Ujwal DISCOM Assurance Yojana

Introduction

On November 05, 2015, the Government of India launched Ujwal Discom Assurance Yojana Scheme to aid operational and financial turnaround of Power Distribution Companies (DISCOMs) owned by any state. This scheme was established with a vision to provide affordable and accessible 24×7 power to all. It also aims to provide a solution for revenue-side efficiency and cost-side efficiency. Moreover, the scheme envisages reform measures in the following sectors: generation, transmission, distribution, coal, and energy efficiency.

Initially, the scheme was targeted for four years until 2019, providing revival package for electricity distribution companies; however, after understanding impact and prospect of this scheme, the government launched ‘UDAY 2.0’ as the next leg of reforms in the power distribution sector, under the Union Budget FY21.

Need for Ujwal DISCOM Assurance Yojana

In India, DISCOMs (Power Distribution Companies) have been accumulating losses and are under outstanding debt, as these utilities are supplying electricity at tariffs that are far below cost. These financially stressed DISCOMs are not able to supply adequate power at affordable rates; this hampers the quality of life and overall economic growth and development.

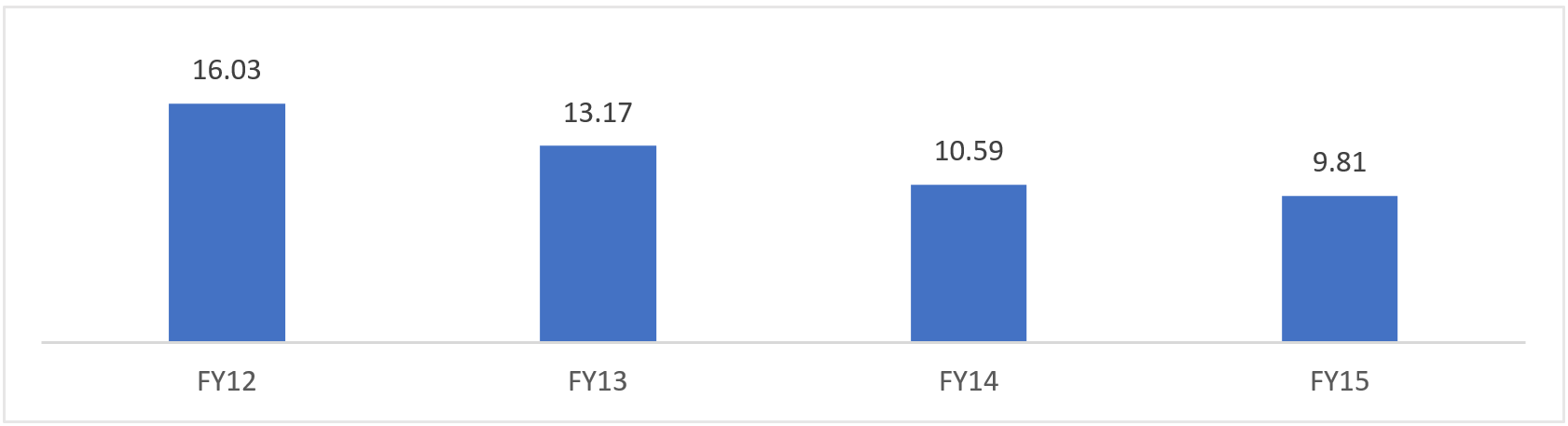

Figure 1: Accumulated Losses and Debt from DISCOMs (US$ billion)

Moreover, inefficiencies in power distribution, such as large transmission and distribution losses on power, have further strained finances of DISCOMs, who have been heavily borrowing from banks to operate themselves. Owing to DISCOMs massive pile of debts and accumulated losses, which stood at ~Rs. 2.75 lakh crore (US$ 49.60 billion) from FY12 to FY15, the government decided to develop a financial scheme to aid these DISCOMs and reduce their transmission losses.

UDAY Objective

The Ministry of New and Renewable Energy first announced the Ujwal DISCOM Assurance Yojana (UDAY) in November 2015. This scheme covers 32 states and all Union Territories and aims to increase annual tariffs, adjust quarterly fuel costs, reduce interest burden, rationalise coal prices, lower fuel costs through coal swapping, minimize time-bound losses, etc.

Key objectives of the Ujwal DISCOM Assurance Yojana (UDAY) scheme are as follows:

- Reduce the aggregate technical & commercial (AT&C) loss (from ~22% to 15%) and eliminate the gap between average cost of supply (ACS) and average revenue realised (ARR) by 2018-19

- Improve operational efficiency via ensuring compulsory smart metering, upgrading transformers and meters. Also, adopt energy efficiency measures such as initiate promotion of energy-efficient LED bulbs, agricultural pumps, fans, and air-conditioners

- Reduce power costs, interest burden and power losses in the distribution sector; improve operational efficiency of DISCOMs to supply adequate power at affordable rates

- UDAY is a debt restructuring plan for DISCOMs and was kept optional for states

- Encourage states to actively participate in the scheme by providing incentives to the performing state. Also, issue bonds in a phased manner by signing a memorandum of understanding (MoU) with the joining states to undertake 75% debts of their respective DISCOMs, while the remaining 25% debts will be issued to DISCOMs in the form of bonds

Benefits to the Participating States

- With support from the Central Government, the power costs of the participating states will be reduced. In addition, the following advantages will be provided:

- Increased supply of domestic coal

- Allocation of coal linkages at notified prices

- Rationalisation of coal prices

- Enabling coal linkage rationalisation & allowing coal swaps

- Supply of washed & crushed coal

- Additional coal at notified prices

- Faster completion of interstate transmission lines

- Power purchase through transparent competitive bidding

- Moreover, these states will receive additional priority funding under numerous schemes such as Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and Integrated Power Development Scheme (IPDS)

UDAY: Progress (as of April 5, 2024)

|

Financial |

|||

|

Indicators |

Progress |

Target |

Participating States |

|

Bonds Issued |

Rs. 2,32,163 crore (US$ 27.85 billion) (86.29%) |

Rs.2,69,056.35 crore (US$ 32.27 billion) |

Data is for 16 states |

|

AT&C Loss |

20.81% |

0% |

Data is for 29 states |

|

ACS – ARR Gap |

Rs. 1.0/Unit |

< Rs. 0/Unit |

Data is for 29 states |

|

Tariff Revision |

Done for 25 states |

27 States |

Data is for 27 states |

|

Operational |

|||

|

Indicators |

Progress (Units) |

Target* (Units) |

Participating States |

|

Total Feeder Metering (Urban) |

56,674 (>100%) |

42,285 |

Data is for 28 states |

|

Total Feeder Metering (Rural) |

130,446 (>100%) |

98,491 |

Data is for 29 states |

|

Distribution Transformer Metering (Urban) |

1,276,237 (98%) |

1,301,226 |

Data is for 28 states |

|

Distribution Transformer Metering (Rural) |

3,049,725 (69%) |

4,414,149 |

Data is for 28 states |

|

Electricity Access to Unconnected Households |

2,055.81 Lakh (>100%) |

1,887.25 Lakh |

Data is for 30 states |

|

Smart Metering above 500 kWH |

712,246 (12%) |

5,733,297 |

Data is for 29 states |

|

Smart Metering above 200 and up to 500 kWH |

2,110,385 (11%) |

18,429,956 |

Data is for 29 states |

|

Feeder Segregation |

53,977 (86%) |

62,901 |

Data is for 18 states |

|

Rural Feeder Audit |

873,822 (>100%) |

98,003 |

Data is for 28 states |

|

Distribution of LEDs Under Unnat Jyoti by Affordable LEDs for All Scheme (UJALA) |

3,033.89 lakh (>100%) |

2,339.21 lakh |

Data is for 28 states |

Source: UDAY Website, Ministry of Power

Note: * - Target is as per UDAY Scheme (2015-2019)

UDAY 2.0 and Liquidity Infusion Scheme

Under the Union Budget FY21, the Indian government launched ‘UDAY 2.0’ scheme, with an aim to install smart prepaid metres, prompt payments by DISCOMs, ensure short-term availability of coal and revive gas-based plants. In addition, Finance Minister Nirmala Sitharaman proposed a Rs. 3.05 lakh crore (US$ 41 billion) scheme, which will be implemented over five years, to revive DISCOMs and to develop a framework to provide an option to electricity consumers to choose from service providers.

On May 13, 2020, the central government introduced the liquidity infusion scheme, as part of the ‘Aatmanirbhar Bharat Abhiyan’, amid the outbreak of COVID-19 pandemic in the country. Owing to the consequent nationwide lockdown, revenues of the power distribution companies (DISCOMs) nosedived, as people were unable to pay their electricity bills. As of March 2021, power distribution utilities (DISCOMs) have been sanctioned loans of Rs. 1.35 lakh crore (US$ 18 billion) and disbursed Rs. 46,321 crore (US$ 6.16 billion) under the liquidity infusion scheme.

In addition, Power Finance Corporation (PFC) and Rural Electrification Corporation Ltd. (REC) extended special long-term transition loans at concessional rates to DISCOMs against their receivables from the state government in the form of electricity dues and subsidy not disbursed. This was done to enable them to clear their outstanding dues, as existed on June 30, 2020, towards Central Public Sector Undertaking (CPSU) Generation (GENCO) & Transmission Companies (TRANSCOs), Independent Power Producers (IPPs) and Renewable Energy (RE) generators.

Further, to enable DISCOMs that do not have adequate headroom available under working capital limits of 25% of last years' revenues, as imposed under UDAY scheme, or do not have adequate receivables from the state governments, the Government of India approved a one-time relaxation to PFC and REC Ltd. for extending these loans.

The Road Ahead

The government has ensured to have sufficient generation capacity to meet the future demands of electricity. The all-India power generation installed capacity by 2026-27 is estimated to be 6,19,066 MW, which includes 2,38,150 MW coal, 25,735 MW gas, 63,301 MW hydro, 16,880 MW nuclear and 2,75,000 MW renewable energy, to fully meet the electricity demand projected as per the 19th Electric Power Survey. Moreover, as per a study by Central Electricity Authority on ‘Optimal Generation Capacity mix for 2029-30’, the likely all-India power generation installed capacity in 2029-30 is estimated to be 8,17,254 MW, which includes 2,66,911 MW coal, 25,080 MW gas, 71,128 MW hydro, 18,980 MW nuclear and 4,35,155 MW renewable energy. The government aims to increase the share of renewable energy, which is available in abundance within the country, to meet India’s requirement and export to neighbouring countries.

As a paradigm shift is taking place in power sector operations, more renewable energy projects are bound to come that will require a green corridor. While conventional energy will play its part, business opportunities will increasingly come from the renewable sector and strong distribution utilities will be required to withstand this transformation. This might result in the power sector financial institutions (FIs) such as Power Finance Corporation Ltd. (PFC), Rural Electrification Corporation Ltd. (REC) and other firms finding UDAY scheme extremely useful.