Advantage India

Increasing

Demand

*Rising number of medical facilities will boost the demand for medical devices in the market.

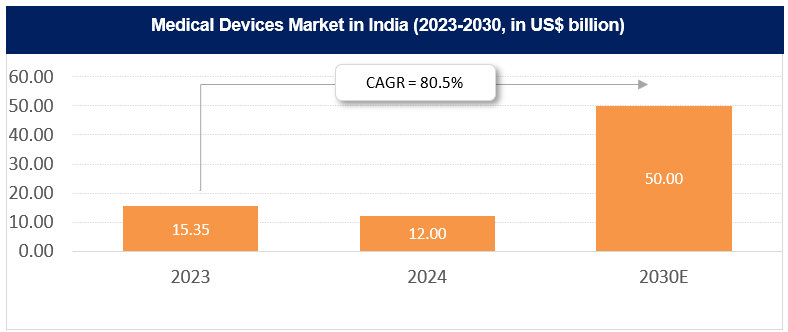

*The medical technology sector in India is projected to reach Rs. 4,33,150 crore (US$ 50 billion) by 2030.

*Diagnostic equipment market to reach to Rs. 51,978 crore (US$ 6 billion) by 2027, up from Rs. 34,652 crore (US$ 4 billion) in CY23.

Opportunities

in Export

*India and Russia have set the bilateral trade target at Rs. 260,880 crore (US$ 30 billion) by 2025. Trade is expected to increase by an additional Rs. 43,480 crore (US$ 5 billion) per annum, with opportunities in pharmaceuticals & medical devices, minerals, steel, and chemicals.

*India's medical technology industry is poised to reach exports of up to Rs. 1,69,000 crore (US$ 20 billion) by FY30, according to the Confederation of Indian Industry (CII).

*India’s medical devices industry is seeking a larger footprint in the United Kingdom’s (UK) Rs. 161.16 crore (US$ 18.17 million) medtech market, with an ambition to triple exports to Rs. 2,917-3,493 crore (US$ 329-394 million) by 2030 from Rs. 1,117 crore (US$ 126 million) in 2024.

Policy

Support

*Comprehensive policy support through the National Medical Device Policy 2023, PLI & MDP schemes, cluster assistance, HR development, standards, export promotion, and PPPs is driving growth in India’s MediTech sector.

*Lower GST on medicines and medical devices was announced to make healthcare more affordable, further incentivizing industry growth and expanding access to advanced medical technologies.

*100% FDI is allowed in the medical devices sector In India. Categories such as equipment and instruments, consumables and implants attract the most FDI.

Increasing

Investments

*Union Chemicals and Fertilisers Minister Mr. JP Nadda launched a Rs. 500 crore (US$ 59.24 million) scheme to boost India's medical devices industry, focusing on manufacturing key components, skill development, clinical studies support, common infrastructure, and industry promotion.

*FDI inflow in the medical and surgical appliances sector between April 2000-June 2025 stood at Rs. 27,900.25 crore (US$ 3.96 billion).

*In the Union Budget 2025-26, Rs. 99,858 crore (US$ 11.48 billion) was allocated as a budget for the healthcare sector.

Medical Devices Clusters

- Gujarat

- Maharashtra

- Karnataka

- Haryana

- Andhra Pradesh

- Tamil Nadu

Posters

MORE

INDIAN MEDICAL DEVICES

India is among the top 20 markets for medical devices worldwide.

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREHow Green Hydrogen Will Shape Renewable Energy in India

Green hydrogen, a superior and a more sustainable alternative to fossil fue...

Cooperatives Rising: How Local Communities Are Shaping India’s Growth

The co-operative movement in India is a strong driving force of inclusive d...

India’s Aspirational Districts: Stories of Progress and People-Led Change

India’s Aspirational Districts Programme (ADP) was launched in Januar...