Advantage India

Demand

Growth

* Being the third largest energy consuming country in the world, there is always increased demand for power and electricity in the country, and hence the surge in demand for coal.

* In FY25, India has committed to achieve 50% of cumulative electric power installed capacity from non-fossil sources by 2030.

* Demand for steel is likely to grow by ~10% as the government’s augmented focus on infrastructural development continues with increased construction of roads, railways, airports, etc.

* The demand of zinc is expected to double in India in the next five to 10 years on the back of huge investments in infrastructure sector, including steel, International Zinc Association.

Attractive

Opportunities

* In January 2025, the Ministry of Steel has introduced the PLI Scheme 1.1 for specialty steel, covering five product categories, which aligns with the existing PLI Scheme. This initiative aims to encourage greater participation in response to industry requests for relaxation. The PLI Scheme 1.1 was open for applications from January 6 to January 31, 2025, and will be implemented from FY26 to FY30.

* By becoming Aatmanirbhar in producing specialty steel, India will move up the steel value chain and come at par with advanced steel-making countries like Korea and Japan.

* Under the PLI Scheme for Specialty Steel, 57 MoUs with 27 companies have been signed, attracting investments of US$ 3.55 billion (Rs. 29,500 crores), creating an additional capacity of 25 MT and generating employment for 17,000 people by FY28.

*India’s mining & construction equipment sector is set to grow 19% annually, adding Rs. 8.5 lakh crore (US$ 99 billion) to the economy and 20 million jobs by 2030, backed by policy support and technology upgrades.

Policy

Support

* Enactment of Mines and Minerals (Development and Regulation) Amendment Act, 2021 enabled captive mines owners (other than atomic minerals) to sell up to 50% of their annual mineral (including coal) production in the open market.

* India launched the seven-year National Critical Mineral Mission in January 2025 with a proposed Rs. 16,300 crore (US$ 1.9 billion) outlay and an expected Rs. 18,000 crore (US$ 2.1 billion) investment by Public Sector Undertakings and other stakeholders to secure key minerals for clean energy and advanced technologies.

Competitive

Advantage

* India holds a fair advantage in cost of production and conversion costs in steel and alumina.

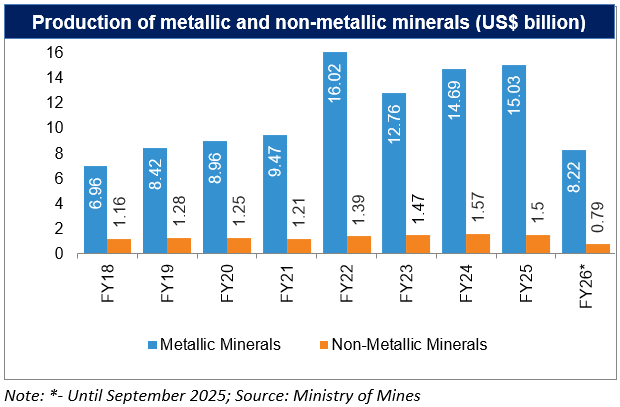

* In FY25 (Provisional), the number of reporting mines in India stood at 1,973, down from 2,046 in FY24. Reporting metallic mineral mines decreased from 799 to 772, while non-metallic mineral mines declined from 1,247 to 1,201. Excluding atomic minerals, fuel mineral and minor minerals.

* India is the second largest Aluminium producer, third largest lime producer and fourth largest iron ore producer in the world.

Major Mining States

- Andhra Pradesh

- Jharkhand

- Odisha

- Rajasthan

- Karnataka

- Madhya Pradesh

- Maharashtra

IBEF Campaigns

MORE

Aatmanirbhar Bharat Utsav 2024

Union Minister of External Affairs, Dr. S. Jaishankar and Union Commerce an...

Case Studies

MOREIBEF BLOG

MOREThe Future Is Creative: India’s Big Moment in AI Avatars

The past decade has been marked by consistent development in computing, and...

The New Indian Investor: Young, Digital and Confident

India’s investor profile is rapidly shifting to a younger, tech-savvy...

Why India Is Emerging as a Global Sourcing Hub for Textiles

India’s textile industry is quickly weaving a new story on the world ...