SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (14)

- Trade (5)

India’s Artificial Jewellery Market Boom: Affordable Fashion Fuelling Domestic and Export Demand

- Dec 18, 2025, 10:00

- Consumer Markets

- IBEF

The market of artificial jewellery in India is expanding rapidly. An increasing number of people are growing fond of fashionable yet affordable accessories. Imitation jewellery, which was initially a niche segment, is currently popular with many individuals in cities and towns. Evolving fashion preferences along with more earning power and social media have contributed to this trend. As a result, artificial jewellery is being worn daily and not just during leisure events.

This trend has been accelerated by online stores, with a wide range of designs easily available to shoppers. E-commerce assists brands to access the youthful generation that is concerned about style. It also provides tailor-made designs and new fashions, which offline stores may not be able to provide. Moreover, the fact that artificial jewellery is cheap, available in a variety of options and readily available, makes more people purchase it in India. This has turned India into a powerful player in the global costume jewellery industry. India is a land of skilled workers, inexpensive production and a shifting group of customers which give rise to the artificial jewellery market.

Market outlook

The market of artificial jewellery in India is growing due to the desire of customers to have stylish and inexpensive accessories. The broader gems and jewellery business exported Rs. 2,43,162 crore (US$ 28.5 billion) in FY25 indicating strong global demand for India’s ornament craftsmanship.

The artificial jewellery market in India is expected to expand at a compound annual growth rate (CAGR) of 11.4% over 2025 to 2029 by Rs. 10,280 crore (US$ 1.16 billion). Its growth is largely driven by the rising demand for affordable fashion accessories, increased online purchases and shifting preferences of younger consumers.

Government initiatives are also playing a crucial role in supporting this growth. The Maharashtra state cabinet has approved a dedicated policy allocating Rs. 13,800 crore (US$ 1.56 billion) for the gems and jewellery sector from 2025 to 2050. The policy aims to boost the sector’s exports to Rs. 2,65,860 crore (US$ 30 billion) within five years, attract Rs. 1,00,000 crore (US$ 11.28 billion) in investments and generate five lakh new jobs. Additionally, Tamil Nadu is also establishing a modern jewellery park in Coimbatore to assist the craftsmen who are impacted by the high prices of gold and low orders.

These developments indicate a promising future of the artificial jewellery market in India, where the local demand, export and government assistance have contributed to a steady growth.

From local to global: India’s export story

India's artificial jewellery sector has evolved from a domestic staple to a prominent player in the global market. In FY25, the country exported Rs. 1,154 crore (US$ 136 million) worth of imitation jewellery.

The United States (US), Spain and the United Kingdom (UK) are the major purchasers who collectively receive majority of the exports. Other key markets include the United Arab Emirates (UAE), Netherlands, Canada, Australia, France, Italy and Nigeria, which have their own preferences and are boosting demand of Indian artificial jewellery. In April 2025, the exports to the US, Spain and the UK were approximately Rs. 34 crore (US$ 3.88 million), indicating high demand in these countries.

India exported 5,048 consignments of artificial jewellery to 625 customers worldwide between June 2024 and May 2025, 12% higher than last year. The US, the UAE and the UK were the leading destinations.

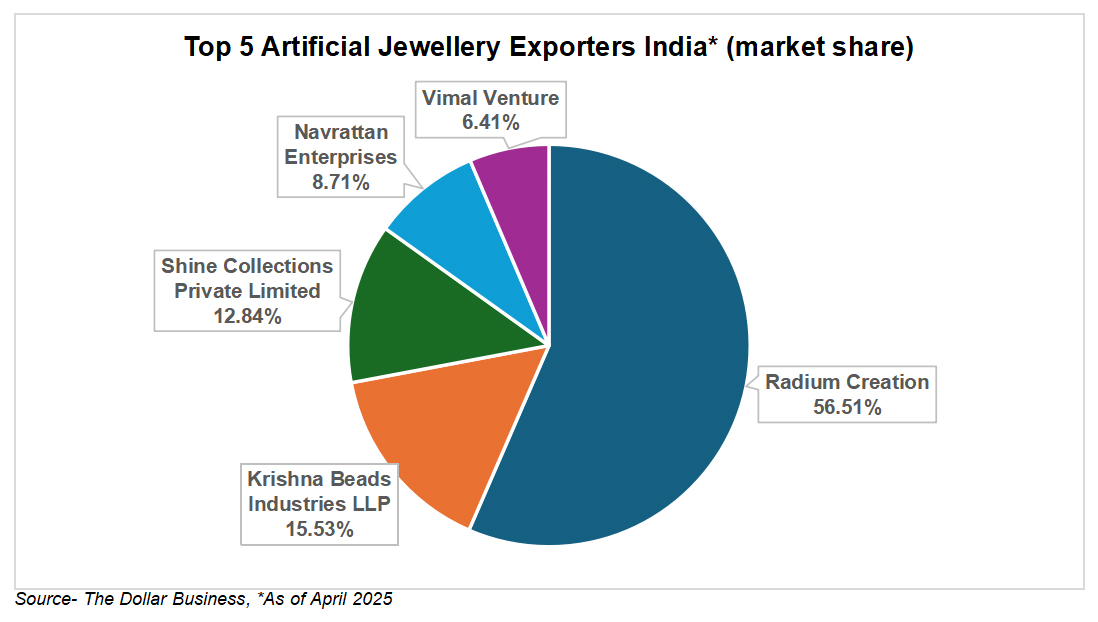

The Dollar Business reports that the five leading exporters in April 2025 were Radium Creation (56.51%), Krishna Beads Industries LLP (15.53%), Shine Collections Private Limited (12.84%), Navrattan Enterprises (8.71%) and Vimal Venture (6.41%). They are jointly increasing the market share of India in the global market of artificial jewellery with numerous stylish and eco-friendly designs.

This growth is also assisted by the government. Gems and Jewellery Export Promotion Council (GJEPC) facilitates exports, serves the interests of small and medium businesses and assists them in gaining exposure to the foreign markets.

The market of artificial jewellery in India is expanding rapidly, owing largely to micro, small and medium enterprises (MSMEs) and digital adoption.

From June 2024 and May 2025, India shipped 5,048 consignments to 625 customers across the globe, a 12% rise over the previous year. In May 2025 alone, 403 shipments were exported - an 8% increase over May 2024 and a 31% increase over April 2025.

MSMEs and digitalisation drive India’s artificial jewellery

The market of artificial jewellery in India is expanding. This growth is fuelled by MSMEs, and more customers are resorting to online platforms. Thousands of artisans are supported by these MSMEs, and they make numerous designs to address the needs of the people. These MSMEs are highly adaptable. They pay attention to what the customers desire and incorporate these preferences in their collections.

The market is further being transformed by digital adoption. E-commerce platforms such as Amazon, Flipkart and Myntra enable artificial jewellery makers to target customers in a short time. Instagram and Pinterest allow the brands to speak to fashion-conscious individuals. Influencers assist in the decision-making process of purchases and increasing the visibility of the jewellery.

The artificial jewellery market in India is gaining strength within the country through the integration of small-scale production, new designs and internet penetration. Hence, it not only generates employment but forms a foundation of consistent growth.

Major private investments

The artificial jewellery sector in India is attracting substantial amounts of private investments, indicating strong investor confidence and supporting rapid expansion, digital adoption and product innovation.

Private investments:

- In September 2025, Lucira Jewelry raised Rs. 49 crore (US$ 5.5 million) in seed funding led by Blume Ventures and Spring Marketing Capital. The funds will enable Lucira Jewelry to open four flagship stores by FY26 and upgrade its online platform with intelligent and personalised capabilities to address evolving demands of customers.

- In August 2025, a celebration-wear jewellery startup, Nuyug, secured Rs. 2.5 crore (US$ 0.28 million) in a pre-seed funding round led by A Junior Venture Capital (AJVC) and angel investors. The funds will assist the startup to expand its online and physical stores, introduce more products and invest in research, development and design to enhance product quality and life.

- In August 2025, a demi-fine jewellery brand, Palmonas, raised Rs. 55 crore (US$ 6.21 million) in a Series A funding round led by Vertex Ventures Southeast Asia and India. This follows a previous Rs. 1.26 crore (US$ 0.14 million) investment from Shark Tank India.

- In June 2025, Aukera, a lab-grown diamond jewellery brand, has raised Rs. 28 crore (US$ 3.2 million) from investors including Fireside Ventures. The company produces sustainable and affordable luxury jewellery.

These investments are accelerating growth and novelty in India’s artificial jewellery market. It also renders the market as vibrant and competitive in the global market.

The future of India’s artificial jewellery market

The market of artificial jewellery is evolving rapidly in India. It is affordable, quality-focused and employs new digital innovation. The jewellery is still mostly made by small businesses. Social media and online stores assist more individuals in making purchases and choosing what they desire. India is a major exporter to the US, UK and the UAE indicating its good international presence.

Market growth is accelerating with the help of private investments and technological innovations. These investments and innovations allow brands to develop, provide superior products and engage customers with fashionable and environmentally friendly designs. Moreover, government initiatives assist the artificial jewellery sector in generating employment, motivating new entrepreneurs and enhancing the reputation of India in the global costume jewellery industry. With the combination of all these factors, the market is prepared to expand further. Hence, the future of investors, producers and shoppers in India’s artificial jewellery market is bright and promising.

FAQs

Why is India’s artificial jewellery market booming?

Affordable fashion, rising disposable incomes, social media trends and growing consumer awareness are driving unprecedented growth.

Which countries import Indian artificial jewellery the most?

The US, UK and UAE lead imports, with Europe, Canada, Australia and Africa showing increasing demand.

How do MSMEs shape the industry?

MSMEs support thousands of artisans, produce trend-driven designs and leverage e-commerce to reach urban and semi-urban consumers efficiently.

What impact do private investments have on the sector?

Funding boosts retail expansion, strengthens online platforms, improves design innovation and enhances overall competitiveness in domestic and global markets.

How is technology changing consumer experiences?

Digital tools, social media and e-commerce platforms enable virtual try-ons, personalised shopping and direct engagement with fashion-conscious buyers.