SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (14)

- Trade (5)

How Government Policies Shape the Steel Industry in India

- Dec 17, 2025, 16:25

- Manufacturing

- IBEF

The steel industry contributes significantly to India’s manufacturing base and continues to modernise facilities with new and efficient technology. Steel is vital for infrastructure development, including roads, bridges, railways, pipelines and urban facilities, enhancing productivity and economic competitiveness. India is the world’s second-largest crude steel producer as of FY25. The country’s domestic steel demand is projected to increase by 8-9% YoY in 2025, supported by abundant iron ore resources and low-cost labour.

India targets to be a Rs. 4,43,90,000 crore (US$ 5 trillion) economy by 2027 and the steel sector is directly related to national development and initiatives like the ‘Make in India’ campaign. The National Council of Applied Economic Research (NCAER) indicates that steel is employed in housing, automobiles, power generation, petrochemicals and fertilisers. The employment multiplier of steel is 6.8x and output multiplier is 1.4x. It contributes 2% to India’s GDP and offers over 6,00,000 direct and 2 million indirect jobs, which highlight its strategic contribution to the development of India.

Market outlook

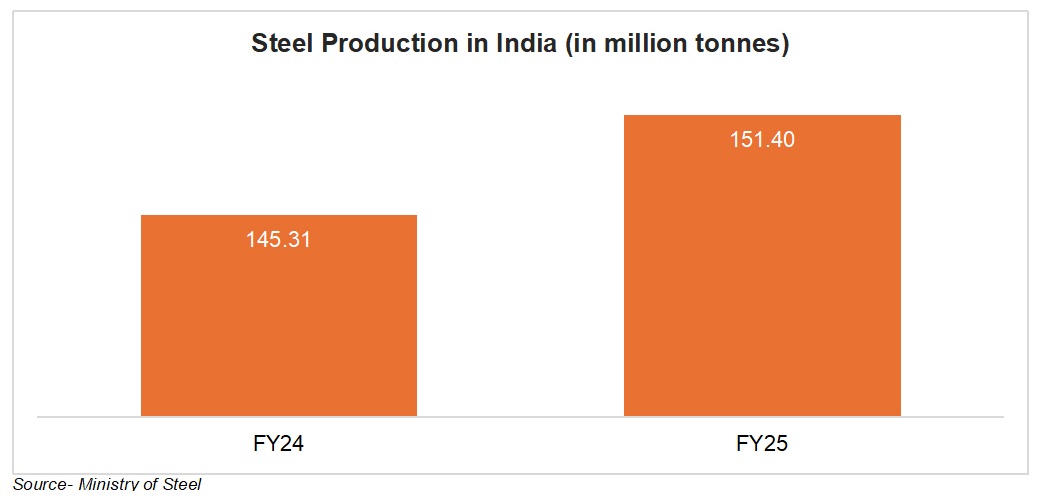

India stood as the world’s second-largest crude steel producer in FY25, producing 151.14 million tonnes (MT), a 4.7% increase over 144.31 MT in FY24. The finished steel production reached 145.31 MT in FY25, and consumption to 150.23MT. The main sources of this high demand are major infrastructure projects, industrial development and city development.

India’s steel industry has demonstrated that it can continue to grow despite global market fluctuations. The crude steel output in India rose by 6.8% YoY in the first two months of 2025, whereas major other producers like Germany and Iran experienced a drop.

The government initiatives (including the National Steel Policy 2017, the Production-Linked Incentive (PLI) Scheme of Specialty Steel and the Steel Import Monitoring System (SIMS)) promote domestic output and reduce dependence on imports.

In the future, India’s steel industry is poised to cater to domestic demand and aid the country’s economic growth.

Policy evolution and strategic support

The steel industry has experienced major policy reforms in recent years to boost production and competitiveness in India. The National Steel Policy (NSP) 2017 established targets of 300 MT per annum (MTPA) of steel manufacturing and 160 kg of steel demand per capita by 2030-31. This policy provided a foundation to subsequent attempts to modernise the industry and reduce the reliance on imports.

In July 2021, the PLI Scheme of Specialty Steel was launched, targeting to increase the local manufacturing of high-value steel and generate employment. The scheme is well supported in the industry, and the second round has attracted more investments, with planned incentives.

The government has also provided mechanisms of monitoring and regulating steel imports, such as the Steel Import Monitoring System (SIMS). These measures cushion the local producers against unfair trade practises and sudden increases in imports.

Government initiatives driving sustainability and growth in India’s steel sector

The Indian government has made efforts to ensure that the steel industry grows faster and becomes more sustainable and relies less on imports. Such attempts are evident in new policies and missions which are meant to modernise the industry and put it at par with global standards.

- PLI Scheme for Specialty Steel

In July 2021, the PLI Scheme of Specialty Steel was launched to attract investment and boost the output of value-added and specialty steel products in the country. The scheme encompasses five broad product lines: coated or plated steel products, high-strength/wear-resistant steel, specialty rails, alloy steel products and steel wires, and electrical steel. It targets to generate 42 MT of specialty steel annually by FY27. Companies committed a total of Rs. 27,106 crore (US$ 3.05 billion) as of March 2025, and about Rs. 20,000 crore (US$ 2.25 billion) of this commitment is already invested. These projects have directly employed 9,000 individuals, and the government intends to pay out Rs. 2,000 crore (US$ 225.28 million) in incentives to the manufacturers by FY30. During the second round in January 2025, 35 companies committed additional Rs. 25,200 crore (US$ 2.84 billion). With Memorandums of Understanding (MoUs) being signed, the government anticipates to offer Rs. 3,600 crore (US$ 405.53 million) in incentives.

- Domestically Manufactured Iron & Steel Products (DMI&SP) policy

The Ministry of Steel revised the DMI&SP policy on July 25, 2025, mandating government procurement of fully Indian-made steel. The update introduces local content norms, revised import lists and relaxed norms for Indian technology suppliers in steel plant tenders to boost self-reliance and domestic manufacturing.

- Greening the Steel Sector: Roadmap and Action Plan

In March 2025, the Ministry of Steel published the ‘Greening the Steel Sector in India: Roadmap and Action Plan’, which provides a plan to decarbonise the industry and achieve net-zero emissions by 2070. The plan includes:

- Green steel taxonomy: A taxonomy that categorises steel by its carbon output per tonne, so it is easier to identify which steel is cleaner and promote low-carbon steel.

- Financial incentives: A national mission of approximately Rs. 5,000 crore (US$ 563.19 million) to assist both primary and secondary steel producers to switch to green technologies, with low-interest loans and risk guarantees.

- Technological developments: Green hydrogen, carbon capture, utilisation and storage (CCUS) and renewable energy integration to cut down on emissions in conventional coal-based steel processes.

- Public Procurement Policy: A policy that requires the use of a specified amount of green steel in public infrastructure projects starting FY28, establishing a market for low-emission steel and motivating private sector participation.

- Green hydrogen initiatives

India is driving the adoption of green hydrogen to produce less-emission steel, as it can substitute part of coal in the Direct Reduced Iron (DRI) process and reduce carbon in steel factories. In October 2025, the Punjab Energy Development Agency (PEDA) and the Indian Institute of Science (IISc) in Bengaluru signed an MoU to initiate a pilot project producing green hydrogen using biomass, in particular, paddy straw. The project can prevent stubble burning and enhance air quality besides providing the steel industry with a constant supply of green hydrogen. It endorses the application of green steel technologies and the intention to reduce emissions.

Major investments driving India’s steel sector

India’s steel industry is receiving large investments, both private and government, to increase capacity, modernise operations and make the production processes greener.

In April 2025, ArcelorMittal Nippon Steel India announced a Rs. 60,000 crore (US$ 6.76 billion) investment to increase the capacity of its Hazira facility to 15 MTPA by FY27, with 70% of production under the Green Steel Taxonomy in India.

Over the next three to four years, JSW Steel is set to invest over Rs. 50,000 crore (US$ 5.63 billion) to construct up to 10 MTPA of green steel capacity in the vicinity of its Salav plant in accordance with international low-carbon regulations, as announced in April 2025. The JSW Group has also declared a Rs. 1,00,000 crore (US$ 11.6 billion) 25 MTPA plant in Gadchiiroli, Maharashtra, and a 13.2 MTPA plant in Jagatsinghpur, Odisha, with a total investment of 65,000 crore (US$ 7.8 billion), generating substantial employment and supporting the growth and sustainability targets of the sector.

In February 2025, approximately half of the Rs. 26,000 crore (US$ 3.02 billion) of investment offers the Jharkhand government received at the Bengal Global Business Summit were steel-related.

These investments demonstrate the strong growth trend of the sector and its alignment with the national development and sustainability objectives.

The road ahead

The Indian steel industry is projected to expand. The strong growth is driven by high domestic demand, supportive government policies and large private investments. Initiatives like SIMS, NSP, PLI Scheme, DMI&SP policy and the green steel roadmap assist in modernising the industry, making India more independent and production environmentally sustainable. Large corporations such as JSW Steel and ArcelorMittal Nippon Steel India are adding capacity, promoting green steel and generating numerous jobs. As the country continues to invest in road construction, factories and new technology, India’s steel industry will likely play a significant role in the economy, complying with international low-carbon and sustainability standards.

FAQs

What is the DMI&SP policy?

The Domestically Manufactured Iron & Steel Products (DMI&SP) policy mandates central government entities to procure steel products entirely made in India, promoting self-reliance.

How does the PLI Scheme support steel manufacturing?

The Production-Linked Incentive (PLI) Scheme incentivises domestic production of specialty steel, attracting investments and generating employment.

What are India’s green steel initiatives?

The government promotes low-carbon steel via green hydrogen, carbon capture, renewable energy and public procurement of green steel.

What is the role of SIMS?

The Steel Import Monitoring System (SIMS) regulates imports to protect domestic producers from unfair trade practices.

Which major investments are shaping India’s steel sector?

JSW Steel and ArcelorMittal Nippon Steel India are expanding capacity and green steel production with investments exceeding Rs. 1,15,000 crore (US$ 14 billion).