Advantage India

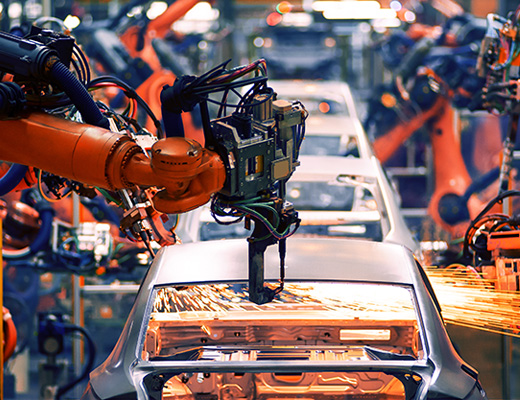

Growing

Demand

*Rising middle-class income and young population will result in strong demand growth.

*The Indian automotive industry is targeting to increase the export of vehicles by five times between 2016-26.

*Automobile exports from India rose 19% to over 5.3 million units in FY25, led by strong demand for passenger vehicles, two-wheelers, and commercial vehicles abroad.

*The total production of Passenger Vehicles*, Three Wheelers, Two Wheelers, and Quadricycle in October 2025 was ~2.8 million units.

Opportunities

*Focus shifting on electric cars to reduce emissions.

*Government aims to transform India into an R&D hub.

*India could be a leader in shared mobility by 2030, providing opportunities for electric and autonomous vehicles.

*The electric vehicles industry is likely to touch Rs. 20,00,000 crore (US$ 234 billion) and will create around five crore jobs by 2030.

Rising

Investment

* India offers 10-25% operational cost savings for auto firms compared to Europe and Latin America.

* The automobile sector attracted Rs. 3,48,752 crore (US$ 39.3 billion) in equity FDI between April 2000-June 2025.

* India is set to become the largest EV market by 2030, with an investment potential exceeding US$ 200 billion over the next five years.

* The PLI scheme for automobiles and auto components received Rs. 2,818.9 crore (US$ 325.6 million) in FY26.

Policy

Support

*Automotive Mission Plan 2016-26 is a mutual initiative by the Government of India and the Indian automotive industry to lay down the roadmap for the development of the industry.

*The Centre has launched the PM E-DRIVE scheme with a budget of US$ 1.30 billion (Rs. 10,900 crore), effective from October 1, 2024, to March 31, 2026. The initiative aims to accelerate the adoption of electric vehicles (EVs), establish charging infrastructure, and develop an EV manufacturing ecosystem in India.

Automobile Clusters

- Mumbai-Pune-Nashik-Aurangabad

- Chennai-Bengaluru-Hosur

- Delhi-Gurgaon-Faridabad

- Kolkata-Jamshedpur

- Sanand-Hansalpur-Vithalpur

Posters

MORE

REVVING UP

India is expected to become the third largest market for electric vehicles by 2025 at 2.5 million vehicles.

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREHow Green Hydrogen Will Shape Renewable Energy in India

Green hydrogen, a superior and a more sustainable alternative to fossil fue...

Cooperatives Rising: How Local Communities Are Shaping India’s Growth

The co-operative movement in India is a strong driving force of inclusive d...

India’s Aspirational Districts: Stories of Progress and People-Led Change

India’s Aspirational Districts Programme (ADP) was launched in Januar...