SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (68)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (24)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (33)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (17)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (6)

- Tourism (13)

- Trade (5)

Regional Rural Banks: Strengthening Financial Inclusion and Driving Rural Development in India

- Jul 09, 2025, 17:00

- Banking and Financial services

- IBEF

Regional Rural Banks (RRBs) were established in 1975 to provide financial services to rural areas. They mainly focus on offering services relevant to the needs of small and marginal farmers, agricultural labourers, artisans and rural entrepreneurs. Today, RRBs stand as important institutions contributing towards the progress of rural development.

A historical overview and evolution

Originally, RRBs were set up to be the coordinates that connected available offers at commercial banks and cooperative banks with rural areas. Governed by the RRB Act (1986), the central government—usually in association with a sponsoring bank—was empowered to set up these banks in each state or union territory. These sponsor banks not only subscribe to share capital but also assist in establishing operations, recruiting and training the staff. In their early years, the focus was on agricultural loans. However, with the banking sector reforms of the late 1990s and increased competition from commercial banks, their traditional operating model came under pressure. Yet, RRBs have carried forward their basic belief to adapt, keeping in mind the changing dynamics of banks despite challenges, such as low operating margins and a falling Credit-Deposit (C/D) ratio.

How RRBs work

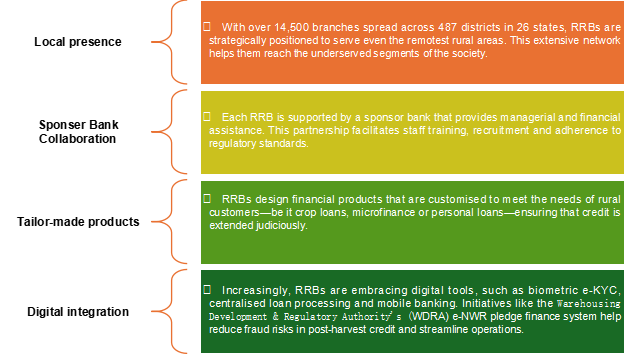

RRBs are structured to operate within local limits as defined by government notifications. Their working model is unique for several reasons:

Financial performance and key metrics

Evaluating a bank’s financial health involves several pivotal measures that characterise the bank's ability to lend, make profits, ensure viability and manage deposits. In the case of RRBs, these indicators give insight into their involvement in rural development.

- Credit disbursement

There has been a consistent rise over the years in the loan disbursements made by RRBs, continuing its commitment towards rural development. In the year 1979-80, RRBs disbursed loans worth Rs.173 crore (US$ 19.9 million), growing to Rs. 3,57,076 crore (US$ 41.10 billion) for the FY22, indicating an increasing thrust in rural financing. It is also important to note that disbursements have reached a level beyond Rs. 50,000 crore (US$ 5.76 billion) post-2007-08, thus making a meaningful inflow of credit into the rural economy.

The impact of these loans extends beyond mere numbers. More credit has allowed farmers to modernise agricultural practices, improve irrigation, and develop infrastructure, contributing to greater productivity and increased income. For example, in FY23, gross loans by RRBs grew 13.2% YoY to Rs. 4,11,000 crore (US$ 47.31 billion). This increase demonstrates the commitment of RRBs to revitalize rural economies with customised financial support over time. Studies have shown that the RRB's agricultural loan scheme leads to increased agricultural production and increased income levels for farmers. By providing customised financial products and services, RRBs meet local needs so that economic and social development can take place.

- Profitability

Profitability shows how efficiently a bank generates earnings from its operations. As on March 31, 2023, RRBs registered an all-time high consolidated net profit of Rs. 4,974 crore (US$ 572.5 million), reflecting a 54.5% increase over the previous year. The recovery was possible due to better functioning and steady management practices, enabling these banks to plough back money into rural development. During FY23, the total business of RRBs crossed Rs. 10,00,000 crore (US$ 115.10 billion) with a YoY growth of 10.1%.

- Capital adequacy and asset quality

The Capital to Risk-Weighted Assets Ratio (CRAR) represents a bank's ability to absorb potential losses. With a CRAR of 13.43%, RRBs have a strong capital base, adding stability, even during financial stress. In conjunction with the gross Non-Performing Asset (NPA) ratio, now standing at 7.28%, this scenario demonstrates improved asset quality and risk management. All things considered; these indicators show that RRBs are not only growing but doing so responsibly.

- Credit-Deposit ratio

This ratio represents loans disbursed per deposits received and indicates how well the bank uses deposits to lend productive loans. The consolidated C/D ratio stands at 71.2% as of March 2024, indicating that RRBs are effectively using their funds to advance credit in support of rural enterprises and households.

Role in financial inclusion and rural development

RRBs have a profound impact on the rural economy. About 70% of their credit is directed toward the agriculture sector, with 64% going toward weaker sections, such as small and marginal farmers. Custom designed financial products allow RRBs to spread their branch network to remote rural areas, offering basic banking services. Thus, they act as facilitators of financial inclusion to ensure socio-economic development in rural communities by modernizing traditional agriculture and fostering rural entrepreneurship.

Challenges

- Underutilisation of deposits

The Credit-Deposit (C/D) ratio, a key indicator of lending efficiency, has shown a downward trend. Despite mobilising substantial deposits, many RRBs are not fully leveraging these funds for rural lending. This underutilisation is partly due to a growing preference for investing in government securities, which are considered a safer option over extending direct credit to rural borrowers.

- Shift in investment strategy

Factual data indicate that RRBs have increasingly allocated funds to government and approved securities rather than lending. While this improves asset safety, it compromises their primary mandate of providing credit to rural areas. This deviation is a significant concern, given that their core mission is to serve the unbanked rural population.

- Operational inefficiencies

High employee costs outdated in-house processes, and fragmented systems contribute to operational inefficiencies. The consequences are low staff margins and higher attrition rates. Without streamlining operations—through technology adoption and process re-engineering—RRBs struggle to meet the dynamic credit needs of rural customers.

- Competitive pressure

The pace of digital transformation makes for highly competitive markets in which commercial banks and fintech companies are gradually assuming a larger share. This poses a direct threat to the traditional, process-driven RRB model, which has been slow to embrace new technological tools, for the very reason that these institutions can very quickly offer digital solutions and innovative financial products to increase market adoption.

- Regulatory constraints

Strict regulatory frameworks are vital for the stability of the financial system; however, they highly restrict the flexibility of operations. Compliance requirements could delay innovation and deprive RRBs of the ability to quickly adapt to changing market conditions.

Government initiatives

To counter these challenges and rejuvenate RRBs, the Government of India has launched several initiatives:

- Enhanced Access and Service Excellence (EASE)

This initiative focuses on modernising RRB operations through digital integration, improved governance and customised financial products. Recent reforms have led to an increase in the CRAR (from 7.8% in FY21 to 13.7% in FY24), along with a significant turnaround in net profit figures.

- Digital transformation

Upgrading digital platforms, such as biometric e-KYC, centralised loan processing and mobile banking, is crucial. The WDRA’s e-NWR pledge finance system, for instance, is transforming post-harvest credit processes by reducing fraud and improving operational efficiency.

- Focused outreach and product diversification

High-level meetings chaired by Union Finance Minister, Ms. Nirmala Sitharaman have emphasised expanding digital services, increasing outreach to Micro, Small and Medium Enterprises (MSME) clusters, and promoting schemes such as PM Surya Ghar Muft Bijli Yojana and One District One Product (ODOP) to boost rural credit penetration.

Through such initiatives, RRBs can address operational inefficiencies and competitive pressures, realigning their investment approach to ensuring that deposits will serve their primary objective of rural development.

Conclusion

Regional Rural Banks (RRBs) in India have come a long way since their inception in 1975. Serving the cause of rural India through economic and social development, RRBs have a business volume of over Rs. 11,00,000 crore (US$ 126.61 billion), indicating improvements in profitability and asset quality. However, challenges such as underutilisation of funds, poor operational efficiencies and competition stress the need for continued reforms and digital transformation within RRBs. Their governance must be strengthened, further operationalised, and modernised with technology to allow RRBs to serve their purpose of financial inclusion and the sustainable development of rural areas. Their evolution reflects a critical balancing act between preserving their core mission and adapting to a rapidly changing financial landscape. This balancing act will continue to rewrite the destiny of rural banking in India.