RECENT CASE STUDIES

Driving Global: India’s Rising Passenger Vehicle Exports and its Emergence as an Automotive Export Hub

Last updated: Sep, 2025

India’s automotive sector has long been a pillar of its industrial and economic strength. The growing momentum in passenger vehicle exports signals a new chapter in the country's global trade aspirations. The world’s third-largest automobile market by volume, India has evolved from a domestic consumption-driven auto economy to an increasingly important export-oriented manufacturing base. The rise in passenger vehicle exports underscores India's manufacturing competitiveness and its ability to meet global standards in quality, safety, and design.

The automotive industry in India has undergone a remarkable transformation over the past seven decades. In its early years post-independence, India’s vehicle production was tightly controlled, with limited product offerings and high import tariffs. The liberalisation of the 1990s ushered in foreign investments and joint ventures, which enabled access to innovative technology and design, and global best practices. The result was the emergence of a vibrant and integrated auto ecosystem comprising OEMs (Original Equipment Manufacturers), suppliers, testing facilities, and export infrastructure.

Today, India is not only producing vehicles for domestic use but also emerging as a key export hub for compact cars, sedans, SUVs, and increasingly, electric vehicles. Export markets range from Latin America and Africa to Southeast Asia and the Middle East, with Indian-made cars gaining popularity for their affordability, fuel efficiency, and durability. Major manufacturers such as Hyundai, Suzuki, Tata Motors, and Kia are using India as a strategic production and export base for global markets.

The significance of passenger vehicle exports is further amplified in the context of India’s broader industrial and trade policy. Export growth contributes to foreign exchange earnings, job creation, industrial capacity utilisation, and a strong balance of payments. The government has also prioritised the sector under initiatives like ‘Make in India,’ the Production Linked Incentive (PLI) scheme, and FTA negotiations, aiming to position India as a globally competitive, self-reliant automotive powerhouse.

As the global auto landscape shifts toward sustainability, connected mobility, and regional supply chain diversification, India’s role as an automotive export hub is poised to become even more prominent.

India’s automotive industry landscape

India’s automotive industry is one of the largest and most diverse in the world. It is pivotal role in the country’s economic development, contributing ~7.1% to India’s GDP and employing ~37 million people, directly and indirectly. With robust manufacturing capabilities, a well-developed component supplier base, and increasing integration with global value chains, India is positioning itself as a formidable player not only in domestic consumption but also as a global manufacturing and export hub for passenger vehicles.

Domestic Strengths: The foundation of export capability

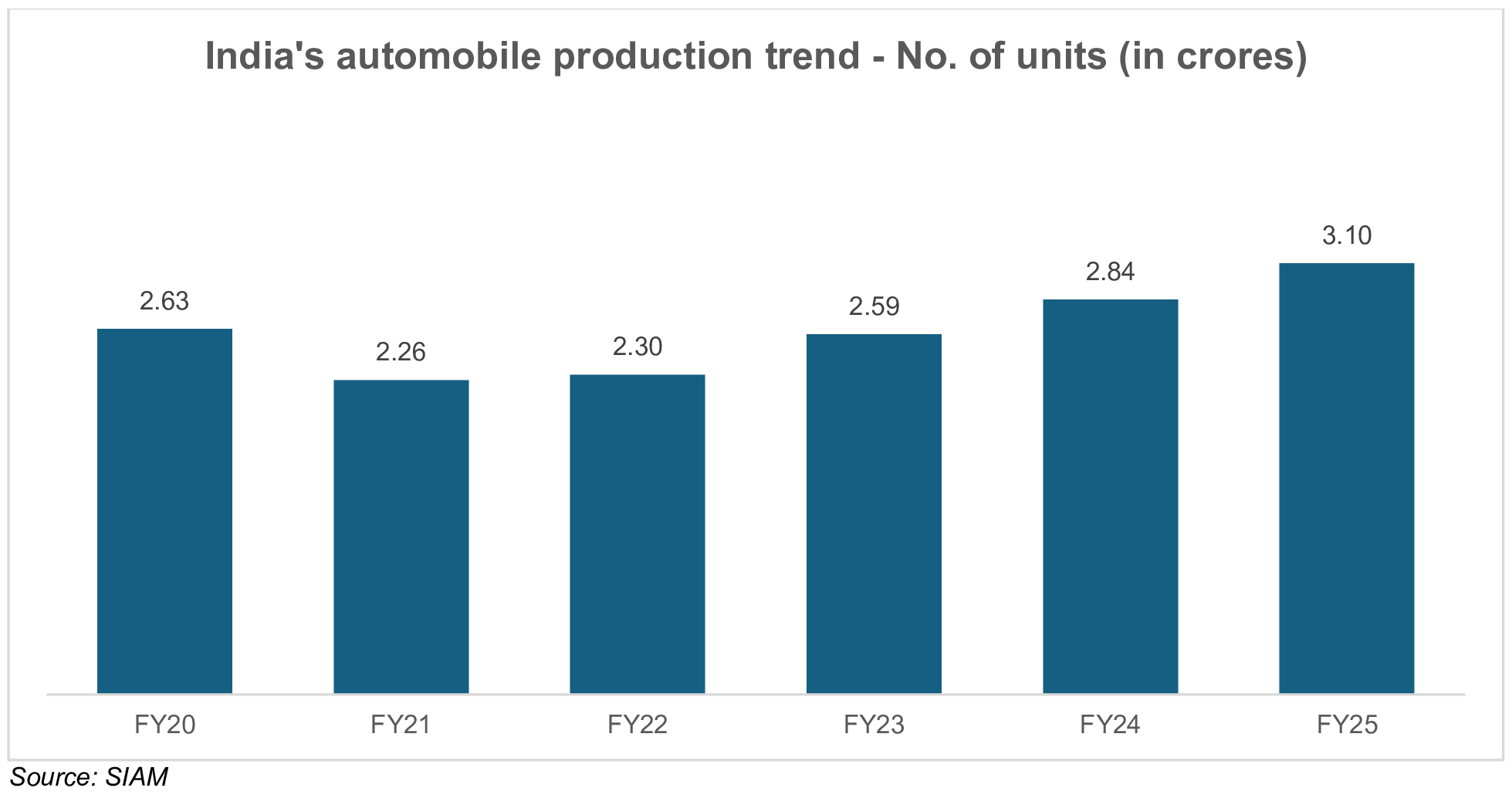

Note: Includes production of Passenger Vehicles, Commercial Vehicles, Three Wheelers, Two Wheelers, and Quadricycles

India’s journey in automotive manufacturing began modestly in the post-independence era, dominated by a few players like Hindustan Motors and Premier. However, the real transformation occurred post-1991 with liberalisation, which invited foreign direct investment (FDI) and technology collaborations. Today, India is home to ~15 global automobile manufacturers who have set up production facilities across the country.

India’s passenger vehicle segment—comprising hatchbacks, sedans, SUVs, and MPVs—has seen exponential growth over the past two decades. Automotive clusters have emerged in Chennai (the Detroit of Asia), Pune, Gujarat, NCR, and Karnataka, offering a complete ecosystem of OEMs, Tier-1 and Tier-2 suppliers, R&D centres, testing facilities, and logistics infrastructure.

Maruti Suzuki, Hyundai, Tata Motors, Mahindra & Mahindra, Kia Motors, Toyota Kirloskar, and Renault-Nissan have built high-capacity production plants geared to meet domestic demand and serve international markets. These plants follow global quality standards, enabling Indian-made vehicles to be exported to ~100 countries.

India’s comparative advantages—cost-effective labour, engineering talent, a wide vendor base, and improving ease of doing business—further strengthen its appeal as a global production base. Compact cars have become India’s forte, aligning with the international demand for fuel-efficient and affordable vehicles in developing and emerging markets.

Future opportunities

While India’s passenger vehicle export ecosystem has witnessed robust growth, the existing challenges also present clear avenues for strategic improvement and value creation. For instance, port congestion and infrastructure gaps, especially during peak export periods, offer opportunities for public-private partnerships to develop dedicated automotive terminals and multimodal logistics hubs. These investments can reduce lead times and improve export efficiency, making India a more attractive hub for global automakers.

Similarly, issues like high shipping costs and limited Ro-Ro vessel availability underline the need to develop indigenous maritime logistics capabilities, including domestic Ro-Ro fleet development. Indian shipping companies can tap into this gap by investing in automotive-specific freight services, boosting both the maritime and auto sectors.

On the regulatory front, customs delays and procedural inconsistencies highlight the scope for deeper digitisation and single-window clearance systems across all ports. These reforms will enhance India's ease of doing business and align with global best practices.

Lastly, the growing global demand for electric and connected vehicles presents India with a chance to become a specialised export hub for EVs, provided the ecosystem evolves with the right battery handling, safety infrastructure, and certification standards.

India’s bottlenecks today are its springboards for tomorrow’s leadership in global auto exports.

Conclusion

India’s emergence as a global passenger vehicle export hub reflects its growing strength in manufacturing, engineering, and supply chain integration. Backed by strategic government policies, world-class production facilities, and a skilled workforce, the country has positioned itself as a reliable partner for global automotive markets. Leading OEMs like Hyundai, Maruti Suzuki, Kia, and Tata Motors have leveraged India’s infrastructure and cost competitiveness to serve over 100 countries, including those in Latin America, Africa, and Southeast Asia.

While challenges in logistics, port capacity, and regulatory processes remain, they also offer opportunities for targeted reforms and investments. With rising demand for electric and connected vehicles, India can further enhance its global role by becoming an export hub for green and smart mobility.

Innovation, continued policy support, and infrastructure development will be key to sustaining India’s momentum and reinforcing its position in the global automotive value chain.