SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (68)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (24)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (33)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (17)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (14)

- Trade (5)

Decoding the Growth of India’s Chocolate Market

- Nov 21, 2025, 10:00

- Consumer Markets

- IBEF

Chocolate was once a luxury novelty reserved only for special occasions and largely consumed by the urban masses. However, the industry has undergone a dramatic transformation over the years, turning into a multi-billion-rupee market catering to daily cravings as well as festival indulgences.

What was once a special treat handed out to children is today a product embraced by all. From multinational players introducing premium lines to Indian players experimenting with native spices, the Indian chocolate market is at a crossroad at which indulgences and aspirations are the same. The rise of the chocolate industry is a signal of large consumption shifts, rising incomes, international sensibilities getting imbibed, and cities getting populated.

Chocolates have today burst out of city malls and supermarkets to reach village retail and online outlets, reaching millions of consumers. As health consciousness increases, dark as well as sugar-free variants are seeing more demand than ever.

Market overview

India’s chocolate market has grown steadily over the past decade, expanding into one of the most dynamic segments of the country’s food industry.

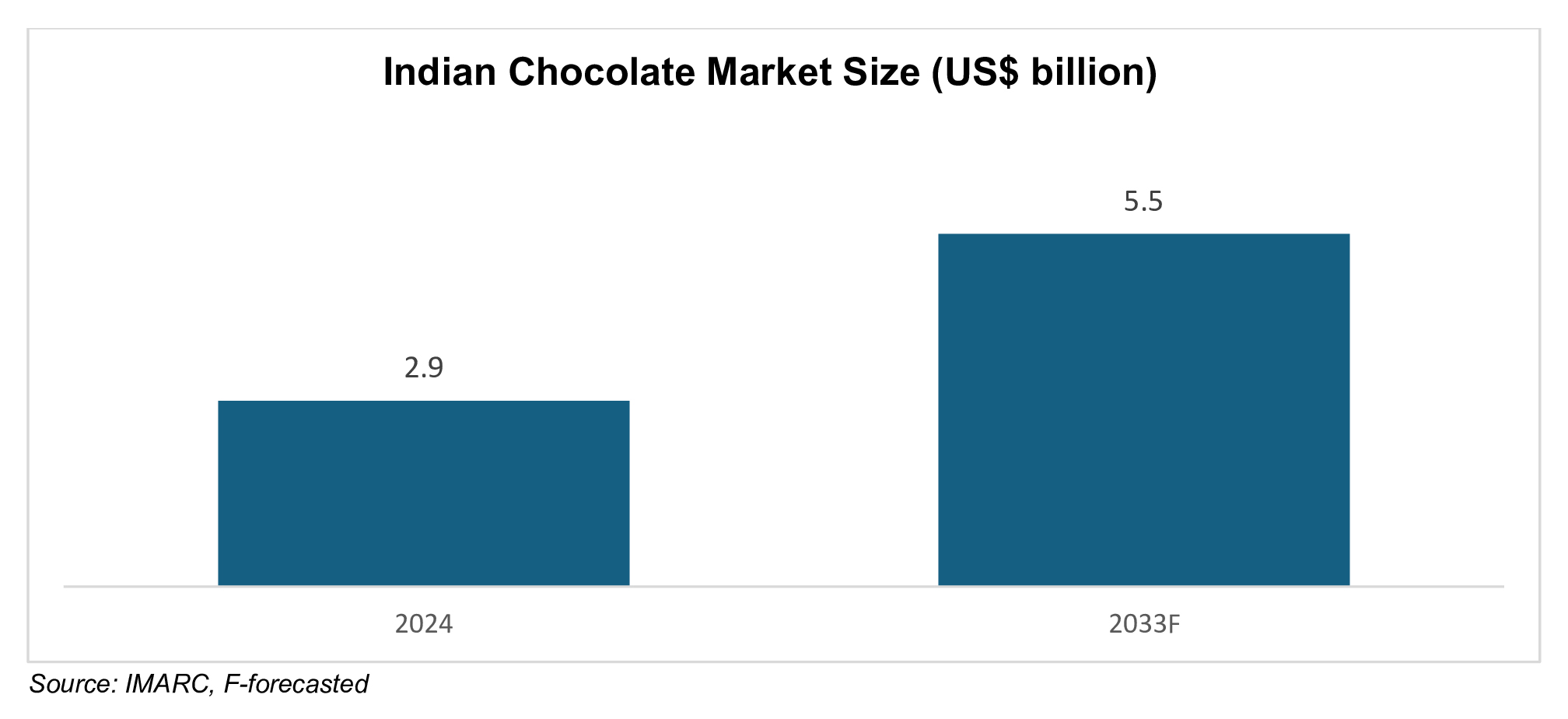

According to IMARC, the Indian chocolate market reached Rs. 25,245 crore (US$ 2.9 billion) in 2024 and is projected to hit Rs. 47,878 crore (US$ 5.5 billion) by 2033, growing at a CAGR of 7.30% from 2025-2033.

Urbanisation, rising disposable incomes, and a young population with evolving tastes have made chocolate consumption more popular than ever. Premiumisation is also accelerating growth, as consumers are increasingly opting for dark, sugar-free, and artisanal varieties.

Evolving consumer preferences

Chocolate is no longer just a treat for children; it is turning into a choice that spans age groups.

- Young consumers: The 15-30 age group drives the bulk of demand, fuelled by exposure to global brands and lifestyle aspirations.

- Middle-class: The middle class sees chocolates as convenient alternatives to traditional sweets, especially during festivals and special occasions.

- Health-conscious buyers: A newer demographic exploring dark chocolate, sugar-free options, and premium formats, reflecting a growing emphasis on wellness without giving up indulgence.

Chocolates are also steadily gaining traction in rural areas, where affordably priced packs and wide distribution is helping brands penetrate new markets.

Competitive landscape

The market is controlled by a few international giants, although the environment is multi-dimensional. Mondelez India (Cadbury) is a leading company along with Nestle being a tough competitor. Together with Ferrero and Mars, these four multinationals, control approximately 80% of the Indian retail chocolate market. Amul and CAMPCO with 3% and 2% share, respectively, are among the homegrown brands which have enhanced their presence, and premium brands like Ferrero Rocher, Lindt and Laderach have established a niche among the affluent consumers.

Direct-to-consumer (D2C) start-ups and small-scale chocolate producers are also on the rise, appealing to the urban customers with bean-to-bar ideas and responsible sourcing practises. The international chocolate awards Asia Pacific 2023 competition resonates this point with most of the entries being Indian chocolate companies and startups. This was also the case in 2025 where companies such as Manam Chocolate and Paul and Mike were awarded silver and bronze in different categories.

How product innovation is rewriting expectations

Innovation within the Indian chocolate market sounds like a tasting tour. Companies are experimenting with local condiments like saffron, cardamom, chilli and mango which happily coexist with hazelnut and sea salt.

Health messaging is gaining traction. Increased cocoa percentages, transparent sugar labelling and sugar-free ranges are a response to consumers’ needs without compromising indulgence.

Innovation within packaging: Resealable pouches, portioning and luxury hampers has converted daily consumption into memorable moments.

The industry is demonstrating that it can be both democratic and discretionary. One manufacturer can retail a pocket bar at a ‘kirana’ while also selling a hand-finished truffle to a luxury boutique store.

Distribution: From the corner shop to the cloud

How chocolates reach the consumer has also changed dramatically. Traditional ‘kirana’ stores remain vital, for penetrating smaller towns. While modern supermarkets and convenience chains provides shelf theatre for family packs and festival editions.

Yet the biggest change is digital. E-commerce and quick-commerce platforms have allowed access to imported brands, artisanal makers, and niche chocolateries, accelerating adoption in previously unreachable places.

D2C brands differ by bypassing intermediaries and using subscription models and exclusive launches to gain customer loyalty.

Chocolates as a symbol

Chocolates have transitioned from novelty to ritual. Corporate gifting and Valentine’s Day collections and Diwali hampers now underpin category expansion and brands have honed the art of storytelling around festivity. Elegant packaging, co-creation collections, and limited editions have turned buying into an experience. Gifting a high-end chocolate box to many metropolitan consumers signifies thoughtfulness, the same as how a classic mithai box once did. Social media multiplies these moments, and product launches and festive editions are converted into lasting moments, fuelling chatter and sales.

Looking ahead

The future of chocolate in India is promising in terms of innovation, inclusion and growth. Premiumisation will result in quicker growth in high-end urban consumers, and small pack sizes will keep infiltrating rural markets. Low-sugar, high-cocoa concentration, and organics players will also gain as wellness and health consciousness become the centre of attention.

The export potential of India is also bright bearing in mind the increasing demand of quality and affordable chocolate in the international market. Indian companies might become significant players in the world as the efficiency of the supply chain and investment in manufacturing increases. The growing involvement of domestic and international brands coupled with the growth in e-commerce penetration is also creating new growth opportunities. Seasonal gifts, festivals and customised chocolate collections are on the rise and high-end cafe chains, and luxury retailers are also growing to keep up with changing consumer tastes. The storey of the chocolate market in India is one of change and opportunity.

What started with modest origins is now a multibillion-dollar business that serves all types of tastes and wants. Chocolate is now a symbol of indulgence, festivals and cultural events. The market is expanding its target audience with more emphasis on sustainability, ethical sourcing, and innovative flavours based on local ingredients. With the further penetration of innovation and the exploration of new markets, the industry is ready to experience another explosive growth with all its sweetness and with the prospect of becoming a global player in the world of chocolate.

FAQs

How large is India’s chocolate market today?

The market reached Rs. 25,245 crore (US$ 2.9 billion) in 2024, making it a key segment of the food industry.

What is the projected size of the market?

It is forecast to grow to Rs. 47,878 crore (US$ 5.5 billion) by 2033 at a CAGR of 7.30%.

What factors are boosting chocolate demand in India?

Rising disposable incomes, urbanisation, lifestyle changes, and preference for premium products are fuelling growth.

Who are the major players in the Indian chocolate industry?

Mondelez, Nestle, Amul, ITC, and premium brands like Ferrero Rocher dominate alongside artisanal startups.

What are the emerging consumer trends in chocolate consumption?

Premiumisation, dark chocolate demand, sugar-free options, and artisanal bean-to-bar varieties are gaining traction.