SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (14)

- Trade (5)

Charging Ahead: The Evolution of Electric Vehicle Infrastructure in India

- May 22, 2024, 15:30

- Automobiles

- IBEF

Here is all about India's electric vehicle (EV) market, analysing its recent surge in sales, growth rates and shifting consumer preferences. It highlights the progress in establishing EV charging infrastructure, government initiatives such as the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) India Scheme and ambitious EV sales penetration targets for 2030. Additionally, it addresses challenges and opportunities in battery recycling, providing an overview of India's electric mobility infrastructure landscape.

Accelerating electric vehicle revolution in India

India experienced a substantial rise in EV sales in 2023, with the total volume reaching 1.62 million units (~+50% YoY), up from 1.09 million units in 2022, signalling a robust growth trajectory in EV adoption. This surge has significantly increased EVs' overall market share in India's automotive sales, which increased to 6.38% in 2023 from just 1.75% in 2021. This upward trend mirrors a growing consumer preference for EVs over the span of two years.

Further analysis of category-wise data reveals differentiated growth rates across segments. Two-wheelers and three-wheelers saw YoY growth of 35% and 64% from 2022, respectively. Meanwhile, the car/SUV segment witnessed a notable surge of 117%. These figures underscore a strong and expanding momentum towards electric mobility in India, highlighting a marked shift in consumer preferences and indicating a promising future for the EV market in the region.

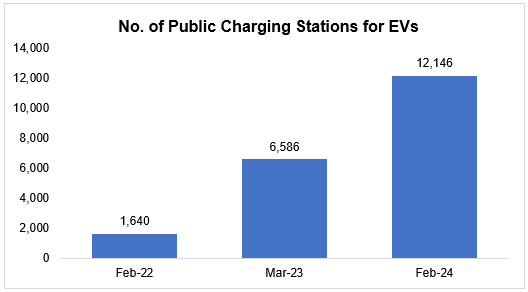

By 2030, the Indian government has set ambitious targets for EV sales penetration: 30% for private cars, 70% for commercial vehicles and 80% for two- and three-wheelers. As India propels towards its ambitious EV sales targets for 2030, the surge in public charging stations emerges as a pivotal catalyst. Furthermore, the government's unwavering support and rising consumer adoption are driving the rapid establishment of EV infrastructure.

Energising India's electric future: Charging stations, battery recycling and innovative solutions

EV public charging station

As of February 13, 2024, India has established 12,146 operational public charging stations, with Maharashtra and Delhi leading the count by 3,079 and 1,886 stations, respectively. This represents a remarkable growth of around 640% in the past two years, reflecting a rapidly expanding market. The surge in EV charging facilities can be attributed to heightened government support and an increase in EV adoption among consumers. The momentum is expected to continue, paving the way for exponential growth in the sector as it responds to evolving policies and the shifting preferences of environmentally conscious drivers.

Source: Press Information Bureau

As of September 2023, the ratio of EVs to charging points was 1:188, a figure substantially below the global average of 6 to 20 EVs per public charger. According to recent government projections, the top nine Indian cities, each with a population exceeding 4 million, would require 18,000 public EV charging stations by 2030 to accommodate this growth. The Confederation of Indian Industry has released a report titled ‘Changing Infrastructure for Electric Vehicles,’ which indicates that India may need at least 1.32 million charging stations by the end of 2030 to satisfy the burgeoning demand for EVs. Furthermore, the report projects that approximately 106 million EVs would be sold annually by 2030. To adequately meet this demand, it is estimated that India would require a minimum of one charger for every 40 EVs, translating into a need for over 4,00,000 charging stations annually. This data underscores the critical need for a rapid expansion of the EV charging infrastructure to support India's ambitious electric mobility goals.

EV battery recycling and reusing

India's battery recycling market, particularly for lithium-ion batteries (LIBs), is in its nascent stage, with a limited number of organised entities managing LIB waste. However, as per a report by NITI Aayog, by 2025, the battery recycling sector in India is anticipated to see significant attractiveness. Traditionally, LIB waste from consumer electronics has predominantly fuelled the recycling industry's input streams. Nonetheless, the landscape is shifting due to the increasing endorsement and adoption of EVs, alongside rising demand for LIBs spurred by applications in grid storage, such as utility-scale storage systems, telecom towers and home power backup solutions. Furthermore, the report highlighted that India's annual LIB demand in 2020 stood at approximately 5.2 GWh, with the projection that these batteries would reach their end-of-life (EOL) by 2030 or earlier. This would translate to an annual LIB waste generation of around 43,000 tons based on an average energy density of 120 Wh/kg.

The majority of these EOL batteries are expected to originate from the EV sector, offering the recycling industry an organised method of collection and transportation by original equipment manufacturers to recycling facilities. According to the same report, the estimated cumulative demand for LIBs in India from 2022 to 2030 across segments is projected to be about 600 GWh (base case), with the recycling volume from these deployed batteries expected to reach 128 GWh by 2030, nearly 59 GWh of which would likely come from the EV segment alone. To accommodate this influx, India's lithium battery recycling capacity must expand by approximately 60-fold over the next seven years from its capacity of 2 GWh, as reported by the Times of India in 2023.

Another critical component of the battery supply chain is the reuse of batteries, which offers the potential to extend their lifecycle through refurbishment for the same or different applications. EV batteries present a substantial opportunity for reuse, with studies indicating that an EV battery may retain about 70–80% of its initial capacity upon retirement. Such batteries could enjoy an extended second life of 10–15 years in alternate applications. In the context of India, where two- and three-wheelers dominate the EV market, the expected second life of these batteries is likely to be on the lower side, ranging from two to three years compared to six years for four-wheeler batteries.

Globally, the total recycling capacity exceeded 100,000 tons per year in 2020. Despite the current recycling capacity in India being less than 2,000 tons per year, it is projected to reach 30,000 tons per year in the next 1–2 years. Domestic firms such as Attero, Exigo and Tata Chemicals are poised to spearhead the advancement of India's LIB recycling industry.

EV battery swapping

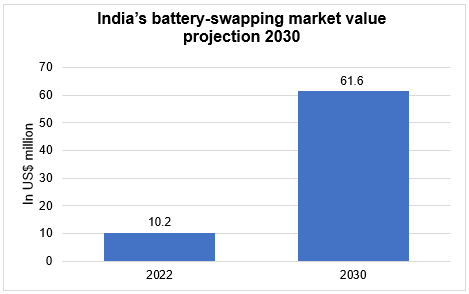

Battery swapping offers a convenient solution for recharging EV batteries by exchanging depleted batteries for fully charged ones at designated swapping stations within a network operated by a battery swapping operator. This method is particularly suitable for electric two- and three-wheelers due to their significantly shorter duration compared to traditional charging stations.

This innovative approach addresses key challenges hindering EV adoption, such as range anxiety, high upfront costs and long wait times, transforming the future of electric mobility. According to the Trade Promotion Council of India, the EV battery-swapping sector in India is experiencing rapid growth, valued at approximately US$ 10.2 million in 2022, with projections indicating it could reach around US$ 61.57 million by 2030, growing by a compound annual growth rate of 25.20%. This growth is attributed to the advantages of reduced initial expenses for EVs and the elimination of charging wait times.

A draft policy document released by NITI Aayog on battery swapping aims to promote swapping batteries with advanced chemistry cell batteries. The core objective is to decouple battery costs from upfront EV purchase costs, accelerating EV adoption and aligning with the nation's climate change objectives for 2030. Implementing this policy swiftly could contribute to achieving the desired acceptance of EVs.

Source: Trade Promotion Council of India

Government Initiatives

FAME India Scheme

Phase I: The Ministry of Heavy Industries introduced the FAME India Scheme in 2015, encouraging the uptake of electric and hybrid vehicles in India. The scheme's first phase, which concluded on March 31, 2019, was allocated a budget of US$ 107.8 million (Rs. 895 crores). During this initial phase, a total of 427 charging stations were established.

Phase II: The government has extended the FAME India Scheme for five years starting from April 1, 2019, allocating a budget of US$ 1.2 billion (Rs. 10,000 crores) to support EV adoption. This phase of the scheme offers incentives to EV purchasers through an upfront reduction in vehicle costs. Additionally, the Ministry of Heavy Industries has approved the establishment of 2,877 EV charging stations across 68 cities in 25 states/UTs, and 1,576 stations along 9 expressways and 16 highways. A further investment of US$ 96.4 million (Rs. 800 crores) has been sanctioned as a capital subsidy for three oil marketing companies under the Ministry of Petroleum and Natural Gas for setting up 7,432 public EV charging stations.

A notification dated November 7, 2023, outlined a directive for indigenising EV charger components, setting a deadline for manufacturers to achieve at least 50% domestic value addition by December 1, 2024. Under the FAME II scheme, this policy targets the enhancement of local manufacturing of essential charger components, including enclosures, software for charge point operators and charge management systems. This effort aims to bolster the domestic EV charging infrastructure, reduce reliance on imports, promote local industry growth and address consumer concerns over the scarcity of charging options, thereby facilitating wider EV adoption.

Battery Waste Management Rules 2022:

The Battery Waste Management Rules, 2022, issued by the Ministry of Environment, Forest and Climate Change on August 24, 2022, aim to ensure the environmentally sound management of various types of batteries, including EVs, portable, automotive and industrial batteries. These rules operate under the framework of extended producer responsibility (EPR), where battery producers, including importers, are accountable for collecting and recycling/refurbishing waste batteries and utilising recovered materials in new batteries. EPR mandates the collection, recycling and refurbishment of all waste batteries, prohibiting landfill disposal and incineration. Producers may fulfil their EPR obligations by directly engaging in or authorising other entities to collect, recycle or refurbish waste batteries. The rules facilitate the establishment of a centralised online portal for exchanging EPR certificates between producers and recyclers/refurbishers to meet producer obligations. They encourage the establishment of new industries and entrepreneurial ventures in battery waste collection and recycling/refurbishment. Setting minimum material recovery percentages from waste batteries would stimulate the adoption of new technologies and investments in the recycling and refurbishment industry, creating new business prospects. Mandatory phased targets are established to increase the use of recycled materials in new battery products, aiming for a 20% utilisation rate by 2030–31.

Conclusion

In conclusion, India's EV landscape is poised for a transformative future, marked by robust growth in EV sales, ambitious government targets and strategic initiatives. The surge in the number of public charging stations, as shown by a 640% increase in the past two years, underscores the nation's commitment to supporting EV adoption. Concurrently, innovative solutions such as battery swapping are gaining traction, which offer swift and cost-effective recharging options. With focused efforts on battery recycling, India aims to manage the EOL phase efficiently, further reinforcing sustainability. The convergence of these elements signifies a dynamic and sustainable EV infrastructure that aligns with India's ambitious electric mobility goals.