Advantage India

Robust

Demand

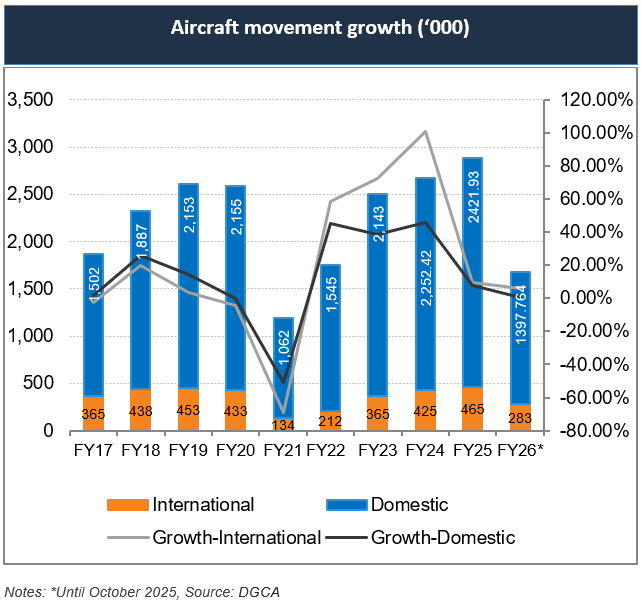

* Rising working group and widening middle-class demography is expected to boost demand.

* India has envisaged increasing the number of operational airports to 220 by 2025.

* India will require over 2200 aircraft by 2042.

* Indian airlines are expanding global connectivity by increasingly deploying long-range narrow-body jets for nonstop international routes from secondary cities.

Opportunities

in MRO

* Growth in aviation accentuating demand for MRO facilities.

* As of 2024, expenditure in MRO accounts for 12-15% of the total revenue; it is the second-highest expense after fuel cost.

* Union Budget 2024-25 introduces incentives to boost MRO activities in aviation, including extending export and re-import periods for repairs and implementing a 5% uniform IGST on aircraft parts.

*In June 2023, the US committed to creating a global hub for MRO for high-end drones in India.

Policy

Support

* As per the present FDI Policy, 100% FDI is permitted in scheduled Air Transport Service/Domestic Scheduled Passenger Airline (Automatic upto 49% and Government route beyond 49%). However, for NRIs 100% FDI is permitted under automatic route in Scheduled Air Transport Service/Domestic Scheduled Passenger Airline.

Increasing

Investments

* India’s aviation infrastructure received over Rs. 96,000 crore (US$ 11.2 billion) in capital expenditure between FY20 and FY25 through the Airports Authority of India and public-private partnerships.

Aviation India / Major Airports

- Delhi

- Mumbai

- Chennai

- Bengaluru

- Kolkata

- Hyderabad

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MORECooperatives Rising: How Local Communities Are Shaping India’s Growth

The co-operative movement in India is a strong driving force of inclusive d...

India’s Aspirational Districts: Stories of Progress and People-Led Change

India’s Aspirational Districts Programme (ADP) was launched in Januar...

Government Initiatives Boosting the Healthcare Industry in India

India has been undertaking sweeping reforms to strengthen its healthcare ec...