SEARCH

RECENT POSTS

Categories

- Agriculture (32)

- Automobiles (19)

- Banking and Financial services (35)

- Consumer Markets (51)

- Defence (6)

- Ecommerce (21)

- Economy (69)

- Education (13)

- Engineering (6)

- Exports (21)

- Healthcare (25)

- India Inc. (8)

- Infrastructure (29)

- Manufacturing (28)

- Media and Entertainment (15)

- Micro, Small & Medium Enterprises (MSMEs) (15)

- Miscellaneous (30)

- Perspectives from India (34)

- Pharmaceuticals (4)

- Railways (4)

- Real Estate (17)

- Renewable Energy (18)

- Research and Development (9)

- Retail (1)

- Services (6)

- Startups (15)

- Technology (56)

- Textiles (8)

- Tourism (14)

- Trade (5)

Electric Mobility in Secondary Cities: Beyond Delhi and Bengaluru

- Jan 14, 2026, 10:00

- Automobiles

- IBEF

India’s electric vehicle (EV) revolution is gathering pace nationwide. In early 2025 the country surpassed 5.5 million EVs on its roads and sales are soaring. This growth is not limited to big metropolises such as Delhi or Bengaluru. In fact, the fastest gains are coming from Tier-2 and Tier-3 cities. The Union government and state governments are rolling out ambitious policies and subsidies to support this trend. Public and private fleets of electric two-wheelers (e-2Ws), three-wheelers (e-3Ws), cars, buses, and light commercial vehicles (e-LCVs) are expanding rapidly outside the major cities. Initiatives such as Faster Adoption and Manufacturing of Electric Vehicles (FAME-II), PM eBus Sewa, PM e-DRIVE and the Production-Linked Incentive (PLI) scheme for EV batteries are key drivers, helping improve air quality and boost India’s energy security as the country moves towards its 2047 goal of energy independence.

Booming e-2W and e-3Ws in smaller cities

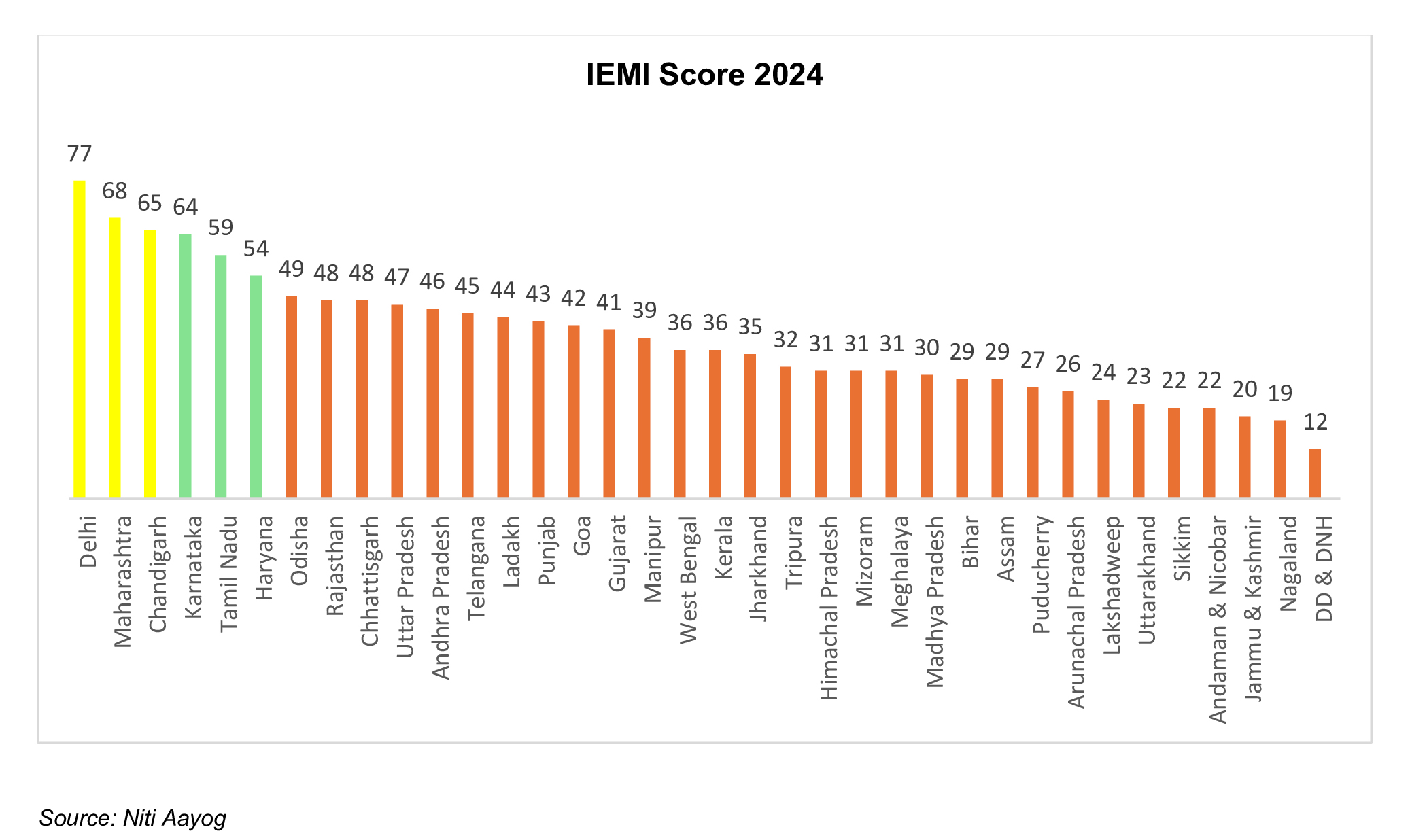

The India Electric Mobility Index (IEMI) score assesses how the states and union territories are performing in developing the electric mobility ecosystem, including EV adoption, charging infrastructure and electric mobility technology. The states are categorised into frontrunners, performers and aspirants, based on their scores.

Frontrunners: Delhi, Maharashtra, Chandigarh

Performers: Karnataka, Tamil Nadu, Haryana

Aspirants: All others

e-2Ws and e-3Ws are leading the charge on city streets across India. These vehicles are ideal for urban and peri-urban travel in Tier-2 cities, offering low operating costs and zero emissions. For example, e-scooters and moped bikes have seen record demand in recent years. In fact, all-India e-2W sales have jumped so sharply that companies are forecasting growth to seven million units annually for the first time. Local markets are responding quickly.

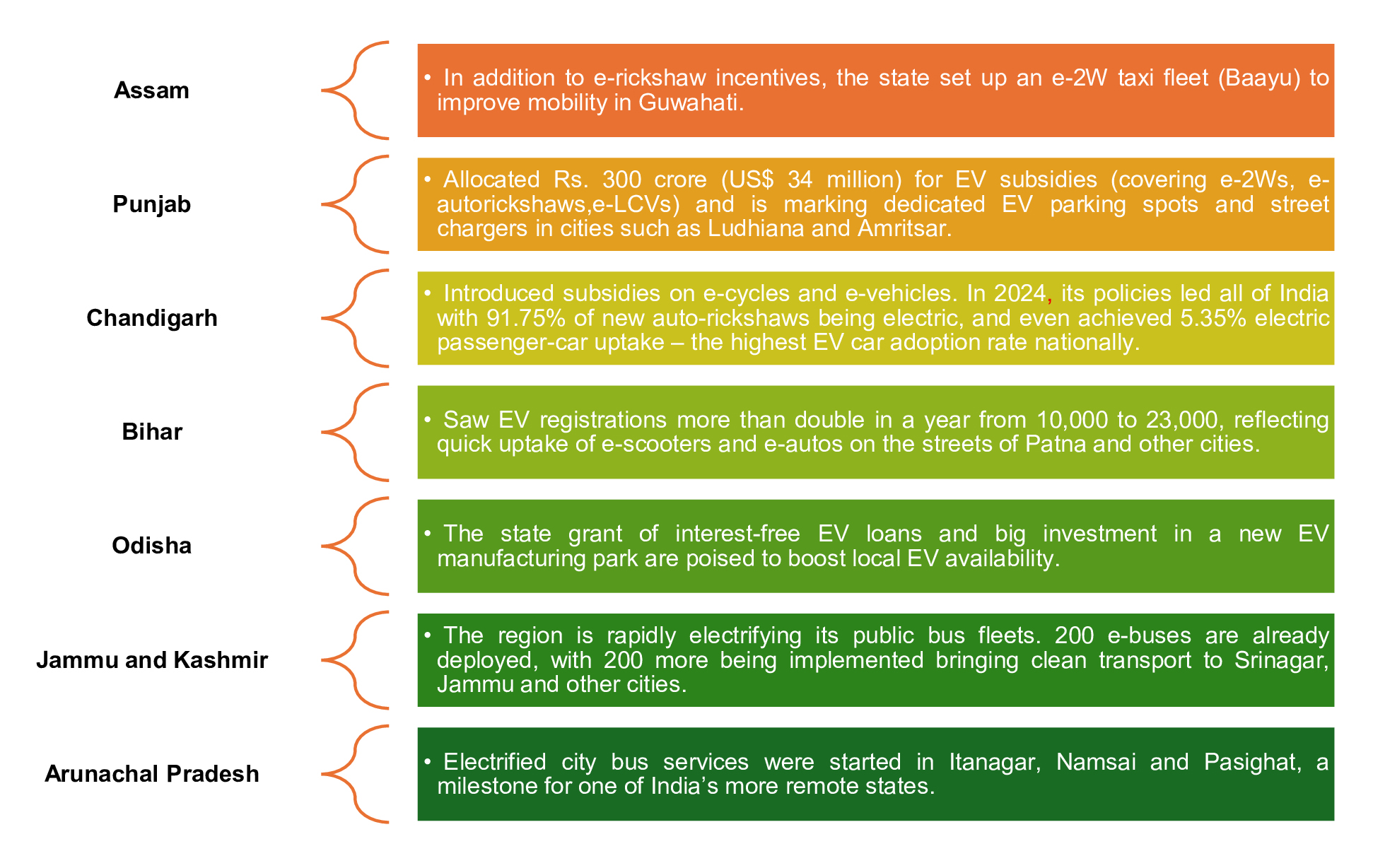

The case of Assam and Bihar

Assam is a striking example: here over 85% of newly registered three-wheelers were electric in 2024. This was driven by state incentives such as waiving road tax and registration fees on e-rickshaws. Assam even launched ‘Baayu,’ one of India’s first app-based electric bike-taxi networks, to show how e-bikes can serve as affordable urban cabs. In Bihar, the state has also seen rapid uptake. Local registrations rose from ~10,000 vehicles in FY24 to ~23,000 by FY25. These numbers show a quick transition to e-scooters and e-rickshaws on Bihar’s roads as they offer low running and high state incentives.

Chandigarh and Punjab

Chandigarh and Punjab in the North have enabled strong actions for 2Ws and 3Ws. Chandigarh, for one, offers incentives for e-bicycles in addition to mass advertising of e-rickshaws. This has led to significant results as nearly 92% of the new 3Ws in Chandigarh were electric by 2024. The city also achieved a 65% electrification rate of its commercial EV fleet. Punjab, in turn, has planned Rs. 300 crore (US$ 32 million) over three years to boost e-2Ws, e-cycles, e-autorickshaws and e-LCVs. It is also installing public charging infrastructure on streets in major cities such as Ludhiana, Amritsar, Jalandhar, Patiala, and Bathinda. These measures are making EVs more affordable and convenient, prompting more drivers in smaller towns in Punjab to switch to e-scooters and tuk-tuks.

Across India

Similar momentum is visible across the country. In Odisha, the state government approved a large EV manufacturing complex, specifically a JSW Group investment of Rs. 4,000 crore (US$ 453 million) for EVs and components. Moreover, the schemes, e.g. interest-free advances for government employees for buying EVs, encourage the state. The far north-east, Arunachal Pradesh, for its part, has already been deploying e-buses in several cities, such as intra-city routes in Itanagar, Namsai and Pasighat. The above examples from Assam, Bihar, Chandigarh, Punjab, Odisha and Arunachal, proves that state and local measures allow spreading the benefits of electric mobility to every city and corner in India.

E-buses transforming regional transit

It’s not just personal vehicles that are going electric. Public buses, for long the backbone of city transit, are undergoing an overhaul in smaller cities. Historically, India’s nine largest metros (including Delhi and Mumbai) had over 61% of the nation’s public buses, while many Tier-2 cities had very few or no bus networks at all. To address this gap, the government’s PM eBus Sewa scheme is deploying e-buses widely outside the big cities.

The scale of this effort is unparalleled: over 50 cities are currently deploying 10,000 e-buses, with another 20,000 on the horizon. As an example, according to World Resources Institute (WRI) - India, the growth of e-buses in smaller urban centers can be massive and low cost, allowing India to achieve its goals of long-term energy independence. As a result, in the near future, Tier-2 cities will have e-buses that are cleaner and quieter than heavily polluting diesel fleets. This is critical not just for reducing urban pollution but also for curbing expensive fuel imports. By 2047 the aim is to have a predominantly electric public transport system and rolling out e-buses beyond Delhi and Bengaluru is a key step in that direction.

National schemes fuel electric mobility

In order to fast-track EV uptake, the central government introduced numerous schemes. The majority of the funds were set for the purchase of subsidies, charging infrastructure and research and development (R&D) under the FAME II policy (2019-24). FAME-II was allocated approximately Rs. 11,500 crore (US$ 1.30 billion). In 2024, the government announced a new e-DRIVE scheme to provide ~Rs. 10,900 crore (US$ 1.24 billion) to advanced EVs. Meanwhile, the PM eBus Sewa scheme earmarks roughly Rs. 20,000 crore (US$ 2.27 billion) to finance 10,000 e-city buses in 169 cities. It covers not only vehicle purchase but also up to 10 years of operating support via public-private partnerships.

Another cornerstone is the PLI scheme for advanced battery cells. This Rs. 18,100 crore (US$ 2.05 billion) programme aims to build domestic battery manufacturing capacity. Together with policy push for charging infrastructure, these measures are turning India into a global EV hub. As NITI Aayog notes, schemes such as FAME and the PLI for battery cells underscore our resolve to localise electric mobility. In summary, the government’s concerted push through generous subsidies, targets and industry incentives is creating a favourable climate for EVs to thrive beyond the big cities.

The impact

The transition to electric mobility in India has clear benefits. EVs produce no tailpipe emissions, cutting harmful pollutants in crowded towns. This improves air quality and public health in smaller cities as much as in big ones. Beyond local clean air, EVs help India’s energy strategy. Road transport accounts for ~13.5% of India’s energy-related emissions. Electrifying vehicles can significantly reduce carbon emissions over time and allows India to shift away from imported oil to domestic clean power. As analysts note, EVs are a “critical pathway” for decarbonising transport and enhancing energy security.

Government data and expert projections suggest these positive impacts are accelerating. For example, electric mobility is already helping India edge closer to its target of 30% EV share by 2030. Industry projections estimate India’s EV stock could exceed 17 million vehicles by 2030 under current policies. The rapid growth in Tier-2 cities is vital to meeting these national goals. Every e-auto and e-bus in a small city adds to the big picture of sustainability. With continued expansion of central programmes and state incentives, India’s secondary cities are poised to mirror or even surpass the EV success seen in its big metros. The country is moving steadily toward a future where clean, affordable EVs connect not just New Delhi and Bengaluru, but every town and city across India.

FAQs

What is the FAME-II scheme?

FAME-II is a national subsidy programme (2019-24) designed to boost EV uptake. It provided financial incentives for purchasing EVs and building charging infrastructure, with an outlay of about Rs. 11,500 crore (US$ 1.30 billion).

What does the PM eBus Sewa scheme do?

PM eBus Sewa is a government initiative launched in 2023–24 to put 10,000 e-buses into service in cities across India. It allocates ~Rs. 20,000 crore (US$ 2.27 billion) for buying and operating e-buses in 169 cities.

Which cities and states are leading in EV adoption?

While major metros are well known, many smaller cities and states have become EV leaders. For instance, Chandigarh achieved a 91.8% electrification rate for new 3Ws in 2024. Assam recorded over 85% of new autorickshaws as electric. Punjab, Odisha, Bihar, Jammu & Kashmir, and Arunachal Pradesh have all launched special EV policies or incentives.

Why are e-2Ws and e-3Ws popular in smaller cities?

E-2Ws and e-3Ws are well-suited to India’s smaller urban centres. They cost less to run per kilometre than petrol vehicles, often have lower service needs and benefit from state incentives. In many Tier-2 towns, riders of e-scooters save substantially on fuel and maintenance. This practical benefit, plus government support.

What benefits do EVs bring to secondary cities?

EVs offer cleaner air and quieter streets, directly improving urban living standards. Fewer tailpipe emissions mean lower levels of smog and pollution. Over time, widespread EV adoption in smaller cities can shrink carbon footprints and contribute to India’s climate goals.