SEARCH

RECENT POSTS

Categories

- Agriculture (33)

- Automobiles (19)

- Banking and Financial services (35)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (57)

- Textiles (8)

- Tourism (14)

- Trade (5)

Growing Power of India’s DIIs

- Jan 15, 2026, 14:10

- Banking and Financial services

- IBEF

India’s equity markets are experiencing a major structural shift. Domestic Institutional Investors (DIIs) such as mutual funds, insurance companies, pension funds, banks and other financial institutions now command a record share of Indian stocks. For example, DIIs held about 17.62% of listed equity market capitalisation as on March 31, 2025, edging past foreign institutional ownership. This rise reflects growing Indian household savings channelled into equities, making institutional investing more locally driven. DIIs draw from domestic pools (retail, high net worth individuals (HNIs) and corporates), so their inflows and outflows are governed by India’s economic fundamentals rather than global risk appetite. As a result, their expanding role is reshaping market dynamics and underpins recent trends in institutional investing in India.

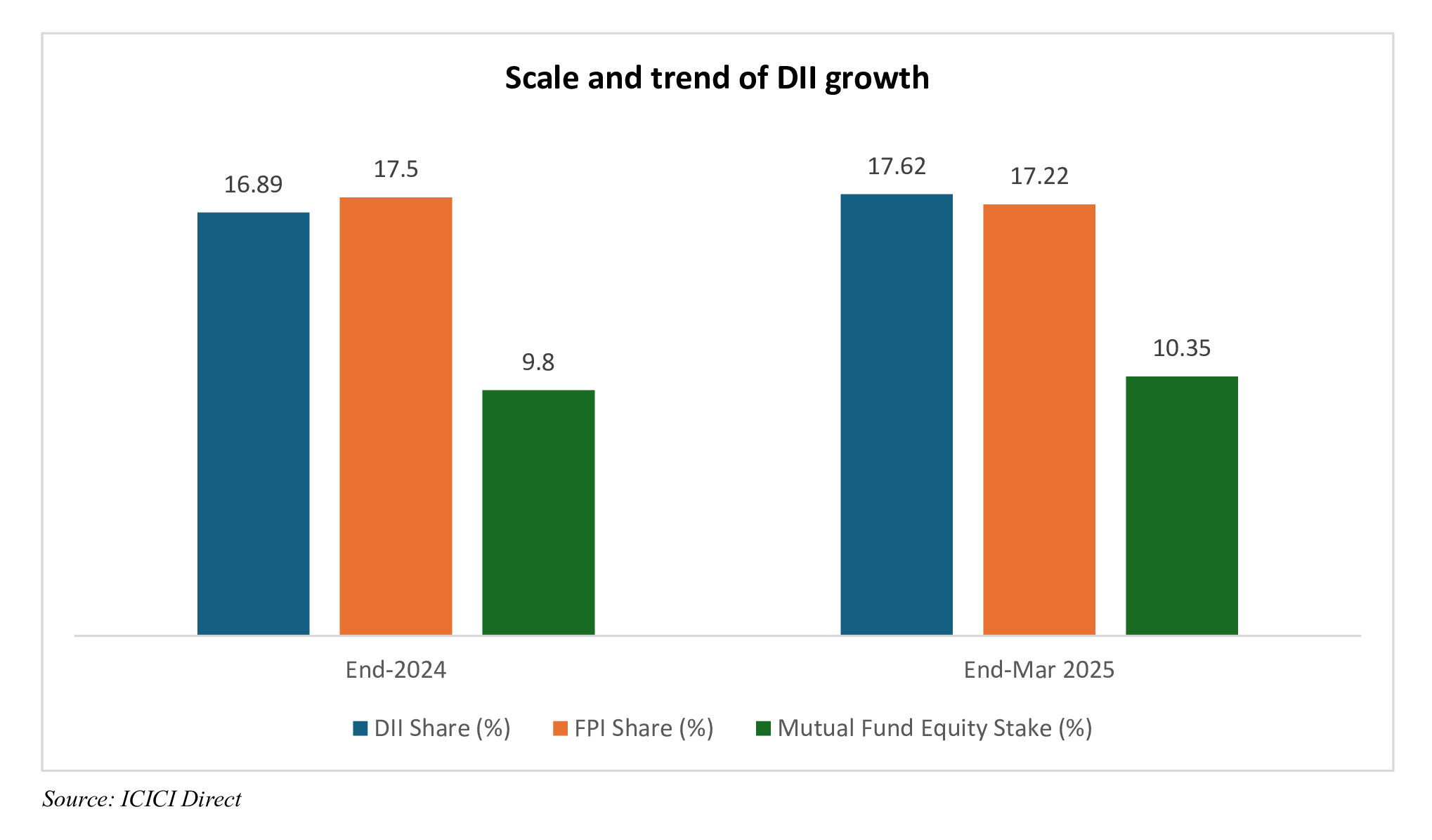

Domestic institutions now rival foreign investors in influence. In the latest data, DIIs’ 17.62% share (end-Mar 2025) just exceeds the 17.22% held by Foreign Portfolio Investors (FPIs). Mutual funds which are the largest DII subset alone owned 10.35% of equity by March 31, 2025. In other words, one in 10 shares is held via Indian mutual funds. When combined with shares owned by retail and HNI investors, about 27.1% of market capitalisation was in domestic hands as of early 2025. This growing domestic footprint means India’s stock market is becoming more self-anchored, reducing its historical sensitivity to foreign capital swings.

Scale and trend of DII growth

According to ICICI Direct, DII holdings hit a record 17.62% by end-March 2025 (up from 16.89% in 2024), surpassing foreign investors’ 17.22%. Net DII inflows were around Rs. 1,89,000 crore (US$ 21.23 billion) during January-March 2025, while FPIs recorded outflows.

By June 2025, DIIs’ combined ownership rose further to 19.2%, exceeding FPIs’ 18.5% for the second straight quarter. Mutual fund inflows of around Rs. 1,16,000 crore (US$ 13.15 billion) in Q1 FY26, supported by robust systematic investment plan (SIP) participation of Rs. 80,000 crore (US$ 9.07 billion), continued to strengthen their share. Overall, data from ICICI Direct and National Stock Exchange (NSE) confirm that DIIs now anchor India Inc.’s ownership, reversing decades of foreign dominance.

Drivers of the rise of DIIs

The rise of DIIs is driven by four major trends.

- Household savings and SIP culture:

Household investments in equities have surged. According to the CFA Institute, direct plus mutual fund holdings reached about 18.5% of the market by mid-2025, up fivefold since 2020. The State Bank of India notes that equities’ share in household financial savings rose from 2.5% in FY20 to over 5% by FY24. Monthly SIP flows crossed Rs. 28,464 crore (US 3.23 billion) in July 2025, while over 200 million demat accounts were opened by June 2025.

- Regulatory reforms:

Reforms by SEBI and the RBI simplified KYC, T+1 settlement, and broader eligibility for provident and pension funds have made equity investment more attractive. The mutual fund industry’s AUM nearly doubled in 27 months to August 2025, supported by these changes and a shift from deposits to market-linked products.

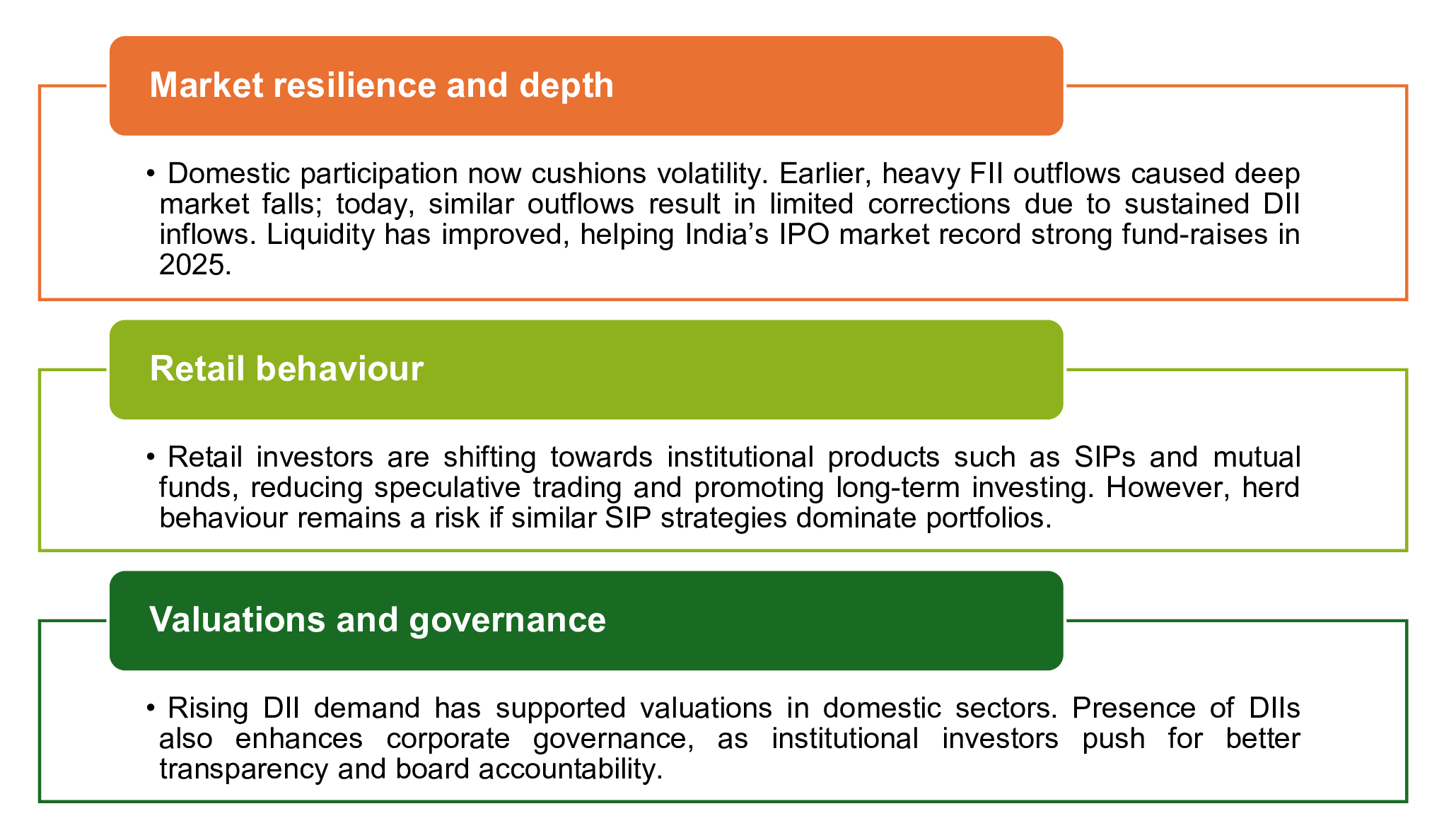

- Stability of domestic flows:

DIIs are more stable than foreign institutional investors (FIIs), as their flows are driven by steady savings and SIPs, not global rate cycles. During periods of global volatility and FII outflows, DII inflows cushioned markets, helping limit declines in indices like the Nifty to a few per cent.

- Structural shareholding shifts:

Promoter ownership has declined to about 50% across NSE-listed companies, freeing up equity for non-promoter investors. Meanwhile, household and HNI participation has touched two-decade highs (over 18% of market cap), naturally raising DII share.

How DIIs’ strategies differ from FIIs

DIIs are long-term and domestically focused, investing steadily in India’s growth sectors such as finance and infrastructure. FIIs, by contrast, are tactical and driven by global factors such as interest rates and currency moves.

By March 2025, DIIs had raised exposure to financial services (27.5%) while trimming exposure to information technology (IT), whereas FIIs continued to favour globally aligned sectors such as energy and chemicals. DIIs’ collective net buying of Rs. 11,40,000 crore (US$ 129.21 billion) over 25 months shows their increasing market power and their role as steady stabilisers, compared to FIIs’ short-term volatility.

Implications for Indian equity markets

The growing influence of DIIs is strengthening India’s markets in three ways.

Overall, India’s equity markets are evolving from being “foreign driven” to “domestically anchored,” with DIIs now at the core of market development.

Outlook and considerations

Going forward, several themes will define DII momentum:

- Flow monitoring:

Tracking DII net inflows, mutual fund data (Association of Mutual Funds in India [AMFI]), and SIP registrations will help assess investor sentiment. Sustained growth signals continued DII strength.

- Sectoral trends:

DIIs may diversify beyond financials to sectors such as infrastructure, renewable energy and affordable housing. Digital participation, aided by fintech platforms and the 200 million demat accounts milestone, will further drive inclusion.

- External shocks:

How DIIs respond during global downturns remains key. While domestic flows have so far remained steady, extreme external shocks could test their resilience.

- Policy and regulation:

Reforms allowing deeper pension and provident fund participation could accelerate DII growth. Conversely, adverse tax changes could impact flows. Policy direction will be critical to sustaining momentum.

India’s market performance now increasingly depends on domestic factors such as household savings, mutual fund flows and policy cues, rather than foreign cycles.

Looking ahead

The rise of DIIs marks a structural evolution in India’s markets. Their growing dominance enhances market stability and financial independence while reducing vulnerability to global volatility. Tracking DII data fund flows, SIPs, and pension allocations has become crucial to understanding India’s market trajectory. As analysts note, this is an “equity revolution” driven from within, with a domestically anchored market offering both resilience and opportunity.

FAQs

Who are DIIs in India?

DIIs include mutual funds, insurers, banks and pension funds that invest Indian savings into equities, holding around 17.6% of market capitalisation as on March 31, 2025.

How has DII ownership changed?

Their share rose from 16.9% in 2024 to 17.62% in 2025, surpassing FPIs for the first time and touching 19.2% by June 2025, marking a shift from foreign to domestic dominance.

How do DII and FII strategies differ?

DIIs invest long-term in India-focused sectors such as finance and infrastructure, while FIIs adjust positions based on global macro factors, making DIIs more stable investors.

What is the impact of DIIs on retail investors?

DIIs promote systematic, long-term investing through SIPs, improving stability and investor confidence but requiring diversification to avoid herding.

What are the key trends shaping DII investments in India?

Key trends include growing retail participation through SIPs, higher allocation to equity assets and a steady rise in institutional ownership across key sectors.