SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (68)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (24)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (33)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (17)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (14)

- Trade (5)

From Kitchens to Living Rooms: Mapping India’s Appliances Revolution

- Nov 24, 2025, 10:50

- Consumer Markets

- IBEF

India is catching up with the smart home revolution, whereby the traditional living spaces are being transformed into smart homes that are convenient and efficient. Smart homes are becoming a reality with automated lighting, intelligent security systems, smart appliances, and more. The use of home appliances in India is rapidly increasing, with the help of the rising internet access, digital penetration, and the growing middle-income population, which is increasingly spending on high-end appliances.

Kitchen appliances are not new in India, and the rise of smart appliances in India is transforming convenience. Smart refrigerators, air purifiers, robotic vacuum cleaners, and smart lighting, enabled by AI, are increasingly available. Redseer estimates that smart home device penetration is 8-10% in 2023, up from under 4% pre-pandemic, and the market is worth Rs. 90,000 crore (US$ 10.3 billion) and is expected to reach Rs. 1,40,000 crore (US$ 16.03 billion) by 2028. Security devices will be the fastest-growing segment, with an estimated contribution of about 14% of the market.

The journey: From kitchen staples to living room statements

India's household kitchen appliances market was valued at Rs. 1,32,711 crore (US$ 15.2 billion) in 2024 and is estimated to surpass Rs. 1,92,082 crore (US$ 22 billion) by 2030, at a CAGR of 6.5%. The market comprises refrigerators, cooking appliances, dishwashers, and range hoods. Refrigerators were the highest in revenue generation, and dishwashers were the fastest-growing segment in 2024.

The home appliances industry in India has evolved from fulfilling basic needs to emerging as an innovation-driven sector. The early penetration was influenced by urban demand for essential appliances; however, government-led electrification and affordable housing programs brought rural dwellers within the scope of electrification. As incomes and dreams are on the rise today, there is an influence towards more energy-efficient, connected products and design-oriented products. Smart home appliances are hastening the replacement of kitchen essentials with statement pieces in the rooms. Categories like security devices (cameras, doorbells, locks), lighting and control (lights, switches, plugs, fans), and small environment appliances (air purifiers, heaters, air coolers) are picking up. According to a Redseer report, the adoption of smart bulbs and smart plugs is strong, with a Net Promoter Score (NPS) of 72 and 66, respectively, whereas the NPS of smart air purifiers is 85. Innovations are being driven by emerging brands such as Mi, Qubo, Atomberg, and established brands such as Philips, Dyson, and Airtel.

Appliances are now not only functional but also used in expressing lifestyle, comfort, connectivity, and aspirations. The increased volume of smart home devices, combined with the increased availability of marketplaces, refurbishing efforts, etc., is prolonging the lifecycle of products and providing consumers with additional means of experiencing convenience and efficiency.

Market outlook: past, present, and future

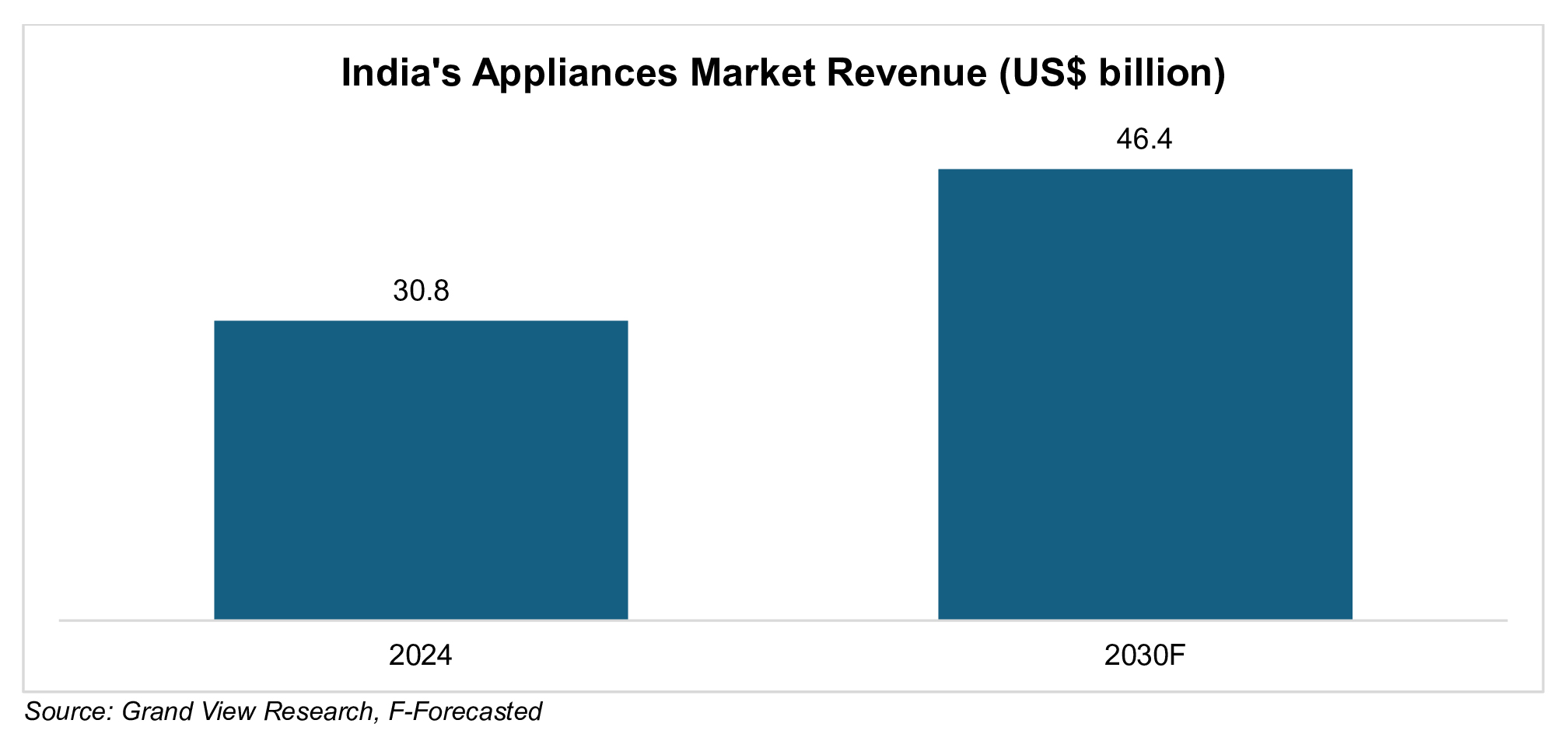

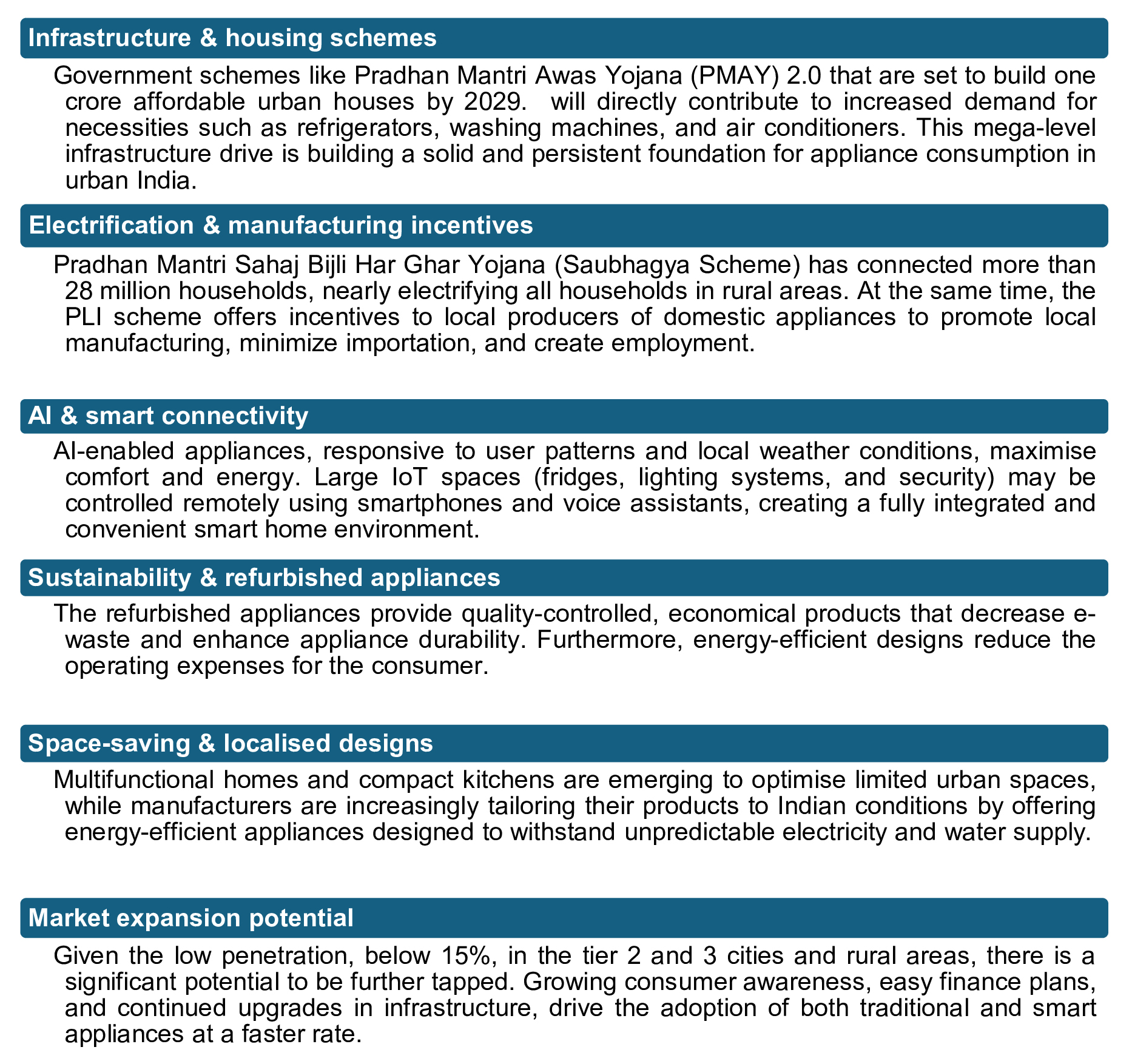

The total appliances market in India was worth Rs. 2,68,915 crore (US$ 30.8 billion) in 2024 and is projected to reach Rs. 4,05,118 crore (US$ 46.4 billion) by 2030, growing at a CAGR of 7.2%. Major appliances were the biggest revenue generators, and small appliances were the fastest growing, with India being the fastest-growing market in the Asia Pacific region. The smart kitchen appliances market in India was worth Rs. 9,255 crore (US$ 1.06 billion) in 2022, which is projected to reach Rs. 42,782 crore (US$ 4.9 billion) by 2030, growing at a CAGR of 20.9%. Manufacturing centres like Sri City in Andhra Pradesh are enhancing the domestic supply and exports. The Indian appliance market has transformed itself over the years, with the rise in income and adoption of technology, as well as favourable policies, opening up opportunities in both the traditional and smart appliance sectors.

Key growth drivers

- Rising disposable incomes & affordability:

The growing level of household income and factors like improved production efficiencies and a decline in manufacturing costs are enabling more consumers to afford smart, good-quality, and energy-efficient appliances. This is not only widening the target market base to include households beyond the top-tier cities but also increasing adoption in tier 2 and 3 cities.

- Demand for smart & energy-efficient products:

Over the years, there has been pent up demand for smart and energy-saving products, including the Internet of Things (IoT) and Artificial Intelligence (AI) - enabled products. From smart fridges to air-conditioners controlled by artificial intelligence, this trend is increasing the usage of technology in homes today.

- Lifestyle shifts and convenience:

Rising nuclear families, fast-paced lifestyles, and rapid urbanisation are driving demand for automation, advanced security systems, remote surveillance, and time-saving appliances, with products that simplify daily routines and enhance quality of life witnessing strong growth.

- Government initiatives & e-commerce growth:

Government plans such as ‘Make in India’ as well as Production-Linked Incentives (PLIs), rising percentages of e-commerce sales (estimated at 7.5% of total sales by 2025), and bullish marketing campaigns are all making modern appliances more affordable, well-known, and popular.

- Demographics & consumer aspirations:

The growing middle class, along with tech-savvy millennials and Generation Z, combined with rising discretionary spending on home improvement (around 6% annually), is shaping household demand for convenience-driven and lifestyle-oriented appliances. At the same time, greater awareness of energy efficiency and smart technology is further expanding the market.

Innovations, initiatives, and opportunities

The Road Ahead

The Indian appliance industry is on the verge of tremendous growth due to growing disposable incomes, urbanisation, and the trend towards smart, energy-efficient, and design-conscious appliances. IoT and AI devices are transforming connected home environments, with appliances providing convenience, security, and energy efficiency. Government policies, electrification, and increased e-commerce penetration are spreading modern appliances to both urban and rural households. The presence of tier 2 and tier 3 cities and increasing consumer awareness introduce significant growth potential in the market. Technological innovations in sustainable and refurbished products, compact designs, and localisation to Indian contexts are further accelerating adoption and increasing product lifespans. This transition in essential kitchen staples to connected living spaces represents a larger shift in lifestyle into a future that showcases the beginning of modern living and how convenience, efficiency, and modern living unite to transform the living experiences in the country at large.

FAQs

What factors are contributing to the rapid growth of home appliances in India?

Rising disposable incomes, urbanisation, digital penetration, and a growing middle class are driving adoption.

How is the demand for kitchen appliances evolving in India?

Consumers are increasingly choosing smart, energy-efficient, and multifunctional kitchen appliances that simplify daily chores and suit modern lifestyles.

How are smart appliances reshaping modern homes in India?

AI- and IoT-enabled devices offer automation, remote control, energy efficiency, and enhanced security.

What role do government initiatives play in supporting the adoption of appliances in India?

Schemes like PMAY, Saubhagya, and PLI improve electrification, manufacturing, and accessibility.

Where do future growth opportunities for smart appliances lie in India?

Tier 2 and Tier 3 cities, compact designs, energy efficiency, and refurbished products offer strong growth potential.