RECENT CASE STUDIES

Revolutionising Connectivity: The Surge of India's Telecom Sector

Last updated: Sep, 2024

The Indian telecom sector has evolved during last two decades in terms of growth and competition. From being dominated by a state owned monopoly carrier to becoming a competitive and integrated industry that revolutionized communications and fostered economic growth. The liberalisation reforms at the beginning of the 1990s initiated this radical shift, opening the doors for private companies and innovations to enter the market. Today, the telecommunications sector in India is the second largest in the entire world and caters to more than a billion, contributing 6% to its overall gross domestic product. The development in communication technologies and particularly the affordable mobile phones and internet connections have assisted in the digital adoption that has connected millions in India. There has been improved foreign investment in the telecom sector mainly in 4G, and 5G technology. This case study examines and evaluates the major causes of this growth and reviews the current economic and social impacts of this transition process, informs about the current problems and outlines the near prospect.

Market analysis and trends

The transformation of India’s telecom sector has been on an upward trend. Ranking as the second-largest telecommunication market globally, India has the world’s second-highest number of internet users.

Source: Telecom Regulatory Authority of India (TRAI)

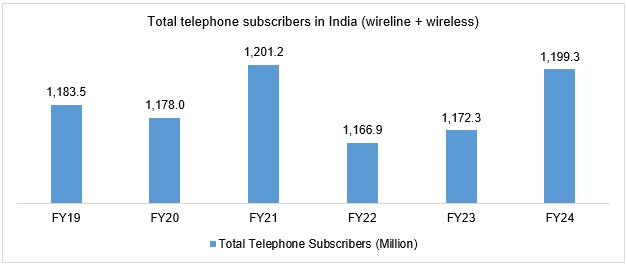

The overall telephone subscribers (both wire-line and wireless) has been increasing in India from FY22 till FY24. As of FY22, the total subscribers were 1,166 million and for FY24 they had risen to 1,199 million. This was facilitated by affordable data tariffs, a rise in smartphone ownership, and enhanced networks. New technologies like the 4G and 5G entered the market to help in attracting millions of new users most of who were from the rural areas that had slow internet connection previously. In addition, better advancement in the digital world and the policies related to such advancements from the government have also helped in increasing this growth rate. It can be attributed to continued digital evolution in the country that ranks among the biggest and rapidly growing telecommunications markets globally where the use of the internet is rising every year.

The total telephone subscribers between the period of 2001 and 2011 have been on the rise at a Compound Annual Growth Rate (CAGR) of 35%. The similar rates for the 1980s and 1990s were 9% and 22%, respectively. However, the type of the subscribers shows that the mobile subscribers have been on the lead. A comparative analysis of the current and previous tele-density established that there has been improvement because of development in mobile telephone.

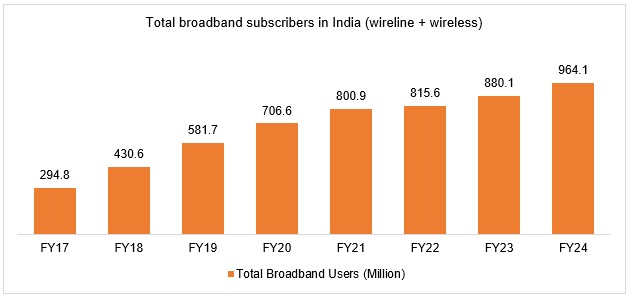

The number of broadband subscribers has been displaying a consistent rise from 2017 to 2024.

Source: Telecom Regulatory Authority of India (TRAI)

India is ranked 2nd in ‘Mobile broadband internet traffic within the country’ and ‘Internet bandwidth provided internationally’. Overal broadband subscription users have continued to increase in the country. Broadband subscription was 294.8 million in FY17, which has risen to 964.1 million in FY24 growing by 227% over the same period. By December 2024, the Department of Telecommunications anticipates to have 50 lakh km of optic fibre deployed throughout India, 70% of towers fiberized, average broadband speeds of 50 Mbps, and 100% of villages connected to the internet.

Government initiatives promoting digital inclusion further supported the growth of broadband, reflecting India's rapid digital transformation and increasing reliance on internet connectivity. The extension of the broadband internet services has been actively supported through Prime Minister Wi-Fi Access Network Interface (PM-WANI). This has been done through provision of public Wi-Fi service through PDOs that are expected to have been established across the country. Rising number of broadband subscription in India can be explained with the help of economical data tariffs, better connectivity and massive use of smart-phone. Mobile phone service providers are providing low cost packages, thus increasing the affordability of internet to more people. These advances made the existing infrastructure even stronger; the coverage of 4G networks increased, and the implementation of 5G started to strengthen connections, including rural areas. Also, increasing popularity of inexpensive smartphones made internet accessible to a wider population.

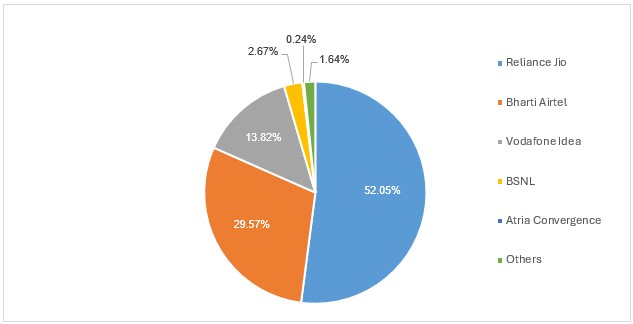

By the end of March 2024, the top five service providers held 98.36% of the market share among all broadband subscribers. These service providers are Reliance Jio Infocomm Ltd (481.07 million), Bharti Airtel (273.23 million), Vodafone Idea (127.69 million), BSNL (24.70 million) and Atria Convergence (2.25 million).

Service provider-wise market share of broadband (wired + wireless) services as of March 2024.

Source: Telecom Regulatory Authority of India (TRAI)

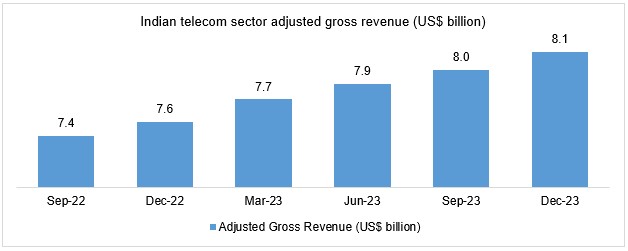

Telecom sector revenue has been on an upward trend QoQ

Source: Telecom Regulatory Authority of India (TRAI)

Gross Revenue (GR), Applicable Gross Revenue (ApGR) and Adjusted Gross Revenue (AGR) of Indian telecom sector for the quarter ended December 2023 has been Rs. 84,500 crore (US$ 10.14 billion), Rs. 81,101 crore (US$ 9.73 billion) and Rs. 67,835 crore (US$ 8.14 billion), respectively. GR increased by 2.13%, ApGR increased by 1.70% and AGR increased by 1.88% in the quarter ended December 2023, as compared with previous quarter.

According to the DoT officials in August 2021, DoT was trying to formulate a package where the revenue share licence fee will be brought down from 8% to 6% of AGR of the operators. This would be achieved by cutting down the 5% universal service obligation levy by two percentage points and offer some operators relief of about Rs. 3,000 crore (US$ 403. 63 million) annually. However, in July 2023, the DoT mentioned that only the activities covered under the scope of the licence will be classified as telecom activities and used to calculate AGR. This enables the telecom companies to reduce their payment obligation to the government.

The telecom industry in India is expected to grow from FY16 to FY25 by overall 63%, even though there is a global consolidation in the sector that has reduced private mobile operators from more than 10 to only three. Revenue for the telecommunication sector stood at Rs. 1.7 lakh crore (US$ 20.39 billion) in FY16 while there were more than 10 private sector companies associated with the sector. As Reliance Jio entered the market in 2017, the sector’s revenue could be touching Rs. 2.78 lakh crore (US$ 33.35 billion) in FY25 and have only three private players - Jio, Bharti Airtel, and Vodafone Idea (Vi). The strong revenue growth will stem from an anticipated tariff increase, increased conversion of customers from 2G to higher average revenue per user (ARPU) 4G/5G and consumers migrating to higher value data bundles.

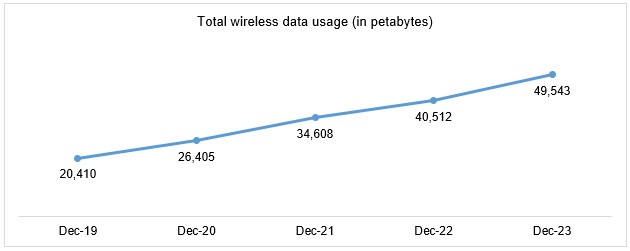

Rise in the total wireless data usage post COVID-19

Source: Telecom Regulatory Authority of India (TRAI)

India holds the distinction of being the largest consumer of mobile data globally. The overall wireless data usage in the Indian telecom sector has grown tremendously since 2019. The total wireless data usage was 20,410 petabytes (PB) in December 2019, which has risen significantly to 49,543 PB in December 2023. This is due to the increased use of smartphones, affordable data tariffs, and the growth of the 4G network across the country. The emergence of Reliance Jio with affordable data tariffs has boosted the usage of data in India. Furthermore, the COVID-19 crisis which triggered the widespread use of digital services, distance learning and remote employment has also contributed to this process. With the recent launch of 5G, data consumption is expected to rise further, which will define the country’s role in the global digital economy.

Conclusion

The Indian telecom industry is on the verge of substantial growth and transformation, supported by significant investments and strategic initiatives. Projections by Deloitte and Confederation of Indian Industries (CII) suggest a robust expansion of US$ 12.5 billion every three years, highlighting the telecom sector’s pivotal role in pushing the digital economy forward. Factors such as aggressive pricing strategies, network expansions and bundled value-added services have expanded the customer base and boosted data consumption. As per an analysis of CLSA, revenues are anticipated to reach Rs 2.78 lakh crore (US$ 33.35 billion) by FY25, driven by tariff increases and the transition towards high-value data services, with 5G technology in place to further accelerate growth. Despite challenges, including price competition and regulatory pressures, the industry has shown resilience through diversification, digital transformation and a focus on cybersecurity and customer-centric innovations. By investing in advanced technologies and expanding into the rural areas, telecom operators are unlocking new markets and driving inclusive growth, positioning themselves as key enablers of India's digital future and economic prosperity.