Advantage India

Growing

Demand

* In July 2025, Indian gold ETF AUM reached Rs. 64,523 crore (US$ 7.5 billion) an 88% YoY increase, reflecting growing demand among retail investors.

* Total gold holding reached 66.7 tonnes, with two tonnes added in June 2025 and nine tonnes in H1 2025.

Increasing

Investments

* RBI’s gold purchases reached 57.5 tonnes in FY25 and was the second highest purchase in seven years from December 2017.

* Malabar Gold & Diamonds has opened its largest jewellery manufacturing facility in Hyderabad with an investment of Rs. 1,000 crore (US$ 116 million).

* Cumulative FDI inflows in diamond and gold ornaments in India stood at Rs. 12,337 crore (US$ 1,434 million) between April 2000-March 2025.

Policy

Support

* The Government has permitted 100% FDI under the automatic route in this sector.

* India has signed an FTA with UAE which will further boost exports and is expected to reach the target of US$ 52 billion.

* India has signed Economic Cooperation and Trade Agreement (ECTA) with Australia.

* The India-UK Free Trade Agreement is expected to more than double India's gems and jewellery exports to the UK, reaching Rs. 21,183 crore (US$ 2.5 billion) within the next two years.

Attractive

Opportunities

*India’s gold demand stood at 135 tonnes in Q2 2025 with full year forecast ranging between 600 to 700 tonnes, displaying opportunities for the sector to tap into the growing demand.

Major Hubs for Gems and Jewellery

- Surat

- Mumbai

- Jaipur

- Thrichor

- Nellore

- Delhi

- Hyderabad

- Kolkata

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREGrowing Power of India’s DIIs

India’s equity markets are experiencing a major structural shift. Dom...

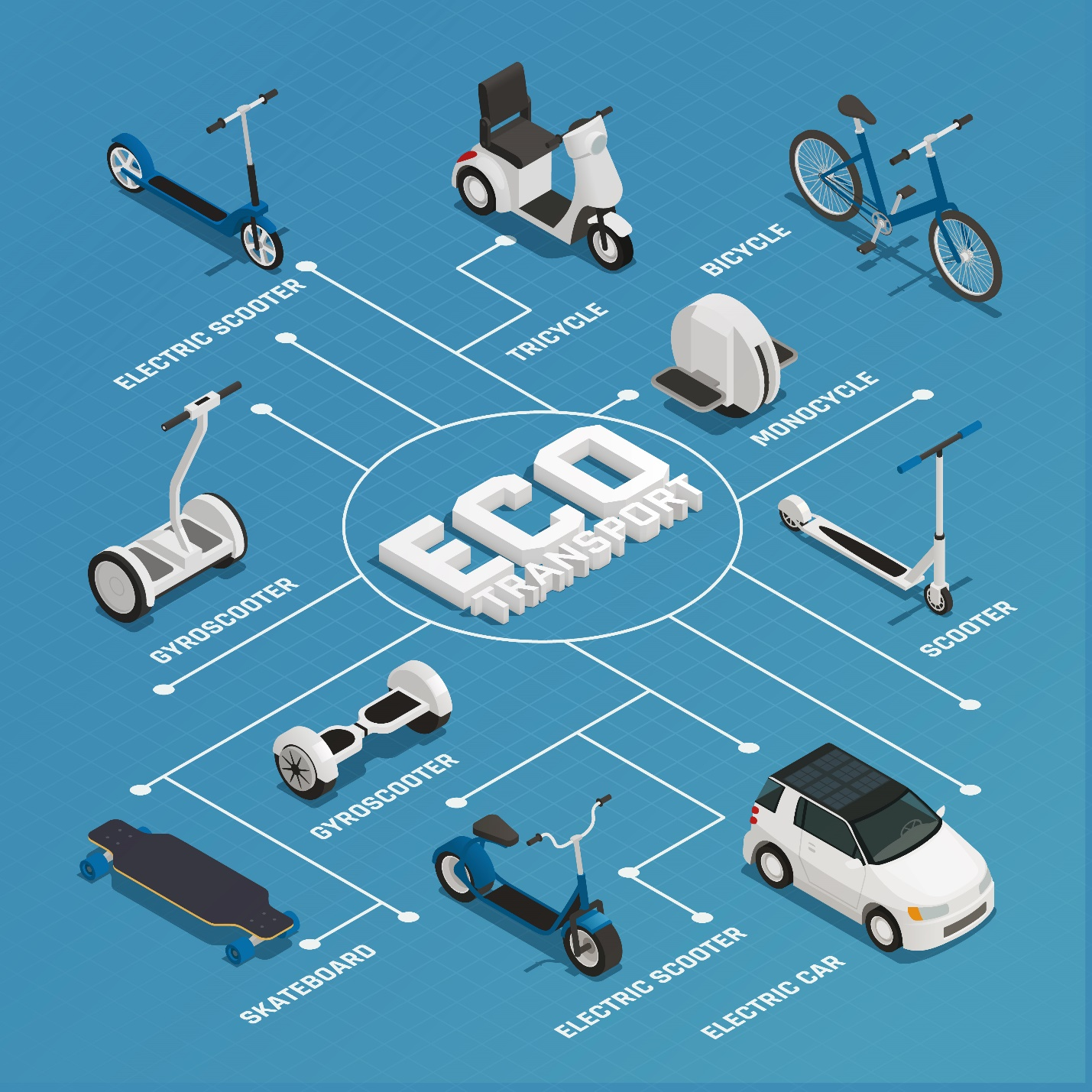

Electric Mobility in Secondary Cities: Beyond Delhi and Bengaluru

India’s electric vehicle (EV) revolution is gathering pace nationwide...

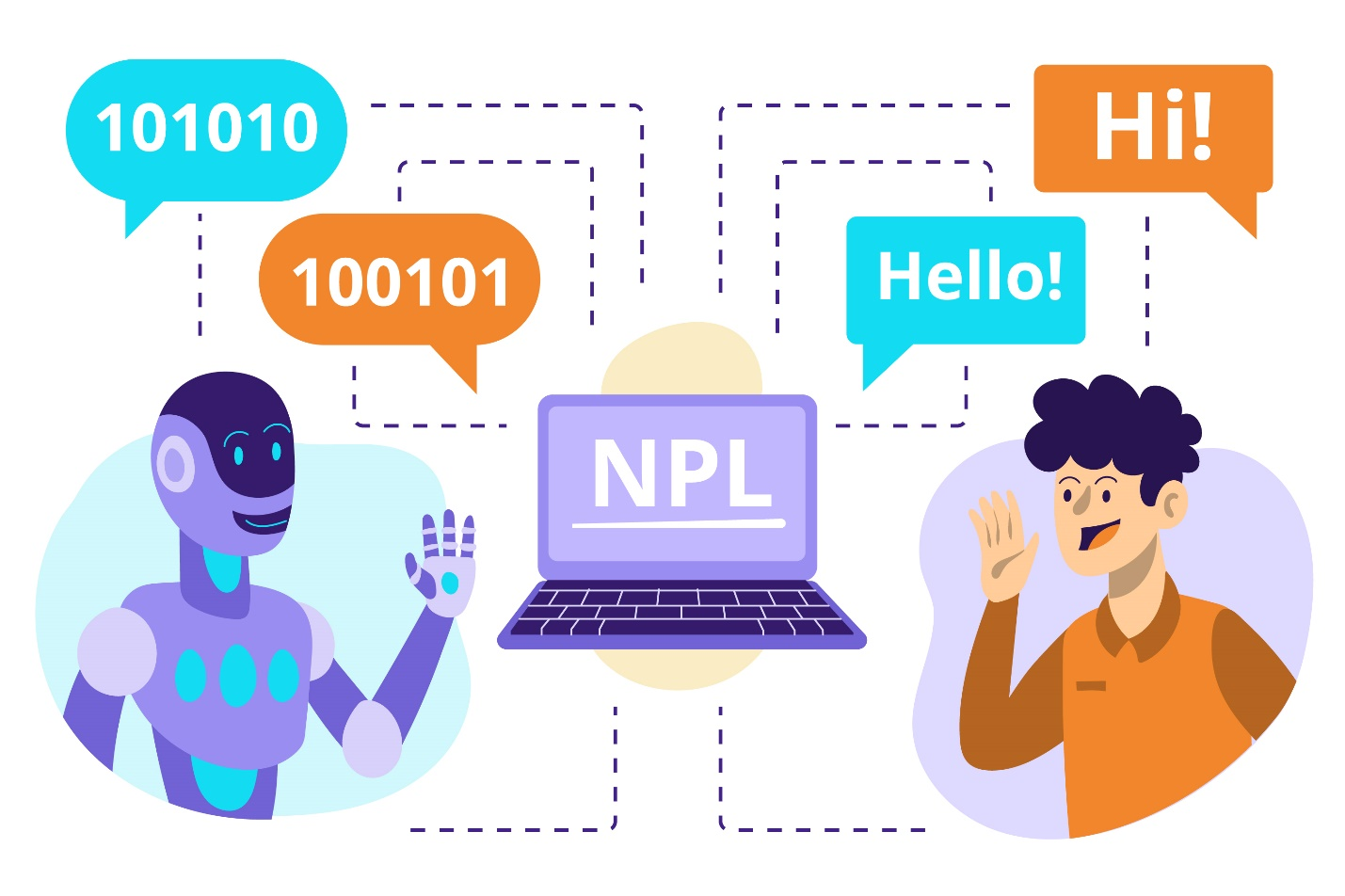

AI for Local Language - Inclusion through Vernacular Models

India, home to hundreds of languages and celebrated for its cultural divers...