SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (34)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (68)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (24)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (33)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (17)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (7)

- Tourism (14)

- Trade (5)

Understanding Aviation Leasing and Financing: The Role of GIFT IFSC

- Aug 11, 2025, 13:20

- Consumer Markets

- IBEF

Given the fact that a single commercial aircraft can cost between Rs. 432 crore (US$ 50 million) and Rs. Rs. 864 crore (US$ 100 million), no airline would want to tie up all its capital in every new airplane that it needs. Instead, airlines select lease arrangements through which costs are spread over many years. This approach not only ensures cash flow preservation but also provides flexibility to renew and grow fleets in line with market demand. In addition, financing arrangements, where banks or investors provide funds for these leases, also play an important part in making sure airlines have the capital needed to be competitive in operations.

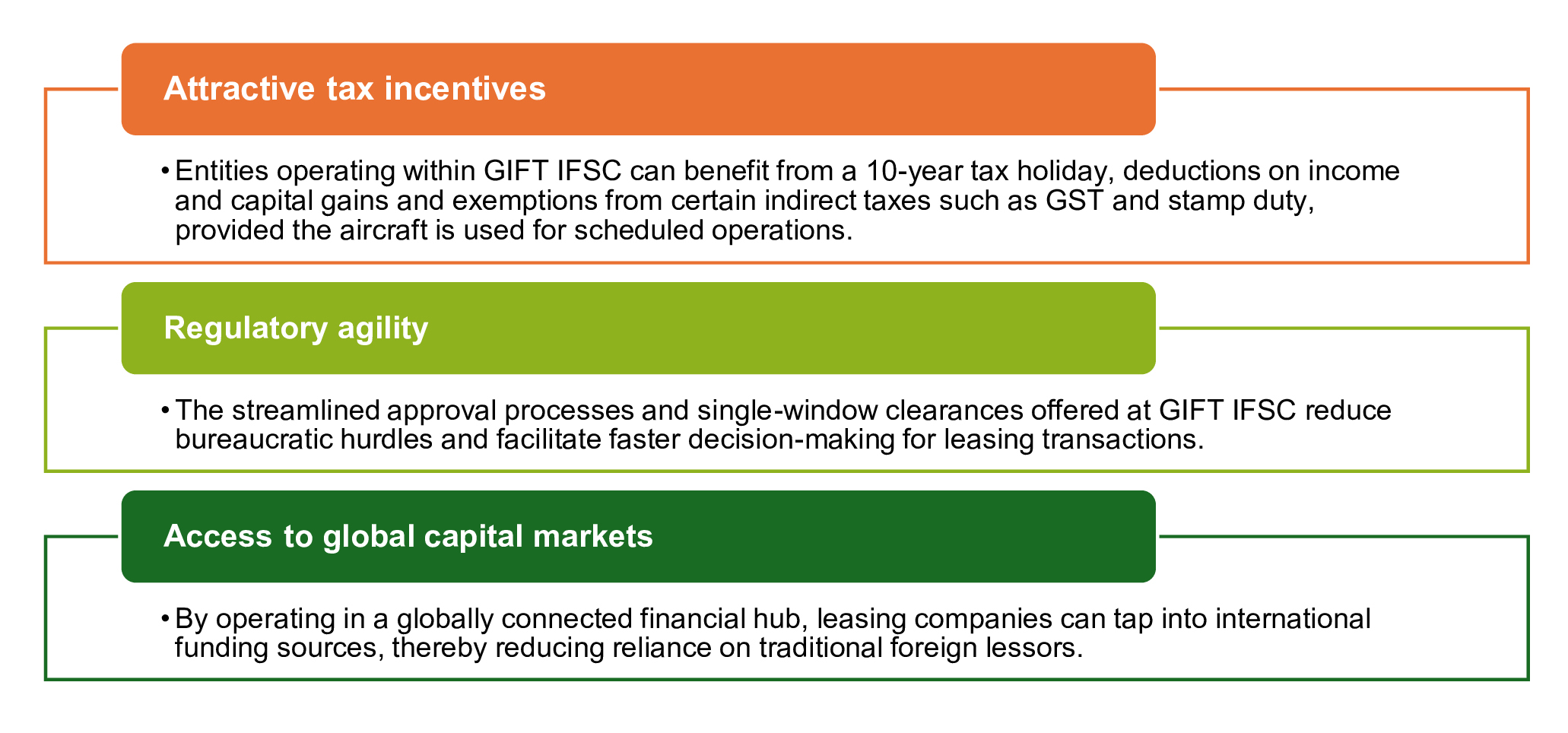

Gujarat International Finance Tec-City International Financial Services Centre (GIFT IFSC), established in Gujarat, India, aims to modernise the leasing and financing activities in the Indian aviation arena. With tax breaks, relaxed regulations and access to international capital, GIFT IFSC is set to emerge as the most important location for aircraft leasing, taking away India's historical dependence on foreign lessors and aiding the country's bigger aviation dreams.

The need for aircraft leasing

High capital costs and financial flexibility

Aircrafts are one of the most expensive assets that airlines manage. The cost of purchasing a new airplane can be prohibitively high, often reaching hundreds of millions of dollars. Leasing provides an alternative that allows airlines to avoid these substantial upfront investments. Instead of purchasing, airlines “rent” the aircraft for a defined period. This method:

- Spreads costs over time: Leasing allows the airlines to spread the cost of an aircraft over many years, facilitating cash management.

- Preserves working capital: Airlines may not allocate huge sums of money to asset purchases but instead use that money for other critical areas such as route development, improving customer service or upgrading technologies.

- Provides flexibility: Airlines can change their fleet size or upgrade their aircraft with minimal concern about bearing the cost of long-term ownership, enabling them to closely match market conditions.

Types of leasing models

Understanding the different models of aircraft leasing is essential for appreciating how each addresses the financial needs of airlines:

- Financial lease

Here the leasing company directly buys the aircraft from the manufacturer and leases it to the airline. The arrangement usually includes an option for the airline to acquire the aircraft at a predetermined price at the end of the lease term. The airline usually assumes responsibilities such as maintenance, thus making this leasing arrangement a form of long-term loan.

- Operational lease

Under operational lease, ownership and associated risks are retained with the leasing company; the airline simply uses the aircraft for a specific period. This, therefore, seems best suited for airlines that want to quickly adjust capacity without being tied into a long-term lease. It is very useful in instances requiring a speedy efficient fleet expansion or short-term capacity adjustments

- Sale and leaseback model

In the sale and leaseback (SLB) model, the airline first purchases the aircraft and sells it to a leasing company, which then leases it back to the airline. By employing this creative technique, the airline takes a large asset off its balance sheet, thereby reducing debt and aiding financial health, while still being able to exercise operational control over the aircraft.

Global leasing: Learning from international best practices

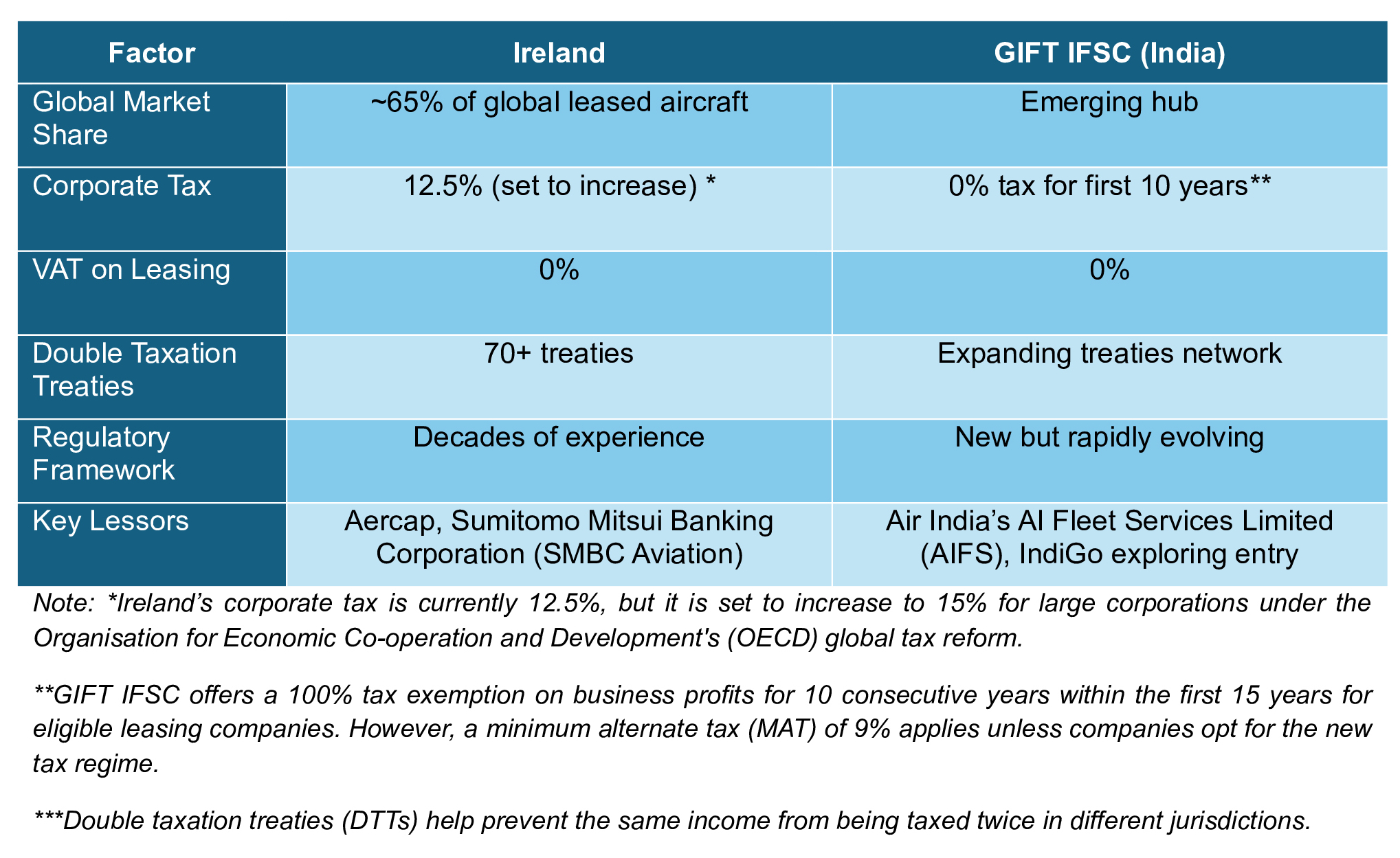

Countries such as Ireland have long dominated the global aircraft leasing market. Irish lessors benefit from:

- Low corporate tax rates: A reduced tax burden on leasing income makes it an attractive destination.

- Zero VAT on aircraft leasing: Eliminating additional taxes enhances the cost competitiveness.

- Extensive double taxation treaties: Ireland’s network of treaties prevents income from being taxed twice, providing clarity and predictability for lessors.

- Tax neutrality provisions: Such policies ensure that leasing companies operate on a level playing field, regardless of the scale of their operations.

These global practices have set the benchmark, and now India is leveraging its own regulatory frameworks to create a similar, if not superior, environment through the IFSC model.

Comparative Analysis: Ireland vs. GIFT IFSC

GIFT IFSC: Revolutionising aviation leasing in India

A new hub for global financial activity

GIFT IFSC is a pioneering initiative designed to position India as a global hub for various financial services, including aviation leasing and financing. Its benefits include:

Enhanced legal framework and investor confidence

A significant boost for the Indian leasing sector has been the introduction of legal measures such as the Protection of Interests in Aircraft Objects (PIAO) Bill. This bill:

- Strengthens repossession rights: The bill caption provides for clear and fast-track procedures for the lessors to recover their assets in case of any default on the part of the airline.

- Reduces legal disputes: By clarifying the legal framework, it minimises the risk of prolonged legal battles that have historically hampered asset recovery, as seen in cases involving Kingfisher and Jet Airways.

- Boosts investor confidence: The law provides clear backing to attract international as well as domestic investors into the Indian leasing ecosystem, which has become strong and competitive.

Success stories and industry milestones

Axis Bank’s pioneering deal

Axis Bank has recently set a landmark achievement by becoming the first Indian bank to structure an aircraft financing deal through GIFT IFSC. This deal, executed for AI Fleet Services Ltd (AIFS) (the leasing arm of Air India), involves providing a long-term loan to finance 34 training aircraft. The specifics of this transaction include:

- Diverse fleet composition: The agreement contains 31 single-engine planes from Piper Aircraft Corporation and three twin-engine airplanes from Diamond Aircraft.

- Pilot training initiative: The aircraft financed will be sent to Air India's upcoming pilot training institute in Amravati, Maharashtra.

- Reduced reliance on foreign lessors: More than 80% of Indian airlines have leased their fleet from abroad in recent years. This deal is towards domestic financing and leasing, which will mark a move towards self-sufficiency and a reduction in operating costs.

Broader impact on the aviation sector

The development of a local leasing and financing ecosystem at GIFT IFSC is expected to have far-reaching implications:

- Economic growth: A well-functioning leasing ecosystem benefits economic development through cost reductions and fleet expansion, subsequently fostering the broader growth of aviation.

- Job creation and MRO growth: A healthy leasing market encourages growth in the interdependent industries of maintenance, repair and operations (MRO), thereby generating new employment and a stable supply chain.

- Enhanced global competitiveness: As India moves ahead in the modernisation of its aviation sector, a vibrant domestic leasing market should incentivise competition among Indian airlines on the global front, ensuring better connectivity and facilitating international trade.

Market context and outlook

The aviation sector in India is experiencing quite a sizeable growth spurt, with recovering air passenger traffic bringing about massive aircraft orders from most airlines. Air India's recently announced 570 aircraft under its Vihaan.AI transformation strategy highlights the need for efficient financing and leasing solutions.

Looking forward:

- Growing domestic demand: Increasing urbanisation, rising disposable incomes and expanding connecting regional networks are factors expected to drive a boom in air travel demand.

- Strategic investment: With projections indicating a need for substantial investments in fleet expansion—amounting to hundreds of billions of dollars—aircraft leasing remains a cost-effective and flexible solution.

- Enhanced regulatory environment: Continuing refinements of regulatory frameworks as well as proactive measures such as the PIAO Bill will improve the legal operational landscape for lessors.

- Global integration: The more GIFT IFSC integrates with global capital markets, availability of such international funds and competitive financing will only strengthen the cause of India as a key player in the global aircraft leasing market.

Leasing and financing have become almost indispensable in the modern-day airline industry. The strategic move by India to develop a dedicated leasing hub at GIFT IFSC marks an extraordinary phase in its journey toward achieving self-reliance in aviation. The integration of financial innovation, regulatory reforms and international best practices gives GIFT IFSC the advantage of lightening cost burdens from airlines and establishing a vibrant competitive leasing ecosystem.

This integration not only helps foster rapid modernisation and expansion in the aviation sector but also supports larger economic growth by way of improvement in connectivity, job creation and induction into ancillary sectors. GIFT IFSC will play a pivotal role in capital provision and regulatory support for both established and newer players as India's aviation market recovers and rebounds from the effects of the Covid-19 pandemic. Now besides catching up with established leasing hubs such as Ireland, India is also positioning itself towards being a new force in the international aircraft leasing and financing landscape.