SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (35)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (57)

- Textiles (8)

- Tourism (14)

- Trade (5)

An Overview of Recent Mergers and Acquisitions Trend in India

India recorded a resurgence in the mergers and acquisitions (M&A) space in 2024. Indian deal-making segment has been volatile from highs in FY22 to Q1 23. Thereafter, the number of deals receded quarter after quarter till the end of 2023. Unlike, the global trend of moderate deals taking place, India, since the start of 2024, revived from the sluggish 2023 M&A environment. This was primarily driven by increasing investor confidence in the Indian economy.

Despite the resistant, non-budging, macro environment of high interest rates and inflation, the RBI inched up its GDP outlook for the FY25 to 7.2% from the previous forecast of 7.0%. This was because of healthy consumer spending and urban consumption. The progressive growth in the Indian stock market, inching up of GDP and PMI index and positive consumer confidence are prospects for increased M&A deals. Moreover, the positive macro-economic setting in India during the ongoing global uncertainties is likely to support the M&A activity in the near future.

Market Dynamics in M&A activities

Source: PwC

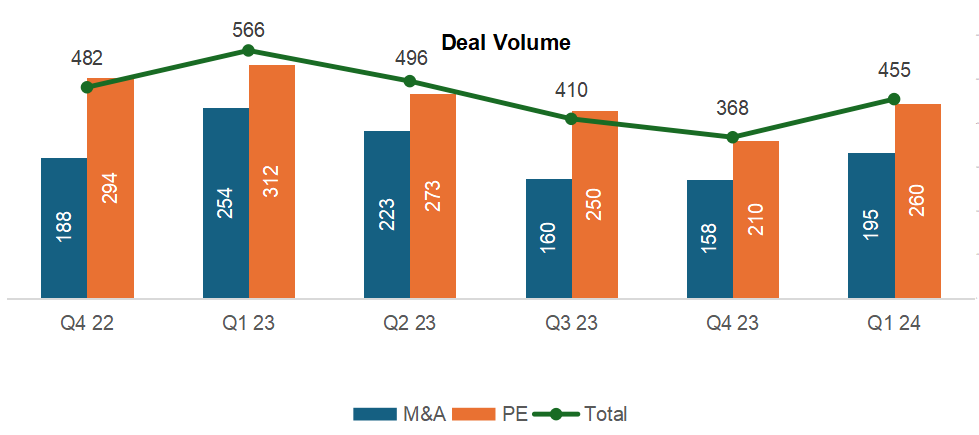

Q1 23 started off good with 566 deal volume, a 2.1% QoQ increase, which then declined consecutively for the next three quarters. In 2023, the total number of deals stood at 1,840. During Q4 23, the deal volume declined 10.2% QoQ and 23.7% YoY to 368. However, the deal making scenario improved in Q1 24 with 455 deals, clocking a sequential growth of 23.6% on the back of improving market dynamics.

Source: PwC

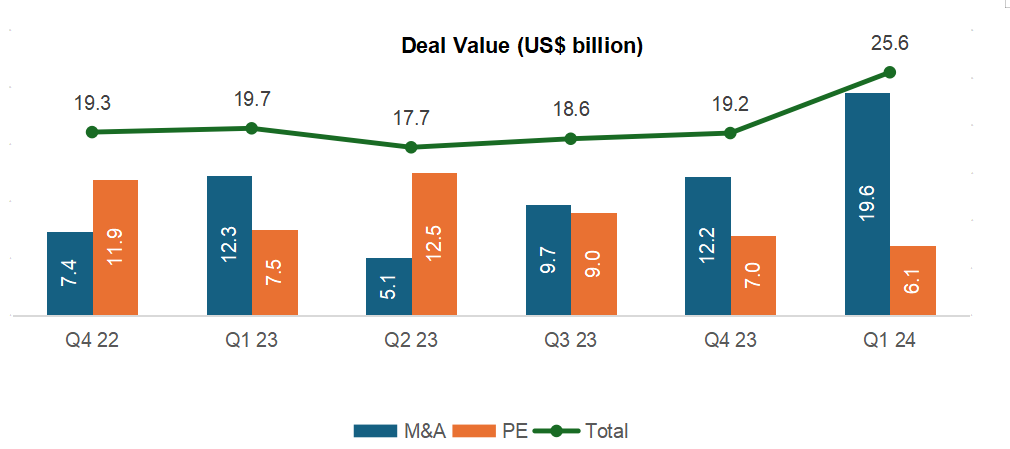

Unlike deal volumes, deal values has shown less volatility. In Q4 23, Deal value increased 3.2% QoQ to US$ 19.2 billion, and grew further to US$ 25.6 billion in Q1 24, posting a sharp jump of 33.3% QoQ.

The average ticket size in Q1 24 for M&A deals stayed at US$ 142 million on QoQ basis but 42.0% higher on YoY basis. Similarly, 12 out of 14 deals with a ticket size over US$ 500 million (versus 9 deals in Q423) were M&A transactions.

Deal analysis of 2023 and 2024

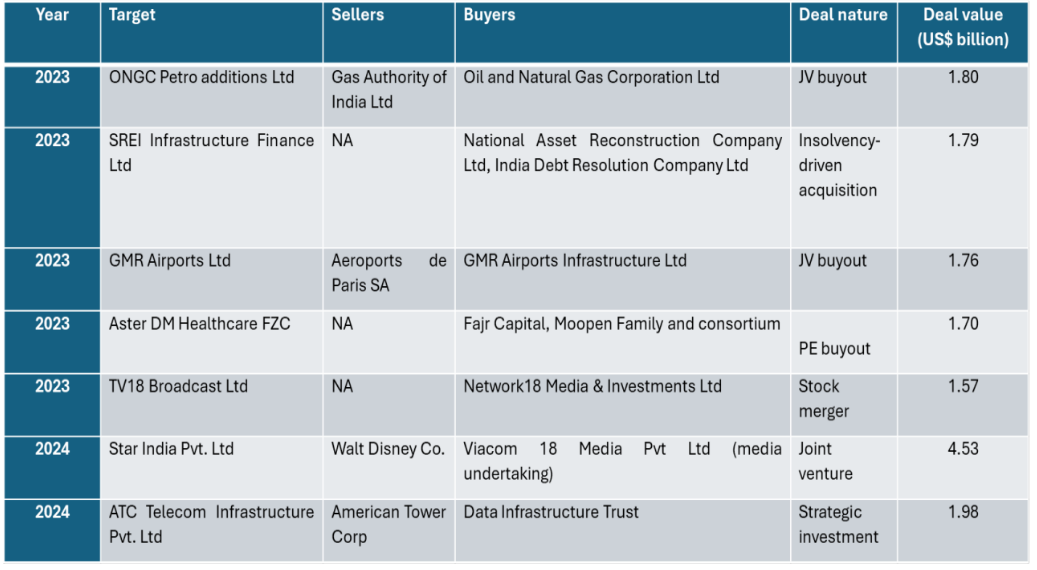

During 2023, the number of deals announced stood at 1,850 of which 26.7% (494) were domestic M&A deals. The deal value stood at US$ 75 billion, and the largest deal executed was at US$ 1.8 billion. In Q1 24, the deal volume stood at 455, out of which 143 (31.4%) were domestic M&A deals. The deal value in Q1 24 was over US$ 25 billion, and the largest deal stood at US$ 4.5 billion surpassing the 2023 largest deal by 2.5x. The number of domestic deals is on the rise as investors are apprehensive about global uncertainties, and hence, cross border deals are taking a back seat.

In Q1 24, the quarter’s largest deal was from media and entertainment sector, between Reliance Industries and Disney forming a joint venture to merge Viacom 18 and Star India. In future, it will create a media giant spanning across TV broadcasting, streaming, movies and sports.

Top deals of 2023 and 2024

Source: PwC

Sector specific deals

Both in FY23 and Q1 24 the sectors with the higher number of deals were retail and consumer (FY23 - 289, Q1 24 - 81) and technology (FY23 - 269, Q1 24 - 49). The increase in consumer spending and masses tilt towards technology has kept these two sectors up for the last five quarters. Furthermore, healthcare inched up to the third place in Q1 24 signalling consumers focus on health and prevention.

The sectors with highest deal value in 2023 were retail and consumer amounting to US$ 8.8 billion, financial services amounting to US$ 8.2 billion and power amounting to US$ 7.9 billion. Likewise, in Q1 24, the media & entertainment sector was at the forefront in terms of deal value at US$ 4.7 billion, power US$ 3.1 billion and pharma US$ 2.2 billion. The pharma deals values surged massively in this quarter from US$ 3.5 million in 2023 to US$ 2.2 billion indicating prioritisation of healthcare by consumer as well as investors.

Driving factors for M&A

The attractiveness of the M&A market in India is poised by its lucrative position on the global landscape (amongst emerging economies), the opportunities it presents and favourable macro-economic conditions. Key indicators boosting investment through M&A are summarised below:

- The Nifty 50 index remarkably climbed 13.5% as on July 19, 2024, and 19.42% in 2023 projecting a booming growth potential in the Indian economy.

- The GDP has been consistently on an upward trajectory expanding from 6.2% in Q2 23 to 7.8% in Q1 24. Moreover, revised outlook by RBI to 7.2% for the rest of 2025 from 7.0% stirs positivity.

- The Purchasing Manger’s Index rose to 58.3 in June 2024 from 57.5 in May 20 reflecting improved business conditions fuelled by increased new orders, output, and purchasing activities.

- The cumulative growth triggers will develop excellent M&A opportunities for India whether be it consolidation, small to mid-market deals or PE deals.

Challenges

With majority of factors playing in Indian economy’s favour, following are few challenges that the M&A investment universe could face:

- Deal values might remain in the lower to mid-market segment especially in the PE investments

- Cross-border deals falling due to higher interest rate, inflation and global uncertainty

- Anticipating very few high tickets value deals

Despite the challenges, the above scenarios could be reversed with easing rates. The interest rate cuts in the near future will bring some relief and certainty on the surface leading to reversal in challenges. This will likely result in more cross-borders deals with big ticket sizes.

Conclusion

India's M&A investment landscape is increasingly attractive compared to other Asian countries, drawing significant global investor interest. Key macroeconomic factors contribute to this appeal, including robust GDP growth, a buoyant capital market, and rising number of IPOs across mainstream and SME sectors. Additionally, the surge in retail consumption and a growing focus on technology and healthcare bolster prospects for substantial growth in these areas, whether through M&A or organic means. The growth narrative for India is expected to span over the next decade, with companies possessing strong competitive advantages poised to thrive through organic growth, joint ventures, buyouts or M&A activities.