SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (68)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (24)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (33)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (17)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (14)

- Trade (5)

Policy & Regulatory Renaissance: How Strategic Reforms Are Redefining India’s Investment Landscape

India is witnessing a bold transformation in its investment arena. A series of strategic reforms initiated by the government ─ from simplified tax policies to unification of labour laws on the one hand and relaxed FDI norms and fast-track digital regulatory processes on the other ─ are tearing down barriers and leading to investor-friendly development. This means more speed, less cost, and easy approvals. All of these have made it easier for both local and global businesses to invest and grow. This renaissance in policy and regulatory affairs is modernising the framework of India, but, more importantly, it is redefining how investments facilitate sustainable growth, building momentum toward a vibrant emerging market in competition with the best.

Export growth – A record-breaking trajectory

Recent fiscal reports indicate that India’s exports have surged to Rs. 67,20,621 crore (US$ 778.21) billion in FY24 ─ the highest-ever recorded for any period ─ with a 67% jump vis-à-vis Rs. 40,26,275 crore (US$ 466.22 billion) in FY14. This growth, which is bolstered by excellent performances in exports of merchandise Rs. 37,49,006 crore (US$ 437.10 billion) and services Rs. 29,45,825 crore (US$ 341.11 billion) reflects India's growing role in international trade. Vital industries like electronics, pharmaceuticals, and engineering goods have contributed to the positive performance, aided by targeted policy interventions and increased market access. This has not just happened by chance; it is a result of deliberate reforms directed towards simplifying export processes and minimising trade friction.

The Union Budget 2025-26 goes a few steps further by identifying exports as the fourth engine for growth, with a target of Rs. 1,72,72,000 crore (US$ 2 trillion) by 2030. The vision laid down not only strengthens India's view for exports but also shows the clear intention of the government to become a facilitator for global market opportunities via digital trade finance and capacity-building measures.

Transformative tax reforms – The GST effect

The introduction of the Unified Goods and Services Tax (GST) in 2017, has been one of the significant structural changes. Prior to the introduction of GST, India's tax system consisted of several cascading taxes, which added to a higher compliance burden and inefficiencies. However, GST in India simplified the entire structure, reduced the burden on companies, and improved transparency. This reform is crucial to minimising operational costs so that companies now direct resources towards innovation and growth.

Labour law consolidation – Balancing flexibility and worker welfare

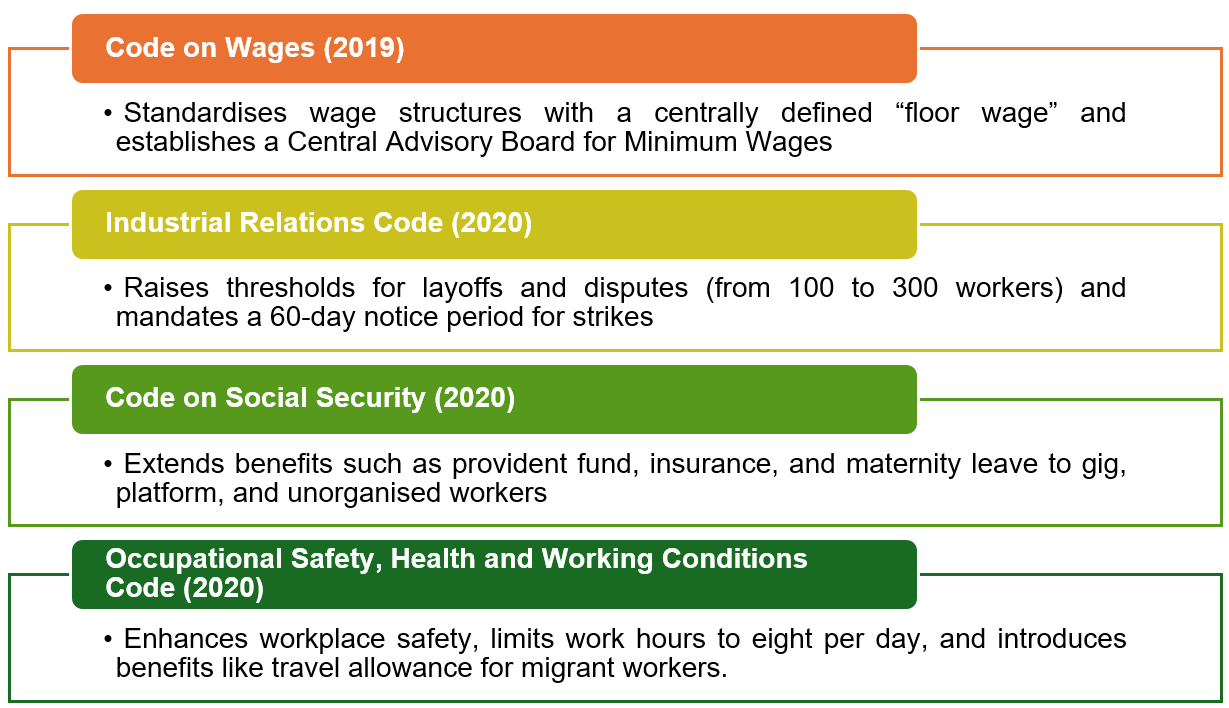

Four new labour laws replaced 29 previous laws, streamlining over 40 central and 100 state labour laws into a unified framework.

Key labour laws enacted:

The Ministry of Labour and Employment stated that this has not only made compliance simpler but also ensured that there is a more balanced review supportive of business efficiency and employee welfare. Businesses are now able to plan well for long-term investments and growth. A leaner regulatory system establishes an increasingly attractive environment for domestic as well as foreign investments in India.

Liberalised FDI policies

India has added yet another milestone to its economic journey as gross foreign direct investment (FDI) inflows from April 2000 to February 2025 reached Rs. 86,36,000 crore (US$ 1 trillion). For H1 FY25, this landmark achievement turned into FDI inflow-reach of Rs. 3,63,575 crore (US$ 42.1 billion), which is almost 26% more compared to FY24. It indicates that India's transformation into one of the most-favourable global investment arenas has continued from enhancing an increasingly proactive policy framework and dynamic business environment, as well as rising international competitiveness.

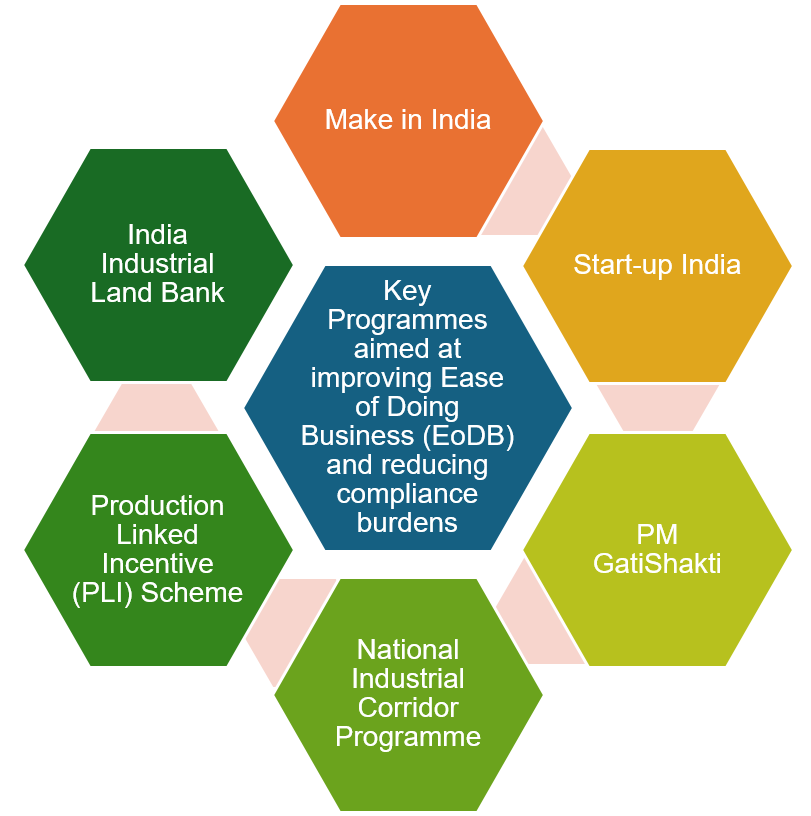

The Government of India has implemented multiple policies to attract foreign investments and boost industrial activity through initiatives led by the Department for Promotion of Industry and Internal Trade (DPIIT) and other ministries.

Key programmes include:

100% FDI under automatic route:

India permits full foreign direct investment in several sectors without prior approval by the government; 90% of FDI inflows are automatically processed.

Expedited investment procedures:

Project Development Cells (PDCs) in government ministries help fast-track investment proposals and facilitate quicker decision-making.

Liberalised and simplified policies:

FDI limits have been liberalised and regulatory barriers removed, while infrastructure improvements support smoother business operations.

Streamlined compliance environment:

Over 42,000 compliances have been reduced, and 3,800 provisions decriminalised through initiatives like the Jan Vishwas (Amendment of Provisions) Act, 2023, enhancing ease of doing business.

Enhanced global competitiveness:

India’s Ease of Doing Business ranking improved significantly from 142 in 2014 to 63 in 2019.

Integrated approval system:

The National Single Window System (NSWS) consolidates regulatory approvals from 32 Central Ministries/Departments and 28 State/UT systems, offering access to 277 central and 2,977 state-level approvals, increasing transparency and accountability for investors.

Digital transformation of regulatory processes

Digital initiatives form yet another cornerstone of India’s reform agenda. Platforms such as UMANG and various e-licensing portals have revolutionised government approvals by cutting down clearance times and reducing operational delays. By migrating key processes to online formats, India is paving the way to a paperless, efficient ecosystem benefiting start-ups and large corporate entities alike. Regulating online procedures through digitisation enhances transparency, reduces corruption risks, and instils confidence in international investors.

Robust infrastructure investments – Driving down costs

Infrastructure is the backbone of every economy, and India is significantly investing in this sector. The Union Budget 2025-26 allocated Rs. 11.21 lakh crore (~US$ 130 billion) for fast tracking infrastructure development in India, in line with the government's vision of a "Viksit Bharat" by 2047. Already, massive government capital expenditure on roads, ports, and digital networks has lowered logistical costs. The Delhi-Mumbai Industrial Corridor (DMIC) and other such industrial projects are cutting down the transit time between manufacturing clusters and major export hubs, making investments instrumental in overcoming "last-mile" challenges that have historically troubled export competitiveness.

Stable fiscal management – A pillar of investor confidence

The reforms in fiscal management and financial regulations have paved the way for achieving the long-term equipotentiality of the financial sector. Even when the global environment is uncertain, the Reserve Bank of India’s policies have ensured that the country continues to enjoy good credit ratings. Fiscal discipline and regulatory interventions for the resolution of bad loans under the Insolvency and Bankruptcy Code strengthen the resilience of the financial sector to domestic shocks. It creates a nurturing environment for investors (local and offshore), which can be utilised fruitfully for the deployment of capital.

Sector-specific initiatives – Catalysing export competitiveness

The government’s commitment to export-led growth is further underscored by several targeted initiatives:

- Export Promotion Mission: Aims to enhance global trade by providing MSMEs with the tools and platforms needed to operate internationally.

- Bharat Trade Net (BTN): As part of India Stack 2.0, BTN digitises international trade by integrating systems like Customs, DGFT, GSTN, and banking services, thereby creating a seamless and paperless trade ecosystem.

- Production Linked Incentive Scheme (PLI) and PM GatiShakti National Master Plan: These schemes focus on modernising infrastructure and boosting manufacturing and services, which directly contribute to increased export capacity.

Navigating challenges in the investment ecosystem

Trade exports continue to grow about 6% yearly. Yet, there are issues like accessibility of traditional trade finance, lack of adequate credit data for exporters, and occasional regulatory bottlenecks. Besides, the overall investment rate in India, in terms of percentage of GDP, is rather low in comparison with a few other Asian countries. However, the government is attempting to fill the contours by being proactive in its approaches to digital trade finance, capacity building for MSMEs, and continuous regulatory reform. This combined approach will ensure that the export ecosystem thrives in a competitive and sustainable manner in the long run.

Outlook – The ‘Amrit Kaal’ vision

Looking ahead, the government’s long-term vision—embodied in the concept of ‘Amrit Kaal’—aims to transform India into a developed nation by 2047. This vision is supported by several forward-looking initiatives:

- Extended incentives for start-ups: Proposals include extending the period of incorporation benefits and providing tax certainty measures to spur innovation in the electronics manufacturing sector.

- Modernisation of financial services: By offering tax certainty for Alternate Investment Funds (AIFs) and extending investment windows for sovereign and pension funds, the government is setting the stage for steady capital inflows into infrastructure and other critical sectors.

- Regulatory reforms: The anticipated Jan Vishwas 2.0 bill, along with the establishment of a High-Level Committee for Regulatory Reforms, is expected to further streamline inspections, reduce litigation, and enhance overall ease of doing business.

These initiatives not only aim to attract increased FDI but also to create a more resilient, competitive, and transparent investment environment. The strategy is clear—build a robust policy framework that supports both immediate growth and long-term sustainability.