RECENT CASE STUDIES

Scooping Success: Analysing Growth, Trends and Opportunities in India's Ice Cream Industry

Last updated: Aug, 2025

India’s ice cream industry has undergone a remarkable transformation over the past few decades—from a largely seasonal and unorganised segment to a thriving market marked by innovation, intense competition and growing consumer demand. Traditionally associated with summer indulgence, ice cream has steadily evolved into a year-round treat, supported by rising incomes, urbanisation and a youthful demographic that increasingly seeks convenience and novelty in food choices.

Moreover, the industry has seen increasing penetration not only in urban centres but also in Tier-II and Tier-III cities. Companies are responding with tailored products, regional flavours, improved distribution models and digital-first marketing strategies that resonate with India's diverse consumer base. Furthermore, the country’s position as the world’s largest milk producer gives its domestic ice cream manufacturers a natural competitive edge. However, the industry also faces structural challenges—chief among them being cold chain logistics, high product perishability and heavy dependence on seasonal sales. Additionally, the market is witnessing growing fragmentation, with regional brands, artisanal players and health-focused startups intensifying the competitive landscape alongside long-standing national players such as Amul, Kwality Wall’s and Vadilal.

In recent years, innovation has become a cornerstone of industry growth. Consumers today are drawn to new flavour profiles, health-conscious formulations (such as vegan and sugar-free options) and experiential formats such as ice cream cafés and dessert parlours. Digital platforms, too, are playing a significant role in influencing buying behaviour, enabling e-commerce delivery and helping brands create deeper engagement with consumers.

India’s ice cream market dynamics

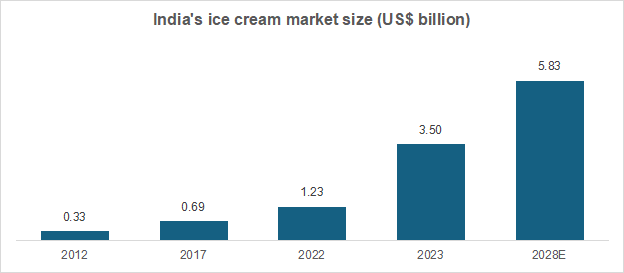

Source: Upstox, E- estimated

With rising demand, new product development and an expanding customer base coming together to create a dynamic and competitive market, India's ice cream sector is at an exciting juncture. The country’s ice cream market, estimated at Rs. 30,000 crore (US$ 3.50 billion) in 2023, is projected to grow to Rs. 50,000 crore (US$ 5.83 billion) by 2028. The industry has changed from being largely controlled by a small number of businesses and seasonal consumption to a complex ecosystem with a wide range of segments, strong regional economies and quick innovation.

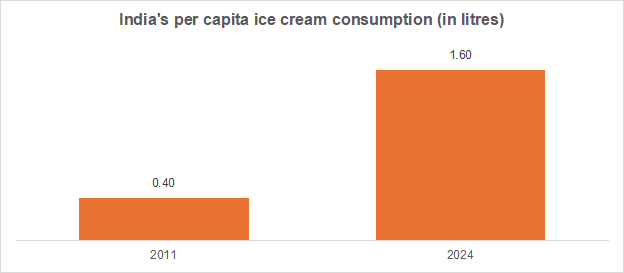

Source: Hindu Business Line

India’s per capita ice cream consumption has experienced a steady and promising rise over the past decade, growing from just 400 millilitres in 2011 to around 1.6 litres in 2023. Although this figure remains significantly lower than in developed markets such as New Zealand (28.4 litres) or the United States (over 20 litres), it reflects a strong upward trajectory that highlights increasing consumer demand and market penetration. This growth is primarily driven by a combination of factors—rising disposable incomes, rapid urbanisation, a burgeoning middle class and evolving food habits that embrace indulgence and convenience.

The expansion of organised retail, cold chain infrastructure and digital commerce platforms such as Zepto, Swiggy Instamart and Blinkit has made ice cream more accessible throughout the year and across a wider geographic spectrum. Additionally, the introduction of a variety of product formats—ranging from affordable impulse buys to premium artisanal tubs—has helped cater to diverse consumer preferences. The industry is also seeing rising demand from Tier-II and Tier-III cities, indicating that consumption is no longer confined to metropolitan hubs. As brands continue to innovate in flavours, formats and health-focused alternatives, India’s per capita consumption is expected to rise further, unlocking vast potential in this underpenetrated market.

Key players: Organised vs. Unorganised

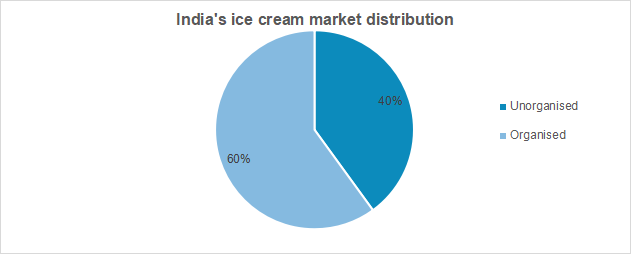

Source: News Articles

India’s ice cream industry is broadly divided into organised and unorganised segments, each playing a distinct role in catering to the country’s diverse consumer base. The organised segment, which includes major brands such as Amul, Kwality Wall’s, Vadilal, Havmor and Baskin Robbins, accounts for nearly 60–65% of the total market and is steadily expanding. These players benefit from established cold chain logistics, widespread distribution networks, consistent quality and strong brand visibility. They offer a wide variety of flavours and formats, from economy cups to premium tubs, and are increasingly tapping into quick commerce and modern retail channels to boost accessibility.

In contrast, the unorganised segment, comprising local vendors, small-scale manufacturers and traditional frozen dessert sellers (such as kulfiwalas), holds about 35–40% of the market share. These players often operate with limited refrigeration and distribution infrastructure and primarily serve price-sensitive customers in rural and semi-urban regions. While they offer affordability and localised flavours, the lack of standardisation and hygiene controls can be a limitation.

However, the gap is narrowing. With rising consumer awareness, infrastructure development and shifting preferences toward branded and hygienic products, the organised segment is rapidly gaining ground. The trend suggests a gradual consolidation of the market, with organised players poised to dominate the future of India’s ice cream landscape.

Opportunities and Outlook

India’s ice cream industry stands at an exciting crossroad. Having moved beyond an urban market into a symbol of lifestyle and innovation, the sector is ripe with opportunities that could significantly reshape its trajectory over the next decade. From exploring untapped geographies to leveraging health trends and cultural soft power, ice cream brands have ample room to grow and diversify.

Unlocking the rural ice cream economy

While urban markets are saturated with national and international players, rural India remains underpenetrated despite comprising nearly 65% of the population. Lack of infrastructure, awareness and cold chain logistics have historically deterred expansion into these regions. However, with improving road connectivity, rising rural incomes and increasing aspiration levels, rural India presents a high-growth, low-competition opportunity.

Localised flavours, value-for-money SKUs (such as ice cream cups or sticks at Rs. 10 each) and energy-efficient freezers can help brands make inroads. Rural-focused marketing, especially via mobile vans and village fairs, can create lasting brand recall. Companies that invest early in these markets can secure first-mover advantage in what may become the next consumption frontier.

Health and wellness: From indulgence to guilt-free delight

The demand for health-forward ice cream options is rapidly rising, particularly among millennials, Gen Z and working professionals. Consumers are seeking products that align with dietary needs—be it low-sugar, low-calorie, high-protein, probiotic, keto-friendly or plant-based options.

This has led to the rise of specialised brands such as Get-A-Way, White Cub and Minus 30, which are carving out loyal consumer bases with functional offerings. For mainstream players, this represents a chance to diversify portfolios and enter the “better for you” category. Fortified ice creams with added vitamins, fibre or natural sweeteners such as stevia also offer potential in both urban and semi-urban segments. With growing health awareness, this is a long-term trend rather than a short-term fad.

Exporting Indian flavours to the world

India’s rich culinary heritage offers a unique export opportunity in the form of indigenous flavours such as saffron, cardamom, mango, rose, gulkand, filter coffee and kulfi-style desserts. As global consumers become more adventurous and culturally curious, there’s room for Indian ice cream brands to tap into ethnic and fusion dessert categories abroad.

Target markets include the Indian diaspora across the US, UK, Canada, Middle East and Southeast Asia, as well as broader audiences via gourmet retail and restaurant partnerships. With proper shelf-life innovation, temperature-controlled exports and branding around “Made in India with Authentic Flavours,” ice cream could become an unlikely soft power ambassador, much like yoga or Bollywood.

Experiential retail and tourism tie-ins

The growing trend of experiential consumption offers a fresh avenue for ice cream brands to enhance visibility and customer engagement. Boutique ice cream cafés, dessert bars, live counters and themed food trucks are increasingly popular among younger consumers and tourists seeking shareable, Instagram-worthy experiences.

Collaborations with travel hubs, malls, resorts and cultural festivals can convert ice cream into a multi-sensory indulgence. There’s also potential for destination-based flavours that reflect regional heritage, tying into India’s push for domestic tourism and cultural branding.

Summing up

India’s ice cream industry is undergoing a remarkable transformation—from a seasonal business to a dynamic, year-round, consumer-driven segment. Backed by rising per capita consumption, shifting consumer preferences, premiumisation and increasing penetration into Tier-II, Tier-III and rural markets, the sector is poised for sustained growth. With a market valued at over Rs. 30,000 crore (US$ 3.5 billion) and expected to register a CAGR of 13–15% in the coming years, the future looks not only sweet but also strategic.

Challenges such as high perishability, distribution costs, regulatory complexities and price competition persist, but they are equally catalysts for innovation. Brands investing in cold chain modernisation, health-forward product lines, hyperlocal and global flavours and experiential retail formats are gaining significant traction.

The evolving Indian consumer—health-conscious, digitally connected and experience-oriented—is reshaping how ice cream is produced, marketed and consumed. Opportunities in exports, functional foods, rural outreach and tourism tie-ins add further dimensions to this growth story.

As India heads toward becoming one of the largest ice cream-consuming nations globally, the industry stands on the cusp of its next revolution. For stakeholders who can blend tradition with innovation, and scale with sustainability, the scoop ahead is rich with possibility.