SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (14)

- Trade (5)

Fast-Tracking Growth: The Evolution of India's Express Logistics and Parcel Market

Rapid technical breakthroughs, changing customer expectations and strong government investments in infrastructure are all driving a revolutionary change in India's express logistics and parcel delivery industry. Recent developments indicate that this vibrant sector is not only changing the way commodities are delivered but is also significantly contributing to the expansion of the national economy. The rise of the hyperlocal delivery market, expanding e-commerce industry and increasing disposable incomes have been the key contributors to the boom in this industry.

The surge in express logistics and parcel delivery

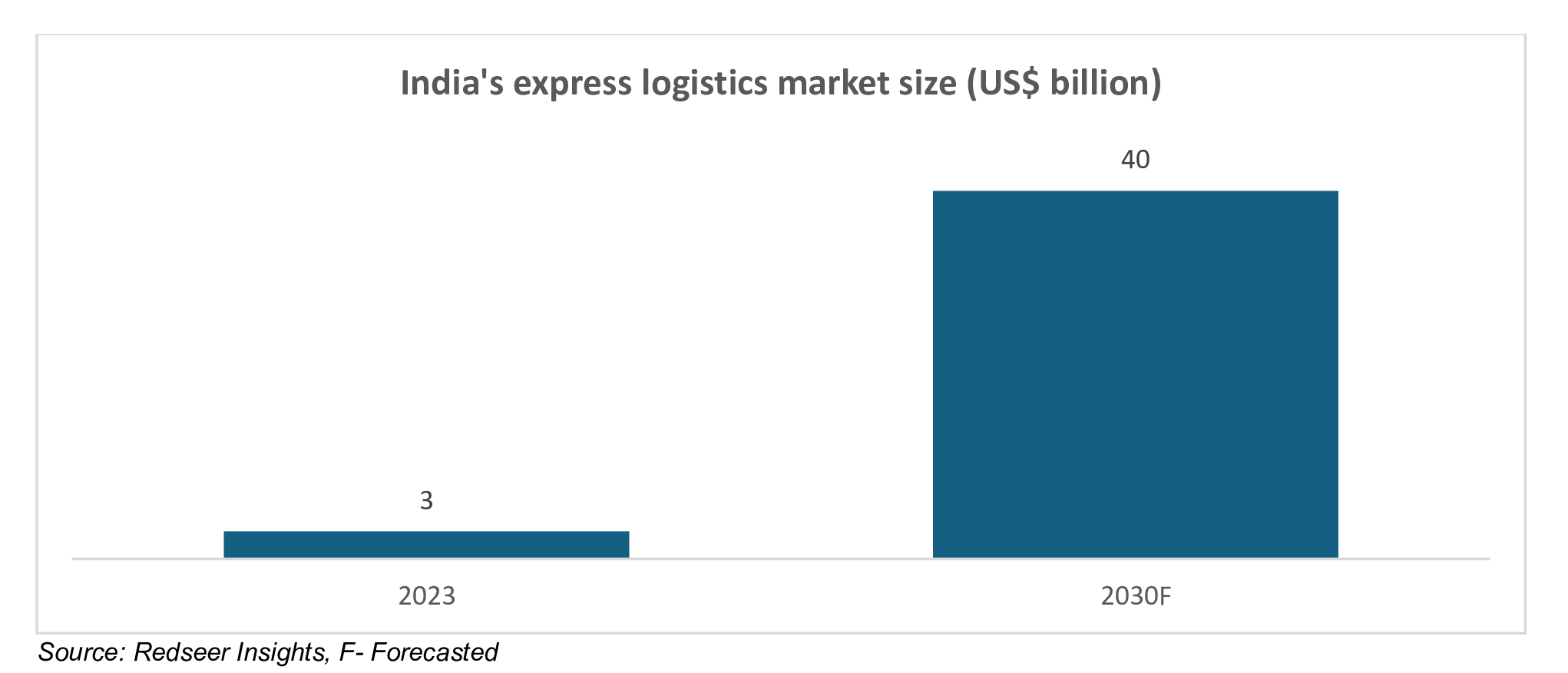

In recent years, India's express logistics market has grown at a rapid pace. Estimated to be worth around US$ 3 billion in 2023, it is expected to skyrocket to US$ 40 billion by 2030. The growing demand for ultra-fast delivery services, particularly in urban areas where customers desire convenience and immediacy, is primarily responsible for this spike.

Businesses that have tapped into this demand include Swiggy, Zepto and Blinkit, which deliver food and other household necessities as low as in 10 minutes. For example, Swiggy's ‘Bolt’ service has spread to more than 400 Indian cities and towns, including Tier 2 and Tier 3 cities like Roorkee, Guntur and Nashik. This quick growth demonstrates the industry's dedication to satisfying changing customer demands.

By FY30, India's express logistics market is anticipated to grow significantly and reach a volume of 29 billion shipments, propelled by the growing e-commerce industry and the emergence of hyperlocal and fast-commerce segments. The e-commerce sector accounted for over 50% of the country’s express parcel volume with 4.8–5.5 billion shipments (as of FY24). India’s express parcel volume is expected to reach 10–11 billion shipments by the end of FY25.

The rise of quick commerce and its implications

In India's logistics scene, quick commerce—which is defined by lightning-fast delivery services—has become a major trend. To support this concept, businesses like Swiggy and Zepto have made significant investments in increasing the capacity of their warehouses. For example, as of 2024, Swiggy operated 538 warehouses with an average floor area of 4,000 square feet (42% more than that in 2023),

However, quick commerce has drawbacks even if it provides customers with unmatched convenience. There is fierce competition for traditional retail shops, which is a major source of livelihood. Furthermore, there are concerns related to the long-term viability of quick commerce due to the significant expenses associated with them.

Technological innovations driving efficiency

The express logistics industry in India is going through a digital revolution, as businesses use smarter technologies more frequently to satisfy rising customer expectations and delivery demands. For automated decision-making, intelligent route optimisation and real-time demand forecasting, artificial intelligence (AI) and machine learning (ML) are being used. Logistics companies can manage dynamic delivery loads, cut down on transit times and improve operational transparency with the aid of these technology. Businesses may increase service dependability, properly allocate resources and predict peak seasons with predictive analytics. As a result, even in Tier 2 and Tier 3 cities, express delivery services are growing in speed, accuracy and affordability.

The Internet of Things (IoT) is contributing significantly to the increasing end-to-end supply chain visibility in addition to AI. Real-time shipment tracking, temperature-sensitive commodities preservation and vehicle performance monitoring are all made possible by IoT-enabled devices and sensors. In addition, geofencing and RFID tags are enhancing inventory control and decreasing the number of lost packages. In order to speed up order processing and reduce human error, logistics companies are also investing in automation through robotics in warehouses and sorting centres. In the Indian logistics environment, these technological advancements are not only improving delivery efficiency but also establishing new benchmarks for scalability and customer happiness.

Major players in the logistics and parcel delivery market

- Delhivery

Delhivery is one of India’s largest integrated logistics companies, offering end-to-end supply chain solutions, including express parcel delivery, freight, warehousing and cross-border logistics. It leverages advanced technology and data-driven platforms to ensure high-speed delivery services to more than 18,000 pin codes throughout the country.

- Blue Dart Express

A subsidiary of DHL, Blue Dart is a premier courier and logistics company known for its extensive domestic delivery network and reliable express services. It offers specialised solutions for industries like e-commerce, banking and pharmaceuticals, supported by air and ground transportation infrastructure.

- Ecom Express

Ecom Express is a leading logistics service provider focused primarily on the e-commerce industry, offering services such as forward logistics, reverse logistics and doorstep verification. With operations in over 2,700 towns, it emphasises deep penetration into Tier 2 and 3 markets.

- XpressBees

XpressBees started as the logistics arm of FirstCry and has since evolved into a full-scale logistics provider, offering services in B2B, B2C, cross-border and third-party logistics (3PL). Known for speed and scalability, it manages over three million shipments per day.

- Shadowfax

Shadowfax operates on a tech-driven, crowdsourced delivery model catering to a variety of sectors including food, grocery, pharmaceuticals and e-commerce. The company’s flexible, asset-light approach helps businesses ensure rapid last-mile delivery to more than 1,200 cities.

- Amazon Transportation Services

Amazon Transportation Services (ATS) is the in-house logistics arm of Amazon India, built to support its massive e-commerce operations. It combines advanced AI and robotics with a vast delivery network to enhance speed and reliability across the country.

- Flipkart Logistics (Ekart)

Ekart is the logistics subsidiary of Flipkart, providing delivery services not only to Flipkart but also to third-party clients. Known for its deep network and automation-driven warehouses, Ekart plays a key role in powering quick commerce and scheduled deliveries.

- DTDC Express

DTDC is one of India’s oldest and most recognised courier brands, offering both domestic and international parcel delivery services. It operates through a vast network of franchise partners and has a presence in over 14,000 pin codes across India.

Government initiatives and infrastructure development

Multi-Modal Logistics Parks

Multi-Modal Logistics Parks (MMLPs) are being developed nationwide by the government under the Logistics Efficiency Enhancement Programme (LEEP). These parks seek to save freight expenses, increase the effectiveness of warehousing and improve consignment tracking and traceability. MMLPs have the potential to completely transform freight logistics in India by combining many forms of transportation and offering cutting-edge amenities.

Dedicated Freight Corridors

To enable quicker and more effective commodities movement, the Dedicated Freight Corridor Corporation of India (DFCCIL) is leading the effort to build dedicated freight corridors (DFCs). The Western Dedicated Freight Corridor was 85% operational as of April 2024, while the Eastern Corridor was fully operational. These corridors are expected to considerably shorten transit times and improve freight transport's overall effectiveness.

Bharatmala Project

The Bharatmala initiative focuses on developing economic corridors, feeder routes and logistics parks to improve road connectivity and freight movement. By identifying 44 economic corridors and integrating them with logistics parks, the project aims to create a hub-and-spoke model that facilitates efficient cargo movement across the country.

The market for express logistics and parcel delivery in India is at a turning point, marked by quick expansion, cutting-edge technology and improving infrastructure. With ongoing government assistance and changing customer expectations, the industry is well-positioned to satisfy the needs of a changing economy. However, determining the future course of this important sector will require striking a balance between sustainability, inclusion and rapid growth.