SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (14)

- Trade (5)

Neobanks Rising: Millennial Banking in a Digital-First India

- Nov 11, 2025, 11:40

- Banking and Financial services

- IBEF

India’s youthful population is the cornerstone of its digital transformation. As the world’s most populous nation, India boasts an uneven share of tech-savvy citizens, with millennials and Gen Z leading the charge. Ambitious technology goals such as a Rs. 25,71,600 crore (US$ 300 billion) electronics manufacturing target by 2026 and a booming Information Technology (IT) sector underscore how India is harnessing its young workforce. This tech-savvy generation sees India as a “digital superpower”. As the country moves forward in its Digital India era, neobanking is capturing the interest of the Gen Z and millennials. Today, India has more than 21 neobank ventures.

What are neobanks and their global evolution

Neobanks are fully digital banks with no physical branches. The first neobank was First Direct in the UK (1989). The term “neobank” only gained prevalence around 2017. What sets neobanks apart is their streamlined, user-centric design. Without branch overheads they can offer much lower fees and often higher interest rates than traditional banks. These apps handle everyday banking from accounts, payments and savings from the comfort of a smartphone. Many leverage advanced technologies like artificial intelligence (AI), big data analytics and cloud computing to personalise services. In other words, neobanks simplify banking and make it highly convenient. Account setup is entirely online and immediate, and customers receive real-time transaction alerts and easy access to budgeting tools or trading apps. This mobile-first design with intuitive interfaces is very attractive to on-the-go millennials. By avoiding branches, neobanks cut costs and pass the savings to users via free or low-cost services.

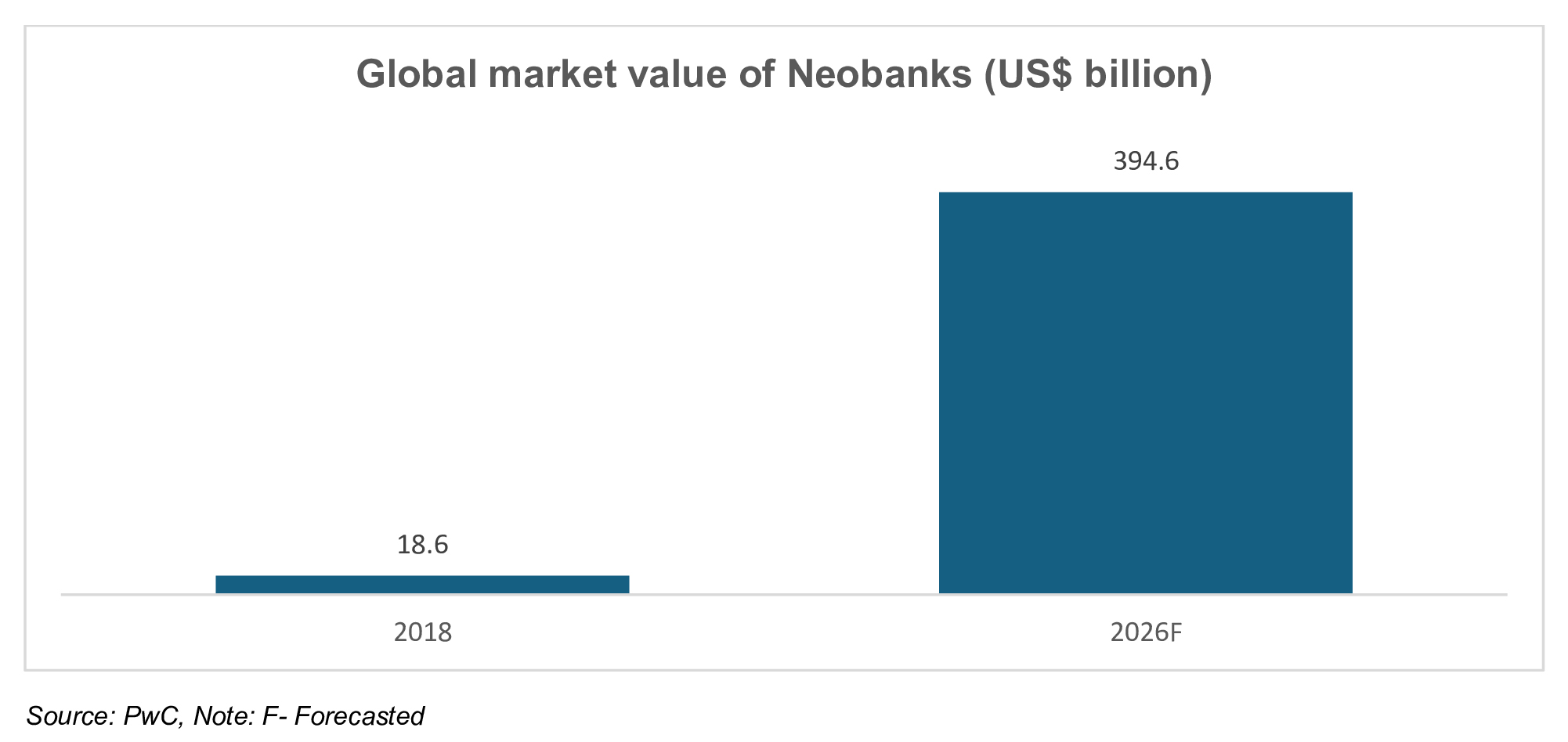

Internationally, the market for neobanks has surged in value. It was ~Rs. 1,59,439 crore (US$ 18.6 billion) in 2018 and is expected to expand at ~46.5% per year until 2026, jumping towards ~Rs. 33,85,940 crore (US$ 395 billion). This boom is driven by several factors:

- Young professionals and tech-savvy users favour the ease of app-based banking.

- Freelancers and small businesses with irregular income appreciate flexible, low-cost financial tools.

- Hundreds of millions of dollars in fintech investments have poured into neobanks and related startups.

- Neobanks in United Kingdom and Germany have shown how this model can scale globally.

Neobanks in India

India’s neo-banking ecosystem has grown rapidly, with a diverse mix of digital-only banks (partnering with existing lenders) serving different customer segments. For example, consumer neo-banks like Fi Money and Jupiter (each backed by Federal Bank) offer zero-balance savings accounts with attractive returns.

- Fi Money provides upto ~5.1% interest on savings, while Jupiter’s automated “pots” earn ~2.5% interest (plus 1% cashback on UPI/debit spends).

- On the business side, platforms like RazorpayX and Open (teaming with IDFC First Bank and ICICI Bank) deliver full-featured SME banking suites – covering payroll, invoicing, taxes, etc.

- Other neo-banks target specific niches: Niyo (with YES Bank/DCB Bank) offers multicurrency forex cards and saving tools for travellers; youth-oriented apps like Akudo (and FamPay) provide teen prepaid cards and gamified saving to teach financial habits; Mahila Money focuses on women entrepreneurs (via an NBFC tie-up) with easy, collateral-free loans; and ZikZuk serves startup founders with dedicated founder credit cards and business loans.

Each of these neo-banks emphasises secure, 24/7 mobile banking and innovative features (often in partnership with traditional banks) to broaden financial access across India.

Digital infrastructure paving the way

The bedrock of this transformation is a robust digital public infrastructure. Innovative frameworks like the Unified Payments Interface (UPI) and Aadhaar have emerged as the backbone of India's fintech ecosystem. UPI's smooth, around-the-clock payment platform and Aadhaar's all-encompassing digital ID have greatly boosted the country's financial inclusion, channelling their money into the banking system smoothly. In a survey, 97% of users felt that UPI and Aadhaar had improved their lives. Such platforms have lowered barriers to financial services and paved the way for innovative banking solutions.

Neo banking’s growth trajectory in India

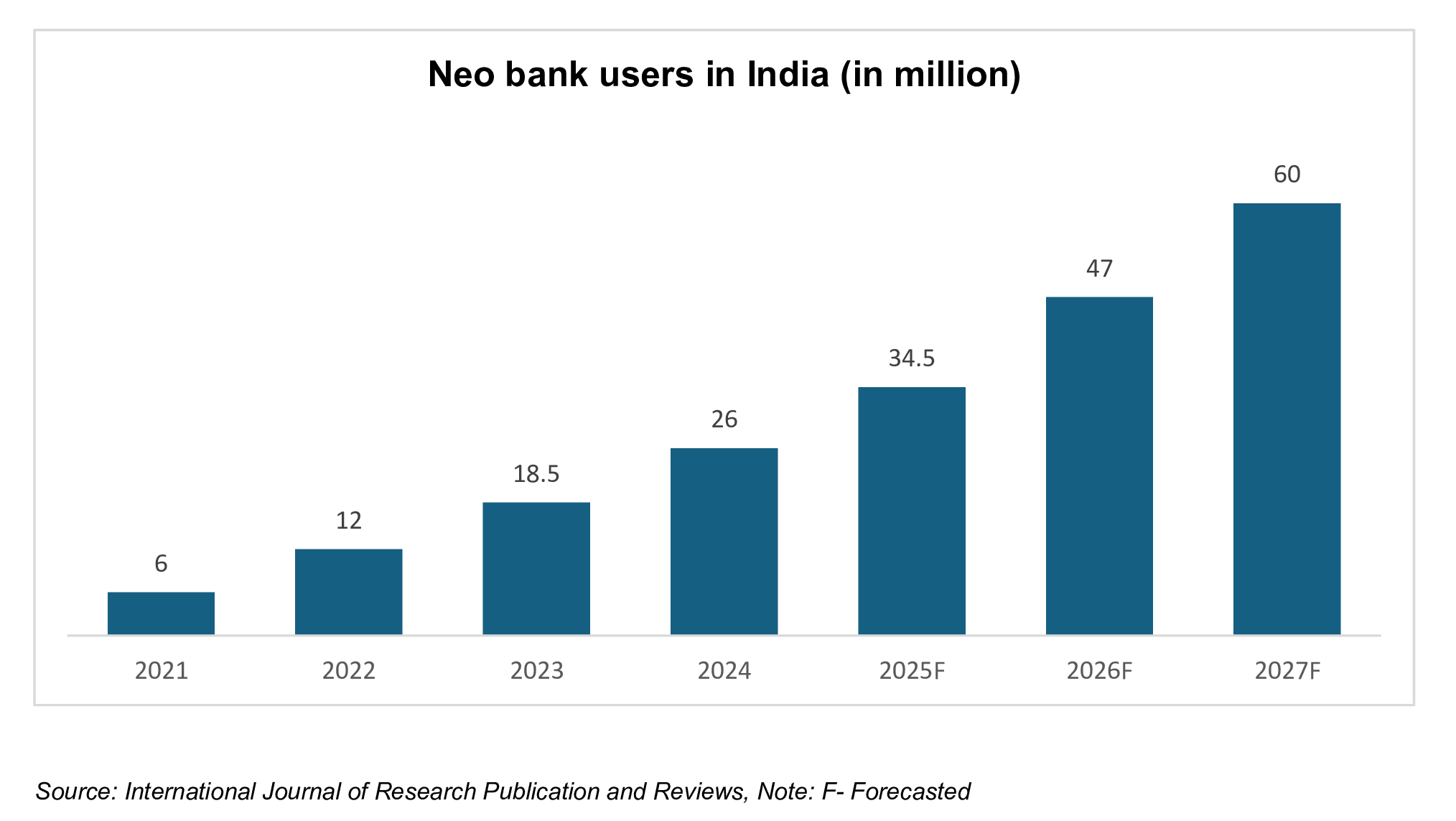

India’s neo-banking sector is on a steep upward curve. From ~6 million users in 2021, the number is projected to reach ~60 million by 2027, a tenfold jump in six years. This surge reflects growing trust in digital banking and wider financial inclusion. There are currently over 20 neobanks in India, many targeting urban millennials, freelancers and small enterprises. India’s strong mobile internet penetration and smartphone use support this trend, making it easy for neobanks to onboard customers easily.

Why millennials and Gen-Z prefer neobanks

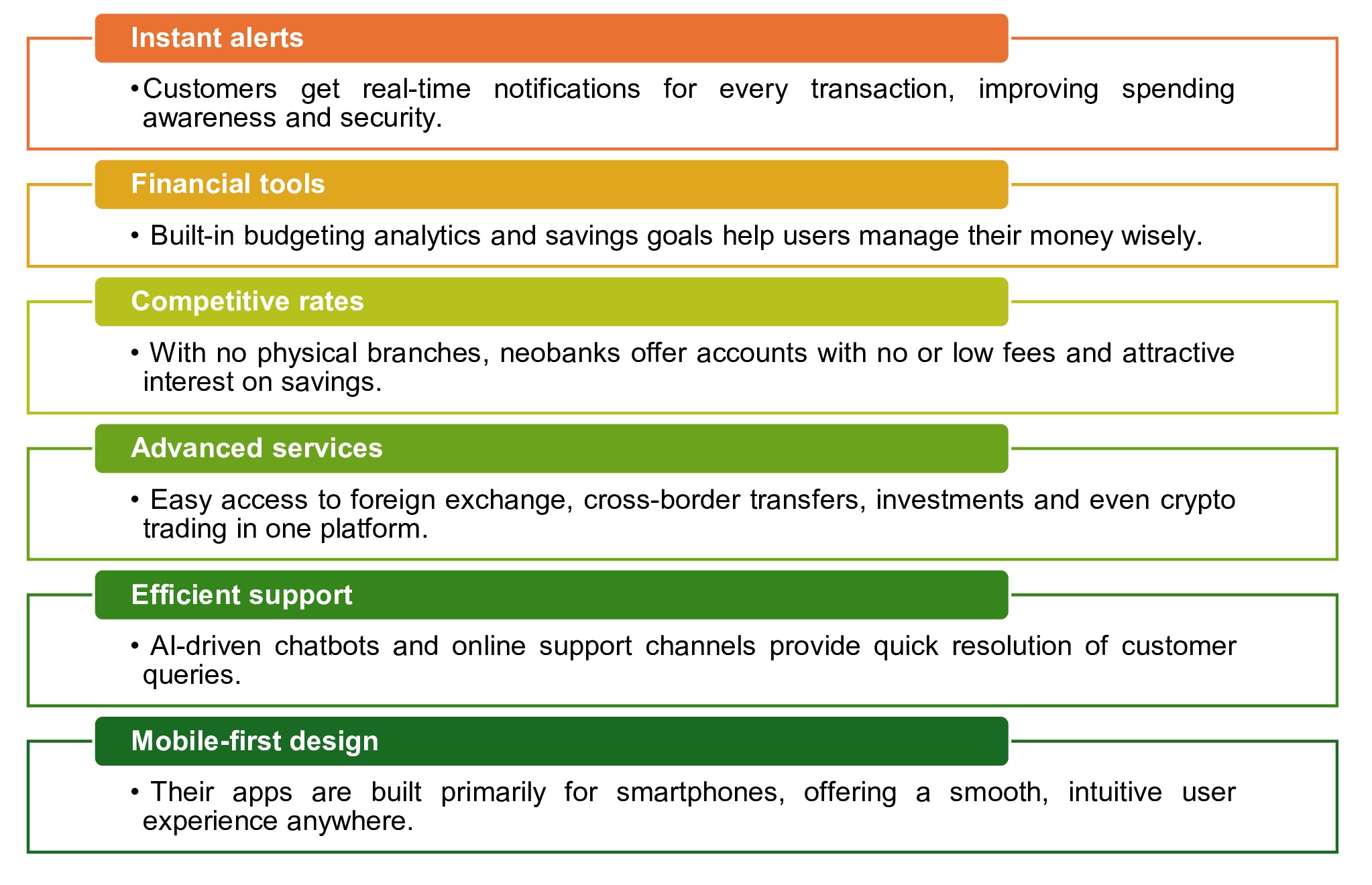

Neobanks are preferred by young Indians because they cater to a digital lifestyle. Born in the smartphone era, this generation anticipates services that are instant and available on demand. Neobanks meet these expectations by offering:

- Convenience: Fully mobile banking means no branch visits and quick app-based account setup.

- Low costs: Many neobank accounts have minimal or zero fees and higher interest rates, thanks to low overhead.

- User-friendly features: Simple app interfaces, instant transaction alerts, and built-in budgeting tools help users manage money easily.

- Modern offerings: Access to investments, stock trading and cryptocurrencies directly from the app.

Key innovations and differentiators of neobanks

Neobanks distinguish themselves from traditional banks through a few key innovations:

Prospects: AI, inclusion and partnerships

Neobanks have already broadened financial inclusion by offering app-based, no-frills banking services to India’s digitally-savvy youth and freelancers. The fully digital, app-based model resonates with India’s young consumers and their lifestyle. Many people appreciate the convenience of banking from home. In fact, neobank apps are explicitly designed for mobile devices, making financial management easy for customers on the go. Surveys indicate that customers, especially younger ones, are steadily migrating toward “online-only” platforms.

Several trends support a bright outlook. First, internet and smartphone coverage in India continue to expand, creating new customer pools. Neo-banks are in a strong position to attract first-time users and those who do not currently hold bank accounts. Second, since India is highly receptive to rapidly advancing technological innovations, neo-banks are leading the way in seamlessly integrating AI to offer a cleaner and simpler interface that appeals to millennials and Gen Z. For example, many neo-banks have adopted chatbots that provide instant support for customer queries. Third, partnerships are evolving into rich ecosystems. Neobanks collaborate with fintech firms, insurers and retailers to broaden offerings without heavy infrastructure. For instance, some now provide mutual funds and insurance via third-party tie-ups. This lets them bundle banking, shopping and travel rewards into one app. All this places neo-banks in a strong position to grow among youngsters, with millennials and even Gen Z increasingly using these services.

FAQs

What is a neobank?

A neobank is a fully digital bank with no physical branches. A neobank in India operates entirely online through apps, offering easy account setup, low fees and smart tools for digital banking.

What is neobanking and how does it work?

Neobanking uses technology to deliver banking services on smartphones. Unlike traditional banks, digital banks in India cut branch costs and offer faster, cheaper banking with instant UPI, savings and spending insights.

Which are the top neobanks in India?

Top neobanks in India include Fi Money, Jupiter, Niyo, Open and FamPay. These Indian neobank options serve millennials and Gen Z with secure, app-based banking tailored for a Digital India.

Why are neobanks popular for digital banking in India?

Young Indians choose neobanks for hassle-free digital banking. With smart apps, 24/7 access and zero-balance accounts, they fit perfectly into India’s push for digitalisation in banking.

What is the future of neobanking in India?

Neobanking in India is growing fast. From six million users in 2021 to 60 million by 2027, Digital banking and mobile use drive this growth.