SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (14)

- Trade (5)

The Impact of Research & Development on Biotech Companies in India

- Dec 05, 2025, 18:55

- Research and Development

- IBEF

India’s biotechnology sector has been on a remarkable growth trajectory. Fueled by post-2020 innovation and investment, the bioeconomy more than doubled from about Rs. 2,61,300 crore (US$ 30 billion) in 2015 to over Rs. 6,09,700 crore (US$ 70 billion) in 2020. It is estimated to reach Rs. 13,06,500 crore (US$ 150 billion) by 2025. Major advances have come especially in health and pharmaceuticals: India’s pharma industry is now the world’s third largest by volume, with a Rs. 4,35,500 crore (US$ 50 billion) market in FY24 where domestic sales contributed Rs. 2,04,685 crore (US$ 23.5 billion) and exports Rs. 2,30,815 crore (US$ 26.5 billion). Behind this success is a deep research & development (R&D) commitment from government science labs to corporate R&D centres that turn research into real products, giving India a stronger global presence in biotech.

Government R&D ecosystem

India’s government has built a broad R&D ecosystem to support biotech innovation. In 2024, it launched the BioE3 Policy (Biotechnology for Economy, Environment and Employment) to accelerate cutting-edge research and make India a global biomanufacturing hub. The Biotechnology Research Innovation and Development Ecosystem (Bio-RIDE) consolidate past Department of Biotechnology (DBT) initiatives into a single framework for translating academic research into marketable products. Similarly, the National Biopharma Mission is backing 101 drug- and vaccine-development projects (involving over 150 organisations) to move discoveries closer to patients. The Bio-KISAN program links lab research to agriculture; by the end of 2022, it had supported 1,60,000 farmers through new biotech crop and farm-tech solutions.

DBT and affiliated agencies have established seven National Institute of Pharmaceutical Education and Research (NIPER) institutes of high-end pharma research, biotechnology parks and incubators across the country. Biotechnology Industry Research Assistance Council, DBT innovation arm of BIRAC proactively funds new start-ups: in 2022, it invited proposals to create new products in healthcare, agritech and cleantech. Government has also eased eligibility (including quicker approvals of clinical trials) and fiscal aid on attracting industry-based R&D. Cumulatively, this is expected to result in the creation of a pipeline of educated scientists and an ecosystem where an idea could be turned into a company.

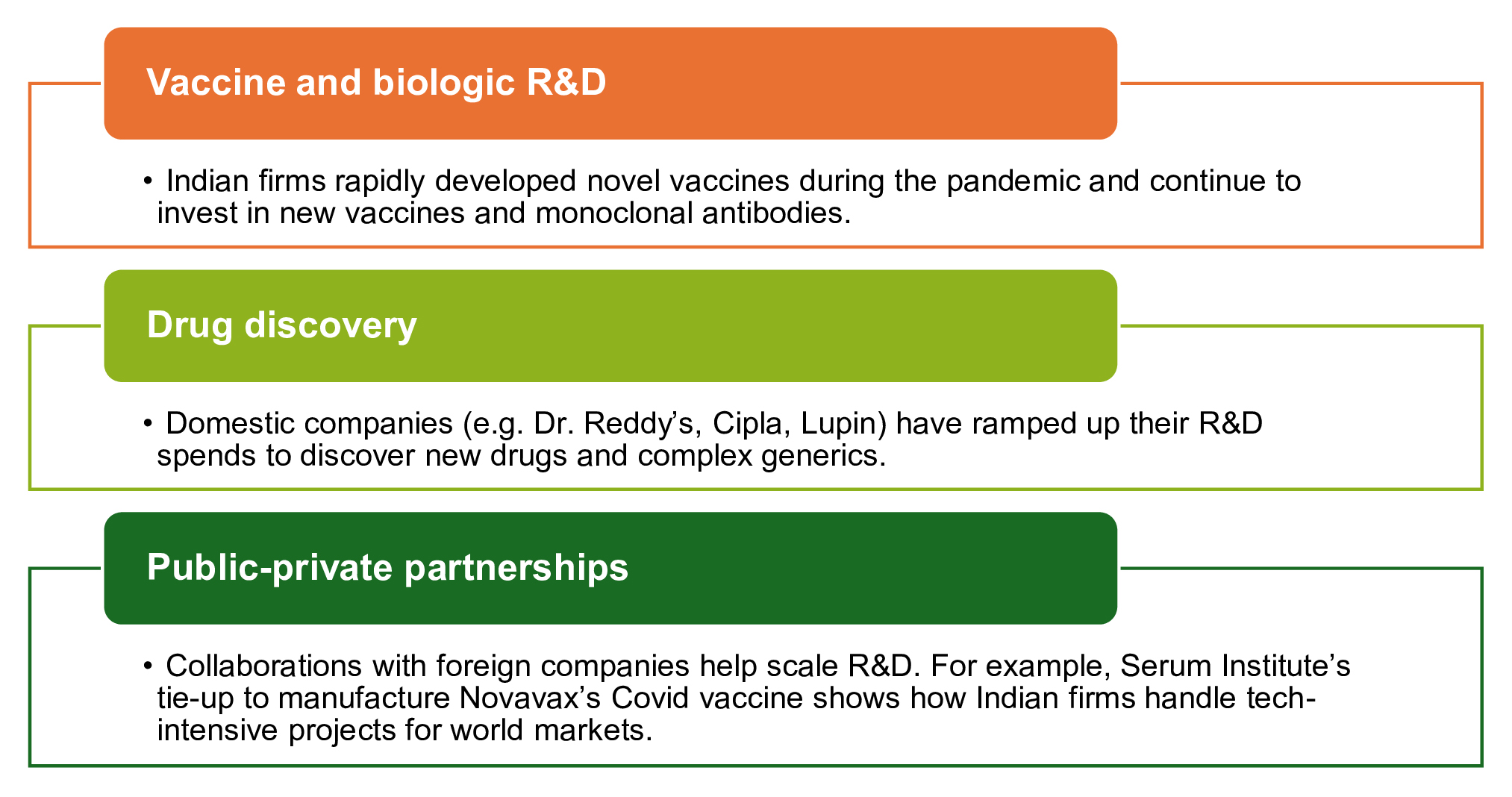

Pharmaceutical and healthcare innovations

R&D has transformed India’s pharma and healthcare industry. Companies are shifting gears to come up with new biologics, vaccines and diagnostics. Among them, are Bharat Biotech, which has created iNCOVACC, the first intranasal COVID-19 vaccine in the world and Zydus Cadila, the first plasmid-DNA COVID vaccine. Biocon Biologics has established a worldwide biosimilars portfolio: it launched HULIO (a Humira biosimilar) in the US in 2023 and currently has approximately 20 biosimilar drugs in development. Indigenous drug innovators are also catching up with new modalities; for example, in 2022, Gennova Biopharma finished human testing of an indigenous mRNA vaccine.

These R&D gains are reflected in trade: formulations and biologicals now make up about 73% of India’s pharma exports, which hit Rs. 2,00,330 crore (~US$ 23 billion) in FY22 and roughly Rs. 2,30,815 crore (US$ 26.5 billion) by FY24. Such high-value exports (from vaccines to oncology drugs) underscore India’s transition from being just the “pharmacy of the world” to an innovation leader.

Agriculture and biosolutions

Agricultural biotechnology in India is also benefiting from R&D. R&D is also rewarding agricultural biotechnology in India. Indicatively, in early 2024 the government announced a Speed Breeding Crop Facility in the National Agri-Food Biotechnology Institute, Mohali. This is expected to radically reduce crop development periods and make it possible to develop climate-stable varieties faster. Through the Bio-KISAN plan and state biotech missions, universities and startups are developing biofertiliser, microbial pesticides and enhanced species that yield more and lessen use of chemicals.

Moreover, bio-manufacturing for agriculture such as enzymes for biofuel production or biopesticides is a growing area. DBT’s recent policies encourage agri-biotech enterprises to scale up. This means farm produce such as cotton, rice and sugarcane could see India-developed biotech upgrades. In the long run, these innovations can boost farm incomes, conserve water/soil and make Indian agri-products more competitive overseas.

Industrial biotechnology and green innovation

India’s industrial and environmental biotech segment is expanding through R&D, supporting the green economy. Under the BioE3 framework, biotech innovations are being pushed into areas such as clean energy, waste treatment and sustainable materials. DBT’s Emerging Frontiers in Biotech programme, for instance, has funded 157 high-risk projects across 21 states (as of 2024) targeting next-gen solutions.

In practice, Indian firms and research labs are developing biocatalysts and processes for industries. Examples include enzymes for textiles, detergent and food processing (reducing energy and water use); algal bioproducts (e.g. Zaara Biotech’s seaweed-based biofuel venture); and fermentation-based production of bioplastics and solvents.

Diagnostics, genomics and digital bio

In response to the COVID-19 crisis, the development of PCR and rapid test kits, gene sequencing capacity and data platforms took place faster domestically. In 2022, India inaugurated the first Indian Biological Data centre (IBDC), a national depository of genomics and life-science information. This underscores a strategic focus on digital biology, enabling researchers to mine big data for disease markers or crop genetics.

Homegrown companies are developing medical diagnostics using genomics and personalised medicine. Indicatively, companies such as Strand Life Sciences and Mapmygenome are already providing genomic profiling tests, and companies such as Mylab and CoRapti Biotech have massively increased affordable testing kits. Gene therapies and cell therapies have also been studied by research institutions: Crisprbits (a gene-editing startup) in Bengaluru recently received venture capital to fund more research. These developments help provide better healthcare outcomes and make India better positioned in the novel fields of gene editing and bioinformatics.

Startups, partnerships and global impact

India’s thriving startup ecosystem is translating R&D into commercial success. By mid-2023, thousands of biotech startups were active in India, spanning vaccines to enzymes. The 2022 Biotech Startup Expo in New Delhi showcased 75 BIRAC-supported startups and incubators (including teams from 21 Indian Institute of Technology (IIT)) under the banner of “Aatmanirbhar Bharat” (self-reliant India). Events such as these highlight how young companies backed by government and Venture Capital (VC) funding are covering areas from gut microbiome therapeutics to novel diagnostics.

Indian biotechs also engage globally. More recent agreements encompass joint research initiatives with Japan, Europe and the US and multinational corporation investment. E.g, in 2023, Aurigene (a Hyderabad-based biotech company) announced the establishment of a Rs. 348 crore (US$ 40 million) facility to support its drug discovery services. These partnerships introduced both capital and expertise into the Indian technological development process.

This expansion driven by R&D is enhancing the soft power of India. India as the supplier of the vaccine to the whole world now exports its medicines and bioproducts to more than 200 countries. This has been aided by affordable innovations, such as low-cost insulin (Biocon) or new vaccines, which have benefited global health. As the R&D ecosystem grows, India will not only fill its own needs in public health and sustainability but also be a model to other countries.

Outlook

In summary, intensive R&D investment is driving a biotech renaissance in India. Government programmes (DBT, BIRAC, NIPER, etc.) are funding research from labs to farms, while companies are converting discoveries into products. The result is a virtuous cycle: new biopharma drugs, crops, enzymes and diagnostics are improving lives and generating export revenue. Looking ahead, India’s blend of scientific talent, supportive policy and entrepreneurial energy suggests it can emerge as a global leader in biotech. By continuing to nurture innovation and collaboration, India’s biotech sector will write the next chapters of its “Make in India” and “Green Growth” success stories, strengthening both the economy and India’s influence in the world.

FAQs

How is R&D boosting India’s biotech sector?

R&D is driving biotech growth by turning research into products such as vaccines, biosimilars and biofertilisers. This innovation has helped India’s bioeconomy expand from Rs. 2,61,300 crore (US$ 30 billion) in 2015 to a projected Rs. 13,06,500 crore (US$ 150 billion) by 2025.

What government support exists for biotech R&D in India?

Key programmes such as BioE3, Bio-RIDE and the National Biopharma Mission, along with DBT, BIRAC and NIPER, provide funding, incubation and regulatory support, enabling biotech startups and firms to scale faster.

How has R&D transformed Indian pharma and healthcare?

R&D has led to breakthroughs such as Bharat Biotech’s intranasal COVID vaccine and Biocon’s biosimilars. With growing investment in drug discovery, India is shifting from being the “pharmacy of the world” to an innovation hub.

What role does R&D play in Indian agriculture?

Agricultural R&D supports climate-resilient crops, biofertilisers and sustainable farming. Initiatives such as Bio-KISAN and speed breeding facilities help raise yields, boost farmer incomes and make agri-products more competitive.

What is the future of biotech R&D in India?

With advances in genomics, green biotech and digital biology, India’s R&D-led ecosystem is set to make the country a global hub for biotech innovation, exports and sustainable growth.