amount disbursed, 41.76% went to the women borrowers with 63.63% of the total accounts belonged to women.

Women entrepreneurs are expected to play a significant role in transforming India into a self-reliant country. According to a report by Bain & Co. and Google, women entrepreneurs in India are expected to generate ~150-170 million jobs by 2030, accounting for > 25% of all new jobs available for India's working-age population.

Through PMMY, the government has offered numerous opportunities to women entrepreneurs. Between 2018 and 2023, ~67% loans, representing 19.22 crore accounts, with a total value of US$ 95.15 billion (Rs. 7.93 lakh crore) have been sanctioned to women entrepreneurs.

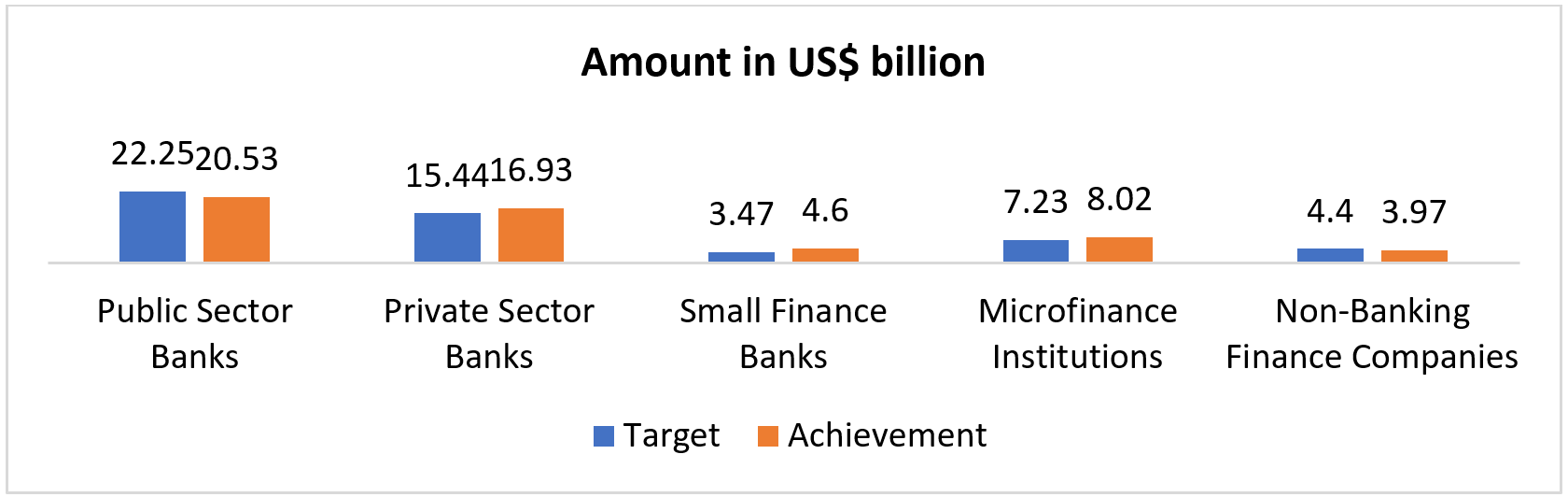

PMMY: Agency-wise Achievement in FY24

The Government of India established a target of disbursing Rs. 5,00,000 crore (US$ 58.53 billion) rupees under PMMY for FY24. This amount was allocated among different lending institutions, including banks, MFIs, and NBFCs, according to their coverage and presence across different regions of the country.

Source: MUDRA Annual Report FY24

The achievement data indicates 18% increase over the previous year in the overall performance of the programme implemented by all the lending institutions. This is mainly due to the increased volume of disbursements done in FY24 by the NBFCs, NBFC-MFIs, SFBs & Private Sector Banks.

Among the Public Sector Banks, State Bank of India (SBI), with disbursement of Rs. 43,714.32 crore (US$ 5.12 billion) to 17.99 lakh loan accounts topped the table. SBI was followed by Canara Bank and Union Bank of India with a disbursement figure of Rs. 21,985.33 crore (US$ 2.57 billion) and Rs. 21,976.84 crore (US$ 2.57 billion) respectively.

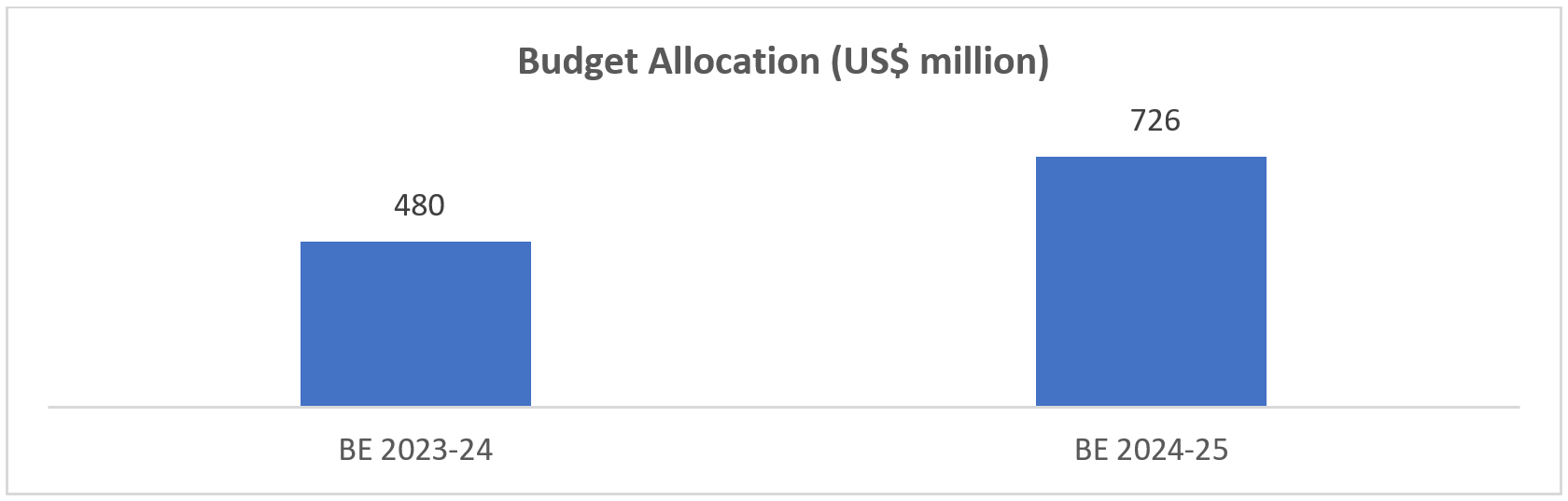

Budget allocation & highlights

In the Interim Budget 2025, the government allocated funds worth US$ 725.9 million (Rs. 6,050 crore) to the Pradhan Mantri MUDRA Yojana (PMMY).

Source: Union Budget 2024-25

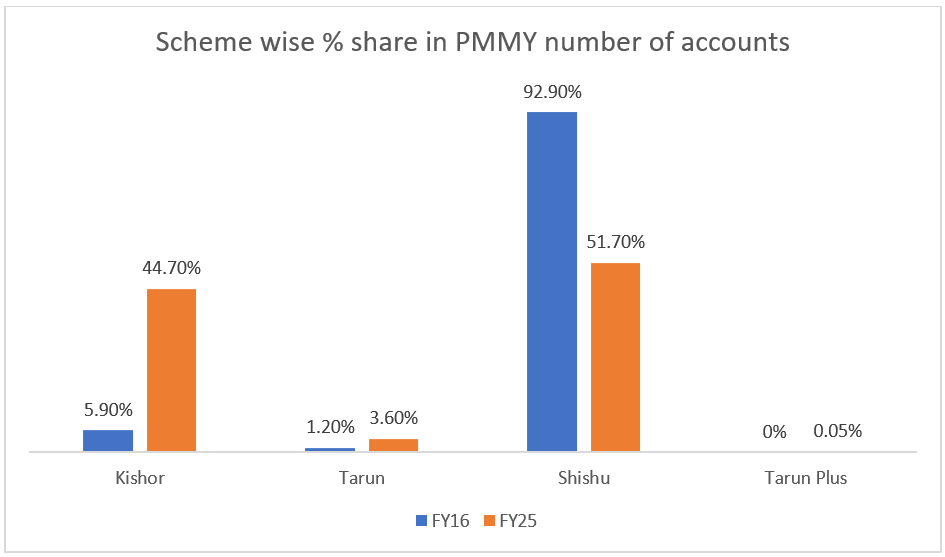

Scheme wise % share in PMMY number of accounts

Source: Press Information Bureau

Key developments:

- Over the past 10 years, Mudra has facilitated the opening of over 52 crore loan accounts, marking a steady rise in entrepreneurial activity.

- Women account for 68% of all Mudra beneficiaries, underscoring the scheme’s pivotal role in advancing women-led enterprises across the country. Between FY16 and FY25, the per woman PMMY disbursement amount increased at a Compounded Annual Growth Rate (CAGR) of 13%, reaching Rs. 62,679 (~US$ 728), while per woman incremental deposits grew at a CAGR of 14% to Rs. 95,269 (~US$ 1,107).

- The SBI report highlights a significant rise in credit flow to MSMEs, driven by Mudra’s impact. MSME lending surged from Rs. 8,51,000 crore (~US$ 98.95 billion) in FY14 to Rs. 27,25,000 crore (~US$ 316.64 billion) in FY24 and is projected to cross Rs. 30,00,000 crore (~US$ 348.76 billion) in FY25. The share of MSME credit in total bank credit increased from 15.8% in FY14 to nearly 20% in FY24.

- Since its launch in April 2015, the Pradhan Mantri Mudra Yojana (PMMY) has sanctioned over 52 crore loans worth Rs. 32,61,000 crore (~US$ 379.11 billion), fuelling a nationwide entrepreneurial revolution.

- On April 8, 2025, India marks 10 years of the Pradhan Mantri MUDRA Yojana (PMMY) — the flagship programme of the Prime Minister aimed at Funding the Unfunded micro enterprises and small businesses. By removing the burden of collateral and simplifying access, MUDRA laid the foundation for a new era of grassroots entrepreneurship.

- As of March 31, 2025, under the PMMY scheme for FY25, a total of 4,79,48,320 loans were sanctioned amounting to Rs. 5,02,782.13 crore (~US$ 58.44 billion), out of which Rs. 4,91,787.92 crore (~US$ 57.16 billion) has been disbursed.

- The 2024 Union Budget raises the Mudra loan limit to Rs. 20 lakh (US$ 24,024) from Rs. 10 lakh (US$ 12,012) for borrowers who have successfully repaid previous loans under the Tarun category, aiming to support employment, skill development, and the growth of MSMEs.

- In FY25, over 11 lakh residents in Uttar Pradesh have received Rs. 11,000 crore (US$ 1.32 billion) in loans through the PM Mudra Yojana, showcasing a significant increase in financial accessibility and support for entrepreneurship, driven by coordinated efforts between the state government and financial institutions.

- In FY24, Mudra Loans surpassed Rs. 5 lakh crore (US$ 59.94 billion) in disbursals, marking a significant milestone for small business financing and highlighting the effectiveness of the Pradhan Mantri Mudra Yojana in promoting entrepreneurship, financial inclusion, and economic growth across India, particularly benefiting underprivileged sections and women entrepreneurs.

- As of March 24, 2023, approximately 23.2 lakh crore rupees have been sanctioned across 40.82 crore loan accounts. Women entrepreneurs account for 68% of the scheme's accounts, while 51% of the accounts belong to entrepreneurs from SC/ST and OBC categories.

- The Ministry reported that as of March 31, 2021, over 29.55 crore loans worth US$ 186.23 billion (Rs. 15.52 lakh crore) have been sanctioned under PMMY since its launch in April 2015. Of these, more than 6.80 crore loans totalling US$ 62.40 billion (Rs. 5.20 lakh crore) have been extended to new entrepreneurs/accounts.

- In FY20, the performance of private sector banks significantly improved, with a sanction of US$ 12 billion (Rs. 91,780 crore), an increase of 43% YoY.

- This was attributed to the merger of SKS Microfinance (Bharat Finance Ltd.) with IndusInd Bank, which was the leading private sector bank with a sanctioned amount of US$ 5 billion (Rs. 38,199.43 crore), accounting for >41% of all private sector bank sanctions.

- The other key private sector banks, such as Bandhan Bank and IDFC Bank, also contributed to this space.

- Under the scheme, lending institutions issued a ‘Mudra Card’, a debit card, to loan borrowers on the RuPay platform to help them access working capital funds at an affordable rate. As of FY20, the total number of Mudra Cards in use stood at >1 million; ~4.26 lakh new Mudra Cards worth US$ 1.17 billion (Rs. 8,623 crore) were released.

- In September 2020, public sector banks (e.g., State Bank of India) launched 'eShishu Mudra' (a digital service) to streamline processing of loans for microenterprises and provide customers a digital personal loan.

- In June 2020, the Union Government approved a scheme, under the PMMY, to provide 2% relief on interest to small bank borrowers. As part of the scheme, all loan accounts, under the Shishu group of the MUDRA scheme, will be eligible for interest subvention gain for 12 months.

The Road Ahead

PMMY is a significant step towards achieving financial inclusion, boosting employment, and increasing the number of self-employed people.

In 2020 the government announced an interest subvention scheme for Shishu loans, as part of the Atmanirbhar Bharat (Self-reliant India) economic stimulus package. From FY18 to FY23, banks and financial institutions approved loans worth US$ 213.22 billion (Rs. 17.77 lakh crore), benefitting >28.89 crore beneficiaries in the country.

In addition, under PMMY, lending by private sector banks increased by 20% YoY in FY23. Therefore, the combined effort of the government and private sector is supporting the performance the PMMY scheme. Also, the rising number of beneficiaries benefiting from this scheme is indicative of the fact that India would further improve in its entrepreneurial capabilities and progress further in its self-reliance journey.