SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (68)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (17)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (14)

- Trade (5)

India’s Music Industry Today: Streaming High, Growing Fast

- Dec 08, 2025, 15:05

- Media and Entertainment

- IBEF

The Music industry in India is witnessing unprecedented growth, fuelled by the rapid adoption of Digital music in India. Spotify and other platforms have changed the game by providing clear royalty structures, artist educational programs, and worldwide exposure. Spotify has also made a big impact in promoting local artists, with international streams of Indian artists increasing by over 2,000% between 2019 and 2023. In 2024 alone, Indian artists were heard 11.2 billion times by new listeners, and royalty payments have increased more than twice since 2022. Nearly two-thirds of royalties generated in India now come from local artists, showing the rising influence of Music streaming in India both domestically and abroad. India is the second biggest streaming market in the world and is estimated to have 471 billion streams by December 2025, 78% of which are expected to be domestic Indian music.

The emergence of global players is another factor that facilitates this digital shift. YouTube remains the most popular, with 462 million users, whereas Spotify has the most paid subscribers (3 million). Apple Music has increased its coverage with telecom alliances. Collectively, these platforms are transforming the Indian music industry and offering possibilities of monetisation, internationalisation, and sustainability.

Dominance of digital: Rise of streaming platforms

India recorded 1.03 trillion on-demand streams in 2023, making it the second-largest market by volume after the US. However, monetisation has yet to catch up, with the industry valued at about Rs. 2,798 crore (US$ 319 million) in 2022 and expected to reach Rs. 5,439 crore (US$ 620 million) in 2024, still a fraction of Western revenues despite comparable consumption levels. The presence of global platforms has raised the bar, forcing local services to adapt to tougher economics while accelerating the overall growth of Digital music in India.

Market size and growth outlook

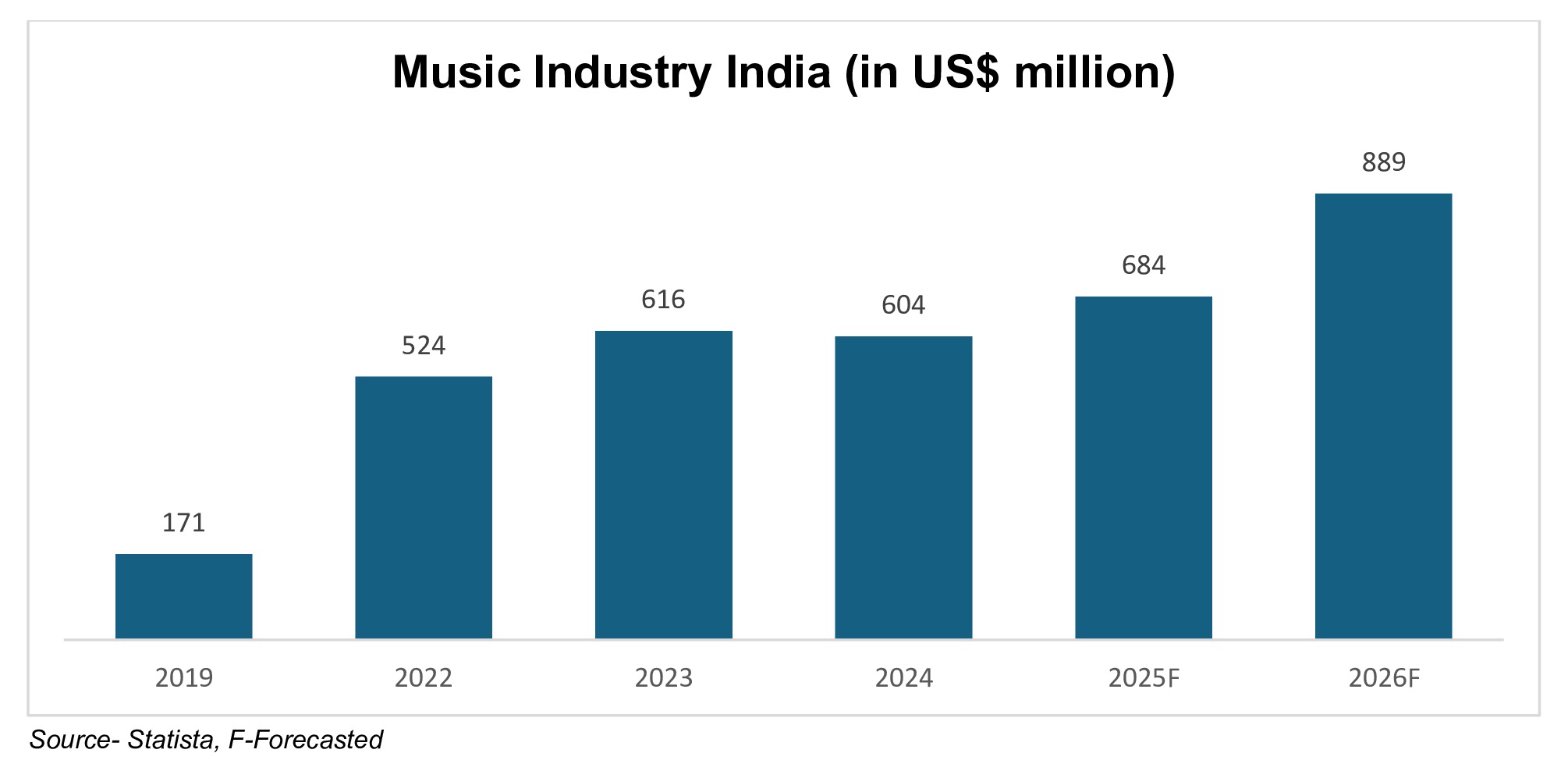

The Indian music industry is expanding at a fast rate, due to digitalization and changing consumer behaviour. It is expected to be around Rs. 6,000 crore (US$ 683.99 million) in 2025 and is likely to go up to Rs. 7,800 crore (US$ 889 million) by 2026 with a compound annual growth rate of 13.4%. The informal music industry in India was estimated to be worth Rs. 10,00,000 crore (US$ 114 billion) in 2022, consisting of local bands, street musicians, and independent artists. However, despite this growth, India is not included in the top global revenue charts due to lower monetisation per user than Western and Chinese markets.

Revenue breakdown and monetisation models

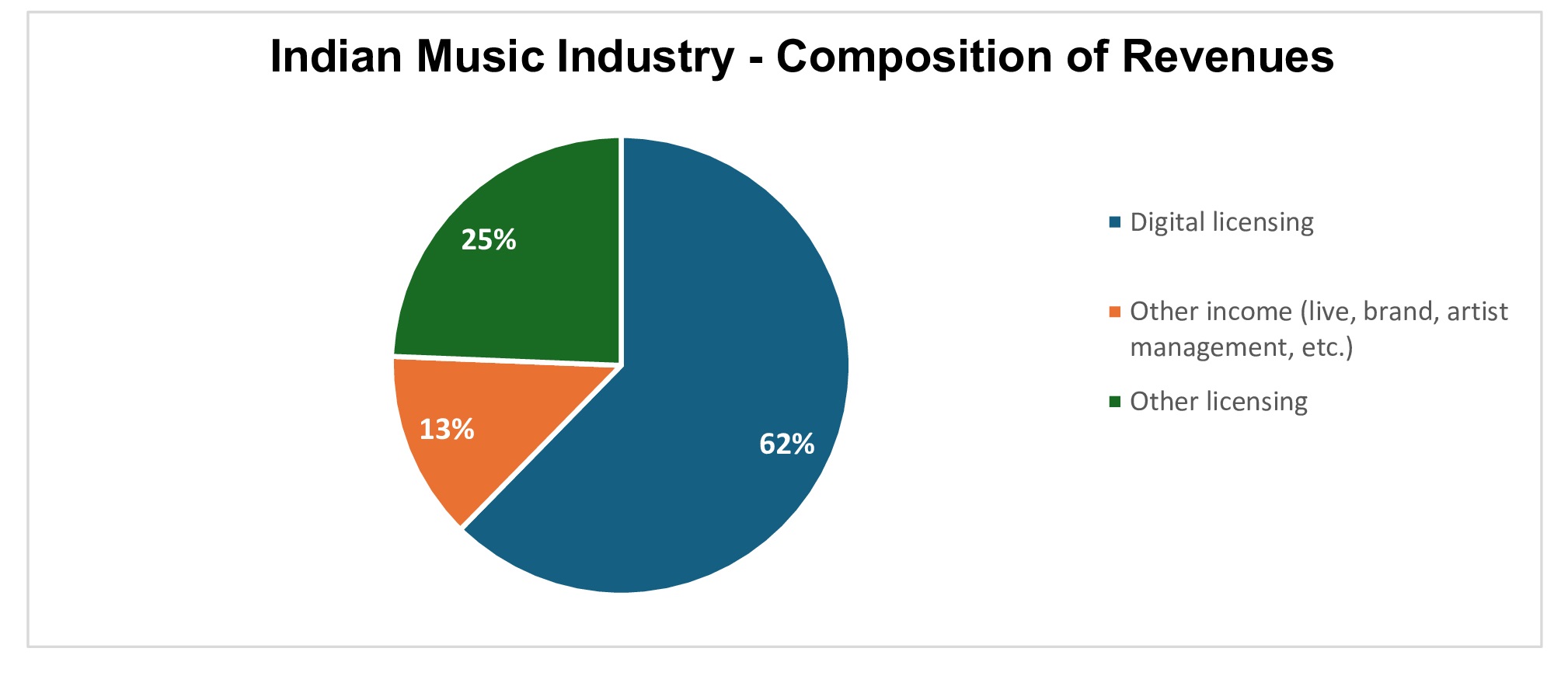

The Music industry in India still depends on digital licensing, which contributed 62% of revenues in 2024, down from 68% in 2023, because of platform shutdowns, declining per-stream rates, and the difficulty in converting free users to paid subscribers. Other licensing revenues, such as publishing rights, sync, and physical sales, were flat at 25% with sync contributing 3% due to the stagnant radio and TV markets. Live events, artist management, and brand partnerships grew robustly, and other income increased to 13% of total revenues.

Performance Royalties have become a silver lining with the IPRS reporting Rs. 700 crore (US$ 80 million) in 2024-25, an increase of 42% over the previous year. This increase is due to streaming revenues on international platforms such as Spotify, Apple Music, and YouTube and reflects the growing consciousness of intellectual property and fair compensation of creative work, despite low premium subscription rates in India.

What’s powering India’s music boom

Key growth drivers shaping the music industry in India include:

- Shift towards artist-led music

Artist-driven music and regional music are increasing, with South Indian and vernacular markets providing new centres of revenue and lessening the dependence on film soundtracks.

- Expansion of monetisation avenues

In addition to streaming, monetisation channels now include concerts, fan clubs, live shows, branded collaborations, and merchandise, enabling artists with a broader range of opportunities to engage with fans and increase profits.

- Youth-driven demand

Gen-Z and millennials are the main consumers with their playlists, short-form content, and on-demand streaming, driving the industry and defining trends.

- Subscription potential and global reach

India has 550 million YouTube users, 40% of whom listen to audio, and has untapped paid subscription potential, and almost half of royalties already originate internationally.

Collectively, these drivers contribute to 30-50% growth annually, and India is one of the most promising music markets across the globe.

Changing consumption patterns

The music industry in India is witnessing a massive change because of a mobile-first audience and a digitally savvy consumer base. The Gen-Z listeners who make up a big portion of music consumption are turning to more Artificial Intelligence (AI)-driven streaming suggestions that personalise their experiences. A Spotify report indicates music is a part of their everyday lives, with the most active listening times being 8-10 a.m. during weekdays and 10 a.m.-12 p.m. on weekends, including travelling, exercising, and socialising.

In the meantime, regional music is becoming a powerful trend, as Gaana claimed a 96% increase in streams of local languages, including a 112% increase in Tamil, Telugu, and Kannada music. This is indicative of a more fundamental cultural transformation whereby India is having its sonic diversity recognised internationally.

Bollywood, independent, and regional music

Film music remains the largest part of the Indian music industry, with Bollywood soundtracks comprising approximately 80% of total consumption and recording approximately 10,000 songs each year. Local content is further diversified by regional cinema, Tollywood (Telugu), Kollywood (Tamil), and Sandalwood (Kannada), which also contributes to the strong cultural preference for playback music. Independent artists and performing arts companies are gaining momentum, with the sector projected to grow rapidly due to digital platforms and post-COVID recovery, indicating an increased interest in non-film and vernacular music and mainstream Bollywood content.

Investment opportunities

The Indian music industry presents a large volume of investment opportunities in regional content platforms, artist management, technology integration, and performance IP. Music is the foundation of storytelling, branding, and audience engagement, with more than 200 million active content creators producing millions of pieces each month. However, the current licensing systems and rights fragmentation leave most of this market unmonetized, costing the industry Rs. 8,000-10,000 crore (US$ 912-1,140 million) per year.

The new solutions, such as micro-licensing, AI-based licensing platforms, and legal music integration, can open new revenue streams to artists and investors, professionalise the ecosystem, and make India a global centre of music-tech and digital content monetisation.

Charting the future of India’s music industry

The Indian music industry is undergoing a revolutionary period, driven by Digital Music India, streaming, and local and independent musicians. High consumer demand, mobile-first audience, and technology integration are generating a variety of monetisation opportunities in terms of subscriptions, live events, and licensing. As the creator economy grows and the world takes note of its presence, India is becoming a major destination for investment, innovation, and sustainable growth, making the country a major hub in the global music industry.

FAQs

What is driving growth in Digital music in India?

Rapid streaming adoption, mobile-first consumption, and the rise of regional and independent artists are key growth drivers.

How is Music streaming in India reshaping the industry?

Platforms like Spotify and YouTube enable global reach, transparent royalties, and artist monetisation, boosting both local and international consumption.

What are the main revenue sources in the Music industry in India?

Digital licensing, performance royalties, live events, branded collaborations, and subscriptions contribute most to revenues.

Why are regional and independent artists important?

They diversify content, fuel consumer engagement, and expand monetisation beyond Bollywood-driven soundtracks.

What investment opportunities exist in Digital music in India?

Regional platforms, micro-licensing, AI/AR/VR integration, and artist rights management present high-growth potential.