SEARCH

RECENT POSTS

Categories

- Agriculture (33)

- Automobiles (19)

- Banking and Financial services (35)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (57)

- Textiles (8)

- Tourism (14)

- Trade (5)

Decoding the Rise of the Pet Care Industry in India: A New Consumer Growth Story

- Sep 12, 2025, 16:45

- Consumer Markets

- IBEF

The Indian economic shifts, along with changes in societal norms, have transformed the last few years in the pet care industry. Pets are not just treated as animals anymore. They are integral members of the family and are provided for at the same level, if not more than humans. This has resulted in a surge of supply for pet care services and products and now India stands as a lucrative market for pet business investments. For years, pets have been an integral part of Indian households. However, the shift from humble companions to beloved family members is remarkable. This change is evident from the increasing willingness of households to spend money on their pets. With the rapidly changing pace of urban life, stress relief, emotional support and companionship is often sought after, and pets help fulfil that role.

Market growth and trends

In light of the current projections, the value of pet care industry in India is Rs. 30,434 crore (US$ 3.6 billion) in CY24 and poised to increase to Rs. 2,10,000 crore (US$ 24.8 billion) by CY32, which is multiplying due to accelerated urbanization and health concerns pertaining to pets. The estimated growth rate is remarkable 20% within the next years. This is driven by increased consumer spending on quality pet food, personal grooming, and veterinary services, reflecting a growing trend of viewing pets as family members.

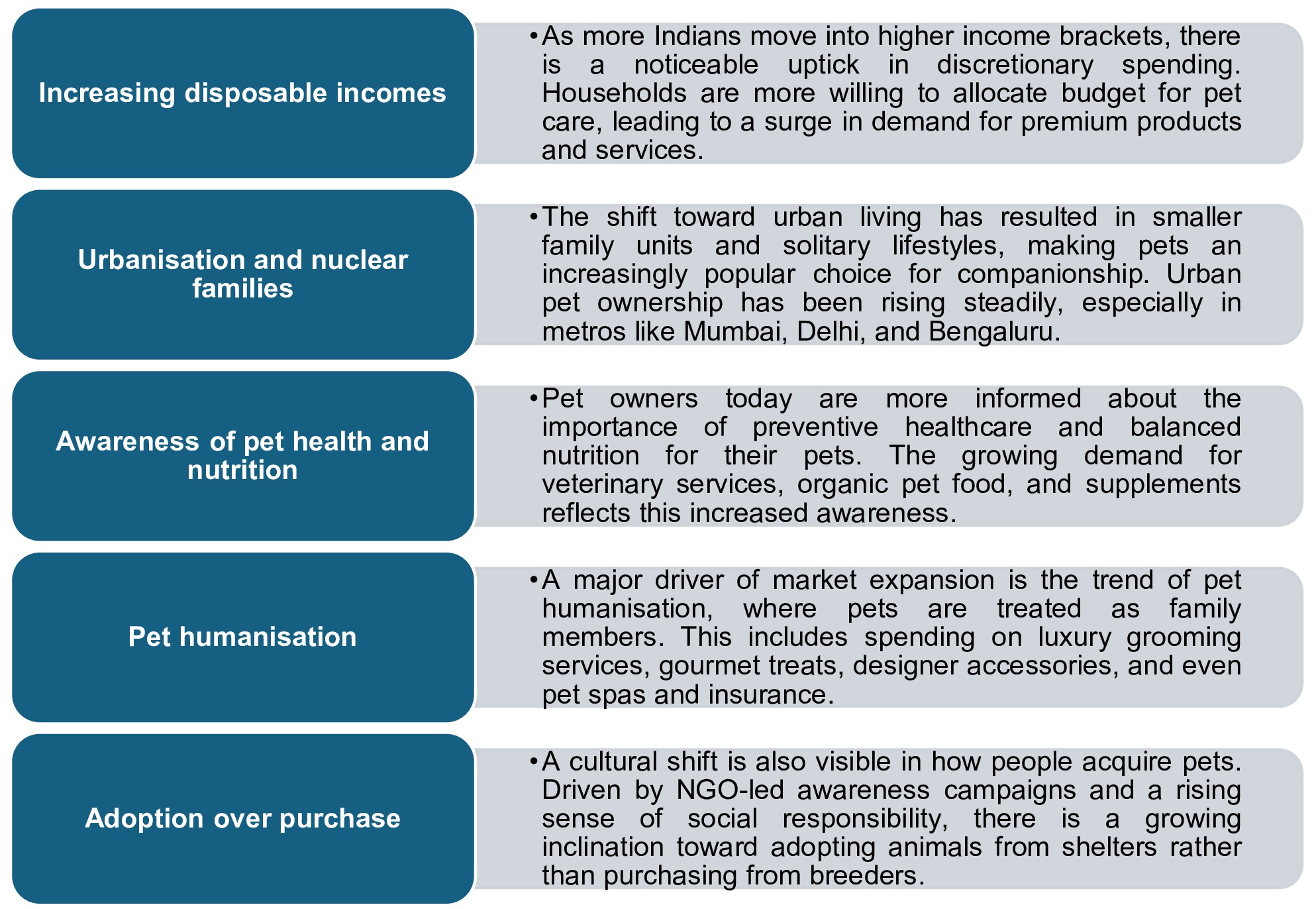

Key drivers of growth

Segments of the pet care market

Pet food

The pet food segment is the largest contributor to the industry, valued at Rs. 4,000 crore (US$ 466.3 million) as of CY24, making up nearly 80% of the total pet care market. According to Euromonitor, India’s pet food market is expected to reach Rs. 10,000 crore (US$ 1.2 billion) by CY28. The shift from homemade meals to commercial pet food is driven by the growing awareness of nutritional needs, convenience, and exposure to global trends.

Categories seeing high demand include:

- Grain-free and organic food

- Breed-specific and age-specific nutrition

- Hypoallergenic and therapeutic diets

Multinational and domestic players like Mars Petcare (Pedigree, Royal Canin), Drools, Farmina, and Purepet are expanding their footprint through online and offline distribution.

Pet health care: Veterinary services and products

The pet healthcare segment, valued at over Rs. 700 crore (US$ 82.8 million) is one of the fastest-growing sub-segments. India has ~4,000–5,000 practicing veterinarians, mostly concentrated in urban and semi-urban areas. However, there is still a shortage compared to growing demand. With platforms like Pawxie and Vetic, telemedicine and vet-at-home services are becoming popular, especially post-COVID-19.

The demand for preventive care is driven by:

- Increased vaccination rates among urban pets

- Greater awareness of dental hygiene, deworming, and neutering

Pet insurance is emerging, with brands like Future Generali, Digit, and Bajaj Allianz introducing tailored policies. As of CY23, less than 1% of Indian pets are insured, indicating significant headroom for growth.

Pet accessories: Trends and innovations

The pet accessories market, including toys, grooming kits, apparel, leashes, beds, and smart devices, is estimated to be worth Rs. 500 crore (US$ 59.1 million) in CY24 and growing at 15–18% CAGR.

Key drivers include pet humanisation and lifestyle upgrades.

- Smart products gaining traction:

- GPS-enabled collars (e.g., FitBark, Tractive)

- Automatic feeders and interactive toys

- Smart bowls that monitor food intake

Designer wear for pets is now available from niche Indian brands and platforms like Heads Up For Tails (HUFT), Supertails, and Wagr. Supplements, treats, grooming tools, and travel gear are increasingly being bundled into subscription boxes for convenience.

Pet services: Grooming, training, and boarding

Estimated at Rs. 600 crore (US$ 71.0 million) as of CY24, the pet services segment is gaining strong momentum in India’s urban and tier-2 cities. Grooming services have become mainstream with pet salons like Flying Fur, Paw Spa, and HUFT Grooming Studios offering premium care packages.

The demand for training services has grown 3x in the last five years, especially among first-time pet owners, with a focus on social behaviour, obedience, and therapy training. Additionally, luxury boarding facilities are on the rise—pet resorts now offer air-conditioned suites, webcams, swimming pools, and custom diets. According to industry surveys, over 60% of urban pet owners look for professional boarding when traveling, preferring facilities with medical supervision and social interaction programs.

Influence of E-commerce and technology

Growth of online pet care retail

The growth of pet care services and products can be attributed to e-commerce features. Pet owners can conveniently shop through online portals offering an extensive selection of products and services from the comfort of their homes. In addition, e-commerce expansion is associated with increased competition, which reduces prices while improving product availability. Emergent retail channels including e-commerce, Omni channel initiatives, and hyperlocals like Instamart and Zepto have significantly increased organisational reach.

Role of social media in pet care marketing

Marketers in the pet care sector have embraced Instagram and Facebook to reach a broader audience. Pet owners are increasingly using social media to share and endorse distinctive experiences. Businesses are leveraging social media marketing to engage with consumers, fostering brand loyalty while promoting their products and services.

Innovative pet care apps and services

Many pet care apps and services have been founded, such as apps that help in tracking the pet’s health, scheduling doctor’s appointments for pets, or even booking pet-friendly lodgings. The adoption of technology in pet care services is expected to grow owing to the consumer demand for convenience and effectiveness.

The pet care industry is undergoing structural spending changes because of shifting consumer perceptions, increased disposable income, and a heightened status of pets as prominent family members. Additional important trends include pet humanisation, the expansion of e-commerce, and increasing focus on sustainability. While the market is challenged by regulatory ambiguity and supply chain ineffectiveness, it also provides veterans and newcomers with innovative avenues to capture market share.

Looking ahead, the pet care in India appears highly promising with sustained growth projected over the next 5–10 years. As pet owners become more informed and emotionally invested, their willingness to spend on premium, health-focused, and tech-enabled offerings will rise. Businesses that can effectively adapt to evolving consumer preferences, embrace digital transformation, and navigate regulatory complexities will be best positioned to thrive in this rapidly maturing market.