SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (14)

- Trade (5)

India’s Private Spacetech Boom: A New Era Unfolds

- Sep 05, 2025, 16:15

- Research and Development

- IBEF

India's space journey, once synonymous with state-led innovation, has now entered a new chapter marked by private sector dynamism. From testing a satellite on a bullock cart to becoming a serious contender in the global space economy, the evolution of India’s space missions has been nothing short of remarkable. And today, a new wave of startups, investments and policies is driving a massive transformation in the sector. This is not just a technological shift—it is a structural and economic revolution.

A space legacy now opening up

For over 50 years, ISRO led India’s space programme with a largely state-run model, relying on MSMEs as suppliers but limiting private sector involvement. This changed in June 2020 with the launch of IN-SPACe, an autonomous body under the Department of Space that facilitates private participation across the space value chain. IN-SPACe handles authorisation, infrastructure sharing, and offers support to non-government entities. As of March 2025, it had received over 658 applications in areas like satellite development and deep space exploration, with more than 1,200 startups and 6,400 users registered on its digital platform.

The rise of the private sector

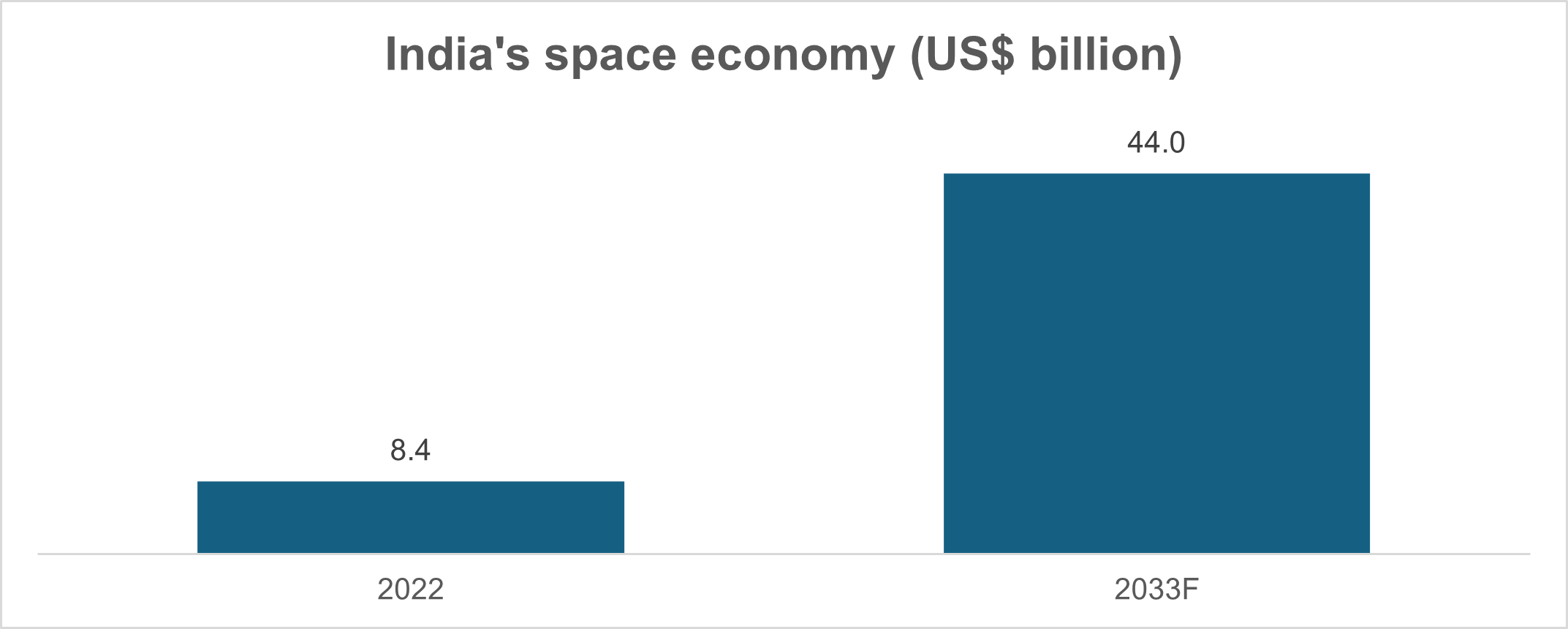

Privatisation of space is not a mere policy update—it is a strategic imperative. India’s space economy was valued at US$ 8.4 billion as of 2022, just 2% of the Rs. 37,53,200 crore (US$ 440 billion) global pie. But projections estimate this figure will grow fivefold to Rs. 3,75,320 crore (US$ 44 billion) by 2033, capturing 8-10% of the global share.

Source: Press Information Bureau, F- Forecasted

The Indian spacetech market is expected to record a compound annual growth rate (CAGR) of 26% from 2023 to 2030. This push is underpinned by:

- Private capital and innovation: Over 200 spacetech startups have emerged since 2020. These startups, including Pixxel, Dhruva Space and Skyroot, are now building launch vehicles, developing Earth observation satellites and offering real-time space-data analytics.

- Global investor interest: Alphabet Inc.’s Rs. 307.08 crore (US$ 36 million) investment in Pixxel underlines the growing faith in India’s spacetech startups.

- Policy momentum: The Indian Space Policy 2023 allows 100% foreign direct investment (FDI) in satellite manufacturing and lays out a clear framework for private participation.

Empowering innovation through the Rs. 1,000 crore (US$ 117.23 million) VC fund

The Indian government made a historic decision in October 2024 when it allocated a dedicated venture capital (VC) fund of Rs. 1,000 crore (US$ 117.23 million) exclusively for the space sector. Capitalising on this, the Government of India has already established a fund worth Rs. 10,000 crore (US$ 1.18 billion), led by IN-SPACe, to invest in over 40 large and small companies in the space-tech domain over the next five years, with Rs. 10 crore to Rs. 60 crore (US$ 1.17 to 7 million) being invested in each company.

The fund’s objectives include:

- Providing early-to-late-stage capital to promising space startups

- Retaining domestic talent by preventing brain drain

- Supporting India’s goal to grow its space economy by five times to Rs. 3,75,320 crore (US$ 44 billion) by 2033

- Driving job creation across engineering, software, analytics, logistics and manufacturing

- Building a globally competitive and self-reliant space ecosystem

- Strengthening India’s standing under Atmanirbhar Bharat

Depending on the growth stage of a company and its projected impact on India’s space capabilities, investment is deployed in two stages:

- Growth stage: Investments will range from Rs. 10 crore (US$ 1.17 million) to Rs. 30 crore (US$ 3.5 million), based on the startup’s development trajectory and long-term potential.

- Later growth stage: Investments will range from Rs. 30 crore (US$ 3.5 million) to Rs. 60 crore (US$ 7.0 million), supporting companies that have shown significant progress with a robust growth trajectory.

Given these funding ranges, the VC fund plans to support around 40 startups with the necessary financial foundation that will help promote growth and innovation across India’s space industry. India’s model now mirrors international best practices, taking cues from UK’s Seraphim Fund, Japan’s US$ 6.7 billion strategic fund, and Italy’s Primo Space Fund—aiming to create a robust financial backbone for space entrepreneurship. India’s VC fund fills a critical gap wherein traditional investors hesitate due to long research and development (R&D) cycles and high risk. It also ensures sustained innovation and signals the nation’s readiness to become a space superpower.

Karnataka: India’s space startup capital

With a legacy deeply rooted in aerospace and space innovation, Karnataka is cementing its position as India’s space tech powerhouse through the Draft Karnataka Space Technology Policy 2024–29. The state envisions capturing 50% of India’s national space market and 5% of the global space economy. To reach this, it will invite investments of Rs. 25,590 crore (US$ 3 billion), create a space producing cluster and assist over 500 startups and MSMEs with funding, Intellectual Property (IP) help and quality certification. It also aims to train 5,000 professionals, of which 1,500 would be women. This is to create a future-ready workforce for some roles in the domestic and global space sectors. Grounded in Bengaluru’s prominence in new space startups and ISRO infrastructure, the policy is oriented towards upstream and downstream activities, commercial and defence applications, and even astronomy and astrophysics. With a vibrant ecosystem of research institutions, MSMEs and global players, Karnataka is not just building rockets—it is building the future of India’s space economy.

Tamil Nadu joins the race

In a landmark move, the Tamil Nadu government has approved the Space Industrial Policy 2025, positioning the state as a future-ready leader in India’s space economy. The policy targets investment of Rs. 10,000 crore (US$ 1.17 billion) and generation of 10,000 high-value jobs in various sectors such as manufacturing, space tech services and downstream applications. One of the main pillars will involve the establishment of dedicated ‘Space Bays’ in Madurai, Thoothukudi, Tirunelveli and Virudhunagar — industrial clusters to be customised to accommodate first-generation startups as well as major companies across the space-tech value chain. Incentives such as expeditious approvals and capital subsidies, as well as proximity to ISRO’s launchpad and propulsion facilities at Kulasekarapattinam, Tamil Nadu is setting the stage for global-scale innovation. Industry giants such as LMW, L&T, Agnikul Cosmos and GalaxEye already anchor this growing ecosystem, reinforcing the state's strategy to become a high-tech aerospace and satellite manufacturing hub.

Startups taking bold leaps in space

While all Indian startups experienced a 20% increase in total startup funding, which jumped to Rs. 1,02,360 crore (US$ 12 billion) in 2024 from Rs. 85,300 crore (US$ 10 billion) in the previous year, spacetech startups registered a funding decrease of 35% YoY to Rs. 6,90,930 crore (US$ 81 billion). In spite of this trend, the sector gained traction with the rise in number of deals to 14 in 2024 from 11 in 2023.

- Skyroot launched India’s first private rocket, Vikram-S, marking a historic shift in private orbital access.

- Agnikul Cosmos is developing India’s first semi-cryogenic, 3D-printed engine that it plans to launch from its own private launchpad at Sriharikota.

- Pixxel is revolutionising Earth observation with its hyperspectral satellites capable of tracking crop health, pollution and climate in real time.

These companies are also expanding India's soft power by enabling launches for global clients. With each successful mission, they are changing the global narrative from ‘low-cost alternative’ to ‘high-performance innovator’.

Policy, FDI & Regulation: Building a business-friendly ecosystem

India has taken decisive steps to create a globally competitive environment for space tech startups and investors:

- FDI limits updated:

- 100% FDI in satellite components and manufacturing

- 74% FDI in ground/user segments and downstream data services

- 49% FDI in launch vehicle development

- Space Activities Bill (Draft): Expected to define responsibilities, licensing rules, insurance mandates and penalties for private entities—bringing much-needed legal clarity.

- Indian Space Association: Acts as a powerful policy think tank and bridge between industry and government, representing major players and startups alike.

- Space-Based Remote Sensing Policy of India – 2020: This policy provides a clear framework and systematic procedures by which approvals of the government shall be obtained to undertake remote sensing applications in India. The guidelines cover companies across both upstream and downstream sectors of the remote sensing industry (including hardware and software), making a comprehensive perspective of operational demands.

- Spacecom Policy 2020: This policy works towards strengthening India’s resource base in satellite communication by actively involving private players while ensuring the national space assets security. An important aspect of the policy enables India-registered entities to leverage domestic and foreign orbital assets to build space-based communication systems. This unlocks opportunities for both domestic and international communication services.

This robust framework removes ambiguity and enables faster decision-making, making India attractive to both domestic and foreign space investors.

Union Budget 2025-26:

India allocated about Rs. 13,416 crore (US$ 1.57 billion) to the Department of Space in the Union Budget 2025-26.

Empowering NGEs: From vendors to visionaries

Earlier, private players in India’s space sector were seen as suppliers or contract manufacturers. Today, NGE have access to the full spectrum of the space economy.

They can now:

- Build, launch and operate satellites

- Own ground stations and data networks

- Offer end-to-end services—imaging, analytics communications

- Develop propulsion tech and reusable rockets

- Even collaborate on national security and deep space missions

This transition from vendor to visionary has been made possible by policy support, technical handholding by ISRO and demand from both public and private clients.

Conclusion

Privatisation has ignited the engine of India’s next space revolution. With robust policy support, active state participation, world-class talent and ambitious private players, India is no longer a fringe participant but a key driver of the global space economy.

India’s private spacetech boom is not a trend—it is a long-term transformation. From building for ISRO to building for the world, Indian startups are now shaping the global narrative.